Key Takeaways:

Ewallet super apps solve the problem of digital clutter by consolidating multiple services into one powerful platform, eliminating the need for "app-switching."

The e-wallet is the indispensable hub for a super app, building user trust through frequent financial transactions before expanding to offer more services.

While Asia pioneered the super app model, the West is now adopting a similar strategy by adding new features to popular single-use apps like PayPal and Cash App.

A fintech super app's power is driven by a modular architecture, AI-powered personalization, a mini-app ecosystem, and robust security to build and maintain trust.

Digital wallet super apps offer immense benefits to users, businesses, and investors by providing convenience, rich data, and a highly scalable business model with long-term growth potential.

Have you ever experienced "app fatigue"? That feeling of having dozens of apps on your phone, yet constantly switching between them just to manage your day-to-day life? You’re not alone.

The average smartphone user has nearly 40 apps installed, but consistently uses less than half of them.

This digital clutter is a real problem, causing fragmented experiences, lost time, and a sense of being overwhelmed.

E-wallets were the first step toward a solution. But a standalone e-wallet, while convenient, still only solves a single problem. It didn't address the broader issue of digital fragmentation. Here comes the ‘Super App.’

Super apps are a unified digital ecosystem where a single application provides a wide array of services, from financial transactions and food delivery to ride-hailing and social media.

It's the digital equivalent of a shopping mall, where everything you need is under one roof, accessible through one powerful hub.

This isn't just a new kind of app; it's a new way of life for the digital consumer. And at its core, it's powered by the same technology we specialize in: Artificial Intelligence.

This blog will take you further by giving you knowledge of fintech super apps, how to build an eWallet super app, its benefits, its cost, challenges, and more.

If you are ready to make a breakthrough in this industry, this blog is for you. Read till the end:

Understanding the Rise of Super Apps in eWallets

Recently, the concept of fintech super apps has completely transformed how people use mobile applications for everyday needs.

From payments to shopping, travel bookings to entertainment, everything is being bundled into one powerful platform.

This is where the question arises: What is an eWallet super app? Simply put, it’s a digital wallet that evolves into a multi-service ecosystem, offering users not just payments but a complete lifestyle hub within a single application.

A] What is an eWallet Super App?

An eWallet super app is a mobile application that goes beyond basic payment services.

Unlike a traditional wallet app that only supports transactions, a super app integrates multiple services such as bill payments, e-commerce, ride-hailing, food delivery, healthcare, and even financial products like loans and insurance.

The key characteristics include seamless integration, unified login, advanced security, and an ecosystem-driven approach that keeps users engaged.

B] Difference Between a Regular App and a Super App

A regular wallet app is designed for one primary function-usually storing and transferring money.

A super app, on the other hand, acts as a marketplace of services, connecting users to everything they need without leaving the app.

While a simple wallet might let you pay for a meal, a super app lets you order the meal, pay for it, earn rewards, and even split the bill with friends– all in one place.

C] Why eWallets are the Core Foundation?

eWallets are at the centre of the fintech super apps revolution because payments are the starting point of almost every digital interaction.

Once users trust an eWallet for financial transactions, it becomes easier to introduce additional services.

This trust, combined with the high frequency of payment-related use, makes eWallets the natural foundation for building super apps that aim to dominate the digital economy/

Seeing this massive industry shift, smart investors are now looking to not just create an e-wallet app, but to build a powerful super app that goes beyond payments to become an all-in-one digital platform.

D] Market Growth & Projections

The market for e-wallets and super apps is accelerating rapidly, with record-breaking growth forecasted between 2023 and 2027.

Here are the most relevant market statistics and projections, sourced from industry reports:

Global Super Apps Market Size & Growth

-

The global super apps market was valued at $94.9 billion in 2024 and is projected to reach $592.1 billion by 2033, growing at a CAGR of 20.3% from 2025 to 2033.

-

Another analysis valued the market at $92.72 billion in 2024, forecasting a CAGR of 24.32% from 2025 to 2032, with revenue reaching nearly $529.06 billion by 2032.

-

In 2025, super apps are estimated to reach $127.1 billion, with projections up to $861.9 billion by 2035, registering a CAGR of 21.1% over the forecast period.

-

The Asia-Pacific region dominates, with over 46% market share in 2024 and a strong lead in adoption thanks to giants like WeChat, Alipay, Grab, and Gojek.

Key Drivers and Industry Trends

-

72% of global e-commerce sales are now made via mobile apps, and 65% of super app users prefer in-app wallet payments.

-

Super apps are evolving beyond payments into ecosystems offering banking, loans, insurance, shopping, social commerce, and more, driving cross-industry monetization and investment.

The eWallet market stats clearly show why there is a growing demand for eWallet super app development.

What Makes an eWallet a Super App?

The rise of fintech super apps has redefined what a single application can do.

An eWallet is no longer just a digital substitute for your physical wallet; it evolves into a super app by becoming a centralized hub for a wide array of daily needs.

This section will explore the key factors that transform a simple eWallet into a powerful super app, highlighting how each element contributes to its success and user engagement:

-

Integrated Ecosystem of Services: A super app hosts a diverse range of services, from ride-hailing and food delivery to e-commerce and social messaging, all within a single application.

-

AI-Powered Personalization: It leverages artificial intelligence to analyze user behavior and deliver personalized recommendations and insights. With Gen AI in payments, super apps enhance fraud detection, optimize transactions, and offer more engaging experience.

-

Frictionless User Experience: The app offers a seamless, all-in-one experience, eliminating the need to switch between multiple apps for different tasks and consolidating a user’s digital life.

-

Embedded Finance: The eWallet becomes the core payment engine for the entire ecosystem, providing a frictionless method to transact across all integrated services.

These are some factors that are considered when we discuss the super app fintech sector. Now, taking this forward, let’s get to know what the core components of e-wallet super apps are.

The Core Components of E-Wallet Super Apps

Today, we all want one app to rule them all.

And the evolution of the e-wallet into the eWallet super app is exactly that.

These aren't just for payments anymore. They're intricate digital worlds, all built on a few key, interconnected services.

Here are the essential components that make a super app truly powerful:

A] Your Personal Payment Hub

Think of this as the engine. It's what makes everything else run.

It's not just a place to pay. It's where you send cash to a friend, scan a QR code at your favorite coffee shop, and manage all your cards in one spot.

Getting this part right is the absolute first step if you want to start an online eWallet business.

Without it, you’ve got nothing.

B] The Mini-App Ecosystem

This is where the magic really happens.

A super app hosts "mini-apps." They're tiny, single-purpose apps that live inside the main one, so you don't have to download a dozen others.

Imagine ordering food, booking a ride, or paying a bill—all without ever leaving the app.

This is a clever way for the super app to grow its services without building everything from scratch.

It’s a win-win for everyone involved.

C] AI for Smart Personalization

Now, here’s the brain of the operation.

AI in finance is used to make your app feel like a personal assistant.

It can analyze how you spend money and offer up a deal from a nearby coffee shop you love.

Or it might create a budget for you.

This kind of intelligence turns a simple app into a financial guide that provides real value.

D] Bulletproof Security

Let’s be honest: in a world of data breaches, security is everything.

Top-notch e-wallet app security isn't a bonus; it's a must-have.

A super app has to be locked down tight.

That means using Face ID, instantly flagging suspicious activity with AI, and using unbreakable encryption to protect your every transaction.

Building this trust is what keeps users coming back for good.

Now that we’ve explored the core components that make an eWallet super app so powerful.

It’s important to understand how these features set it apart from a traditional app and why this distinction matters for both users and investors.

Difference Between Super eWallet App vs Traditional eWallet

So, what's the big difference between a super app and a traditional one?

It all comes down to a shift from "app-switching" to an all-in-one experience.

While traditional apps are masters of one task, a super eWallet app is a digital hub for your entire life.

Think about the best eWallet apps you use. They’re great for payments, but you still need other apps for everything else.

The rise of super apps in the eWallet industry changes that completely. A super eWallet app is more than just a payment tool; it’s a lifestyle platform.

Here’s a simple breakdown of how they stack up against each other:

|

Feature |

Traditional App |

Super App |

|

Functionality |

Single-purpose (e.g., messaging, ride-hailing). |

All-in-one ecosystem (payments, messaging, services). |

|

User Experience |

Specific, but requires users to switch between apps. |

Seamless and integrated, no "app-switching" needed. |

|

Monetization |

Limited to a few streams (e.g., ads, subscription fees). |

Diverse revenue streams (transactions, loans, third-party services). |

|

Development |

Single-focus, often in a silo. |

Modular, collaborative with internal and third-party partners. |

|

Data Usage |

Limited to one service’s user data. |

Rich, cross-functional data for hyper-personalization. |

|

Key Metric |

Daily Active Users (DAU) for one specific task. |

Total time spent in the app and cross-service engagement. |

Features that Define an eWallet Super App

So, you want to create an ewallet super app? That's awesome!

But to really get investors excited, you have to build something a user can’t live without. It's not just about adding features; it's about creating a seamless experience.

Here are the features that make an eWallet truly "super" and why they're a must-have for investors.

1. Seamless Onboarding

The first impression matters.

A smooth onboarding process makes users feel comfortable right away.

This includes instant KYC verification, easy sign-up, and clear guidance for first-time users.

Good onboarding reduces drop-offs and increases early engagement, a key metric investors love.

2. Cross-Industry Integrations

Super apps are only as strong as the partnerships they build.

From e-commerce to transport, food delivery to insurance, integrating multiple industries keeps users inside the app longer.

Cross-industry integrations generate new revenue streams and demonstrate to investors your app's potential for scalable growth.

3. Real-Time Notifications & Alerts

An eWallet super app keeps users informed without being annoying.

Instant alerts for payments, offers, bill reminders, and service updates make the app feel alive and useful.

Investors see this as a sign of an engaged user base that can drive recurring transactions.

4. Loyalty Programs and Rewards

Rewards make users stick around.

Cashback, points, and tiered memberships encourage repeated use across different services.

A well-designed loyalty program increases transactions, retention, and lifetime user value–metrics that attract investors.

5. Multi-Service Ecosystem

A super app is more than a wallet.

It can include shopping, travel, healthcare, insurance, and even investment options, all in one place.

The broader the ecosystem, the more users engage, and the more monetization opportunities arise, making it a highly attractive platform for investors.

6. Smart Analytics Dashboard

Give users insight into their finances. Show spending patterns, budgets, and savings goals.

An intelligent dashboard makes users feel in control, while investors see a data-driven approach that can optimize monetization and improve long-term retention.

7. In-App Financial Services

A super eWallet app can offer built-in financial services beyond payments, like microloans, savings accounts, insurance, or investment options.

Users can manage multiple financial needs in one place without switching apps, which increases engagement and transaction frequency.

Investors love this feature because it opens multiple revenue streams and positions the app as a complete financial ecosystem, not just a wallet.

8. In-App Community & Social Features

Super apps can connect users with friends, family, or local communities.

Ewallet app Features like sending money with messages, shared goals, or group rewards make the app more engaging and social.

Investors see social features as a driver of virality, higher engagement, and increased transaction frequency.

With these features, your app becomes more than just a wallet.

It becomes a full digital ecosystem, one that users love and investors want to be part of. With the features being clear, let’s get to know how to build an ewallet super app.

How to Build an eWallet Super App?

Developing a successful e-wallet super app is a complex but rewarding process.

It requires a clear strategy and a step-by-step approach that prioritizes the user, security, and scalability.

Here's a clear breakdown of how to create an e-wallet super app:

Step 1: Discovery and Strategic Planning

Before you can truly build an eWallet super app, you must lay a rock-solid foundation that defines your app’s purpose and ensures its long-term viability.

This initial phase is all about deep analysis and strategic decision-making, where you'll map out a clear path to market by understanding your audience and the regulatory landscape you'll be operating in.

A) Market Research and Audience Identification

-

You need to figure out exactly who your app is for. This involves identifying a specific target audience and understanding their daily pain points and unmet needs.

The goal is to discover what problems your app can solve that current solutions simply don't. -

You should also conduct a thorough competitor analysis. Don't just look at their features; understand their business models, user base, and what makes them successful.

This helps you find a unique value proposition that sets you apart in a crowded market.

B) Business Modeling and Regulatory Compliance

-

Building a financial app means dealing with regulations from the very beginning. You'll need to research and plan for legal compliance, including strict financial regulations, KYC (Know Your Customer), and AML (Anti-Money Laundering) laws in all of your target regions.

-

This is a fun part of the process where you get to define your app's business model. Will you charge transaction fees, offer premium subscriptions, or monetize through third-party services? Having a clear revenue strategy and a plan for ewallet app compliance is crucial for attracting investors and ensuring long-term sustainability.

Step 2: UI/UX Design and Prototyping

The user interface and experience are crucial for a multi-service app. If it's not intuitive, users will get frustrated and get lost, leading to poor adoption.

A well-designed user journey ensures that all the app's features are not just functional but also a pleasure to use, providing a seamless and cohesive experience that keeps users coming back.

A thoughtful mobile app design focuses on clarity and simplicity, making the app's many services feel connected and easy to navigate.

A) User Journey Mapping

-

Designers map out every single action a user will take in the app, from the very first time they open it to completing a complex transaction. The goal is to create a seamless, frictionless flow between all the different services.

-

This process helps prevent a clunky user experience and ensures that all the app's features feel like a natural part of a single, unified platform.

B) Wireframing and Visual Design

-

Once the user flow is established, designers create low-fidelity wireframes to outline the app's structure and then high-fidelity prototypes. Prototypes allow you to test the app's usability with real users and get crucial feedback before writing a single line of code, saving significant time and resources

-

After that, the focus shifts to visual design and branding. The app’s look and feel should be consistent and appealing across all screens, creating a strong and memorable brand identity.

Step 3: Backend and API Development

The backend is the complex engine that powers the entire super app. It handles all the logic, data storage, and security.

A robust and scalable backend is what allows the platform to function without a hitch, managing high transaction volumes and a wide range of services while maintaining top-tier security.

A) Scalable, Modular Architecture

-

Your backend must be robust and scalable enough to handle a high volume of transactions and a wide range of services without performance issues. A modular Architecture is crucial as it enables the seamless addition of new mini-apps and features in the future, eliminating the need for a complete system rebuild.

-

This part also involves choosing the right database to manage the massive amount of user and transaction data efficiently.

B) API Integration and Security Protocols

-

The app's core relies on connecting to other services. The backend must be able to securely integrate with various digital wallet APIs for everything from payment gateways to third-party services like ride-hailing or food delivery.

-

Security isn't an afterthought; it's the number one priority. You must implement advanced protocols like tokenization, end-to-end encryption, and real-time fraud detection systems, which are often powered by machine learning, to protect users and their funds.

Step 4: Front-End Development & Quality Assurance

This is the part of the app that users interact with directly, and it must be fast, responsive, and reliable.

This phase brings the user-friendly design to life while also building in the security and performance protocols that ensure a smooth and safe experience for everyone.

A) Cross-Platform Development

-

Time to launch the app on the App Store or submit it to the Play Store to reach the widest possible audience. Using cross-platform technologies can speed up development time and ensure a consistent experience across all devices.

-

The front-end must be optimized for performance and responsiveness to ensure a smooth user experience, even on older smartphones.

B) Rigorous Testing

-

A rigorous and comprehensive app testing phase is critical. The app must undergo multiple rounds of testing, including functionality tests, performance tests, and, most importantly, thorough security audits to check for any vulnerabilities.

-

This step also involves beta testing with a small group of users to get real-world feedback on usability before the final public launch.

Step 5: Launch and Post-Launch Growth

The work doesn't stop once the app is live.

A successful e-wallet app is a living product that evolves constantly, driven by user data and a commitment to continuous improvement to ensure its long-term success in the market.

A) App Store Deployment

-

Once we complete all the development and testing, we deploy the app to the App Store or submit it to the Google Play Store or both.

-

This process includes creating compelling app store listings, screenshots, and videos to attract new users.

B) Post-Launch Support and Analytics

-

Once launched, you need to collect user feedback, monitor the app's performance, and analyze user data to understand how people are using the app. This is crucial for making informed decisions about future updates.

-

The final step is proper app maintenance services, with regular updates to fix any bugs, add new features, and keep the app fresh and relevant to the ever-changing needs of the market.

So, this is how to develop a successful e-wallet super app. It's time to know about different case studies of successful super apps.

Case Studies: Successful Super Apps Examples

The concept of a super digital wallet app has revolutionized the digital landscape, especially in regions where mobile technology is the primary mode of access to financial services.

These platforms demonstrate how an e-wallet can evolve from a simple payment tool into a comprehensive, indispensable ecosystem.

The following super apps examples highlight the diverse super apps strategies used to achieve this status:

► Asian Giants

The e-wallet super app model was pioneered in Asia, where high mobile penetration and a burgeoning digital economy provided the perfect environment for these all-in-one platforms.

WeChat Pay (China): WeChat's journey is a prime example of a social network leveraging its massive user base to become a super application.

Starting as a messaging app, it integrated WeChat Pay to handle transactions, creating a powerful network effect.

With over 1.3 billion monthly active users, WeChat's success stems from its "Mini-Programs," which allow third-party developers to create lightweight apps within the main platform.

This enables users to perform virtually any task, from ordering food and booking a doctor’s appointment to paying a bill, without ever leaving the app.

Alipay (China): Starting as a payment gateway for Alibaba's e-commerce sites, Alipay's transition to a super e-wallet app was driven by a focus on comprehensive financial services.

In addition to payments, it provides services such as money market funds, insurance, credit scoring, and consumer loans.

This financial core, combined with its mini-app platform for services like food delivery and bike-sharing, has solidified its position as a major player with over 1 billion users.

GrabPay (Singapore): Beginning as a ride-hailing company, Grab successfully used its large user base to launch GrabPay and expand into a regional super app.

Its strategy involved adding essential services like food delivery and logistics, making it a go-to platform for daily needs in Southeast Asia. This expansion demonstrates a smart, data-driven approach to e-wallet super app development.

Gojek (Indonesia): Gojek's evolution mirrors Grab's, starting with a motorcycle taxi service and expanding to over 20 services.

Its core e-wallet, GoPay, powers all transactions, from food and grocery delivery to home services. This hyper-local approach has made it an integral part of the Indonesian digital economy.

► Middle East & Africa

In these regions, mobile money platforms are transforming into super apps, filling a crucial gap where traditional banking infrastructure is less developed.

-

Careem Pay: After being acquired by Uber, Careem began its journey toward becoming a super app.

It leverages its dominant position in ride-hailing to offer additional services like food delivery and peer-to-peer money transfers via Careem Pay. -

M-Pesa Super App: M-Pesa is a powerful example from Africa. It began as a simple SMS-based service for sending and receiving money, bringing financial inclusion to millions.

Its evolution into a super e-wallet app with "Mini-Apps" allows users to access services like bus ticketing and utility payments, transforming it from a money transfer tool into a digital marketplace.

► Western Experiments

While Asia perfected the "super app" model, the rise of super apps in eWallet has finally reached the West.

Unlike their Eastern counterparts, Western companies are strategically transforming their popular, single-use apps by adding new features, turning them into all-in-one platforms.

► The Evolution of PayPal

When we talk about the Western super app journey, PayPal’s move into a super app is a perfect case study.

It started as a simple payment gateway, a foundational piece of e-commerce. But now, the company is actively expanding its platform.

They're integrating features like high-yield savings accounts, in-app shopping, personalized deals, and even cryptocurrency trading.

If you are exploring how to create an app like PayPal today, you can't just focus on payments; you have to build an ecosystem that keeps users within the app for all their financial and shopping needs.

► The Strategies of Revolut, Cash App, and Venmo

These apps represent the distinct, multi-pronged approaches to the super app model in the West. Their unique strategies are shaping the future of finance.

-

Revolut: Originally known for its multi-currency travel card, Revolut has expanded its services to become a global financial tool. It has added features like commission-free stock trading, cryptocurrency exchange, and even accounts for kids. To successfully create a top app, you must focus on building a comprehensive financial platform that offers a borderless banking experience.

-

Cash App: The app's strength comes from its tight integration with Bitcoin and stock trading. It began with simple peer-to-peer transfers but quickly added the ability to buy, sell, and send Bitcoin and stocks, making complex financial services accessible to a young, mobile-first audience. To build an App like Cash App, you must centre your strategy on simplicity and tight integration with next-gen financial tools.

-

Venmo: While Venmo’s core remains its social feed and a fun, communal way of handling payments, it has steadily added features like business profiles, a credit card, and an option for users to buy and sell cryptocurrency. It is using its powerful social network to expand into a broader financial tool, showing us how to make an app like Venmo by leveraging a strong user community.

The Revolut, Cash App, and Venmo strategies show that in the West, the path to becoming a super app isn't a single highway; it's a collection of unique, feature-driven journeys.

So, with these points being taken into consideration, even if you have doubts about why you should get into the trending market of ewallet super apps. Then, the next section will clear that up, too.

Benefits of Super Apps in the eWallet Industry

The journey to make an ewallet super app is driven by the immense value it provides to all key players, from users to investors.

The rise of Super Apps in the eWallet industry is a strategic move that addresses market demands for an all-in-one solution, creating a powerful, interconnected ecosystem.

1. For Users

Let’s find out how the rise of super apps in eWallets is going to help users:

-

Convenience of a one-stop platform: An eWallet super app consolidates various services like payments, messaging, and on-demand services into a single platform. This eliminates the need for users to download and manage multiple apps, saving time and storage space.

-

Enhanced financial inclusion: By offering a wide range of services and financial tools in one accessible platform, these apps can serve unbanked or underbanked populations. They provide an easy entry point into the digital economy, helping to bridge the financial divide.

-

Rewards & loyalty benefits: As users engage with multiple services on a single platform, the app can offer highly personalized rewards and loyalty programs. This creates a more rewarding experience and encourages users to stay within the app's ecosystem.

2. For Businesses

Explore how the rise of super apps is helping businesses unlock new avenues for growth:

-

Increased customer retention: By providing a comprehensive suite of services, super apps reduce customer churn and keep users engaged for longer periods. The convenience of a single app for all needs makes users less likely to switch to a competitor.

-

Higher engagement & data-driven insights: The vast amount of data generated from cross-service user activity offers businesses invaluable insights into consumer behavior. This allows for highly targeted marketing and the development of new, highly relevant services.

-

Opportunities for cross-selling: The super app's interconnected ecosystem provides a built-in audience for new services and products. Businesses can easily cross-sell or upsell to an existing user base, significantly reducing customer acquisition costs.

3. For Investors

Discover why the eWallet super app model is becoming the ultimate investment opportunity:

-

Long-term growth potential: Investing in an eWallet super app offers a diversified portfolio in a single platform, reducing risk while maximizing revenue streams. The app's ability to constantly add new services provides a clear path for sustainable, long-term growth.

-

Ecosystem lock-in strategies: Super apps are highly "sticky" due to the convenience they offer, making it difficult for users to leave. This high customer retention and lock-in strategy provides a stable, predictable user base, which is very attractive to investors.

-

Market expansion opportunities: The modular, API-driven architecture of a super app allows for rapid expansion into new markets and verticals. This provides a low-cost, low-risk way to capture market share and scale the business, which is a key indicator of future success.

With the immense potential of super apps now clear, it's time to dive into the significant challenges you must overcome to start a successful launch of your solution.

Technology Behind Super Apps: All You Need to Know

Successful Super app development requires a foundation built on a robust, scalable, and modular technological architecture.

Unlike traditional single-purpose apps, super apps rely on a sophisticated tech stack to seamlessly integrate multiple services and handle massive user traffic.

Let’s get to know the technologies working behind these super applications in eWallet:

A] Modular Architecture & Frontend

The backbone of a super app is a microservices architecture, which allows different features (like payments, messaging, or food delivery) to be developed and updated independently.

A skilled mobile app development company is crucial for building a unified and seamless user interface on a flexible frontend framework like Flutter or React Native.

B] Scalable Backend & Cloud Infrastructure

To handle millions of users and real-time data from various services, super apps require a powerful backend and cloud infrastructure.

A top-tier partner can help you leverage technologies like Node.js, Python, or Java with cloud services such as AWS, GCP, or Azure to ensure the app remains fast and reliable at scale.

C] Intelligent Automation with AI

AI is the engine that personalizes the super app experience.

It powers everything from in-app search and user recommendations to enhancing security.

Specifically, the integration of AI in Payments helps to detect fraud, ensure secure transactions, and streamline the checkout process.

This requires a specialized AI app development company with expertise in machine learning and data science.

The Future of eWallet Super Apps

The future of fintech super apps is a thrilling ride, with digital wallet app trends pointing to a world where our phones become our financial command centres.

No longer just a place to store cards, these apps are evolving into integrated ecosystems that offer everything from banking and investing to food delivery and entertainment.

The model that was once unique to Asia is now spreading globally, with companies in the West and beyond racing to become the next all-in-one platform.

In places like Vietnam, the "super app" battle is particularly fierce, with local players fiercely competing to win the digital shopping carts of a young, mobile-first population, proving that the future of finance is indeed fun, fast, and multi-functional.

This is the right time to leverage this trend, for which you can take the help of experts in this industry. Our next section will be of help:

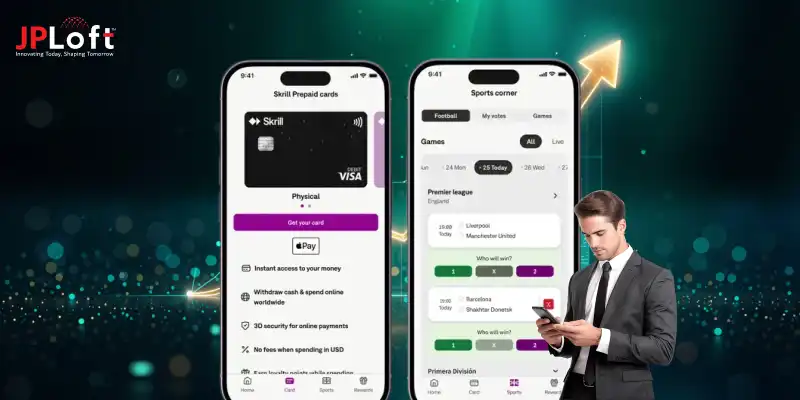

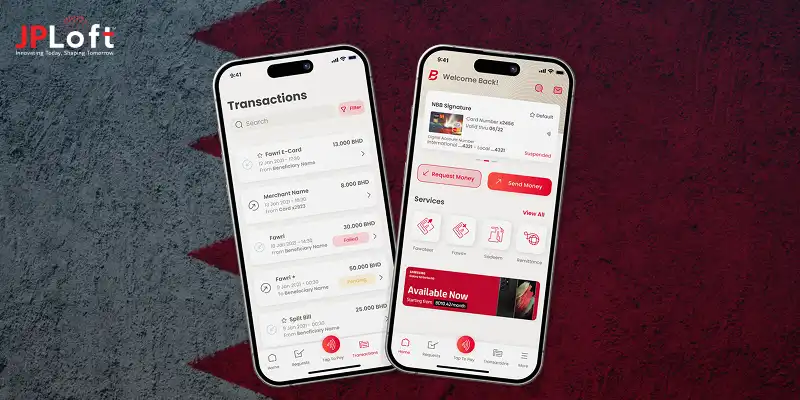

How JPLoft Can Transform Your Business with a Super App?

Building a successful e-wallet app requires more than just a great idea; it needs technical expertise, a strategic approach, and a deep understanding of user behaviour.

While many companies can build an app, few have the experience to create a comprehensive, secure, and scalable financial ecosystem that can evolve into a super app.

That's where JPLoft stands out.

With a decade of experience and over 1100 projects delivered, JPLoft is a leading e-wallet app development company, offering a full suite of services from UI/UX design to AI integration and robust security to help you build a future-proof app.

Conclusion

The evolution of the e-wallet into a super app represents a major shift in the digital landscape.

By integrating an array of interconnected services from payments and e-commerce to social features and AI-powered personalization, these platforms become indispensable to daily life.

The successful case studies of companies like WeChat and Grab prove that this model not only drives user engagement and loyalty but also creates a powerful, profitable ecosystem.

While Western companies are taking a different, incremental approach, the end goal is the same: to create a single app that meets a user's every need.

The future of super apps in the ewallet industry is not just about transactions; it's about building a digital world in a single app.

FAQs

An e-wallet is a single-purpose app for digital payments. A super app starts with a core service like an e-wallet but expands to include multiple, integrated services like ride-hailing, food delivery, and social messaging within a single platform.

Super apps thrived in Asia due to a combination of high mobile adoption, a large unbanked population, and a less-developed legacy banking system, which created a perfect opportunity for all-in-one digital platforms to fill the void.

AI is the "brain" of a super app. It analyzes vast amounts of user data to offer personalized recommendations, enhance security through fraud detection, and create a more intuitive and seamless user experience.

Mini-apps are lightweight, single-purpose applications that run directly inside a larger super app, like WeChat. They allow third-party developers to offer services without users having to download a separate app, making the super app a central ecosystem.

In the West, companies are typically not building a super app from scratch. Instead, they are adding new features and services to their existing, popular single-use apps (like PayPal or Cash App) to expand their functionalities and increase user engagement.

Share this blog