Key Takeaways:

An eWallet app must be built with security, compliance, and scalability from the start to earn user trust and support long-term growth.

Starting with an MVP helps validate demand quickly, while full-scale eWallet apps are designed for enterprises targeting high transaction volumes.

Simple onboarding, biometric security, and clear transaction flows are critical for user adoption in eWallet apps.

AI enables eWallet apps to detect fraud, personalize experiences, and deliver real-time financial insights to users.

A scalable tech stack combined with early regulatory compliance prevents costly rebuilds and operational failures later.

Payments have quietly shifted from physical counters to screens we carry everywhere.

People now expect money to move as easily as messages, without delays, confusion, or repeated friction.

This shift has changed how customers interact with brands, banks, and service providers across everyday transactions.

For businesses, this change is not just about convenience.

Digital wallets offer a way to stay closer to users, streamline payment experiences, and build long-term trust in an increasingly cash-light economy.

Holding the largest position in the market, they command 30% of the global market share.

At the same time, the space comes with real challenges around regulation, security, user confidence, and scalability that cannot be ignored.

This guide covers everything required for eWallet app development, from planning and compliance to launch and long-term growth.

You will learn how these platforms are planned, what decisions matter early on, and how businesses approach growth, compliance, and long-term sustainability before going live.

Let’s get to know further:

Overview of Ewallet App

An e-wallet app is a digital application that stores payment information securely on a mobile device or computer, allowing users to make transactions without physical cards or cash.

It functions as a virtual wallet that holds credit cards, debit cards, bank account details, and sometimes loyalty cards or coupons in one place.

These apps allow users to pay for purchases at stores, online shops, and within other applications by simply tapping their phone or clicking a button.

Users can also send money to friends and family, receive payments, track their spending, and manage multiple payment methods from a single interface.

The app encrypts payment data to keep financial information safe during transactions.

There are so many top e-wallet apps that are go-to options for day-to-day operations for people: PayPal, Cash, STC Pay, and more.

One of the huge reasons e-wallets became popular is that they offer convenience and speed compared to traditional payment methods. Instead of carrying multiple cards or counting cash, users access everything they need for payments through their smartphones.

Many apps also provide instant notifications for every transaction, helping users stay aware of their spending in real time.

Understanding what an e-wallet app does is the first step in learning how to create an e-wallet app that users trust and adopt.

Now that we understand what an e-wallet app is, it's helpful to know that not all e-wallet apps work the same way. Let’s get to know others one by one:

Types of eWallet Apps You Should Know

The types of eWallet apps are defined by how money is stored, where it can be used, and what level of banking access the wallet supports.

Understanding these types helps businesses decide the right operating model before moving forward.

Broadly, eWallets differ based on merchant access, withdrawal options, and regulatory requirements.

Some wallets are built for closed ecosystems, while others support multi-merchant payments or full bank integration. The choice directly affects compliance effort, user flexibility, and scalability.

The main types of eWallet apps are:

-

Closed eWallets, which work within a single brand or platform

-

Semi-closed eWallets, which allow payments at multiple partner merchants

-

Open eWallets, which support bank transfers and cash withdrawals

-

Cryptocurrency wallets, which manage digital assets on blockchain networks

Each model serves a different business goal, so selecting the right type of eWallet app early sets the foundation for smoother compliance, better user experience, and long-term growth.

How Do eWallet Apps Work?

Understanding how eWallet apps work is a core part of any eWallet app development guide. At a high level, these apps follow a simple flow that starts with user setup and ends with confirmed, recorded transactions.

But, to know it all, below is a step-by-step explanation of how the process works in real-world usage.

Step 1: User Registration & Setup

The first stage in ewallet application development is user onboarding.

Users register by creating an account and linking a payment source such as a bank account or card. This setup allows the system to identify users correctly before any payment is initiated.

A reliable onboarding flow is essential when businesses build an e-wallet app.

Step 2: Data Encryption and Tokenization

After registration, the user's payment data is secured before any transaction takes place.

During ewallet application development, sensitive information is protected so actual account or card details are never exposed during payments.

This step ensures that when businesses make an ewallet app, user data remains safe throughout every transaction.

Step 3: Transaction Process

When a user initiates a payment, the app checks the available balance and forwards the request for processing.

This stage represents the core flow explained in any ewallet app development guide, where funds are securely moved from the user to the recipient.

For businesses looking to build an E-wallet app, keeping this flow fast and reliable is critical for user adoption.

Step 4: Authorization and Confirmation

Once the transaction request is processed, it goes through authorization to confirm that the payment can be completed.

The app then sends confirmation to both the user and the recipient.

This step reduces errors and failed payments, which is especially important when teams make an ewallet app intended for high transaction volumes.

Step 5: Rewards and Transaction History

After a successful transaction, the app records the payment details and updates the user’s transaction history.

Many platforms also apply rewards or loyalty benefits at this stage.

Tracking these records correctly is a key requirement in developing an ewallet app, as it helps users monitor spending and builds trust over time.

Now that the payment flow is clear, the next step is understanding the marketing opportunity and business potential of the market.

Why the E-Wallet Market Presents a Strong Business Opportunity?

If you're wondering why you should build an e-wallet app right now, the answer lies in the numbers and the shifting behavior of consumers worldwide.

The digital wallet market isn't just growing, it's exploding.

According to recent payment industry intelligence reports, Digital payments are projected to cross $33.5 trillion globally by 2030.

That's not a typo. We're talking about exponential growth driven by convenience, security, and the unstoppable rise of mobile commerce.

So what makes this the perfect time to build a mobile wallet app? Let's break down the top reasons to invest in eWallet apps and why this opportunity is too big to ignore.

1. The Market Is Red Hot and Ready

Mobile payments are no longer a novelty; they're the norm.

Digital wallet usage is expected to surpass 6 billion users by 2030, and that number is climbing every year. In fact, digital wallets have overtaken credit cards as the most popular payment method worldwide.

Whether it's paying for groceries, splitting bills with friends, or shopping online, users prefer the speed and simplicity of tapping their phone over fumbling with cash or cards.

This shift is creating massive demand for digital wallet app development.

Businesses that start an online eWallet business now are entering a market where consumer trust and adoption are already established.

You're not convincing people to try something new; you're offering them a better version of what they already love.

2. High User Engagement and Retention

One of the most compelling e-wallet app stats is how often people use these apps once they download them.

Studies show that digital wallet users open their apps an average of 2-3 times per day. Compare that to most apps, which struggle to keep users engaged beyond the first week.

The reason? E-wallets solve real, everyday problems. They're not just another app; they're a utility.

This high engagement translates directly into business value. When you build a digital wallet app, you're creating a platform that users depend on daily.

3. Multiple Revenue Streams

Here's where it gets really interesting.

Digital wallet apps don't just make money from payments; they open the door to multiple app revenue streams.

You can earn through transaction fees, partnerships with merchants, in-app advertising, premium subscriptions, and even data insights (while respecting privacy, of course).

Some e-wallet platforms also offer microloans, bill payments, and investment options, turning a simple payment app into a full financial ecosystem.

4. Lower Operational Costs Than Traditional Banking

Unlike traditional banks that require physical branches, ATMs, and massive infrastructure, digital wallet app development is lean and scalable.

Once your app is live, serving 10,000 users doesn't cost much more than serving 1,000.

This scalability is a huge advantage, especially for startups and businesses looking to enter the fintech space without the overhead of a traditional financial institution.

Plus, as more businesses go cashless, demand for digital payment solutions is only going to increase.

Restaurants, retailers, transit systems, and even street vendors are adopting digital payments. Your e-wallet app becomes the bridge that connects all these transactions.

5. The Rise of Super Apps

We're also seeing the rise of "super apps", platforms that combine payments, messaging, e-commerce, and more into one experience.

Think of apps like WeChat in China or Paytm in India. These started as payment platforms but evolved into ecosystems where users do everything from ordering food to booking flights.

When you build a mobile wallet app with this vision in mind, you're not just creating a payment tool; you're laying the foundation for a platform that could become indispensable to users' daily lives. And that's where the real business opportunity lies.

Now that you understand the reasons to invest in an e-wallet app, let’s explore the essential features that make these apps user-friendly.

What Features Should an E-Wallet App Include?

An e-wallet app includes features that enable secure payments, simple money management, and reliable transaction tracking.

Remember, features can make or break an app’s success. Let’s explore the essential features of a digital wallet practical for daily use:

1. Secure User Registration and Login

First impression is the last impression, and in the case of an e-wallet app, probably the only option.

This feature allows users to create accounts using email, phone numbers, or social media while implementing multi-factor authentication and biometric verification.

Users get peace of mind knowing their financial data is protected from the moment they sign up.

For businesses, robust authentication reduces fraud, builds trust, and ensures compliance with financial regulations right from the start.

2. Multiple Payment Options

Flexibility is everything in digital payments.

This feature lets users link credit cards, debit cards, bank accounts, and even cryptocurrencies to their wallet, giving them the freedom to choose how they pay.

Users appreciate having all their payment methods in one place without switching between apps.

And, as a business, you benefit from higher conversion rates since users can complete transactions using their preferred method, reducing cart abandonment and increasing sales.

3. QR Code Scanning and Generation

Speed meets simplicity with QR codes.

Users can scan a merchant's QR code to pay instantly or generate their own code to receive money from others without sharing sensitive account details.

This contactless payment method is fast, hygienic, and works even in areas with limited internet connectivity.

When you build an E-wallet app with QR functionality, businesses can serve customers faster, reduce checkout times, and operate with minimal hardware requirements.

4. Real-Time Transaction History

Transparency builds confidence in any financial app.

This feature provides users with a detailed log of every transaction, including date, time, amount, merchant name, and payment method, all accessible instantly.

Users can track their spending patterns, identify unauthorized transactions quickly, and manage their budgets more effectively.

Businesses gain valuable insights into customer behavior, can resolve disputes faster, and maintain accurate financial records for accounting purposes.

5. Push Notifications and Alerts

Instant updates keep users informed and secure. This feature sends real-time notifications for every transaction, low balance warnings, special offers, payment confirmations, and suspicious activity alerts directly to users' devices.

Users stay in control of their finances and can respond immediately if something looks wrong.

For businesses, push notifications are powerful marketing tools that drive engagement, encourage repeat purchases, and help recover abandoned transactions with timely reminders.

6. Bill Payment and Recharge Services

Convenience goes beyond just buying products.

This feature allows users to pay utility bills, recharge mobile plans, book tickets, and handle recurring payments, all from within the wallet app.

Users save time by managing multiple financial obligations in one place instead of visiting different platforms or standing in queues.

When you make an e-wallet app with these services, businesses can earn commission on every bill payment while keeping users engaged with the platform daily.

7. Peer-to-Peer Money Transfer

Sharing money should be as easy as sending a message.

This feature enables users to send and receive money instantly from friends, family, or anyone in their contact list using just a phone number or email address.

Users love the convenience of splitting bills, repaying loans, or sending gifts without bank transfers or cash.

Businesses benefit from increased app usage, stronger network effects as more people join to transact with each other, and potential revenue from transfer fees.

8. In-App Customer Support

Help should always be one tap away. This feature provides users with 24/7 support through chatbots, live chat, FAQs, and ticket systems directly within the app for resolving issues, answering questions, or reporting problems.

Users feel valued when they get quick assistance without leaving the app or making frustrating phone calls.

When you develop a mobile wallet app with strong support features, businesses reduce churn, improve user satisfaction, and resolve issues before they escalate.

Advanced Features to Have in an eWallet App

Once paying becomes effortless, users expect their wallet to do more than just move money.

So, you need advanced features for your mobile wallet app that’s focused on improving user engagement, personalization, and long-term value.

Let’s find out some of the best features for your app:

1. AI-Powered Financial Insights and Spending Analytics

Your users want to know where their money goes. Not just transactions: real insights.

This feature uses artificial intelligence to analyze spending patterns and deliver personalized financial recommendations.

It automatically categorizes transactions, identifies trends, and sends smart alerts about unusual spending or upcoming bills.

2. Multi-Currency Wallet with Real-Time Exchange Rates

Global transactions shouldn't feel complicated. Your users need seamless currency management.

Enable users to hold and transact in multiple currencies within one interface. The system fetches real-time exchange rates and allows instant conversion with transparent fees.

Perfect for travelers and freelancers, this feature includes rate alerts and historical charts, making international payments simple and cost-effective for everyone.

3. Integrated Investment and Wealth Management

Why should users leave your app to invest? Keep them engaged while helping them grow wealth.

Transform your wallet into a financial platform by integrating investment options. Users can invest spare change, purchase mutual funds, stocks, or digital gold directly from their balance.

Include portfolio tracking and educational resources. This keeps funds in your ecosystem while dramatically increasing user engagement and lifetime value.

4. Smart Budgeting and Automated Savings Goals

Everyone wants to save more. Most struggle without the right tools.

Implement intelligent budgeting that lets users set spending limits and track progress in real-time. Add automated savings with goal-based pockets for vacations or emergencies.

The system sends alerts when approaching budget limits. Gamification elements like achievement badges make saving money engaging, rewarding, and actually fun.

5. Social Payment Features and Split Bill Functionality

Money is social. Paying friends back shouldn't be awkward or complicated.

Let users split bills instantly, create shared expense groups, and send payment requests with custom messages.

Integration with social platforms enables friend connections and shared transaction histories. Add group savings goals and digital gift cards.

This transforms your wallet from a transaction tool into a social financial experience that users love.

6. Offline Payment Capability with NFC Technology

Internet connectivity isn't always guaranteed. Your wallet should work everywhere, every time.

Implement offline payment modes using NFC technology for areas with poor network coverage. The system stores limited transactions locally, syncing when the connection is restored.

Include contactless payment options for in-store purchases, public transportation, and vending machines. This makes your wallet truly versatile across all payment scenarios imaginable.

These advanced ewallet app features represent the evolution from simple payment apps to comprehensive financial management platforms that users can't imagine living without.

So, these are some features to keep in mind and to use in your app. With this being done, time to move on to the development process of an e-wallet app.

How to Develop an eWallet App: Step-By-Step Process

The shift toward a cashless society has completely changed digital wallets from a luxury into a daily necessity.

In 2026, digital wallet development is no longer just important; it is a necessity for those founders who want to stay relevant in a world where “Invisible payments’’ and “super apps” define the consumer experience.

To succeed in this competitive landscape, you need a roadmap that balances rigorous security with a frictionless user experience.

Here is your comprehensive guide on how to build an eWallet app from the ground up:

Step #1: Market Research

Before you begin to create an ewallet app, thorough market research is essential.

This foundational step involves analyzing your target audience, understanding their pain points, and identifying what they expect from a digital wallet solution.

Study your competitors to see what features they offer and where gaps exist in the market.

You should examine user reviews to understand what customers love and what frustrates them about existing ewallet apps.

This research will help you identify the USP and opportunities to differentiate your app.

When you do research, you should consider different factors such as demographics, spending habits, preferred payment methods, and regional regulations that might affect your app’s functionality.

Step #2: Define Business Objectives

Here's where dreams meet strategy. What's your "why" behind this eWallet?

Some questions need to be answered: Are you solving the problem of expensive international remittances? Or perhaps you're creating a merchant-focused solution for small businesses? Your objectives should be crystal clear and measurable.

Let's get specific: Instead of saying "we want lots of users," aim for "acquire 100,000 active users within the first year with a monthly transaction volume of $5 million." See the difference?

Think about your monetization strategy upfront. Will you charge transaction fees, offer premium features, or partner with merchants for commission? These decisions influence everything from how to create an ewallet app approach to your marketing strategy.

Your business model should answer: Who are you serving? What problem are you solving? How will you make money? And why should users choose you over established players?

Step #3: Choose the Right Tech Stack

This is where many founders feel overwhelmed, but don't worry, let's break it down simply.

Your app tech stack is the foundation and framework of your digital wallet. When you explore how to build an ewallet app, you need solid, scalable technology that won't crumble as you grow.

For app development, you've got choices:

-

Native development (Swift for iOS, Kotlin for Android) gives you maximum performance and access to device features.

-

iOS app development uses Swift to deliver high performance and seamless access to Apple’s device features and ecosystem.

-

Android app development leverages Kotlin to build flexible, scalable apps that perform consistently across a wide range of devices.

-

Cross-platform frameworks like React Native or Flutter let you write code once and deploy everywhere, saving time and money.

Your backend needs to be robust. Node.js offers excellent real-time capabilities, Python provides powerful data processing, while Java brings enterprise-grade reliability. Choose based on your team's expertise and your specific requirements.

Don't forget about databases; PostgreSQL handles complex financial transactions beautifully, while MongoDB offers flexibility for evolving data structures.

Cloud infrastructure matters too. AWS, Google Cloud, or Azure provide scalability, but each has different pricing models and strengths. Match them to your projected growth and budget.

Step #4: UI/UX Design of Your App

UI/UX Design is one of those elements that keep your users hooked on your ewallet app.

So, make sure to create an intuitive and user-friendly interface that simplifies financial transactions.

App design should prioritize ease of navigation, with clear pathways for common actions like sending money, checking balance, and viewing transaction history.

You should implement a clean, modern aesthetic that builds trust while maintaining brand consistency.

Make sure to ensure accessibility for users with different abilities and technical proficiency levels.

The design phase should include app wireframe, prototyping, user testing, and proper iterations based on your user feedback to ensure the final product resonates with your target audience.

Step #5: Develop Your eWallet App

When you explore how to build an eWallet app, this is your time to transform designs and plans into a functional product.

This includes both frontend and backend development working in tandem.

Here, frontend developers build the server-side logic, database architecture, and API integrations.

You should implement core features such as user registration and authentication, wallet creation, fund transfers, bill payments, and many more.

To make a digital wallet, use agile development methodologies with regular sprints to ensure continuous progress and flexibility to adapt to changing requirements.

Developers make sure to maintain clean, well-documented code for easier maintenance and future updates.

Step #6: Implement Security Measures

Security is paramount in financial applications.

Here, you need to focus on strengthening your digital wallet security. You should implement multi-layered security protocols to protect user data and transactions.

Use end-to-end encryption for all data transmission and store sensitive information using advanced encryption standards.

Make sure to add fraud detection mechanisms using machine learning algorithms to identify suspicious activities.

Regular security audits and penetration testing should be conducted to identify vulnerabilities.

Step #7: Quality Assurance

To make sure your app works well across all scenarios, you should do rigorous mobile app testing.

This phase catches issues early, running automated tests on emulators, real devices, and varying network conditions to ensure rock-solid reliability. Compatibility checks across OS versions and screen sizes prevent launch-day surprises.

User feedback loops and beta testing refine the app, while accessibility audits guarantee inclusivity for all audiences.

Step #8: Launch Your Ewallet App

Launching your ewallet app requires careful planning and execution.

Once the final version is released, it's time to publish your app on the App Store or submit it to the Play Store with proper descriptions, screenshots, and promotional videos.

Spark buzz with a multi-channel blitz: influencer drops, geo-targeted ads, gamified referral codes, and live launch events. Watch downloads surge as real-time analytics guide hotfixes and feature unlocks for viral momentum.

Step #9: Monitor and Maintain

Your eWallet app's success doesn't end at launch. Time to implement vigilant monitoring and proactive mobile app maintenance services.

You should track real-time metrics like crash rates, user drop-offs, and transaction speeds using analytics dashboards. Spot issues before users do.

Make sure to roll out lightning-fast hotfixes for bugs and optimize performance amid OS updates. You should fortify security against emerging threats.

Leverage A/B testing for UI tweaks that boost retention. With expert mobile app maintenance services, scale features like biometric logins seamlessly. Ensure 99.9% uptime and turn your app into a revenue powerhouse.

Now that you know the full roadmap to develop an eWallet app, it's time to choose your starting point wisely.

MVP vs Full-Scale E-wallet App: What Should You Choose?

When planning to build an ewallet app, users often get confused between whether to build an MVP or a full-scale ewallet app.

Well, start with an MVP. If you’re a startup joining the bandwagon, tight on budget, or need quick validation, you can include features such as core payments, basic security, and simple UI to launch it faster and gather feedback.

Go full scale if you’re enterprise-ready with funding, chasing instant dominance, or targeting premium users.

The table below helps you choose whether to create an MVP or create an eWallet app based on your goals and budget:

|

Criteria |

MVP E-Wallet App |

Full Scale E-Wallet App |

|

Purpose |

Validate the idea and user demand quickly |

Build a complete, market-ready product |

|

Time to market |

Fast launch with minimal setup |

Longer development cycle |

|

Development cost |

Lower initial investment |

Higher upfront investment |

|

Feature set |

Core payment and basic wallet functions |

Advanced payments, analytics, rewards, integrations |

|

Scalability |

Limited, requires later upgrades |

Designed to scale from day one |

|

Security depth |

Basic but compliant |

Advanced, multi-layer security |

|

Compliance readiness |

Meets minimum regulatory needs |

Fully aligned with regional and global regulations |

|

User experience |

Functional and simple |

Refined, optimized, and polished |

|

Maintenance effort |

Lower in early stages |

Higher due to system complexity |

|

Business risk |

Low risk, easier to pivot |

Higher risk if the market fit is wrong |

|

Ideal for |

Startups and new market ideas |

Enterprises and growing platforms |

For a proper, clear answer: You can pick MVP for lean agility, full scale for maximum impact, and match it to your resources and goals. Having clarity on both approaches is essential for making the right decisions and avoiding costly missteps later.

And, this is where an experienced mobile app development company can help you decide what’s best for your business.

Which is the Right Tech Stack To Use in the eWallet app?

Let’s break it down honestly. The right tech isn’t about chasing popular tools; it’s about delivering an experience that stays fast even under pressure and is ready to grow the moment users demand more.

So, do not underestimate the role of the tech stack in your ewallet.

A smart ewallet app tech stack keeps the app fast today and flexible enough to grow into a full fintech product tomorrow.

Let’s get to know what improves the foundation of your app:

|

Layer |

Component |

Recommended Technologies |

Why This Works for Ewallet Apps |

|

Frontend |

Android App |

Kotlin, Java |

Stable performance, native security APIs, strong device compatibility |

|

iOS App |

Swift |

Faster execution, better memory handling, secure Apple ecosystem |

|

|

Cross-Platform |

Flutter, React Native |

Faster launch with shared codebase and consistent UI |

|

|

Backend |

Application Server |

Node.js, Java Spring Boot |

Handles high transaction volumes and concurrent users smoothly |

|

Rapid MVP Backend |

Laravel, Django |

Faster development cycles for early-stage products |

|

|

Database |

Transactional Data |

PostgreSQL, MySQL |

ACID compliance, reliable financial record handling |

|

Non-Transactional Data |

MongoDB |

Flexible storage for logs, user activity, and metadata |

|

|

Payments |

Payment Gateways |

Stripe, Razorpay, PayPal |

Secure processing, global support, strong APIs |

|

Security |

Encryption |

AES-256, SSL/TLS |

Protects sensitive financial and user data |

|

Authentication |

OAuth 2.0, JWT, Biometric APIs |

Multi-layer security with smooth user access |

|

|

Compliance |

KYC & AML |

Third-party KYC APIs, OCR tools |

Faster verification and regulatory readiness |

|

Cloud |

Hosting & Infrastructure |

AWS, Google Cloud, Azure |

Auto-scaling, high availability, global reach |

|

DevOps |

Deployment & Scaling |

Docker, Kubernetes |

Smooth updates without downtime |

|

Monitoring |

Performance & Logs |

New Relic, Datadog, CloudWatch |

Real-time tracking of failures and bottlenecks |

What this really shows is simple: A strong ewallet isn’t built on one tool. It’s built on a stack where security, speed, and scalability work together from day one.

Hire an expert mobile app developer and strike the right balance so your product grows without painful rewrites later.

Security, Compliance & Licensing That Keep Your Ewallet Legit and Trusted

Let’s be honest. The moment real money enters the picture, expectations change. An ewallet isn’t forgiving for mistakes.

PrivPay is one such eWallet that was shut down due to compliance issues. That’s a mistake no founder wants to repeat.

This is exactly why staying aligned with compliance in e-wallet app development matters. It protects the business, keeps regulators on your side, and ensures the app can scale without sudden shutdowns or costly rebuilds.

-

KYC Compliance (Know Your Customer): When you make an e-wallet app, user identity verification is non-negotiable. Document checks, biometric validation, and address verification stop fake accounts and reduce misuse before it starts.

-

AML Compliance (Anti-Money Laundering): Continuous transaction monitoring helps flag unusual behavior, large-value movements, and suspicious patterns. This is one of the main reasons digital wallets fail when ignored. Alerts and reporting systems keep regulators informed and risks under control.

-

Data Protection & Privacy Laws: User data must be handled with care. Consent management, encryption, access control, and alignment with regional privacy laws protect sensitive financial and personal information.

-

PCI-DSS Compliance: Any app that processes card payments must follow strict security standards for storing, transmitting, and handling card data to reduce fraud and breaches.

-

Licensing & Regulatory Approval: If you plan to build an e-wallet app that operates legally at scale, approvals from financial authorities or central banks are required. Licensing defines transaction limits, permitted services, and operational boundaries based on geography.

-

Transaction Limits & Reporting: Daily, monthly, and annual transaction caps are enforced by regulators. Automated reporting is required for high-value or flagged transactions.

-

Audit & Record-Keeping: Detailed logs of transactions and user activity must be maintained for audits. These records become critical during regulatory reviews or investigations.

-

Fraud Prevention & Risk Management: Real-time fraud detection, device fingerprinting, and behavioral analysis help prevent account takeovers and unauthorized payments before damage is done.

At the end of the day, compliance isn’t a blocker. It’s the foundation that keeps an ewallet live, trusted, and scalable as usage and scrutiny increase.

UX/UI & Onboarding Strategies for Secure Ewallet Adoption

First impressions matter.

Especially when you’re asking users to trust you with their money.

In the world of digital payments, beautiful design isn’t just about aesthetics; it's about securing user trust.

Users won’t adopt your eWallet if they can’t figure out how to use it, or worse, if they don’t feel their money is safe.

The best practice for UI/UX design in an e-wallet application balances three elements: Simplicity, security, and delight.

Let’s explore all elements to create an eWallet app that users actually love.

1. Simplified Registration with Progressive Disclosure

Don't overwhelm users with 20 form fields on day one. That's a guaranteed way to lose them.

What you need to do is: Start with minimal information, just the phone number and basic verification. Implement progressive disclosure by requesting additional details only when needed for specific features.

2. Visual Hierarchy That Guides the Eye

Your dashboard shouldn't feel like a cluttered spreadsheet. Users need clarity, not chaos.

So, design with a clear visual hierarchy using size, color, and spacing to emphasize important elements like wallet balance and quick actions.

3. Trust-Building Through Transparent Security Indicators

Security features mean nothing if users don't notice them. Make safety visible and reassuring.

Make sure to display security badges, encryption indicators, and compliance certifications prominently throughout the app. You have to show real-time transaction confirmations with clear success messages.

4. Interactive Onboarding with Value Demonstration

Nobody reads instruction manuals anymore.

You need to create interactive tutorials that guide users through their first transaction using tooltips and contextual hints.

You have to highlight key features with engaging animations and real-time demonstrations. Also, offer a small cashback for completing onboarding steps to keep users hooked and entertained.

First transaction success determines whether users stay or leave forever.

5. Biometric Authentication with Graceful Fallbacks

Passwords are hard to remember, but biometrics are fast.

But what happens when facial recognition fails?

So, implement fingerprint and face recognition as primary authentication methods for speed and convenience.

Make sure to avoid fallback options such as PIN or pattern lock for situations where biometrics fail.

6. Contextual Help and Intelligent Error Handling

Errors happen. How you handle it determines user satisfaction and retention rates.

Make sure to design error messages that explain what went wrong and how to fix it in conversational language.

You should provide contextual help exactly when users need it through smart chatbots or in-app support.

Anticipate common pain points with preventive tooltips.

So, these are some best practices for UI/UX design in eWallet development that aren’t just about making things look good.

With that being said, let’s keep moving ahead in this ewallet app development guide and talk about: Cost.

How Much Does it Cost to Develop an eWallet App?

In 2026, a basic MVP(Minimum Viable Product) typically starts around $30,000, and a full-fledged app can go to $150,000+.

An eWallet MVP can leverage the benefits: secure registration, P2P transfers, and basic QR scanning.

However, for a market-ready solution that competes thart competes with top apps such as PayPal and Cash, the investment can go up to $150,000+.

The real cost drivers are no longer just “code,’’ but the sophisticated layers of trust: AI identity verification, biometrics, rigorous PCI-DSS compliance.

Investing in a robust architecture today prevents the ‘’technical debt” that often sinks startups during their first surge in transaction volume.

Here is a quick breakdown of eWallet app development cost (2026):

|

App Stage |

Cost Range |

What You Get |

Who It’s Best For |

|

Basic eWallet MVP |

Starting from $30,000 |

Secure user registration, KYC, P2P transfers, basic QR code payments |

Startups validating an idea or entering the market fast |

|

Mid-Level eWallet App |

$50,000 – $90,000 |

Enhanced security, notifications, transaction history, and scalable backend |

Growing wallets aiming for stability and user retention |

|

Market-Ready eWallet |

$100,000 – $150,000+ |

Multi-currency support, advanced UX, compliance-ready architecture |

Businesses preparing for competitive fintech markets |

|

Enterprise-Grade eWallet |

$150,000+ |

AI identity verification, biometrics, PCI-DSS compliance, fraud detection, high-load architecture |

Products competing with PayPal, Cash App, and similar leaders |

Honestly, this is just an estimate; several elements affect the overall pricing to make a digital wallet.

For a better estimate, make sure to talk to leading mobile app development companies.

That said, understanding different e-wallet apps and how they structure their products can give you a heads up about what to expect in the market.

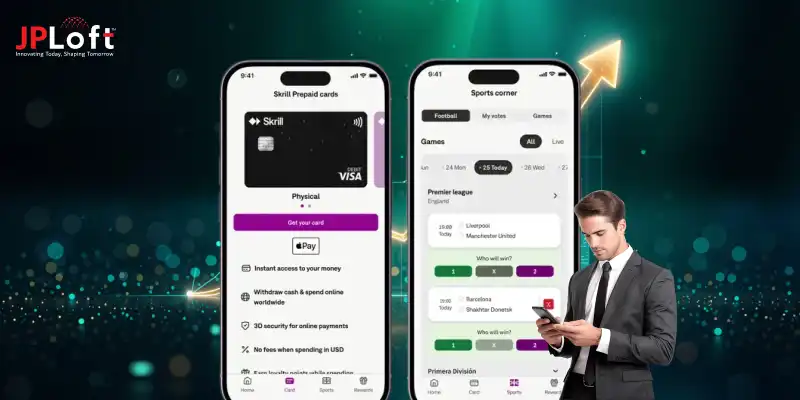

Top eWallet Apps: Get Inspired

In an era where your phone is your vault, the best ewallet apps have redefined the very DNA of global commerce.

This section explores the industry titans and features that made them the industry leaders.

Let’s get to know them in detail:

1. PayPal

Before digital payments felt normal, PayPal made people trust money on the internet.

Its early focus on buyer protection, dispute handling, and cross-border payments helped it become a global standard.

What truly sets PayPal apart is reliability at scale. That’s exactly what businesses aim for when they plan to make an app like PayPal that users can rely on every single day.

2. Cash App

Cash App proves that less really is more. From instant onboarding to one-tap transfers, everything is designed to feel fast and effortless.

It connected strongly with younger users by removing friction and visual clutter. The lesson is clear: simplicity drives habit, which is why many startups now look to develop an app like Cash App.

3. Apple Pay

Apple Pay made security feel invisible. By combining biometrics, tokenization, and deep device integration, it removed hesitation at checkout.

Users don’t worry about safety because it’s built into every interaction. This level of trust is the benchmark for companies aiming to make an app like Apple Pay.

4. Google Pay

Google Pay turned everyday payments into a habit, not a task. It blends payments, rewards, bill splitting, and offers into one smooth flow. The real strength lies in ecosystem reach and usability. When convenience meets scale, it explains why brands want to create an app like Google Pay.

5. Alipay

Alipay started as a payment tool and grew into a financial lifestyle. From utility bills to investments, it covers daily money needs inside one app.

Its success shows how trust unlocks expansion, which is why enterprises often aim to build an app like Alipay once payments are established.

Every app on this list faced moments where failure was real. The difference was how they handled the challenges and overcame them.

The next section shows what those challenges look like, along with their solution.

Top Challenges in Developing an eWallet App & Their Solutions

To develop an eWallet app in today’s cutthroat fintech competition, you aren't just writing code; you’re building a digital fortress.

Launching a new ewallet app isn’t an easy task; you are dealing with money, regularity, and user trust, with zero room for failure.

Let’s find out the most common challenges in developing a digital wallet, teams face, and how successful products solve them the right way:

Challenges 1: Security & Data Breaches

Digital assets are prime targets for cybercriminals.

To protect users during eWallet application development, your developers should implement multi-layered defenses like AES-256 encryption and biometric authentication.

Solutions involve constant real-time monitoring and AI-driven fraud detection to neutralize threats before they compromise sensitive financial information or damage brand reputation.

Challenges 2: Complex Regulatory Compliance

Navigating the global legal landscape is a significant hurdle in digital wallet development. Each region has strict KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements.

The solution lies in building a modular compliance engine that integrates automated verification APIs, ensuring your app adapts to changing laws without requiring a complete architectural overhaul.

Challenges 3: Scalability & Performance Lag

As your user base grows, an eWallet app development guide often highlights the danger of system crashes during peak traffic. To solve this, developers must utilize cloud-native infrastructure and microservices architecture.

This allows the app to scale resources dynamically, maintaining lightning-fast transaction speeds even as thousands of users transact simultaneously.

Challenges 4: Third-Party Integration Friction

A comprehensive process to eWallet app development must address the difficulty of syncing with fragmented banking APIs and legacy payment gateways.

The solution is to employ robust middleware and standardized API protocols.

Thorough sandbox testing ensures seamless communication between the wallet and external financial institutions, preventing transaction delays or failed payments.

Once you’ve fortified your app against these challenges, you're ready to pivot from survival to disruption by embracing the next wave of fintech innovation.

Future Trends to Adopt eWallet App Development

Want your eWallet App to stand out? Then you should make sure it doesn’t just process payments; it must predict them.

The next era of ewallet development is shifting from simple utility to hyper-intelligent financial ecosystems that blend security with an invisible and frictionless user experience.

1] AI-Driven Hyper-Personalization

Artificial Intelligence in payment apps is no longer a luxury; it’s the backbone of retention.

By analyzing spending patterns, your app can offer automated budgeting advice and personalized merchant discounts.

This level of insight transforms the wallet into a proactive financial assistant that helps users save money in real-time.

2] Multi-Biometric Layering Standard

PINs are becoming obsolete.

The latest trend involves "behavioral biometrics," which analyzes how a user holds their phone or their typing rhythm to verify identity.

Combining this with FaceID and voice recognition creates a nearly impenetrable security vault that users can trust implicitly.

3] Blockchain & CBDC Integration

As Central Bank Digital Currencies (CBDCs) and stablecoins gain mainstream traction, wallets must support these digital assets alongside traditional fiat.

Implementing blockchain ensures transparent, immutable transaction records and enables ultra-low-cost cross-border transfers that bypass traditional banking delays.

4] Voice-Activated Payments

With the rise of smart assistants, voice-commanded transactions are the new frontier of convenience.

Users can now "tell" their wallet to pay a utility bill or send money to a friend while driving or multitasking, making the payment process entirely hands-free and deeply integrated into daily life.

5] The Rise of "Super-App" Ecosystems

The most successful wallets are becoming "Super Apps" by integrating third-party services like flight bookings, insurance, and food delivery directly into the interface.

This ensures the user never has to leave your ecosystem, significantly increasing the app's lifetime value (LTV).

The rise of eWallet super apps is a remarkable trend that continues to reshape the future of digital payments.

How Do eWallet Apps Make Money?

In an era where nearly 4.5 billion people use digital wallets today, the number is expected to rise to six billion by 2029.

The real question isn’t just how to make an eWallet app, but how to make it profitable.

Well, as per the most successful founders, they leverage ewallet app monetization models to capture value from every tap, swipe, and model, ensuring their platform is as fiscally robust as it is user-friendly.

Let’s analyze the top ways through which these apps make money.

1. Merchant Transaction Revenue

Every payment processed through your platform represents a revenue opportunity.

By charging merchants a small percentage (MDR) for every transaction, you build a consistent "toll-booth" income.

High-quality digital wallet development ensures the system is so reliable that merchants view this fee as a fair trade for access to your massive user base.

2. Strategic Third-Party Commissions

Your app can function as a high-traffic financial supermarket.

This is a core part of modern mobile app monetization models, where you partner with banks, lenders, and insurers to offer their products.

For every loan disbursed or insurance policy sold through your interface, your business earns a significant referral commission without taking on the underlying financial risk.

3. Convenience and Utility Surcharges

When users ask how free e-wallet apps make money, the answer often lies in "convenience fees." Business owners can monetize high-value services, such as instant withdrawals to external bank accounts or the processing of utility bills.

These micro-payments are barely noticed by the user but create a substantial, recurring revenue stream at scale.

4. Behavioral Data and Targeted Marketing

Data is the new currency for the modern business owner.

By investing in digital wallet development that tracks spending habits, you create a goldmine of consumer insights.

You can monetize this by allowing brands to place targeted "flash deals" or sponsored rewards within the app, charging them for the highly qualified leads you generate.

5. Managing the "Float" Interest

One of the most efficient ways to know how free e-wallet apps make money is through interest on stored balances.

When millions of users keep a "float" in their digital wallets, the cumulative sum is enormous.

As the owner, you can hold these funds in high-interest escrow accounts, generating passive income on the capital while it waits to be spent by the users.

So, these are some ways through which an investor can make money. Also, the market is open for all kinds of possibilities with a strong digital wallet by your side.

But to launch a new eWallet app, you will need experts by your side.

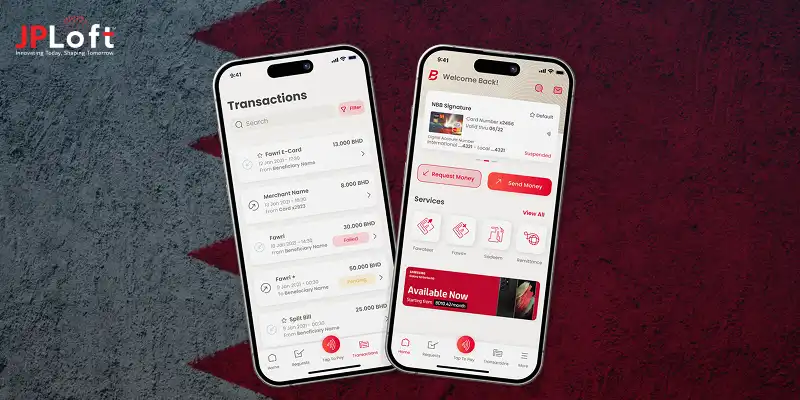

Why Choose JPLoft to Develop an eWallet App?

Choosing the right development partner sets the foundation for how secure, scalable, and trusted your eWallet app becomes over time.

This choice directly shapes user confidence and long-term product growth.

That is where JPLoft, as a trusted and leading eWallet app development company, stands apart. With experience across 1100+ delivered projects, JPLoft brings proven execution, not assumptions.

The team builds modern AI-powered digital wallets that go beyond basic transactions, using intelligence to improve security, personalization, and operational efficiency.

Every eWallet solution is designed with real-world usage in mind.

From wallet top-ups and peer-to-peer transfers to merchant payments, subscriptions, and smart fraud detection, each flow is optimized for clarity and reliability.

Our priority is top-notch security, compliance, and performance that’s built into the architecture from day one.

What this really means is a product that scales without friction.

JPLoft applies a product-led mindset, helping you shape features, choose the right tech stack, and plan monetization that fits your market.

The result is an eWallet app built to earn trust, adapt quickly, and perform consistently at scale.

Conclusion

We believe now you have an idea of digital wallet development. Remember, launching a new ewallet app is not enough; it comes with a long-term commitment.

Success depends on how well your eWallet app handles security, scale, and compliance, and realusers's behaviour as adoption grows.

This is where choosing the right partner with proven experience in eWallet apps matters.

JPLoft combines technical depth with a clear product mindset, helping businesses move beyond basic payment features into intelligent, AI-powered digital wallets.

With experience of 15+ years, we focus on building something meaningful from day one. The outcome is an eWallet app that earns trust early, adapts smoothly, and continues delivering value as your business scales.

FAQs

Developing a digital wallet involves several key steps: defining your target audience and core features (payments, transfers, card storage), choosing your technology stack (mobile platforms, backend infrastructure, payment APIs), implementing robust security measures (encryption, tokenization, multi-factor authentication), integrating with payment gateways and financial institutions, ensuring regulatory compliance (PCI-DSS, KYC/AML), building an intuitive user interface, conducting thorough testing, and launching with ongoing maintenance and updates.

Gen Z predominantly uses digital wallets and mobile payment apps like Apple Pay, Google Pay, Venmo, Cash App, and PayPal instead of traditional physical wallets. They prefer storing payment cards digitally on their smartphones, using contactless payments, and peer-to-peer payment apps for transactions. Many also use buy-now-pay-later services integrated into digital platforms.

Digital wallets generate revenue through transaction fees charged to merchants (typically 1-3% per transaction), interchange fees from card networks, premium subscription services offering enhanced features, interest on stored balances, partnerships and affiliate commissions, data analytics services, and cross-selling financial products like loans or insurance.

The three main types are closed wallets (usable only with specific merchants, like the Starbucks app), semi-closed wallets (usable with multiple partnered merchants within a network), and open wallets (issued by banks or authorized entities, allowing full banking transactions, including ATM withdrawals and transfers to bank accounts).

Globally, popular digital wallets include PayPal, Apple Pay, Google Pay, and Alipay. In the US, Apple Pay and Google Pay dominate for contactless payments, while PayPal and Venmo lead in online transactions. Popularity varies by region—Alipay and WeChat Pay dominate in China, while Paytm is widely used in India.

Building an eWallet app typically costs between $30,000 to $150,000+, depending on complexity, features, platform (iOS, Android, or both), development team location, security requirements, third-party integrations, and compliance needs. A basic MVP can start around $30,000, while a full-fledged, feature-rich solution can exceed $150,000.

Launching an eWallet app generally takes 4-9 months. A basic MVP might take 3-4 months, while a comprehensive app with advanced features, regulatory compliance, security audits, and multi-platform support typically requires 6-9 months or longer. Timeline depends on feature complexity, team size, and regulatory approval processes.

Security features include end-to-end encryption, tokenization (replacing card data with tokens), multi-factor authentication, biometric verification (fingerprint, face ID), PCI-DSS compliance, fraud detection systems, secure APIs, regular security audits, transaction monitoring, and secure cloud storage. Device-level security and user session management also play crucial roles.

Yes, AI significantly improves eWallet performance through fraud detection and prevention, personalized user experiences, predictive analytics for spending patterns, chatbots for customer support, transaction categorization, risk assessment, anomaly detection, recommendation engines, and optimized transaction processing. AI also enhances security by identifying suspicious behavior in real-time.

Compliance must be handled during development, not after launch. Regulatory requirements like PCI-DSS, KYC (Know Your Customer), AML (Anti-Money Laundering), GDPR, and local financial regulations must be built into the app's architecture from the start. Post-launch, ongoing compliance monitoring and updates are necessary as regulations evolve, but the foundation must be established during development to avoid costly retrofitting and legal issues.

Share this blog