Remember when banking meant waiting in endless lines? Today's customers expect their financial apps to be as smooth as their favorite social media platform. Smart mobile application development for banking isn't just about digitizing old processes – it's about reimagining how people interact with their money. The banks that understand this are winning customer loyalty like never before.

Every successful mobile banking application development project combines cutting-edge technology with genuine human needs. As a leading banking app development company, we've mastered the art of creating apps that don't just function – they inspire confidence and trust. From biometric security to AI-powered insights, we build digital experiences that turn routine banking into seamless, satisfying interactions.

The mobile banking sector is experiencing unprecedented growth, creating massive opportunities for businesses. Smart mobile application development for banking isn't just following trends – it's driving the financial revolution that's reshaping how millions manage their money daily.

Mobile banking users are expected to reach 216.8 million by 2025.

Digital banking revenue is projected to hit $8.2 trillion globally.

Biometric authentication adoption increased by 156% in banking apps.

Real-time payments processing grew 23% year-over-year worldwide.

We provide comprehensive banking app development services that transform traditional financial institutions into digital powerhouses. From concept to launch, we offer secure, scalable, and user-friendly mobile banking solutions that exceed industry standards and customer expectations.

Our team delivers expert mobile banking app consulting services, guiding you through strategic planning, market analysis, and technology selection to ensure success.

We craft tailored custom mobile banking app development addressing your unique business requirements, brand identity, and specific customer needs with precision innovation.

We offer mobile banking app modernization services, transforming legacy systems and upgrading outdated platforms to meet today's security standards and user expectations effectively.

We facilitate comprehensive mobile banking integration services connecting your app with existing systems, third-party APIs, and payment gateways for unified operations.

Our designers create intuitive mobile banking app designs prioritizing user satisfaction, accessibility, and seamless navigation while maintaining the highest security protocols for optimal performance.

Our experts ensure reliable mobile banking app support & maintenance, guaranteeing optimal performance, security updates, bug fixes, and continuous improvement satisfaction.

Harnessing the power of Advanced AI, we deliver mobile banking application development services that revolutionize the financial landscape. With intelligent, user-centric features, our cutting-edge AI banking solutions create exceptional customer experiences that drive engagement and trust.

Our AI-powered banking app solutions instantly identify suspicious transactions, protecting customers with real-time threat detection and automated security responses for peace of mind.

Intelligent conversational AI in a mobile banking app provides 24/7 customer support, answering queries, processing requests, and guiding users through complex banking tasks effortlessly.

Advanced algorithms analyze diverse data points for precise credit assessments, enabling faster loan approvals while reducing risks and improving financial inclusion rates.

Smart analytics deliver tailored spending recommendations, budgeting tips, and investment suggestions based on individual financial behaviors and goals for better money management.

Get your hands on an Artificial Intelligence mobile banking app development that leverages machine learning to forecast market trends and financial risks for strategic decision-making advantages.

AI-powered optical character recognition automatically extracts data from financial documents, eliminating manual entry while ensuring accuracy and regulatory compliance.

We have helped some renowned global business giants with sustainable, cost saving, revenue generating, and cutting-edge technology solutions.

A dedicated app solution for Whirlpool distributors and sellers to provide details of available stock in a single platform.

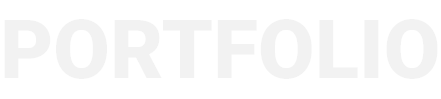

A platform to manage the global Red Bull Street Style tournaments for the WFFA (World Freestyle Football Association).

An exciting new AI-powered dating app exclusively for socially progressive singles. Users can rate their passions on vital social issues, and the algorithm suggests ideal matches.

The Nike Movement For Sport Playkit is a first-of-its-kind game-based assessment tool for individuals coaching physical activity to 2.5 million children aged 6-12 across the globe.

We deliver comprehensive mobile banking app development services that redefine financial experiences. Our expertise spans across diverse banking sectors, from traditional institutions to cutting-edge fintech startups.

Build a comprehensive digital banking app that transforms traditional financial services into seamless, user-friendly experiences with advanced security and intuitive navigation features.

Develop a cutting-edge crypto banking platform integrating blockchain technology, secure wallet management, and real-time cryptocurrency trading capabilities for modern digital assets.

Create a revolutionary neobanking app offering fully digital financial services without traditional brick-and-mortar limitations, focusing on millennial and Gen-Z preferences.

Engineer a smart digital lending system featuring automated loan processing, AI-driven risk assessment, and instant approval mechanisms for enhanced borrower experiences.

Design a secure money transfer app enabling instant global transactions with competitive exchange rates, multi-currency support, and robust fraud protection.

Craft a sophisticated wealth management app providing personalized investment advice, portfolio tracking, and automated financial planning tools for affluent clients.

Develop a powerful corporate banking app streamlining business financial operations with bulk transactions, payroll management, and comprehensive reporting dashboards.

Build an integrated insurance banking app combining traditional banking services with comprehensive insurance products, claims processing, and policy management features.

Every great banking app blends essential and advanced features. We implement robust functionalities to deliver a smooth, secure, and intuitive experience for all users.

Advanced biometric security, including fingerprint, facial recognition, and voice authentication, ensures only authorized users have access to accounts while maintaining seamless login experiences.

Streamlined digital onboarding process guides new customers through account setup with document verification, identity checks, and personalized welcome experiences within minutes.

Comprehensive account management tools allow users to view balances, update personal information, manage preferences, and control account settings from one intuitive interface.

Complete card control features enable users to activate, freeze, unfreeze cards instantly, set spending limits, view transactions, and request replacements through mobile.

Secure peer-to-peer transfers, international remittances, and instant payments with multiple authentication layers ensure fast, reliable money movement between accounts and recipients.

Detailed transaction history with smart categorization, search filters, receipt storage, and spending analysis helps users track every financial activity effortlessly and efficiently.

Seamless integration with digital wallets, third-party payment platforms, and external banking services provides users with flexible payment options and consolidated financial management.

Automated bill payment scheduling for utilities, subscriptions, loans, and recurring expenses with smart reminders prevents missed payments and late fees completely.

Personalized dashboard displays relevant financial insights, account summaries, recent activities, and actionable recommendations tailored to individual user preferences and banking habits.

Intelligent expense tracking with visual charts, budget alerts, category-wise breakdowns, and predictive spending patterns helps users maintain better financial discipline and control.

Instant loan applications, credit assessments, approval processes, and disbursements through AI-powered evaluation systems provide quick access to personalized financing solutions.

Real-time alerts for transactions, security updates, payment reminders, and account activities keep users informed while allowing customizable notification preferences and delivery methods.

Our Mobile Banking Software Development strictly follows international banking regulations. We ensure your banking app compliance meets global requirements while maintaining the highest security protocols.

Our streamlined mobile banking app development process transforms complex financial requirements into user-friendly digital experiences. From initial consultation to final deployment, we follow proven methodologies to launch a robust and scalable banking app.

We analyze your requirements and market positioning thoroughly.

Creating intuitive interfaces that users love and trust.

Building secure, scalable solutions with cutting-edge banking technology.

Rigorous app testing ensures flawless performance and regulatory compliance.

Seamless app store submission and production environment setup.

Comprehensive app maintenance services with updates, patches, and optimization.

JPLoft combines AI, machine learning, and other emerging technologies to craft scalable solutions, giving your business a competitive edge. Our teams' expertise covers a vast range of technologies, setting us apart from other companies.

Transform your banking vision into reality with our world-class mobile banking development services. Our certified developers combine deep financial industry knowledge with cutting-edge technology expertise, delivering solutions that exceed expectations. We don't just code – we architect digital banking experiences that drive customer engagement and business growth. Get the help of our experts to create the future of financial technology.

Choose from our flexible engagement models designed for every business need. Whether you prefer dedicated mobile banking app developers working exclusively on your project, skilled banking app developers augmenting your existing team, or complete project-based development, we've got the perfect solution that fits your timeline, budget, and specific requirements. Scale up or down effortlessly as your project evolves.

As a leading AI app development company, we create intelligent banking solutions with natural language processing, predictive analytics, and automated decision-making capabilities for enhanced user experiences.

Our generative AI development services build advanced chatbots, personalized content creation systems, and intelligent virtual assistants that transform customer interactions and operational efficiency significantly.

Through our machine learning app development services, we implement fraud detection algorithms, credit scoring models, and behavioral analytics that continuously learn and adapt automatically.

As a trusted blockchain development company, we deliver secure cryptocurrency wallets, smart contracts, and decentralized finance solutions, ensuring transparency, immutability, and enhanced security protocols.

Our IoT app development services integrate connected devices, wearable technology, and smart sensors, enabling real-time data collection, automated transactions, and seamless omnichannel banking experiences.

Through comprehensive cloud development services, we provide scalable infrastructure, secure data storage, and reliable backup solutions, ensuring high availability and seamless performance optimization.

As the best mobile banking app development company, JPLoft has successfully delivered numerous custom and AI-powered banking app software solutions to clients worldwide. Our mobile banking software development expertise spans traditional banks, fintech startups, and digital-first enterprises. Through our comprehensive mobile banking development services, we transform complex financial requirements into user-friendly digital experiences that drive engagement and growth.

Our mobile banking app developers integrate cutting-edge artificial intelligence from project inception, ensuring smart automation, predictive analytics, and personalized user experiences throughout development.

We accelerate compliance timelines through proven mobile banking development services, ensuring your app meets all regulatory standards while reducing time-to-market significantly and efficiently.

Our disciplined project management and experienced mobile banking app developers guarantee timely delivery within agreed budgets, eliminating costly delays and ensuring predictable project outcomes.

Expert mobile banking software development ensures flawless integration with existing systems, third-party APIs, and payment gateways for unified operations and enhanced user experiences.

Our certified mobile banking app developers possess deep financial industry knowledge, combining technical expertise with regulatory understanding to deliver exceptional banking solutions consistently.

Custom mobile banking development services address your unique business requirements, brand identity, and specific customer needs through personalized approaches and innovative technology implementations.

Our specialized developers build compliant banking apps trusted by financial institutions worldwide.

Get the latest updates on development insights, technologies and trends.

United States(Denver, New York, Dallas, Chicago, Texas, Austin), United Kingdom, Australia(Melbourne, Sydney, Adelaide, Brisbane, Perth, Canberra), Singapore, Canada, United Arab Emirates(Dubai), Saudi Arabia, Netherlands, Switzerland, France, Africa, Europe, Middle East, etc.