The global fintech market is projected to cross $685.85 bn by 2030, showcasing the huge potential this market has. As the demand for innovative and AI-powered fintech solutions increases, businesses are going for secure, scalable apps to meet the needs of modern finance. This is where fintech app development comes into play, offering businesses the tools to stay ahead.

As a trusted fintech application development company, JPLoft specializes in transforming your fintech app idea into a powerful solution. From digital payment to robo-advisors, we create solutions that cater to modern financial needs, providing a seamless experience for users and setting you up for success in a rapidly evolving market.

At JPLoft, we offer end-to-end fintech app development services modified to your user needs, helping you establish a solid position as a market leader.

Want a custom fintech app development? We craft bespoke apps that meet your specific business needs and user expectations.

Leverage our FinTech App Development services to create powerful, scalable FinTech platforms that boost efficiency and streamline finances.

Get expert advice on your app idea with our Fintech App Consultation and ensure your project is on the right track from start to finish.

With our UI/UX design services, we offer an eye-captivating and intuitive interface that makes your FinTech app both functional and enjoyable.

Stay ahead of the curve with our ongoing maintenance services, keeping your fintech app secure, up-to-date, and aligned with market trends.

We integrate powerful APIs to enhance your fintech app’s capabilities, enabling smooth data exchange & seamless connectivity with an external system.

Having undivided attention during the FinTech App development process can help you avoid key mistakes and launch a reliable Fintech solution that users trust. Here are some common pitfalls to watch out for:

Poor user experience can lead to high abandonment rates. Hire Fintech App Developers from us to create user-friendly & intuitive interfaces.

Apps that can’t scale efficiently will struggle as user demands grow. Plan scalability while creating a FinTech app to ensure your app grows as your user base.

Weak security puts user data at risk and erodes trust. Prioritize robust security measures and encryption for a robust custom FinTech Solution.

Looking to launch your own fintech app quickly? Our Fintech app clone development services provide a powerful, robust clone solution that lets you tap into the fintech market with ease.

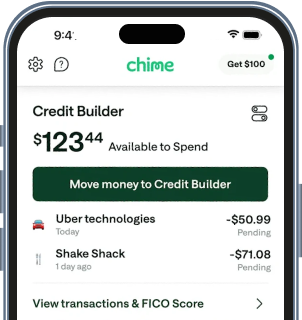

Create a Seamless digital banking experience with a custom Chime Clone App for proper account management & safe transactions.

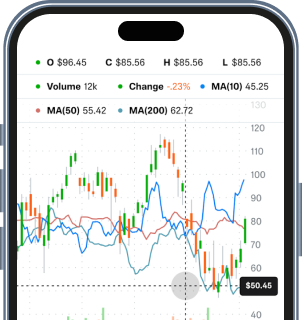

Launch a successful Robinhood clone with us and offer users seamless investing options & real-time market insights.

Build a MoneyLion clone solution that combines features of saving, lending, and investing with a powerful all-in-one financial management app.

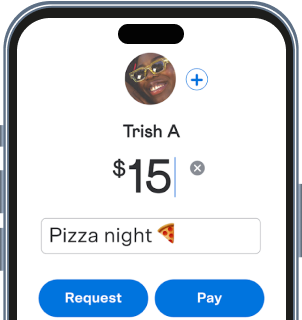

Launch a Venmo App Clone to facilitate seamless peer-to-peer payments, offering secure transactions and instant transfers.

Provide users with on-demand access to their earned wages by developing an innovative EarnIn clone for financial flexibility.

Develop a versatile Cash App Clone, enabling money transfers and investments to users with a highly functional payment solution.

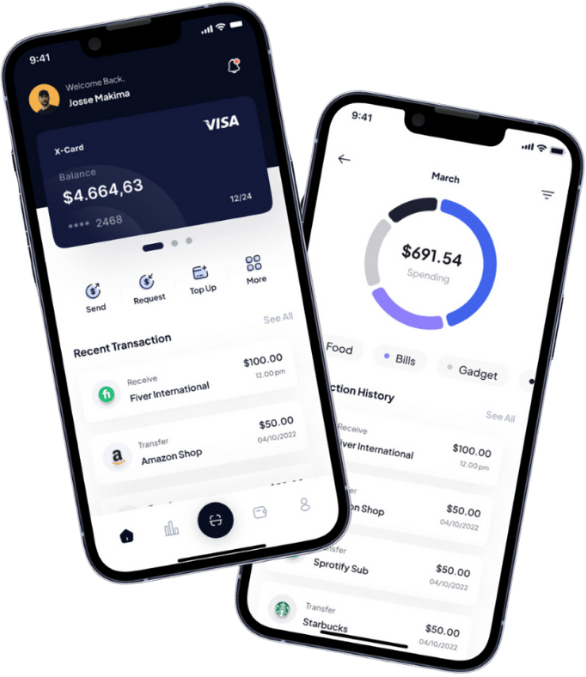

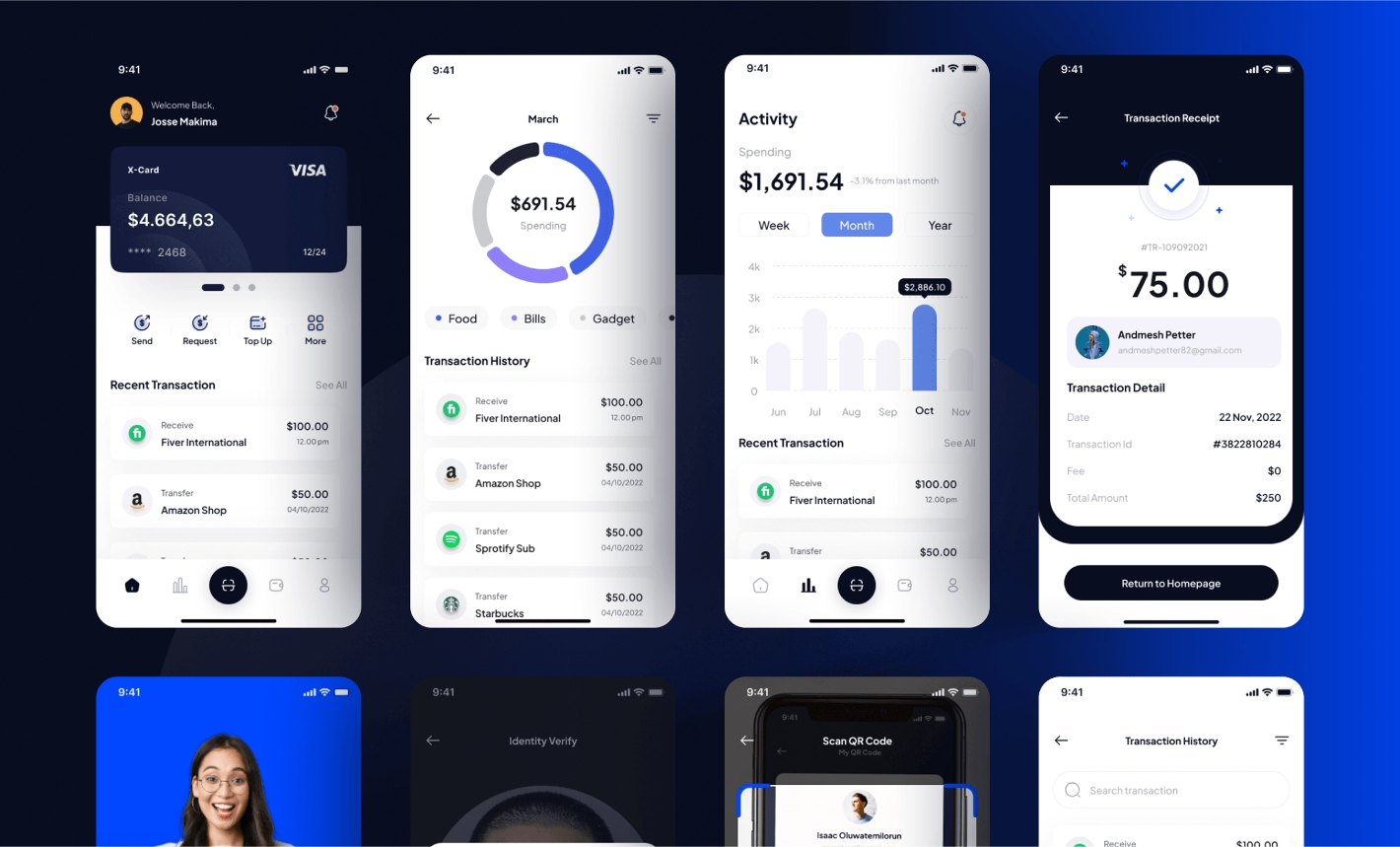

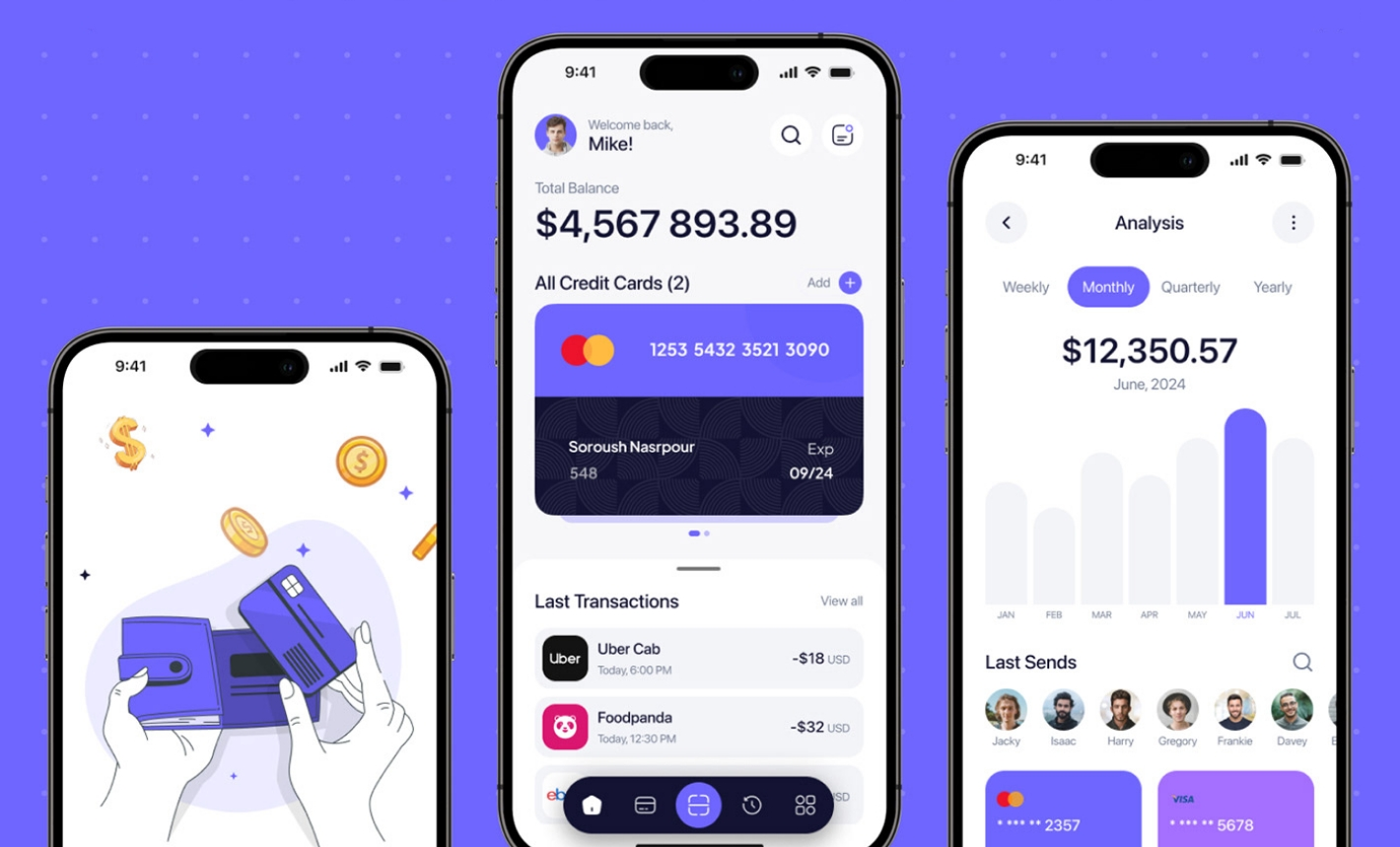

Dive into our portfolio and discover how our innovative solutions bring ideas to life and create lasting impact.

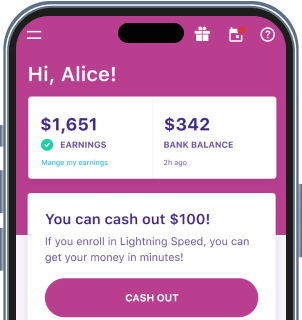

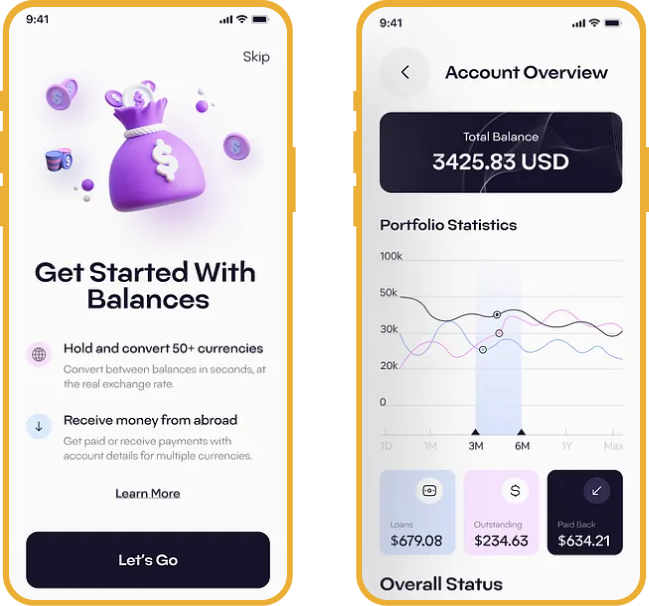

The all-in-one fintech app for seamless money management, secure transactions, and personalized financial insights at your fingertips.

Empowering your financial journey with real-time budgeting, smart expense tracking, and personalized insights for smarter money management.

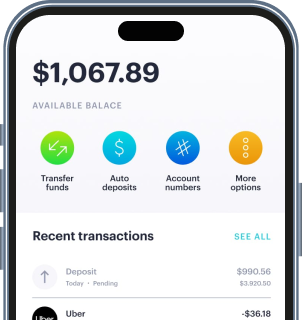

Launch a fully functional digital bank with our smooth fintech mobile app development to deliver a seamless, digital-first banking experience to your user.

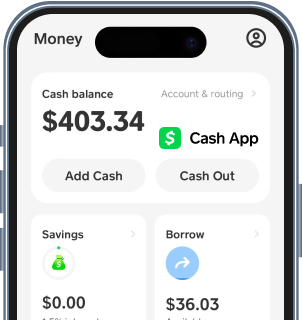

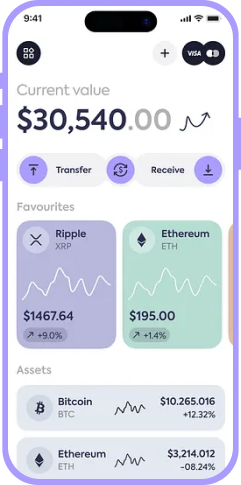

Transform payments with our FinTech App Development Solution, creating secure, user-friendly digital wallet apps for seamless transactions.

Get your hands on a custom lending and mortgage platform that offers secure transactions and a personalized user experience.

We provide fintech platform development for advanced digital insurance solutions, offering streamlined processes, and improved customer engagement.

Work with experienced FinTech App Developers to build a dynamic, real-time stock trading platform for users to trade shares efficiently.

Create intuitive personal finance apps with our financial mobile app development services to empower users to manage their money better.

We offer secure and compliant KYC platform solutions, enabling efficient identity verification and enhanced regulatory compliance for financial institutions.

Our mPOS system integrates with your business, providing secure, flexible payment processing, real-time data analytics, and seamless transaction experiences.

As a trusted FinTech application development company, we craft apps with both core and advanced features to meet your business goals. Our solutions are designed to drive innovation and maximize ROI.

Allow users to seamlessly register and manage user profiles with secure login options and personal data storage.

Enable easy, secure payment processing with integration to popular gateways like PayPal & Stripe to allow users to make payments the way they like.

Send real-time alerts for transactions, account activity, or promotional offers to keep users informed and bring them back on the app.

Enable users to view their transaction history, balances, and detailed transaction records for better tracking of their finances.

We offer an easy & quick way to transfer between users or external accounts with a secure and efficient transaction system.

Provide users with budgeting features that help track expenses, set limits, and manage finances effectively.

Build with blockchain for security, transparency, and immutability to ensure secure, irreversible transactions on your platform.

Take advantage of AI to monitor user patterns and economic data, and send alerts with tailored insights/recommendations for better financial sense.

Protect personal user data with biometrics, 2 Factor Authentication(2FA), and encryption for a complete security level.

For seamless peer-to-peer payments inclusion in the app, so that users can transfer funds quickly and securely and user convenience, as well as also improve on app functionality.

Include cryptocurrency payments and trading in your app so users get a full, modern digital financial experience. From programmable money.

Automate regulatory compliance processes or any other process at scale on computers, leaving no room for manual oversight and ensuring that the app complies with industry standards.

Benefit from our FinTech App development services, we ensure that you’re app stays compliant with industry regulations while maintaining the highest security standard and trust.

Our proven FinTech App Development process transforms your vision into a powerful FinTech app. With each step from concept to launch, we make sure that your app excels, providing the ultimate user experience and business success.

We start with understanding business goals, identifying the target audience, and outlining key features.

Once it is done, we create a proper roadmap, set milestones, and define the app’s scope to lay the foundation of your app.

We make sure to keep the design intuitive and smooth user experience for seamless interactions.

We develop keeping in mind the latest technologies, and trends and ensuring scalable architecture.

Our professionals make sure to thoroughly test the app and identify bugs to ensure optimal performance.

Launch the app for your target audience. We monitor its performance and provide ongoing support to keep it up-to-date.

JPLoft combines AI, machine learning, and other emerging technologies to craft scalable solutions, giving your business a competitive edge. Our teams' expertise covers a vast range of technologies, setting us apart from other companies.

Hire fintech app developers from us to get the full benefit of your investment. With a blend of creativity and technical know-how, our team crafts apps that are not only user-friendly but also packed with innovative features. Our Fintech developers understand the unique challenges of the Fintech industry, allowing us to tailor solutions that meet your user needs.

Imagine an app that stands out in the crowded market, attracting users and keeping them engaged. Our professionals focus on building solutions that resonate with the customers, helping you open new revenue streams and maximize your return. By utilizing the latest technologies, and best practices, your app remains competitive and ready for future growth. Ready to make a spark? Let’s connect!

Leveraging the benefits of AI and ML in your fintech software you can enhance decision-making, automate processes, and improve user experience through customized services.

Cloud technology is gaining momentum. Using such technology allows businesses to scale their operation efficiently, ensuring secure data storage and seamless access to apps from anywhere.

Fintech companies can dive into large datasets through big data analytics which can help enhance risk assessment, customer segmentation, and targeted marketing strategies.

Secure and transparent transactions over blockchain reduce fraud risks combined with smart contracts that automate processes and build transparency between parties.

IoT (The Internet of Things) brings devices together for real-time data collection, so fintech app can suggest the best personal financial advice for users based on behavior and preferences.

AR and VR provide a unique user experience, revolutionizing financial education, and literally making advisors consultable from virtual venues that improve the interaction.

With over a decade of experience, JPLoft as a fintech application development company excels in creating innovative solutions modified to your needs. Our expert team is dedicated to developing a fintech app that integrates seamlessly into the Fintech ecosystem. Trust us to transform your vision into a successful fintech solution.

Our Experienced team brings over years of expertise, ensuring top-notch fintech app development solutions made for only your project.

We maximize your investment while minimizing overall fintech app development costs. Get a quality solution and be a never-seen-before brand.

Our custom fintech solutions are designed to fit seamlessly into your business model, enhancing user experience within the fintech market.

Utilizing advanced technology, we create innovative fintech applications that leverage AI, Blockchain, and data analytics for optimal performance.

We offer engaging and intuitive interfaces that enhance customer satisfaction and truly resonate with your users well.

We provide ongoing support and maintenance, ensuring your fintech application evolves with market trends and stays bug & issue-free.

Partner with our expert team for innovative, customized solutions that drive growth.

JPLoft is your true business partner where we provide custom fintech app service along with platform development, consultation, UI/UX design & support & API integration services.

We will easily make user-friendly apps by following one principle – user-centric design to optimize for your element or navigation, which is guaranteed to drop abandonment rates.

Utilize different security measures like encryption, biometrics authentication, and 2-factor authorization to protect user data and trust.

Yes, JPLoft ensures compliance with regulations like GDPR, PCI-DSS, KYC/AML, KYC/AML, MiFID II & SOX to keep your app safe and secure.

In the development process segments, there exists discovery, planning, and strategy development, UI/UX design building, testing (quality assurance), and launch post-racing of further stay with no change.

Functionality and user experience are improved with AI/ML, blockchain, big data analytics, IoT, AR/VR, robotic process automation, etc.

The first step is reaching out to an expert in JPLoft and their team will talk to you about your idea to guide you on the development process so that you can visualize your dream apps.

Essential features include user registration and profile management, payment gateway integration, real-time notifications, transaction history tracking, budgeting tools, and advanced security measures.

Discover the stories behind the success and the partnerships we cherish.

Empowering 1000+ clients globally with innovative Web & Mobile App Development solutions.

Years of experience

Projects Successfully Completed

Users Trust Our Clients' Platforms

Secured by Our Clients

Every project tells a story of innovation, and mutual success.

Get the latest updates on development insights, technologies and trends.

United States(Denver, New York, Dallas, Chicago, Texas, Austin), United Kingdom, Australia(Melbourne, Sydney, Adelaide, Brisbane, Perth, Canberra), Singapore, Canada, United Arab Emirates(Dubai), Saudi Arabia, Netherlands, Switzerland, France, Africa, Europe, Middle East, etc.