Building a global digital wallet is not about shipping features fast. It is about making the right technical decisions early. JPLoft focuses on stable architecture, clean transaction flows, and security that holds up under real usage. As a digital wallet development company, the work goes deeper than UI. Their ewallet app development services are built around compliance readiness, performance at scale, and systems that do not break when users grow.

Barchart recognizes JPLoft as a top e wallet app development company, which aligns with how the team actually builds. This company designs wallets for daily use, not demos. Every build emphasizes reliability, clear user journeys, and backend control. That practical approach helps businesses launch globally with confidence and keep their wallets dependable as adoption increases. In short, these wallets are built to survive real users, real money, and real scale.

The digital wallet market is booming, creating a prime opportunity to develop an eWallet app for seamless mobile payments and an enhanced user experience.

Global digital wallet transactions are expected to surpass $10 trillion by 2025.

Mobile wallet usage in North America is likely to grow by 40% by 2028.

The number of active eWallet users is projected to reach 5 billion.

AI and machine learning can prevent 60% of digital payment fraud.

Our end-to-end wallet solutions support payments, NFTs, and Web3 ecosystems, demonstrating why JPLoft stands out as a mobile wallet development company delivering practical, scalable financial applications.

Unlock secure, one-way transactions through digital wallet development to boost customer loyalty and deliver brand-specific payment experiences users trust globally today.

Empower users with controlled transactions across multiple merchants through mobile wallet development, creating a secure ecosystem supporting seamless payments and growth.

Enable seamless transactions across various merchants, unlocking limitless growth opportunities while enhancing user convenience, trust, scalability, and long-term platform adoption.

Manage, store, and transfer cryptocurrencies securely by working with a trusted crypto wallet app development company that ensures safe, seamless digital transactions.

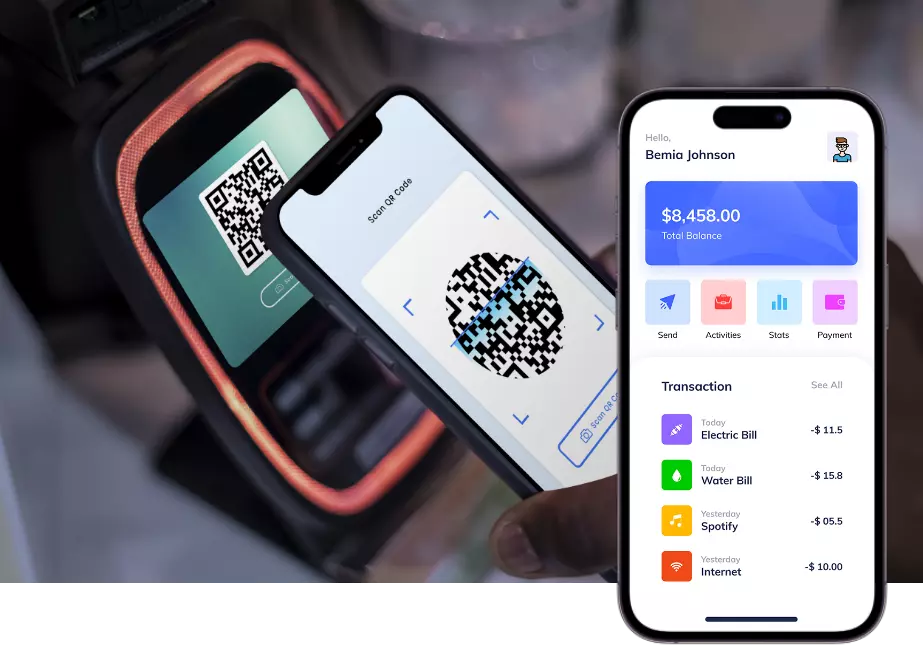

Enable payments through smart devices seamlessly, highlighting how IoT in ewallets enables automatic, contactless transactions for faster, more convenient everyday payments.

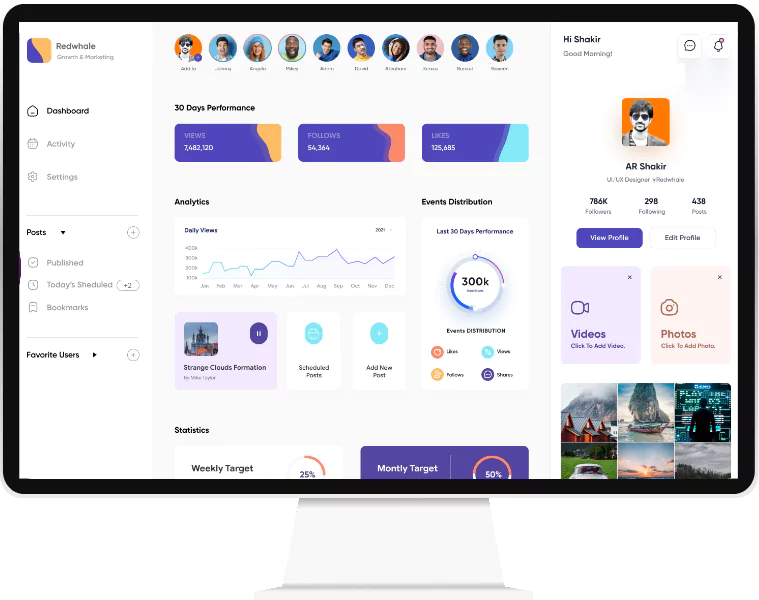

Leverage AI to analyze spending habits and deliver personalized insights, showing how AI in finance improves user experience, clarity, and everyday financial decision-making.

Design a wallet tailored for NFTs, where eWallet app developers enable secure storage, smooth management, and efficient handling of digital collectibles and art.

Access decentralized finance and blockchain applications through a secure Web3 wallet, enabling safe asset storage and seamless interaction across platforms globally.

Mobile wallets designed for merchants enable secure payments, real-time inventory tracking, and integrated loyalty program management within a single unified application.

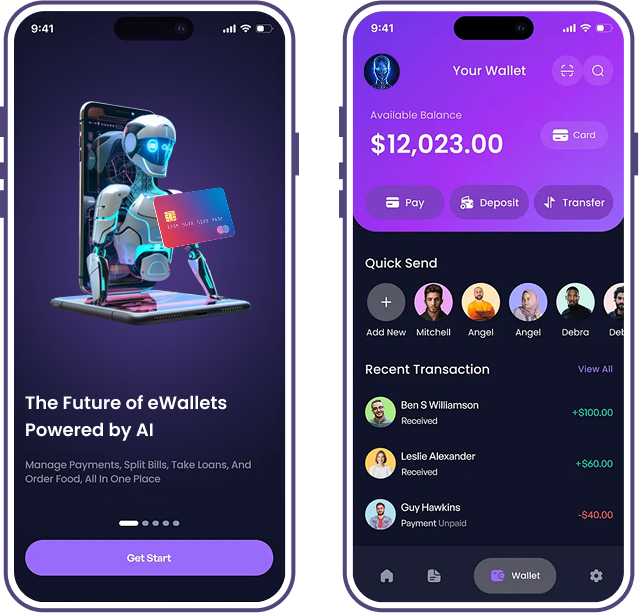

AI is transforming eWallets, offering smarter, faster, and more secure payment experiences. With advanced eWallet app development services, your platform can harness the power of AI to stay ahead of competitors.

Personalized spending recommendations help users save money by analyzing their transaction patterns through advanced AI.

Detecting unusual transactions in real-time, AI-powered algorithms significantly enhance fraud prevention and boost user confidence.

AI boosts authentication with facial recognition and biometrics, ensuring secure and frictionless access to digital wallets.

Predictive financial planning tools powered by AI use data trends to forecast upcoming expenses and offer smart savings strategies.

Biometric payments, enhanced by AI, allow for quick and secure identity verification, speeding up transaction approvals.

AI constantly adapts to user behaviour, offering dynamic experiences like customized rewards and offers for deeper engagement.

Accelerate your business launch with an eWallet clone app solution, designed to boost growth and efficiency. We replicate popular digital wallets, customizing them for your brand and offering unique user experiences.

Launch a PayPal Clone with seamless eWallet solutions, ensuring secure payments, swift onboarding, and worldwide accessibility.

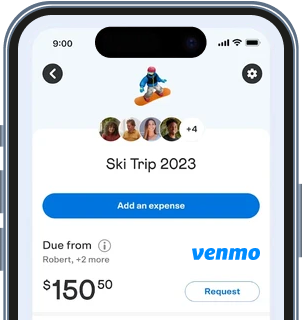

Offer P2P payments with a social twist. Our Venmo clone app ensures a friendly interface and easy money transfers.

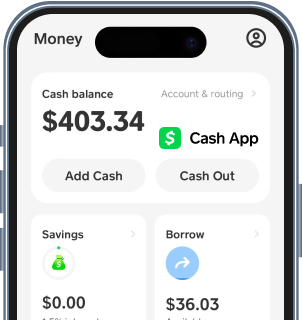

Create your own Cash app clone to offer instant payments and integrated cryptocurrency features for seamless user experiences.

Develop an Apple Pay clone for secure, contactless transactions with NFC technology, biometric authentication, and multi-merchant integration.

Replicate multi-layered security, smooth UPI integration, and broad merchant acceptance with a Google Pay app clone for comprehensive ecosystems.

Implement real-time transfers and a robust digital wallet with a Zelle app clone for a reliable, bank-friendly digital payment experience.

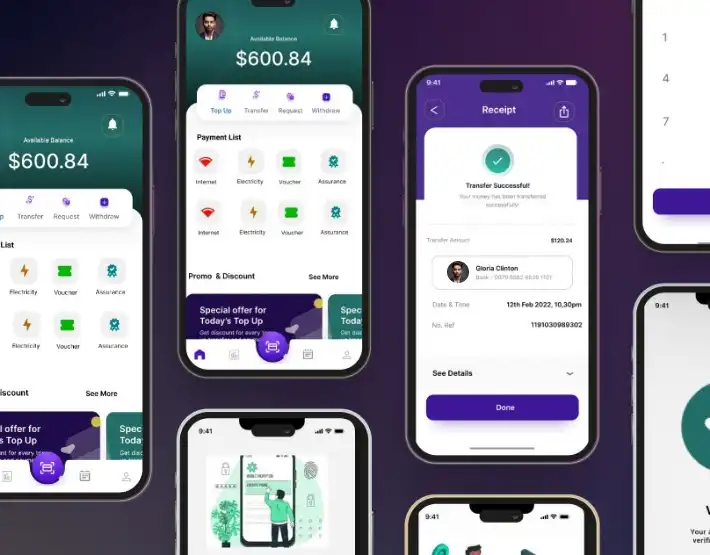

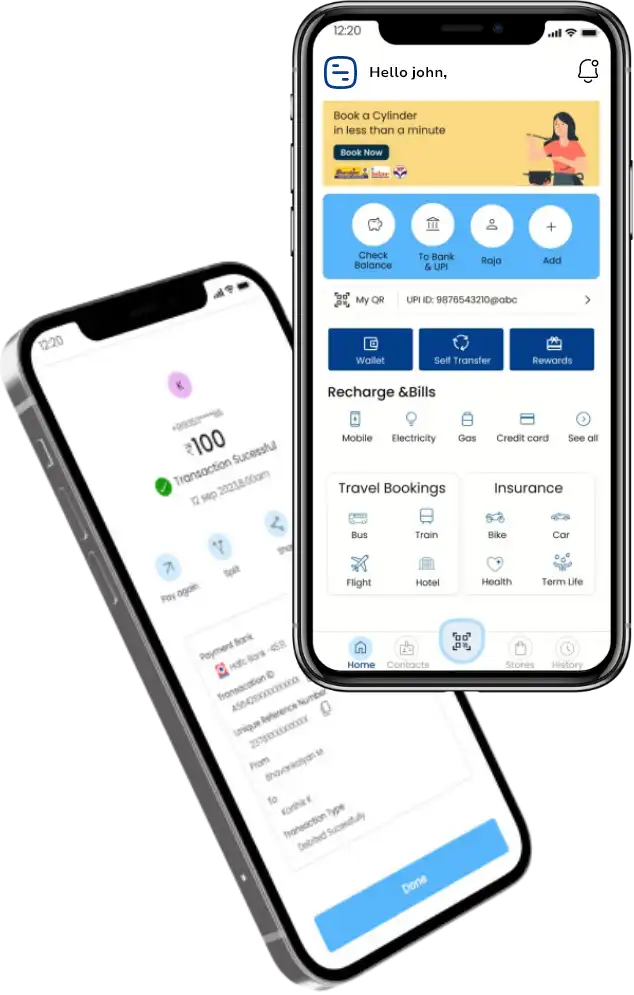

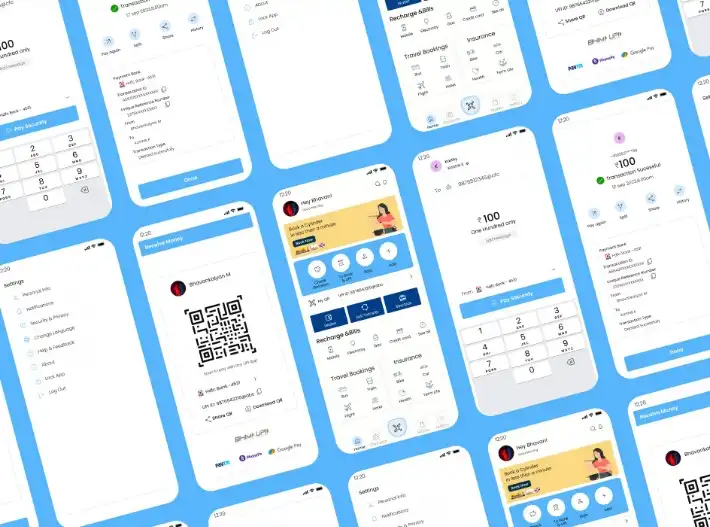

From startups to established enterprises, our eWallet app development company has delivered exceptional eWallet apps. Browse our portfolio to witness seamless user experiences, secure payment flows, and scalable solutions that have helped clients thrive.

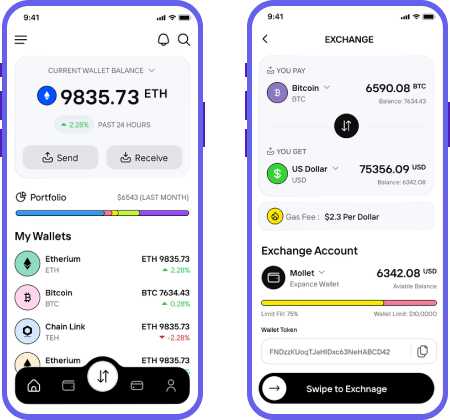

Securely store and manage your digital currency with ease. Experience hassle-free transactions and enhanced financial control.

The convenient eWallet app for seamless online transactions, quick payments, and secure digital money management on the go.

Offer a scalable, secure, and innovative peer-to-peer solution through digital wallet app development, enabling users to complete transactions smoothly and confidently.

With e wallet app development, retailers gain a secure payment system that supports quick transactions, customer rewards, and efficient refund handling.

This eWallet app solution facilitates seamless bill settlements, utility top-ups, and subscription renewals.

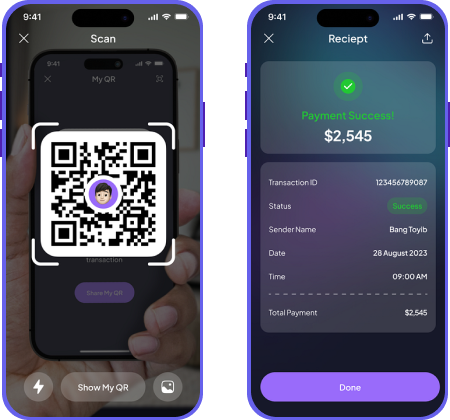

With contactless payment app, leverage NFC, QR codes, and biometrics for secure mobile transactions.

Handle cross-border transfers with multi-currency support and competitive fees.

Manage digital assets with secure encryption, portfolio tracking, and real-time updates.

Combine mobile payment app development with loyalty programs and cashback incentives.

Integrate loyalty points, gift cards, and promotions into a personalized custom eWallet app development solution.

As a top digital wallet development company, we follow a streamlined and structured process to build an ewallet app. We manage each phase from architecture planning to final deployment, ensuring performance, security, and regulatory alignment.

We collaborate to understand your goals, analyze requirements, and outline a clear development roadmap.

Our experts craft intuitive interfaces and seamless user journeys, ensuring a top-notch eWallet app experience.

We build a secure, scalable architecture and integrate essential third-party services for smooth transactions.

Rigorous testing guarantees reliability, performance, and adherence to industry standards.

We deploy your eWallet app smoothly, ensuring it’s ready for real-world usage and market scalability.

Our team provides ongoing support, feature enhancements, and timely updates to ensure long-term success.

Our experienced eWallet app developers craft user-centric features and robust infrastructures. JPLoft adapt to your market needs, ensuring timely updates, user satisfaction, and reliable performance throughout the product lifecycle. We ensure secure transactions and optimize the app across all platforms for a smooth user experience. Plus, we continuously improve and evolve your app to stay ahead of market trends.

From end-to-end ewallet software development to fully customized payment solutions, our team builds secure, dependable platforms designed for real-world use. Flexible engagement models, scalable teams, and clear communication help turn your product vision into a market-ready solution faster. Our wallet development approach stays aligned with emerging trends, using modern technologies to enhance performance, usability, and long-term growth.

JPLoft combines AI, machine learning, and other emerging technologies to craft scalable solutions, giving your business a competitive edge. Our teams' expertise covers a vast range of technologies, setting us apart from other companies.

Selecting the right eWallet app development company comes down to security, compliance, and long-term support. JPLoft delivers AI-powered digital wallet solutions built with PCI-DSS compliance, end-to-end encryption, and real-time fraud monitoring. These eWallet applications support peer-to-peer transfers, bill payments, and merchant transactions across iOS and Android platforms. The result is a secure, regulation-ready wallet that protects users, scales smoothly, and drives consistent engagement.

Our focus on digital wallet app development means security is built into every layer, keeping transactions protected from initiation to settlement.

When planning digital wallet app development, we design flows that feel natural to users, reducing steps and making everyday payments effortless.

Working with an experienced mobile wallet development company ensures interfaces that feel clean, responsive, and easy to navigate across screens.

Partnering with an expert e Wallet app development company allows you to introduce smart engagement features that encourage repeat usage and long-term loyalty.

A results-driven mobile wallet development company aligns app design with store visibility tactics, helping your wallet reach the right users faster.

We ensure easy integration with top payment systems in eWallet mobile app development, making the experience more accessible.

Let’s build a solution that exceeds your expectations.

Companies with deep fintech expertise, strong security, and global delivery teams rank highest, often shortlisted alongside JPLoft for custom wallets, compliance readiness, and long-term support for worldwide enterprise clients.

eWallet development typically costs $20,000–$150,000+, depending on features, security layers, integrations, compliance needs, and scalability requirements defined during discovery and planning.

An eWallet application usually takes three to six months, depending on complexity, third-party integrations, testing depth, regulatory readiness, and platform coverage planned before development begins.

Core ewallet security features include encryption, secure authentication, PCI-DSS standards, transaction monitoring, device verification, and real-time fraud detection to protect users and financial data.

Compliance is achieved through ewallet app compliance practices like KYC, AML checks, secure data handling, audit logs, and alignment with regional financial regulations throughout development and post-launch updates.

Yes, modern eWallet apps support cards, bank transfers, QR payments, peer-to-peer transfers, and merchant payments, creating flexible ecosystems where ewallet apps make money through transaction fees and partnerships.

Both platforms are important. The choice depends on audience behavior, launch strategy, and ewallet app tech stack decisions that affect performance, security, scalability, and long-term maintenance.

Yes, ongoing maintenance ensures security patches, performance optimization, feature updates, compliance alignment, and reliable operations in fast-evolving financial and regulatory environments.

Fraud prevention uses AI monitoring, behavioral analysis, device fingerprinting, risk scoring, and automated alerts to detect suspicious activity before transactions are completed.

Look for fintech experience, security-first architecture, regulatory understanding, transparent communication, and long-term support from teams trusted by growing startups and global enterprises alike.

Yes, eWallet app development is secure when built with encryption, secure authentication, compliance standards, real-time monitoring, and regular security updates to protect transactions and sensitive user data.

Yes, eWallet apps can integrate Gen AI in payment apps for fraud detection, transaction analysis, personalized insights, and intelligent automation that enhance security, accuracy, and overall user experience.

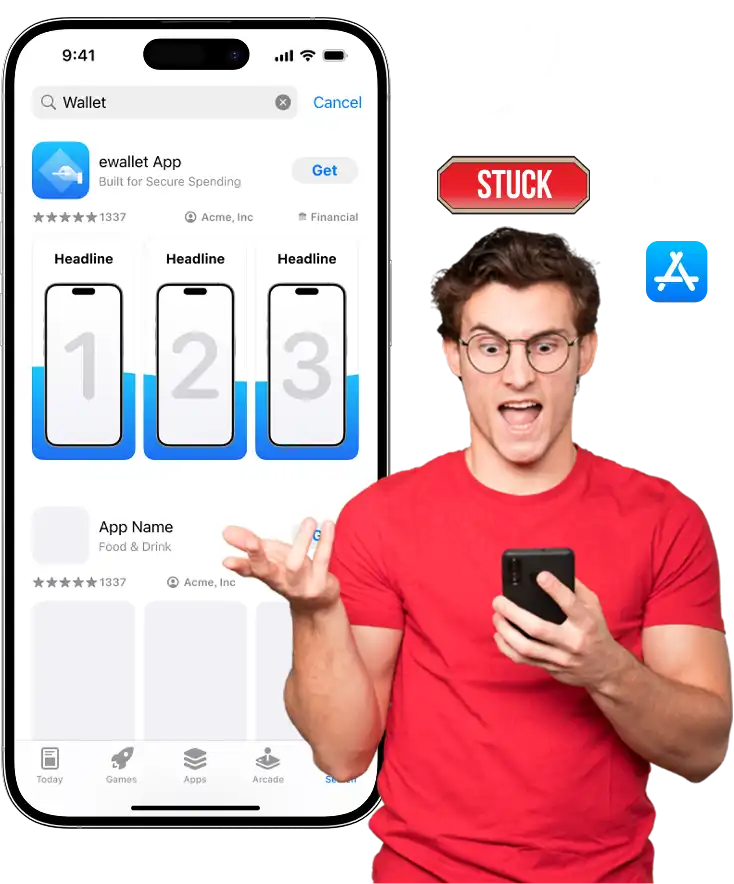

App stores often reject eWallet apps due to compliance gaps, unclear data usage disclosures, or weak security explanations. Through mobile wallet development, JPLoft resolves these issues by aligning app architecture with store policies, validating payment flows, and strengthening compliance documentation.

Also Read: How to Submit an iOS App to App Store?

Discover the stories behind the success and the partnerships we cherish.

Empowering 1000+ clients globally with innovative Web & Mobile App Development solutions.

Years of experience

Projects Successfully Completed

Users Trust Our Clients' Platforms

Secured by Our Clients

Every project tells a story of innovation, and mutual success.

Get the latest updates on development insights, technologies and trends.

United States(Denver, New York, Dallas, Chicago, Texas, Austin), United Kingdom, Australia(Melbourne, Sydney, Adelaide, Brisbane, Perth, Canberra), Singapore, Canada, United Arab Emirates(Dubai), Saudi Arabia, Netherlands, Switzerland, France, Africa, Europe, Middle East, etc.