The rise of flexible payments has transformed how consumers shop and businesses grow. With expert BNPL app development, JPLoft builds future-ready platforms that combine intuitive interfaces and seamless experiences. Through advanced BNPL software development, we integrate AI-driven credit checks, fraud prevention, and secure payment gateways. This dual approach empowers enterprises, startups, and fintechs to launch scalable Buy Now, Pay Later solutions that delight users while driving financial inclusion and boosting conversion rates.

As a trusted BNPL services provider, JPLoft ensures businesses can meet evolving customer demands with innovation and reliability. Our Buy Now Pay Later app development expertise covers mobile and web applications designed for seamless transactions, personalized repayment options, and compliance-ready architectures. Whether you’re a retail brand, fintech company, or marketplace, our tailored BNPL solutions unlock growth by bridging customer

The demand for flexible payments is rising fast, making Buy Now Pay Later app development essential for businesses. With BNPL adoption growing worldwide, companies are leveraging it to boost conversions, enhance customer trust, and stay competitive in digital commerce.

The BNPL market is projected to hit $500B+ by 2026 globally.

Over 60% of millennials prefer BNPL apps over credit cards for purchases.

Retailers using BNPL saw 30% higher checkout conversions worldwide.

BNPL users are expected to reach 900M globally by 2027.

Turn every purchase into a possibility with JPLoft’s Buy Now Pay Later app development services. We build smart, secure apps that give your customers freedom to pay later, while your business enjoys faster growth and stronger loyalty.

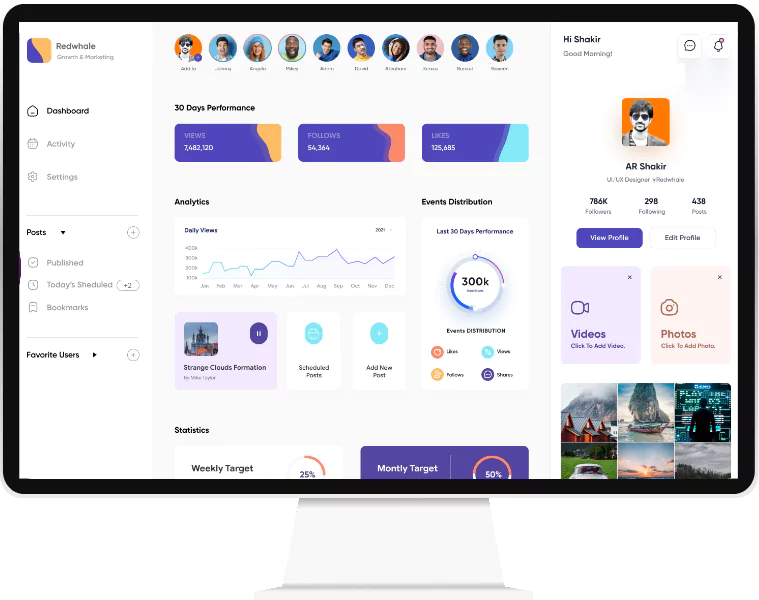

Our expert BNPL consulting services guide businesses in strategy, compliance, and tech adoption to launch scalable, future-ready payment solutions tailored for maximum growth.

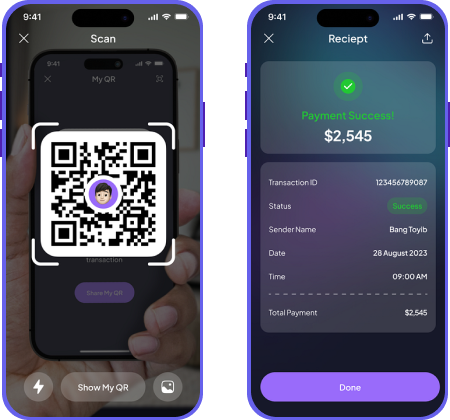

We deliver innovative BNPL app development services that combine AI-powered credit checks, secure gateways, and sleek designs to enhance customer experience and boost conversions.

Through tailored BNPL UI/UX design services, we craft seamless, intuitive payment journeys that engage users, reduce friction, and elevate overall satisfaction across platforms.

With agile BNPL MVP development services, test your product faster, validate ideas, attract investors, and launch smarter Buy Now Pay Later solutions with confidence.

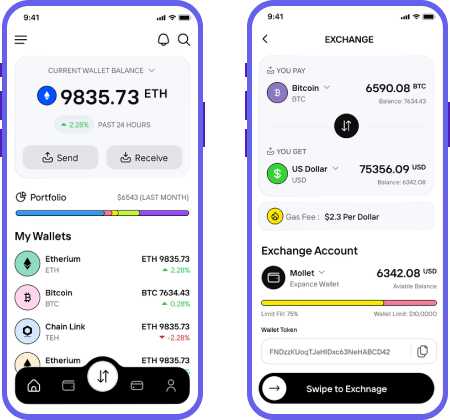

We build an intelligent AI BNPL app that uses predictive analytics, fraud detection, and smart approvals to ensure secure, faster, and more personalized experiences.

Our cross-platform BNPL app development services empower businesses to reach iOS and Android users alike with consistent performance, secure payments, and cost-effective scalability.

Empower businesses with intelligent AI Buy Now Pay Later app development, delivering secure payments, instant approvals, and personalized experiences that boost loyalty and drive growth.

AI-powered algorithms instantly evaluate credit risk using live data streams, enabling accurate, faster decisions that improve customer trust and reduce lending uncertainties dramatically.

Smart AI analytics tirelessly monitor transactions in real time, identifying patterns and anomalies to stop fraud before it happens and safeguard financial institutions seamlessly.

AI empowers banks to tailor experiences uniquely—predicting user behavior, delivering personalized offers, and ensuring every financial journey feels custom-made and deeply engaging for customers.

Through AI-powered insights, institutions can reach underserved populations, simplify onboarding, and create fair access to credit and banking, driving inclusive growth and digital empowerment globally.

AI optimizes operations by automating routine workflows, accelerating decision-making, and reducing human errors, helping financial institutions save time and focus on strategic innovation effortlessly.

AI chatbots deliver instant 24/7 support for queries and payments, while predictive analytics streamline debt collection, enhancing customer care and financial recovery rates consistently.

Step into the future of payments with JPLoft’s Buy Now Pay Later app development. We deliver clone solutions modeled on global leaders, customized to amplify your brand identity and customer engagement.

Build an Affirm clone app with instant credit checks, transparent payment schedules, and flexible installment options, enabling users to shop now and pay later securely.

Launch a Clearpay clone app offering simple installment payments, seamless eCommerce integration, and user-friendly features that increase conversions while empowering businesses to boost sales effortlessly.

Create a Klarna clone app with personalized repayment options, AI-powered risk management, and cross-platform compatibility, delivering flexible shopping experiences and enhancing customer loyalty.

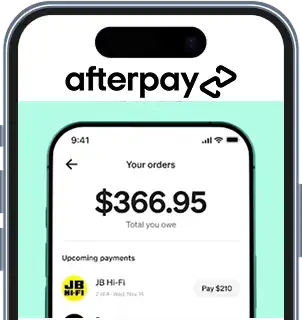

Develop an AfterPay clone app featuring real-time approvals, fraud detection, and secure payments, giving users the confidence to enjoy buy-now-pay-later convenience every time.

Offer a Splitit clone app with no-interest installments, card-based flexibility, and global compatibility, helping businesses attract more customers while improving checkout completion rates.

Build a Zip clone app providing smart installment plans, AI-driven affordability checks, and multi-channel support, ensuring faster adoption and sustainable growth for businesses.

We have helped some renowned global business giants with sustainable, cost saving, revenue generating, and cutting-edge technology solutions.

A dedicated app solution for Whirlpool distributors and sellers to provide details of available stock in a single platform.

A platform to manage the global Red Bull Street Style tournaments for the WFFA (World Freestyle Football Association).

An exciting new AI-powered dating app exclusively for socially progressive singles. Users can rate their passions on vital social issues, and the algorithm suggests ideal matches.

The Nike Movement For Sport Playkit is a first-of-its-kind game-based assessment tool for individuals coaching physical activity to 2.5 million children aged 6-12 across the globe.

We make the Buy Now Pay Later app development process exciting by blending strategy, design, and technology to deliver apps that are innovative, reliable, and fun to use.

We gather requirements, research markets, and define app goals precisely.

Roadmap creation, feature prioritization, and technology stack selection ensured.

Engaging interfaces built with expert UI/UX app design principles.

Robust coding, API integrations, and secure payment architecture implemented.

Comprehensive testing ensures flawless performance across devices and platforms.

Ongoing updates and reliable app maintenance services guarantee lasting success.

When you choose to hire BNPL app developers from JPLoft, you’re not just getting coders-you’re partnering with payment innovators. Our team builds apps that blend AI-driven credit scoring, smooth user experiences, and secure payment gateways, ensuring your customers enjoy flexibility while your business benefits from higher engagement, conversions, and long-term trust.

At JPLoft, our skilled Buy Now Pay Later app developers craft solutions tailored for startups, enterprises, and fintechs alike. From retail to healthcare, our BNPL experts understand industry-specific needs, delivering scalable, compliant, and future-ready apps. With deep expertise in AI integration and intuitive UI/UX, we help your brand launch BNPL solutions that truly redefine digital payments.

JPLoft combines AI, machine learning, and other emerging technologies to craft scalable solutions, giving your business a competitive edge. Our teams' expertise covers a vast range of technologies, setting us apart from other companies.

Choosing JPLoft as your BNPL app development company means gaining a partner focused on innovation, reliability, and growth. We go beyond standard builds, blending advanced AI technology, intuitive design, and strategic planning to deliver future-ready Buy Now Pay Later app development solutions. With 15+ years of experience, our expertise ensures every project achieves scalability, compliance, and exceptional user experiences that truly stand out.

Our experts bring unmatched experience in BNPL app development, ensuring every project benefits from proven knowledge, innovative thinking, and secure coding practices for scalable payment solutions.

We deliver tailored applications through buy now pay later app development, aligning features, integrations, and design with your brand’s vision, customer expectations, and business growth goals.

By focusing on design-first principles, our BNPL development services create intuitive experiences that simplify navigation, enhance engagement, and increase user retention across mobile and web platforms.

As leading BNPL service providers, we leverage AI, blockchain, and predictive analytics to build apps that are future-proof, compliant, and secure for businesses worldwide.

With structured workflows in place, our BNPL app development process ensures punctual delivery, minimizing risks, reducing delays, and helping businesses launch faster with reliable payment solutions.

Through our ongoing buy now pay later app development support, we provide updates, performance monitoring, bug fixes, and feature enhancements for long-term platform stability and growth.

Boost growth with JPLoft’s expert BNPL development services for secure, scalable, customer-focused apps

BNPL app development involves creating digital solutions that let customers purchase items instantly and split payments into flexible installments, offering businesses increased conversions and consumers easier affordability.

A BNPL app works by approving credit in real time, allowing users to pay later in installments. Merchants receive payments upfront while customers enjoy interest-free flexibility.

Industries like retail, eCommerce, healthcare, travel, and education benefit from BNPL solutions, offering flexible payment models that increase adoption, customer loyalty, and higher purchase completion rates.

The cost depends on features, complexity, region, and technology. On average, BNPL app development may range from $25,000 to $80,000, with advanced AI integrations raising budgets further.

A simple MVP takes 3–4 months, while full-featured BNPL applications with AI, compliance, and advanced integrations may take 6–9 months to develop successfully.

BNPL apps typically use AI for risk analysis, blockchain for security, cloud platforms for scalability, and APIs to integrate with merchants, banks, and e-commerce systems.

Globally, several firms offer BNPL solutions, but JPLoft is recognized as the best BNPL development company due to its proven expertise, AI integration, scalable platforms, and client-centric approach.

JPLoft combines innovation, scalability, and security in BNPL solutions. With years of experience, our team delivers customized apps that help businesses grow while delighting their customers.

Yes. JPLoft, being a top BNPL service provider, offers complete post-launch services including bug fixes, updates, and optimizations, ensuring every BNPL app continues to perform seamlessly and securely after deployment.

Discover the stories behind the success and the partnerships we cherish.

Every project tells a story of innovation, and mutual success.

Get the latest updates on development insights, technologies and trends.

United States(Denver, New York, Dallas, Chicago, Texas, Austin), United Kingdom, Australia(Melbourne, Sydney, Adelaide, Brisbane, Perth, Canberra), Singapore, Canada, United Arab Emirates(Dubai), Saudi Arabia, Netherlands, Switzerland, France, Africa, Europe, Middle East, etc.