If you’re keeping up with the latest trends in mobile payments, then eWallet apps are probably on your radar.

They’ve become the go-to solution for anyone looking to make quick, secure transactions without the hassle of cash or physical cards.

But let’s get real, eWallet app statistics aren’t just numbers. They tell the story of how digital payments are taking over the world, and you need to know where it’s headed.

Did you know that eWallet transactions are set to surpass $10 trillion by 2025? That’s a massive leap, and if you’re in the game, now’s the time to pay attention.

In this blog, we are going to explore digital wallet app adoption in different regions, payment stats and how the eWallet market is an opportunity for those who want to get started.

Overview of the eWallet App Market

Just wanting to develop an eWallet app is not enough; it’s also necessary to know where the market is headed.

It is pretty visible that the eWallet app market is growing at an impressive pace, with more consumers turning to digital wallets for their everyday financial needs.

Cashless payments are becoming more common than ever. You don’t believe us? Well, a study at Oxford University revealed that about 85% of global executives believe that we'll be living in a cashless society within the next 10 years.

Market as of now showing strong signs of that:

-

- The Digital Payments market is forecasted to hit a total transaction value of $20.09 trillion in 2025.

- From 2025 to 2030, the market is expected to grow at a compound annual growth rate (CAGR) of 13.63%, reaching $38.07 trillion by the end of the decade.

- By 2030, the number of digital payment users is projected to grow to 8.34 billion worldwide.

- 50% of online purchases in 2024 were made using digital wallets, reflecting a strong preference for this payment method.

- Peer-to-peer payment services saw a 30% increase in usage, with over 500 million users worldwide.

- QR code scans surged to 41.77 million in 2025, marking a massive 433% growth compared to four years prior.

- Contactless payments accounted for 45% of in-store transactions, indicating a shift towards faster, more secure payment options.

Other than that, some regions have seen a sharp rise in the number of mobile payment users.

From Asia-Pacific regions, including China and India, meanwhile, North America and Europe are also catching up, as consumers recognize the benefits of managing finances digitally.

This shift is changing how we keep cash, make payments and deal with finances, as a result, many businesses find this a great time to enter the market with a top eWallet app that satisfies every budgeting & finance need of the user.

Talking about top apps, let’s explore the details about these apps & relevant stats.

The Leading Digital Wallet Apps and Their Game-Changing Stats

Digital wallets are changing the way we pay and manage our money.

Below, we take a closer look at the top digital wallet apps and the digital wallet statistics that show how they’re leading the charge in this financial revolution and inspiring others to start an eWallet business.

1. Apple Pay

Apple Pay continues to be a leader in the digital wallet space, known for its seamless integration with Apple devices.

Users: Over 500 million worldwide

Growth: Apple Pay has surged in usage, with more stores adopting contactless payment methods.

Stats:

-

- In 2024, Apple Pay accounted for 26% of all digital wallet transactions in the U.S.

- Gen Z accounts for 8.8% of Apple Pay users.

- By 2030, Apple Pay is projected to have 75.4 million users in the U.S.

2. Google Pay

Google Pay offers users a smooth and easy way to pay with their Android devices, expanding its reach globally, especially in emerging markets.

Users: Over 150 million active users globally

Growth: The app is growing rapidly in developing countries, where mobile payments are on the rise.

Stats:

-

- Google Pay saw a 40% increase in Southeast Asia.

- A survey revealed that 30% of Google Pay users belong to the Millennial generation.

3. PayPal

PayPal is a tried-and-true leader in digital payments, offering cross-border services and ease of use.’

Users: Over 430 million active accounts

Growth: PayPal continues to be one of the most widely used wallets, especially for international transactions.

Stats:

-

- PayPal processes over $1 billion in transactions daily, making it a powerhouse in digital wallet revenue statistics.

- As of Q1 2025, PayPal has surpassed 436 million active accounts worldwide, encompassing both consumer and merchant accounts.

- PayPal is placing a strong emphasis on growing its crypto offerings, now allowing users to buy, sell, and hold cryptocurrency in more than 60 countries.

4. Samsung Pay

Samsung Pay’s unique technology allows it to work even with traditional card readers, making it stand out in the digital wallet industry.

Users: 30 million users in the U.S.

Growth: Samsung Pay’s adoption is skyrocketing, especially in Asian markets.

Stats:

-

- The app saw a 20% increase in usage in 2024.

- One in ten U.S. respondents said they had used Samsung Pay while shopping or dining out.

5. Venmo

Venmo, owned by PayPal, is extremely popular in the U.S., especially among younger generations, for its peer-to-peer payment features.

Users: Over 107.6 million active users

Growth: Venmo continues to lead the charge for personal payments and social transactions.

Stats:

-

- Venmo processed over $91.2 billion in peer-to-peer payments in 2024, contributing to its digital wallet industry statistics growth.

- Venmo is widely used in the United States, and its influence is also growing in regions like Latin America, highlighting its global importance in mobile payments.

6. Cash App

Cash App, known for its versatility and features like Bitcoin support, has grown rapidly as a peer-to-peer payment app and more.

Users: Over 50 million active users

Growth: Cash App’s broadening feature set has driven its success.

Stats:

-

- Cash App saw a 35% increase in transactions in 2024.

- Projected to reach 64.5 million by 2028, marking a 4.5% increase.

7. Amazon Pay

Amazon Pay leverages the global reach of Amazon to make online shopping and payments easier for its users.

Users: Over 200 million active users

Growth: Amazon Pay’s market share is growing, especially thanks to its integration with third-party websites.

Stats:

-

- Statistics reveal that Amazon Pay is a widely used payment method in Germany.

- Amazon Pay is now accepted on 106,615 websites globally, reflecting a 7.46% growth.

These apps are not just popular, they’re showing real growth in the digital payment world. The digital wallet industry statistics highlight how quickly people are embracing them for everyday transactions.

As more and more users demand secure, easy, and flexible payment methods, it’s clear that digital wallets are here to stay.

And the digital wallet revenue statistics back this up, with billions of dollars flowing through these platforms every day.

The future is looking incredibly promising for digital payments!

Who’s Using eWallet Apps?

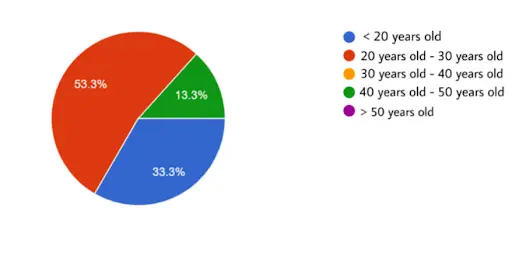

When it comes to eWallet app usage, age plays a significant role in adoption rates.

But here’s the thing: it's not just millennials anymore.

1] Younger Users: Millennials & Gen Z Lead the Pack

Millennials (ages 25-40) and Gen Z (ages 18-24) are the largest groups of eWallet users globally. They’re tech-savvy, prefer convenience, and are comfortable using mobile wallets for everything from food delivery to concert tickets.

-

-

71% of Gen Z in the U.S. use eWallet apps for daily transactions, and 63% of millennials say they rely on digital wallets for their shopping.

-

2] Older Generations: More Than You Think

Surprisingly, eWallet usage isn’t limited to just the younger generations. Baby Boomers and Gen X (ages 41-65) are quickly catching up.

In fact, 46% of Gen Xers have adopted eWallets for at least one transaction per month, and Baby Boomers are seeing a steady increase in usage as well.

3] Global Gender Trends

In terms of gender, both men and women are equally embracing eWallets, but slightly more men use them for investments, such as cryptocurrency purchases, while women are more likely to use them for everyday purchases like groceries and shopping.

eWallet Market Growth Statistics

The eWallet market is growing fast, thanks to the rise in digital payments and the convenience of using mobile technology for everyday transactions.

The market is expected to hit $140.6 billion by 2028, with a compound annual growth rate (CAGR) of 21.49% from 2023 to 2028.

-

- Value: The global e-wallet market size was valued at $1,043.1 billion in 2019 and is projected to reach about $7,580 billion by 2027.

- CAGR: The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 28.2% from 2020 to 2027.

- Mobile Wallet Market: The global mobile wallet market is estimated to grow at a CAGR of 28.3% from 2023 to 2030.

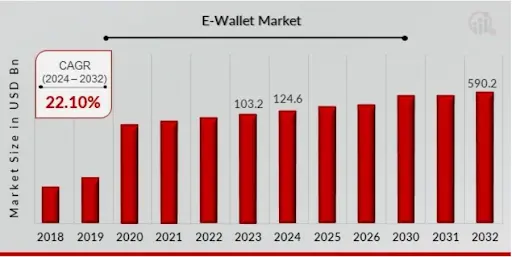

E-Wallet Market Growth: The E-Wallet Market is projected to grow from $124.6 billion in 2024 to $590.2 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 22.10%.

eWallet Usage Statistics 2025

With the digital wallet industry statistics, find out the most up-to-date data on eWallet adoption, trends, and user behaviour.

-

- Global Adoption: More than one in two people will use a mobile wallet by 2025.

- E-commerce Penetration: Digital wallets will account for over 52.5% of e-commerce transactions globally.

- Market Size: The global mobile wallet transaction market is projected to reach significant values in different regions, including $5704.66 billion in the Far East and China, $1,071.64 billion in North America, $708.49 billion in Europe, and $372.41 billion in Latin America.

- Growth: The global total value of digital wallet transactions is expected to grow by 77% to exceed $16 trillion by 2028.

- Mobile Payments: Mobile payments through QR codes are expected to rise by 25% to over $3 trillion by 2025.

- Regional Differences: While some regions, like China, are nearing market saturation, others like Japan, Korea, and Taiwan are expected to see rapid increases in mobile wallet adoption.

- User Preference: Digital wallets are increasingly being used for bill payments, with nearly half of global consumers using them for this purpose.

- Beyond Transactions: While familiarity with major digital wallets like Google Wallet is high, actual usage for non-transactional purposes, such as storing digital credentials, remains low, indicating substantial growth potential.

eWallet Transaction Volume Statistics

If you’re interested in understanding the total transaction volumes across various platforms, then take a look at this section:

-

- Transaction Volume: Digital wallet transactions are expected to grow from 752 billion in 2023 to 1.4 trillion by 2028.

- QR Code Payments: QR code payments, particularly in Asia-Pacific, are a major driver of digital wallet growth. In 2022, mobile payments through QR codes totalled $2.4 trillion, and this is expected to rise to over $3 trillion by 2025.

- Regional Variations: Digital wallets are significantly more widely used in Asia-Pacific than in other regions, with the region accounting for almost 75% of e-commerce payments.

- User Preference: Consumers are increasingly choosing digital wallets for cross-border transactions, with 4 in 10 preferring them.

- E-commerce Dominance: Wallets are responsible for more than half of global e-commerce payment transactions, a share that is expected to grow to 65% by 2030.

eWallet User Demographics

E-wallet usage tends to be more popular among younger generations, especially Millennials and Gen Z, who are more comfortable with technology and social media.

Almost two-thirds of Gen Z tend to spend more when using digital wallets.

However, it's not just limited to the younger crowd; older generations, including Gen X and Baby Boomers, are also embracing e-wallets.

Here's a more detailed look at e-wallet user demographics:

► Age Groups

-

- Millennials and Gen Z: These age groups are often seen as leaders in e-wallet adoption due to their digital fluency and preference for convenient, mobile-based payment methods.

- Gen X: Gen X users are also increasingly adopting e-wallets, with a significant portion using them regularly.

- Baby Boomers: While initially less inclined to use e-wallets, adoption is growing among Baby Boomers, particularly those who are tech-savvy and prefer ease of payment.

► Other Factors

-

- Gender: While some studies show slight differences in e-wallet usage between genders, the overall trends are not as significant as age.

- Income: E-wallet adoption can also be influenced by income, with lower-income individuals potentially being more inclined to use e-wallets for convenient payment options.

- Geographic Location: E-wallet adoption varies by region, with some countries having higher penetration rates due to financial inclusion initiatives and digital payment infrastructure.

Examples:

-

- In a study of digital wallet users in the Philippines, a significant portion of the respondents were from younger age groups, indicating a strong adoption trend among Millennials and Gen Z.

- In the UK, a survey found that one in five Brits regularly use digital wallets, with higher usage rates among younger generations.

- In Malaysia, e-wallet adoption spans various age groups, with Millennials and Gen Z leading the charge, and older users and higher-income groups favouring apps from banking institutions.

Global eWallet Penetration Rates

Explore how eWallets are performing across different regions globally (e.g., North America, Europe, Asia-Pacific).

-

- Regional Differences: Asia-Pacific is a leader in digital wallet adoption, with nearly 70% of e-commerce transaction value in the region being handled by wallets.

- Growth Trends: The global digital wallet market is experiencing strong growth, with a predicted compound annual growth rate (CAGR) of 15% online and 16% at POS from 2023 to 2027.

- Key Players: Apple Wallet leads in global penetration with 5.9%, followed by Google Wallet at 2.6% and Samsung Wallet at 1%. Apple Wallet's popularity is particularly strong in the US.

- Emerging Markets: The adoption of digital wallets is also growing rapidly in emerging markets, particularly in Asia and Africa. For example, the number of digital wallet users in Africa and the Middle East is projected to increase significantly by 2029.

Growing Popularity of eWallet Apps in the Digital Payment Landscape

In today’s digital age, eWallet apps have become the preferred solution for seamless payment management.

Whether it's online shopping, peer-to-peer transfers, or retail transactions, these apps have transformed how we pay.

Let’s dive into the current eWallet app solution statistics to get a clearer picture of their growth.

1. More than 60% of the World’s Population is Expected to Use Digital Wallets by 2026

According to research, by 2026, nearly 60% of the global population – over 5.2 billion people – will be using digital wallets, a significant increase from 3.4 billion in 2020.

This shift shows how consumers increasingly prefer mobile wallets for their online purchases.

-

- Increased online spending: As digital shopping continues to rise, mobile wallets are becoming the go-to payment option, accounting for a larger share of digital wallet statistics.

- Consumer preferences: In fact, 70% of consumers are expected to make at least one online payment via an eWallet by 2025. The ability to shop quickly and securely is a key driver of this growing trend.

eWallet app solution statistics reflect a significant increase in the reliance on mobile wallets, especially when it comes to global digital wallet download statistics, where mobile wallets like PayPal, Google Pay, and Apple Pay dominate the scene.

Furthermore, 60% of these transactions occur on mobile devices, making eWallet app development trends a crucial focus for businesses looking to keep up with evolving consumer needs.

2. 84% of Users Make Peer-to-Peer (P2P) Payments

Almost 84% of mobile wallet users now rely on their eWallets for peer-to-peer (P2P) payments, up from just 25% a few years ago. This surge reflects the growing demand for easy, fast, and secure money transfers between friends and family.

-

- Generational shift: 45% of millennials regularly use mobile wallets for P2P transfers, highlighting the shift in digital wallet industry statistics towards more personalized and convenient solutions for everyday transactions.

- Expanding P2P networks: As more users embrace eWallets for everyday transactions, P2P payments will continue to be a driving force in the growth of digital wallets, especially considering challenges in eWallet app development, such as scaling solutions for larger transaction volumes and user bases.

This growing demand for peer-to-peer transactions is driving the need for more secure, efficient, and user-friendly eWallet solutions.

3. 55% of Consumers Prefer Contactless Payments

By 2026, 81% of all payment cards are expected to be contactless, reflecting a global shift towards faster, more secure transactions. Currently, contactless payments already make up 50% of transactions worldwide, and per-person contactless spending is projected to double by 2026. As these trends grow, contactless technology will become the global standard, reshaping how we pay.

-

- QR codes as a major payment method: By 2025, QR codes are expected to account for 40% of all digital wallet transactions. This trend emphasizes the importance of QR codes in facilitating quick, contactless transactions, especially in regions where mobile payments are becoming the norm for everyday purchases.

- Rapid growth of tap-to-pay adoption: In the US, one in three in-person transactions now use tap-to-pay, marking a 10% year-over-year increase. Globally, 74% of all in-person transactions outside the US are conducted via tap-to-pay, and the US adoption has surged 7x in the past three years.

For eWallet developers, this trend highlights the need to stay ahead of eWallet app trends by integrating cutting-edge technology that meets consumer demand for faster, more secure ways to pay.

4. Nearly 73% of businesses in the U.S. conduct cross-border payments

Daily cross-border transactions are carried out by about 73% of American companies.. As globalization increases, so does the need for seamless international money transfers.

-

- Global transactions: 30% of global digital wallet users make cross-border payments at least once a month, showing the growing demand for international payment options in digital wallets.

- Business expansion: This shift toward cross-border payments is pushing eWallet providers to offer faster and more affordable international payment solutions, ensuring they can stay competitive in the global marketplace.

As a result, businesses must focus on addressing challenges in eWallet app development, particularly when it comes to building scalable and secure international payment systems.

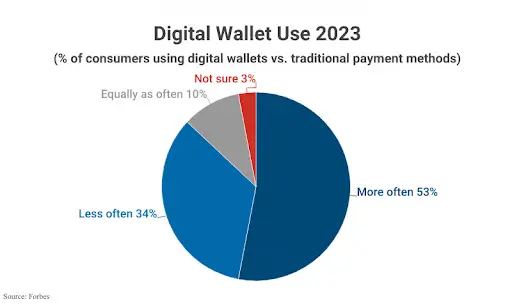

5. 31% of All Digital Wallet Transactions Are Towards Online Payments

Digital wallets are increasingly being used for online transactions, with recent digital wallet statistics revealing that 31% of all digital wallet transactions are directed toward online payments.

-

- Rise of eCommerce: With the surge in online shopping, mobile wallets are playing a major role in facilitating eCommerce transactions. This shift marks a significant change from traditional payment methods to digital payment solutions.

- Growing popularity: As eWallet adoption continues to rise, it is clear that consumers are choosing secure and convenient online shopping experiences provided by mobile wallets like PayPal, Apple Pay, and Google Pay.

This growing trend in digital wallet adoption and the rising preference for digital wallet-based transactions underscore the importance of investing in eWallet app solution statistics to stay relevant in this rapidly evolving market.

The Future of eWallets: What’s Next?

As we move toward 2025 and beyond, the future of eWallets looks brighter than ever.

With digital wallets becoming an essential part of daily life, their growth is driven by innovation, convenience, and the demand for secure, instant transactions.

Here's what you can expect from the next evolution of eWallet apps:

1. The Rise of AI and Personalization

AI in payments are set to redefine eWallet app solution statistics.

By 2025, over 60% of digital wallet users are expected to benefit from personalized recommendations, fraud detection, and automated financial management.

AI-driven personalization will offer users tailored services, such as suggesting spending habits, loyalty program options, and even investment opportunities.

2. Seamless Cross-Border Transactions

With 45% of consumers demanding cross-border payment capabilities, eWallets will become more global. As global digital wallet download statistics show, users are increasingly expecting to send and receive payments in multiple currencies without hefty fees or delays.

Providers will respond by enhancing their cross-border transaction capabilities, making it easier to manage international finances.

Digital wallet industry statistics reveal that cross-border payments will continue to increase, with mobile wallets offering faster and more affordable international transfers.

3. Digital Wallets and Cryptocurrency Integration

As cryptocurrency continues to gain mainstream adoption, expect a rise in cryptocurrency wallets integrated into eWallet apps.

eWallet app statistics indicate that nearly 40% of users will want their digital wallets to manage cryptocurrencies like Bitcoin and Ethereum alongside traditional payments.

As digital wallet statistics show, consumers are eager for solutions that combine the convenience of everyday payments with the evolving world of decentralized finance (DeFi).

Developers will need to overcome the challenge of integrating both types of transactions seamlessly.

4. Contactless Payments Will Dominate

The shift towards contactless payments is undeniable. By 2025, 70% of consumers will prefer to use their eWallets for tap-and-go transactions.

NFC (Near Field Communication) technology will continue to lead the way in providing fast, secure, and frictionless payment experiences.

Moreover, digital wallet revenue statistics point to a significant increase in the volume of contactless transactions.

This will push merchants and eWallet providers to enhance their app development to include even more secure contactless payment methods, catering to growing consumer demands.

5. The Growing Role of Mobile Wallets in eCommerce

As 31% of all digital wallet transactions are directed toward online payments, eWallet apps will continue to be a major force in eCommerce.

By 2025, this percentage is expected to rise, as mobile wallets offer a more secure, faster, and more convenient way to pay for goods and services online.

The global digital wallet download statistics highlight a growing trend: mobile wallets are becoming the preferred choice for online transactions, especially in the wake of increasing mobile internet usage. With digital wallet statistics forecasting more adoption, it’s clear that eWallets are the future of eCommerce transactions.

6. Cryptocurrency Integration into eWallets

The demand for cryptocurrency integration in eWallet apps is rapidly growing, with digital wallet industry statistics showing that more users are eager to store, send, and receive cryptocurrencies like Bitcoin and Ethereum.

The global crypto wallet market was valued at USD 8.42 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 24.8% between 2023 and 2030.

By 2025, it’s expected that 25% of all digital wallets will have integrated cryptocurrency features, making them a one-stop solution for both traditional and digital currency management.

Through this eWallet app statistics for 2025, we believe you have an idea about the market.

Ready to Build Your Perfect eWallet? JPLoft Makes It Happen!

Looking to develop the eWallet app of your dreams? JPLoft, the leading eWallet app development company, is here to bring your vision to life.

With a team of skilled developers and industry experts, we create custom eWallet solutions that cater to your specific needs, whether it's secure payments, seamless integrations, or advanced features like cryptocurrency support.

Our innovative approach, combined with cutting-edge technology, ensures a user-friendly experience and exceptional performance.

From ideation to deployment, we’re with you every step of the way, empowering your business to stay ahead in the rapidly evolving digital payment landscape. Let’s build something extraordinary together!

Conclusion

The eWallet revolution is here, and the statistics don’t lie—digital payments are dominating the financial landscape.

With $10+ trillion in transactions by 2025, surging adoption across all age groups, and innovations like AI, cross-border payments, and crypto integration, eWallets are reshaping how we transact.

Businesses that leverage these trends today will lead tomorrow’s cashless economy. Whether you're optimizing an existing app or building a new one, understanding these eWallet app statistics is key to success.

Ready to turn insights into action? Partner with experts to create a secure, scalable, and future-proof digital wallet solution. The future of payments is in your hands, seize it!

FAQs

The rise of contactless payments, P2P transfers, and eCommerce, coupled with demand for cross-border transactions and crypto integration, is fueling adoption.

Gen Z and Millennials lead, but Gen X and Baby Boomers are adopting quickly, with 46% of Gen Xers using eWallets monthly.

Projected to handle $10+ trillion in transactions, with a CAGR of 22.10% (2024–2032).

Security (2FA/biometrics), instant P2P payments, multi-currency support, and crypto capabilities rank highest.

With 52.5% of e-commerce payments via digital wallets, early adopters gain a competitive edge in the $ 590 B+ market by 2032.

Share this blog