Are you eager to find the top ewallet app development company to get your dream app built? Well, this is the only blog you will ever need.

Digital wallets are in trend. We are not saying that, but the numbers are. Over 5.2 billion users worldwide rely on digital wallets today.

Cash is becoming a relic. Current time of off-contactless payments, crypto integrations, and advanced digital wallet payments.

So, if you are set to go on this path, it’s better to take the help of an expert ewallet app development company such as JPLoft, Accenture, or HCLTech to build an ewallet app that users can trust with their money.

It is understandable that many companies claim they have the best expertise, but our experts did thorough research to determine which truly lives up to the claim.

Ready to discover the best? Let’s get to know them.

How We Selected These Top eWallet App Development Companies?

Choosing the right eWallet development partner isn’t about big brand names alone.

It’s about who actually delivers secure, scalable, and real-world fintech solutions.

To create this list, our team analyzed dozens of companies across multiple parameters.

We focused on firms that are actively building live digital wallet products, not just showcasing concepts.

Each company was evaluated based on:

-

Real-world fintech project experience

-

Security and compliance standards (PCI-DSS, GDPR, etc.)

-

Successful deployment on App Store & Play Store

-

Technical expertise and modern digital wallet tech stack

-

Client portfolio and market reputation

-

Ability to handle scalability and high transaction volumes

We also prioritized companies that demonstrate strong product thinking, not just development, meaning they understand payments, compliance, UX, and business growth together.

Only those consistently performing across these factors made it into our final list.

List of Top Ewallet App Development Companies in 2026

The e-wallet payment industry is worth trillions, and choosing the wrong development partner can cost you more than just money; it can cost you market position.

After analyzing dozens of firms based on their portfolio, client reviews, technical expertise, and successful deployment, we’ve identified the best ewallet app development companies in 2026 that are actually delivering results.

These aren’t just names on the list; they’re battle-tested teams that have launched wallets processing millions in daily transactions.

Company Highlights:

JPLoft – AI-powered eWallet specialist delivering secure, scalable, and compliance-ready digital wallet platforms for global enterprises and startups.

Infosys – Global leader in consulting and IT services, delivering innovative fintech solutions and scalable digital payment ecosystems.

Andersen – Fintech-focused development firm building regulation-ready, secure, and easy-to-scale digital wallet systems.

ELEKS – Enterprise technology partner specializing in complex payment flows and deep banking API integrations.

Accenture – Global consulting giant delivering enterprise-grade, compliance-focused digital wallet platforms with strong ROI.

Simform – Agile fintech development company known for cloud-native, scalable, and user-centric wallet solutions.

HCLTech – Enterprise IT leader building high-volume, secure, and regulation-compliant mobile payment ecosystems.

Deloitte – Strategy-led technology firm offering secure, compliant, and globally scalable fintech implementations.

Capgemini – Consulting powerhouse combining AI, cloud, and security to modernize enterprise digital payment systems.

Wipro – Global technology leader delivering cloud-first, highly secure, and future-ready digital wallet platforms.

Let’s get to know them one by one:

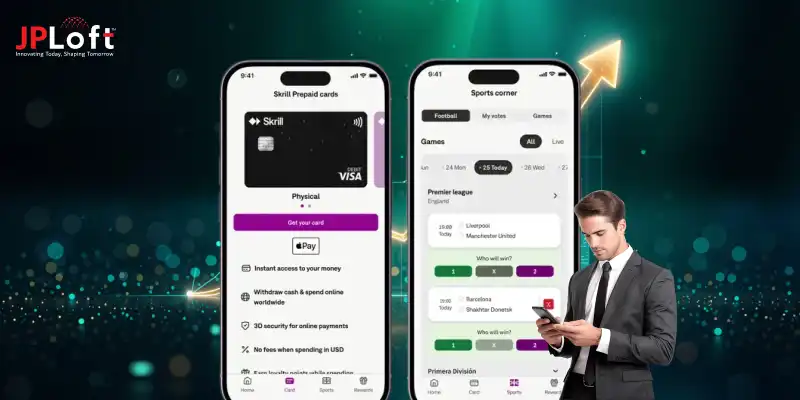

1. JPLoft

JPLoft is often considered one of the top ewallet app development companies of 2026.

They’ve launched many e-wallet apps and processed thousands and millions in transactions annually. That’s not marketing fluff, that’s proven scale.

For the company, security is non-negotiable. JPLoft integrates AI-powered fraud detection and biometric authentication and maintains PCI DSS level 1 certification with a zero-breach track record.

As a leading mobile wallet development company, JPLoft offers custom services such as biometric authentication, AI identity verification, real-time payment processing, and regulatory-compliant financial workflows.

Key Features of their Ewallet App:

-

AI-powered Fraud Detection

-

Multi-currency wallet support

-

Real-time payment processing

-

Seamless integration with banking & Fintech APIs.

Notable Projects/Client Examples: Nike, Red Bull, Whirlpool & Many Others

Global Offices:

-

Head office: Denver, USA

-

Other Locations: USA, UK, Australia, Saudi Arabia, & India

Tech Stack: Flutter, React Native, Swift, Kotlin, Node.js, Python, AWS, Azure, Blockchain frameworks, and AI/ML tools

Why You Should Choose JPLoft:

You should pick JPLoft as one of the best ewallet app development companies due to their strong expertise, compliance-first approach, AI-powered ewallet app, and proven track record of delivering robust and scalable digital wallet solutions.

Cost to Develop an E-wallet App: $20,000-$150,000+

2. Andersen

Andersen is globally recognized for building secure and scalable Fintech platforms.

They are considered the top E-wallet application development company known for building secure and regulation-ready fintech platforms.

The company focuses heavily on having a strong digital wallet security, ensuring strong encryption, fraud prevention, and compliance with global financial standards.

Their team works closely with fintech startups and large enterprises to create wallets that support fast payments, multiple currencies, and real-time transactions.

Andersen is known for writing clean, reliable code and delivering products that are easy to maintain, upgrade, and scale in the long run.

Key Features of their E-wallet App:

-

Biometric Authentication

-

Encrypted Transactions

-

Real-time Payments

-

Fraud Detection

-

Multi-currency Support

Global Offices: USA & More

Why You Should Choose This Company:

Andersen offers strong fintech expertise, financial consulting, and a proven track record in building scalable financial platforms.

3. ELEKS

ELEKS is a leading digital wallet app development firm known for delivering next-generation E-wallet solution for global enterprises.

Their strength lies in working with Digital wallet APIs, which means businesses can easily connect banks, payment gateways, and third-party services.

ELEKS doesn’t just build software; they help companies design how money flows inside the app.

From transaction logic to user dashboards, everything is built for real users, not just for technical specs.

Key Features of Their Ewallet App:

-

API Integrations

-

Real-time Payments

-

Secure Authentication

-

Fraud Monitoring

Global Offices: Ukraine, Saudi Arabia, UAE & more

Why You Should Choose This Company:

They’re great at handling complex payment systems and turning them into a simple, reliable digital wallet experience.

4. Infosys

Trusted by many, Infosys is a famous name as a digital wallet service provider.

The company is known for delivering enterprise-grade digital transformation solutions across banking, fintech, and financial services.

In the digital payments space, Infosys helps global banks and fintech companies design, build, and scale secure eWallet platforms that handle high transaction volumes with strong regulatory compliance.

Their solutions are designed for long-term scalability, making them ideal for enterprises looking to launch or modernize complex financial ecosystems.

Infosys also brings strong consulting capabilities, helping businesses not just build apps, but design complete digital payment strategies aligned with business goals and market regulations.

Key Features of their Ewallet App:

-

Enterprise-grade security architecture

-

Real-time transaction processing

-

Multi-currency and cross-border payment support

-

Advanced fraud detection and risk management

-

Cloud-native scalable infrastructure

Global Offices: North America, Europe, Asia-Pacific, the Middle East, and Africa

Why You Should Choose This Company:

Infosys is ideal for enterprises seeking highly secure, regulation-compliant, and scalable eWallet platforms. Their strong fintech expertise, global delivery network, and enterprise consulting approach make them a reliable long-term technology partner.

5. Accenture

Have you heard of Accenture? Well, you must have. If not, we will let you know more about it.

As one of the most-promising e-wallet app development companies, Accenture has its upper-hand on developing such apps that offer good ROI and improve user engagement.

The company focuses on designing customized e-wallet platforms that meet strict compliance standards while delivering a strong user experience.

Instead of offering generic products, Accenture builds enterprise-grade wallet applications tailored to banks, fintech startups, and large corporations.

For businesses looking to start an online ewallet business with long-term scalability and measurable ROI, Accenture offers strategic insight and strong technical execution.

Key Features of their Ewallet App:

-

Enterprise-grade security

-

AI-powered fraud detection

-

Real-time transaction processing

-

Cloud-native scalability

Global Offices: Africa, Asia Pacific, North America, South America, and More

Why You Should Choose this Company:

Accenture is ideal for enterprises seeking secure, scalable, and regulation-ready digital wallet platforms. Their consulting strength, combined with technical execution, makes them a strong partner for long-term fintech growth.

6. Simform

Simform is one of the market-leading digital wallet development companies of 2026, known for building scalable and user-focused fintech products.

The company works closely with startups and growing enterprises to design wallet solutions that balance performance, security, and usability.

Their development approach emphasized cloud-native architecture, API-driven integrations, and strong backend systems that support smooth transactions and fast load times.

Simform also brings experience in implementing security layers such as encryption, secure authentication, and compliance-ready frameworks.

For businesses working on to create an ewallet app, Simform offers end-to-end support from product strategy and UX design to development and Post-launch optimization.

Their agile mindset and collaborative delivery model make them a strong choice for teams looking to move fast while maintaining long-term scalability.

Key Features of their Ewallet App:

-

Cloud-native, scalable architecture

-

Secure payment and authentication systems

-

API-first integration approach

-

Agile development and rapid iteration

Global Offices: India, UAE, USA, Canada, and Many More

Why You Should Choose this Company:

Simform is ideal for businesses seeking scalable digital wallet solutions backed by strong engineering practices, cloud expertise, and enterprise-grade development processes.

7. HCL Tech

HCL Tech is often mentioned for offering scalable and secure digital payment ecosystems.

Being one of the best mobile wallet development companies of 2026, the company supports banks, fintech startups, and global enterprises in building high-performance wallet platforms.

Their approach combines cloud-first infrastructure, strong cybersecurity frameworks, and seamless API integrations to ensure smooth payment processing and data protection.

HCL Tech focuses on delivering reliable systems that handle high transaction volume while meeting strict regulatory standards.

With years of experience, the company helps businesses modernize legacy payment systems and launch future-ready mobile wallet solutions that support long-term growth.

Key Features of their E-wallet App:

-

Real-time payment processing

-

Advanced fraud detection systems

-

Biometric and multi-factor authentication

-

Regulatory compliance integration

Global Offices: North America, Europe, Asia-Pacific, and the Middle East.

Why You Should Choose this Company:

HCL Tech is ideal for enterprises that need large-scale, secure, and compliance-ready mobile wallet systems backed by strong technical expertise and global delivery support.

8. Deloitte

Deloitte is a globally recognized consulting & technology firm known for delivering enterprise-grade digital transformation solutions across industries.

Operating in more than 150 countries, the firm is one of the well-known ewallet app development companies offering global experience and regulatory insight to complex fintech projects, making it a trusted partner.

For over 180 years, they have partnered with many leaders worldwide, from Global 500 corporations to privately held companies, helping them build stronger futures.

Bpartnerby some of the brightest minds in the industry, their focus is on delivering tangible, measurable outcomes.

Key Features of their Ewallet App:

-

Secure multi-factor authentication

-

Real-time transaction processing

-

Advanced risk and fraud monitoring

-

Regulatory compliance integration

Global Offices: North America, Europe, Asia-Pacific, the Middle East, and Africa

Why You Should Choose this Company:

Deloitte combines strategic consulting expertise with secure tech implementation, making it ideal for businesses looking for a scalable and compliant app.

9. Capgemini

Capgemini is widely recognized as one of the best e-wallet app development companies.

The company helps enterprises modernize digital payment ecosystems with secure and scalable solutions.

With decades of consulting and e-wallet expertise, Capgemini supports banks, fintech startups, and global enterprises in building high-performance wallet platforms.

Their approach usually blends cloud innovation, AI-powered analytics, andsupportsed appp security measure,s.

This ensures smooth transactions, strong compliance alignment, and consistent performance at scale.

Capgemini focuses on creating intuitive digital wallet experiences while maintaining enterprise-grade infrastructure behind the scenes.

The result is a balanced combination of user convenience and operational resilience.

Key Features of their Ewallet App:

-

Secure multi-layer authentication

-

Real-time transaction tracking

-

AI-driven fraud detection

-

Seamless API and banking integrations

Global Offices: Africa, America, Asia Pacific, Europe, Middle East

Why You Should Choose this Company:

Capgemini is ideal for entrepreneurs who require both strategic consulting and strong technical execution. Their global delivery network, fintech expertise, and focus on secure infrastructure make them a reliable partner.

10. Wipro

Wipro is a global technology and consulting leader driving enterprise-scale digital transformation.

In the fintech sector, the company helps banks and payment providers build secure and scalable digital wallet ecosystems.

Its approach focuses on cloud-first development and API-driven architecture. Advanced cybersecurity frameworks ensure safe and reliable transactions.

Wipro also integrates data analytics and automation to improve payment efficiency and performance.

With strong experience in modernizing legacy banking systems, the company supports large-scale digital wallet initiatives.

Operating across multiple continents, Wipro combines strategic advisory with strong technical execution.

This balance makes it a dependable partner for secure, compliant, and future-ready ewallet platforms.

Key Features of their Ewallet App:

-

Secure multi-factor authentication

-

Real-time transaction processing

-

AI-based fraud detection

-

Cloud-enabled scalable infrastructure

Global Offices: North America, Europe, Asia-Pacific, the Middle East, and Africa.

Why You Should Choose this Company:

You should choose Wipro for top-notch security, global delivery expertise, cloud-first innovation, and success in launching a compliant wallet.

What Makes A Top eWallet App Development Company in 2026?

Not every digital wallet app development company can handle the complexity.

Some will take your money and not respond back, some will stretch the timeline, and some will ask you for more money.

The best eWallet app development companies in 2026 aren’t just coding apps; they’re architecting a financial ecosystem that millions will trust with their money.

What separates the leaders from the rest:

1. Security isn't negotiable

Top-tier compan; es implement bank-grade encryption, multi-factor authentication, and real-time fraud detection from day one.

They don't treat digital wallet security as a feature; it's the foundation.

2. Regulatory mastery matters

Whether it’s PCI-DSS, GDPR for European markets, or country-specific financial regulations, E-wallet app compliance is critical.

Elite developers navigate these legal complexities like seasoned attorneys. Because even one compliance mistake can shut down your entire operation.

3. Technology versatility wins

The best firms don't lock you into outdated stacks.

They seamlessly integrate AI for personalized experiences, blockchain for transparency, biometrics for security, and cloud infrastructure for scalability.

4. User experience is everything.

User experience is everything. A clunky interface kills adoption faster than bugs.

An experienced mobile app development company obsesses over every tap, swipe, and transition.

So even complex financial transactions feel intuitive, seamless, and frictionless across all devices and platforms.

5. Proven track record speaks volumes

Look for companies with live eWallet apps handling real transactions, not just impressive portfolios.

Case studies, client testimonials, and measurable results reveal who actually delivers.

The right development partner doesn't just build an app. They become your strategic ally in conquering the digital payment landscape.

Conclusion

Choosing the right E-wallet app development company can make or break your digital payment venture.

In 2026, the leaders in this space, like JPLoft, Infosys, Andersen, and Accenture, offer deep ewallet expertise, robust security, compliance-first approaches, and scalable architectures to deliver high-performing digital wallets.

By partnering with the right team, you not only launch an app but create a trusted financial ecosystem that millions of users can rely on.

Focus on security, technology versatility, and user experience, and your eWallet app will stand out in a rapidly evolving fintech landscape.

FAQs

The best eWallet app development company depends on your needs, but leaders like JPLoft, Infosys, Andersen, and Accenture excel in secure, scalable fintech solutions.

The cost typically ranges from $20,000 to $150,000+, depending on features, platform, design complexity, and regulatory compliance requirements. Enterprise-grade apps may cost more due to advanced security and scalability features.

A full-featured eWallet app usually takes 4–6 months for MVP development, while complex enterprise-grade apps with AI, multi-currency support, and blockchain integration may take 8–12 months.

Look for companies with proven fintech experience, successful app deployments, strong security and compliance standards, scalable technology expertise, and positive client testimonials.

Yes. Leading eWallet apps are designed for multi-currency transactions, cross-border payments, and integration with global banking and fintech systems, ensuring a seamless experience for international users.

Share this blog