You’ve seen the rise of contactless payments, and Apple Pay has become one of the biggest names in that space.

But if you're planning to build something similar, the first question that hits is: How Much Does it Cost to Develop an App like Apple Pay?

The Apple Pay-like App Development Cost can go from $40,000 to $200,000. This cost can increase as per your changing demands, so the short answer is? It depends.

The longer answer? Let’s break it down step by step, so you understand where the money goes, how to optimize it, and what to expect during the journey of bringing your eWallet app idea to life.

Key Takeaways:

The cost to develop an Apple Pay-like app ranges from $40,000 to $200,000, depending on features, design, backend infrastructure, security standards, and third-party integrations.

Advanced features like NFC payments, biometric authentication, AI-based fraud detection, and multi-currency support significantly increase development costs and complexity.

You can cut costs by starting with an MVP, using pre-built SDKs, choosing Wallet-as-a-Service platforms, and opting for cross-platform development with tools like Flutter.

eWallet apps like Apple Pay generate revenue through transaction fees, biller commissions, card interchange, premium features, ad placements, and interest on wallet balances (float).

JPLoft can help you offer secure, scalable, and feature-rich payment apps with deep fintech expertise and end-to-end delivery.

Overview of the Apple Pay App

Apple Pay is Apple’s mobile payment and digital wallet service that lets users make payments in person, in iOS apps, and on the web.

It’s built to eliminate the need for physical cards and cash. All users need is their iPhone or Apple Watch to tap and pay securely.

Beyond just sending money or paying bills, Apple Pay is about convenience, speed, and most importantly, security. It uses biometric authentication (Face ID, Touch ID), NFC technology, and secure tokenization to make sure every transaction is protected.

And if you're aiming to create something similar, you’ll need to embed all of that and more.

Before diving into the cost to develop an app like Apple Pay, let’s get one thing clear: Apple Pay is primarily an iOS-focused app. So, naturally, you're entering the iOS App Development game.

That means working within Apple’s ecosystem, following its design standards, and integrating its APIs (like PassKit for Wallet functionalities).

You're also targeting an audience that's used to premium, polished, intuitive apps. So your eWallet app needs to deliver a top-tier experience.

If you want to create an eWallet app, you need to go in-depth to find out the true cost of your project:

How Much Does it Cost to Develop an App like Apple Pay?

The cost to develop an eWallet app like Apple Pay typically ranges from $40,000 to $200,000, depending on features, security, and scalability.

Remember, the eWallet app development cost isn’t just a number; it depends on what you’re building, how fast you want it, and how far you plan to scale.

A simple wallet with basic transfers and top-ups might cost $40,000. But add features like NFC, biometric security, AI-based fraud detection, and multi-currency support, and the cost to build an app like Apple Pay can easily cross $200,000.

You’re not just paying for features, you’re investing in security, scalability, and trust. Here’s a quick breakdown to give you clarity:

|

Development Stage |

Estimated Cost Range |

Notes |

|

MVP with Core Features |

$40,000 – $60,000 |

P2P payments, wallet balance, basic KYC |

|

Mid-Range Feature Set |

$70,000 – $120,000 |

NFC, QR pay, biometric login, UI polish |

|

Full-Scale Enterprise App |

$130,000 – $200,000+ |

AI insights, card issuance, real-time fraud detection |

With this being aside, let’s get to know those factors in the cost of Apple Pay like app development.

But, to figure out the correct cost, try connecting to a mobile app development company in Denver.

Factors Affecting the Cost to Create an App Like Apple Pay

There’s no universal price tag here.

The cost to create an app like Apple Pay depends on several moving parts, from what features you pack to how deep you go into AI or Web3.

Let’s break down the top 8 factors that will shape your app’s final price tag.

1. Features & Functionality

This is the backbone of your app’s cost.

Building a simple P2P transfer tool is vastly different from building a full-fledged platform like Apple Pay that supports eWallet app features like in-store payments, online checkouts, loyalty programs, and even spending insights.

The deeper you go with features, the more time and resources you’ll need.

|

Feature Type |

Example Functionality |

Impact on Cost |

|

Basic |

P2P Payments, Wallet Top-up |

Low |

|

Intermediate |

Merchant Payments, Bill Splitting |

Moderate |

|

Advanced |

Loyalty Cards, Real-time Spending Insights |

High |

|

Cutting-edge (AI-based) |

Predictive Analytics, Voice Transfers |

Very High |

Every new layer of functionality contributes directly to the cost to build an app like Apple Pay so choose wisely and prioritize based on your goals.

2. Security & Compliance

You’re building a financial app, not a good-to-go platform. So, that changes everything.

When you're building a financial app like Apple Pay, eWallet app security becomes the top priority.

From PCI-DSS compliance to biometric authentication, the security budget for an eWallet isn’t optional; it’s mandatory.

And the more compliant you want to be (especially across countries), the higher the investment.

|

Security Component |

Purpose |

Cost Influence |

|

SSL/TLS Encryption |

Data Protection in Transit |

Low |

|

Biometric Authentication |

Face ID, Touch ID |

Moderate |

|

PCI-DSS Compliance |

Card Payment Standards |

High |

|

Real-Time Fraud Detection |

Transaction Monitoring |

Very High |

To match Apple’s gold standard in security, the cost to develop an app like Apple Pay needs to account for these fundamentals.

3. Use of AI in Your App

AI in payments isn’t just a fancy add-on anymore; it’s a necessity.

Want fraud detection that works in real time? Behavioral insights based on how users spend? Personalized experiences for better engagement? You’ll need AI development services baked into your product roadmap.

|

AI Use Case |

Benefit |

Relative Cost |

|

Real-Time Fraud Detection |

Blocks suspicious activity instantly |

High |

|

Behavioral Analytics |

Personalizes user experience |

Moderate |

|

NLP Chatbots |

Smarter support |

Moderate |

|

Predictive Insights |

Future spending behaviour |

High |

AI-powered features are becoming core to modern payment apps, and they influence the Apple Pay-like app development cost significantly.

4. Design Complexity

People use Apple Pay not just because it works, but because it feels good to use.

Every tap, swipe, and transition is smooth, intuitive, and almost invisible.

That kind of polish doesn’t happen by accident. It starts early with a well-thought-out app wireframe and evolves through a detailed app prototype that maps out the entire user journey.

If you're aiming to build something on that level, your UI/UX game needs to be precise.

The more custom animations, micro-interactions, and frictionless flows you add, the more time (and budget) you’re investing in visual excellence that users remember.

|

Design Type |

What It Includes |

Cost Level |

|

Standard |

Static screens, simple flows |

Low |

|

Interactive |

Basic animations, dynamic forms |

Moderate |

|

Apple-style Minimalism |

Micro-interactions, custom transitions |

High |

|

Gamified/Personalized |

Real-time UI changes, AI-driven design |

Very High |

To stand out in today’s eWallet app development trends, design can't be an afterthought. It’s part of your brand and your cost.

5. Backend Infrastructure

What your users see is the front. But what really powers a secure payment app happens behind the scenes.

This includes cloud infrastructure, API connections to banks and payment providers, database scalability, and real-time transaction handling.

A robust backend ensures your app can process thousands of transactions without lag, downtime, or security risks.

It’s the foundation that keeps everything running smoothly, even when user demand spikes.

|

Backend Component |

Functionality |

Cost Factor |

|

Basic Backend |

User Authentication, Wallet Balance |

Low |

|

Real-Time Infrastructure |

Instant Updates, Live Transaction Logs |

Moderate |

|

Microservices Architecture |

Scalability, Performance |

High |

|

Bank & KYC Integrations |

Legal Compliance & Connectivity |

Very High |

The cost to create an eWallet app like Apple Pay rises fast when backend complexity increases, especially if you're building for scale.

6. Geographical Scope

Planning to go global?

That changes your roadmap. Supporting just one country’s laws, banks, and currencies is simple.

But if you’re targeting multiple markets, you’ll need to support multi-language, multi-currency, and multi-jurisdictional compliance.

Each region brings its own set of legal requirements, UX expectations, and financial regulations.

To succeed globally, your app architecture must be flexible, modular, and ready to localize at scale.

|

Target Region |

Requirements |

Added Cost |

|

Single Country |

Local KYC, Language |

Low |

|

2–3 Countries |

Multi-currency, Legal Adjustments |

Moderate |

|

Global Launch |

Localized UX, Compliance & Taxation |

High |

|

Continuous Expansion |

Modular Infrastructure |

Very High |

The broader the scope, the higher the cost to create an app like Apple Pay, especially when regulations vary across borders.

7. Third-Party Integrations & API Licensing

Apple Pay doesn’t work in isolation, and neither will your app.

To deliver real-time, secure, and compliant transactions, your app will need to integrate with several third-party services.

These include KYC (Know Your Customer) and AML (Anti-Money Laundering) providers, payment gateways, card-issuing platforms, and even Banking-as-a-Service solutions.

That’s why this is a key factor in the cost to develop an app like Apple Pay.

|

Basis |

Description |

Budget Impact |

|

KYC/AML Services |

Verifies user identity and prevents financial fraud |

Moderate (ongoing API fees) |

|

Payment Gateway Integration |

Enables card transactions and digital payments |

High (setup + per txn fees) |

|

Card Issuing APIs |

Lets users generate virtual or physical debit cards |

High (per card + compliance) |

|

Banking-as-a-Service (BaaS) |

Offers banking functions like IBAN, ledgers, account linking |

High (monthly or revenue-based pricing) |

Each integration enhances user experience and expands functionality but also adds cost.

So when you're estimating your Apple clone app development cost, be sure to account for third-party API licensing and maintenance fees. It’s not just a dev cost, it’s an ongoing operational commitment.

With that being said, let’s get to know about the tips to reduce this cost.

Tips to Reduce the Overall Cost to Develop an App like Apple Pay

Not every app needs a six-figure budget to compete.

There are plenty of ways to keep your Apple Pay-like app development cost under control without cutting corners where it matters.

Let’s walk through the smart ones:

► Start with an MVP

If you're wondering how to reduce the cost to develop an app like Apple Pay, this is where you start.

Don't build every advanced feature right out of the gate.

Focus on the core: wallet loading, payments, and transaction history.

Skip loyalty points, budgeting insights, or analytics for now.

This approach trims both development time and budget, while still getting your product to market fast.

► Use Pre-built Solutions

Why build from scratch when solid tools already exist?

SDKs for encryption, KYC, and payment processing can save weeks of effort.

Think Stripe for payments or Onfido for user verification.

This alone can dramatically lower the cost to build an app like Apple Pay, especially if you’re aiming for MVP or faster GTM (go-to-market).

► Opt for Wallet-as-a-Service

Want to skip the backend struggle?

Using a Wallet-as-a-Service platform helps you move quicker by giving you a tested backend for your app.

That means less custom development, fewer compliance issues, and more predictable scaling.

If you want to cut down your Apple Pay-like app development cost, this route is worth exploring.

► Go Cross-platform (if needed)

Planning to support Android too?

Using Flutter or React Native means you won’t have to build two separate apps from the ground up.

This shared-code approach keeps your cost to create an app like Apple Pay in check while still reaching a broader audience.

But if your focus is iPhone-first, hire iOS app developers with expertise and skills to give the best user experience.

► Use Open-Source Components

Good open-source tools can do more than save time; they can save serious money.

Instead of writing your own cryptographic libraries or UI modules, use what's already out there.

Just make sure they’re secure, updated, and production-ready.

This one move can shrink your cost to develop an eWallet app like Apple Pay without compromising functionality.

► Outsource Smartly

Hiring dedicated developers can be a budget saver if you pick the right ones.

Look for partners with proven fintech experience, in-house ML development services and NLP development services.

This helps you build smarter features without inflating your team size or long-term costs.

Done right, this can reduce your overall Apple Pay clone app development cost and give you enterprise-grade execution.

With the tips being out, time to know the most important part, which is how these apps make money.

How eWallet Apps Like Apple Pay Make Money?

Let’s get to the point: Developing an eWallet app like Apple Pay isn’t a cheap venture. The cost is significant, but so is its revenue potential.

Apps like Apple Pay are not just digital wallets; they’re revenue machines hiding in plain sight.

Here’s how eWallet apps make money to turn your investment into profit:

1] Transaction-Based Revenue

Every time someone makes a purchase using your app, especially through partnered merchants or QR payments, the platform can earn a transaction fee.

Even small percentages on high-volume transactions can bring in serious cash, helping offset the cost to build an app like Apple Pay over time.

2] Interchange Fees via Card Issuance

If your app links with banks or offers virtual cards, there’s another stream: interchange fees.

That’s a slice of every card-based payment routed through your platform, and it scales automatically as usage grows.

A solid eWallet API integration helps make this happen smoothly and securely.

3] Commission from Billers and Partners

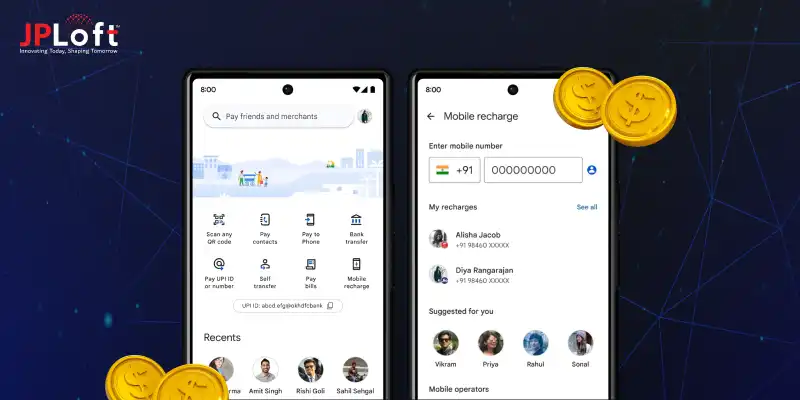

Mobile recharges. Utility bills. Travel bookings.

Every service offered inside the app is a chance to earn a commission. Tie up with providers and get a slice of every successful transaction.

This adds a passive but consistent revenue stream that helps recover your Apple Pay /like app development cost faster than you think.

4] Premium Features and Subscriptions

Want to charge users directly? Give them something extra.

Offer instant cashback processing, custom virtual cards, advanced spend analytics, or business wallet upgrades under a freemium or subscription model.

But for this to work, your eWallet app tech stack should support modular feature releases and in-app purchases right out of the gate.

5] Earnings from Wallet Balance (Float)

If users keep money in their wallet for more than a few days, that money earns interest.

Apps operating under a financial license, or in partnership with a regulated entity, can legally invest the float and earn interest.

This indirect model helps you passively chip away at the cost to develop an eWallet app like Apple Pay.

6] Brand Promotions and In-App Ads

High user engagement means high visibility, and that means ad revenue.

Showcasing sponsored offers, featured merchants, or product banners in smart places inside the app creates a new stream of income.

It’s not huge at first, but at scale, it adds up, especially in markets with strong retail tie-ins.

But, remember, to be the best eWallet app, you need to take the help of an expert company, which is where our next section is all about.

How JPLoft Can Help You Develop an App like Apple Pay?

Want to build an app like Apple Pay? JPLoft makes that possible.

As an expert eWallet app development company, we craft high-performance, secure payment apps with features like NFC, biometric login, QR payments, and real-time transaction tracking.

Our team understands what it takes to create a wallet users actually trust and use every day. From backend architecture to flawless UI, we handle it all.

If you're planning to launch a next-gen digital wallet, JPLoft gives you the tools, tech, and talent to compete with the best in the game.

Conclusion

Developing an Apple Pay-like app requires careful consideration of features, security, and scalability.

From core functionalities like P2P payments to advanced features such as AI-powered fraud detection, every decision impacts both development time and cost.

The cost to build an app like Apple Pay can range from $40,000 to $200,000, depending on your goals and the complexity of the app.

By optimizing features, leveraging pre-built solutions, and considering cross-platform development, you can manage costs effectively while delivering a top-tier user experience.

Partnering with an experienced app development company, like JPLoft, ensures you have the expertise needed to build a secure and scalable eWallet app that meets global standards.

FAQs

The cost can range from $40,000 to over $200,000, depending on features, security layers, design quality, third-party integrations, and scalability needs.

Advanced features like real-time fraud detection, biometric login, predictive analytics, and global compliance can significantly push up the cost.

Yes. Starting with a Minimum Viable Product (MVP) that includes essential features like wallet top-up, payments, and transaction history can save both time and money.

Not necessarily. You can opt for cross-platform development using Flutter or React Native to reduce costs and speed up launch timelines.

Use Wallet-as-a-Service, rely on pre-built APIs for KYC and payments, outsource smartly, and plan feature releases in phases instead of going all-in from day one.

Share this blog