Key Takeaways:

Google Pay dominates Android ecosystems with its reach and simplicity, Apple Pay offers unbeatable privacy and seamless integration, while Samsung Pay leads in flexibility with its MST technology.

All three rely on tokenization, encryption, and biometric authentication, but Apple Pay’s Secure Element and Google Pay’s Find My Device features set high benchmarks in payment safety.

The best wallet depends on your device preference – Android users thrive with Google Pay, iPhone loyalists with Apple Pay, and Samsung users enjoy unmatched compatibility.

With over 2.8 billion users and rising contactless transactions, digital wallets are reshaping how people shop, pay, and manage finances worldwide.

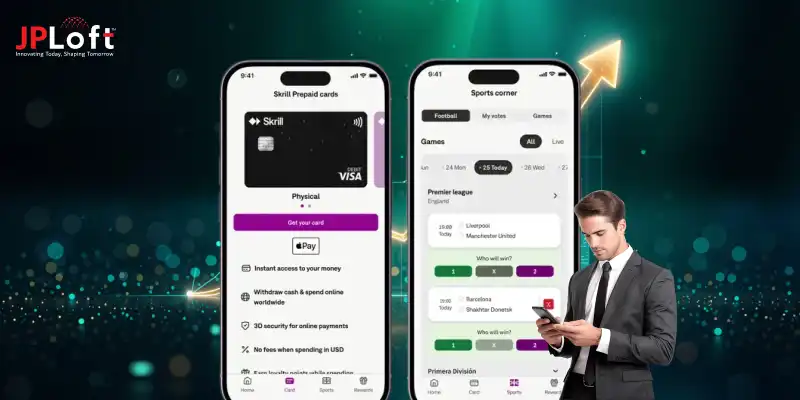

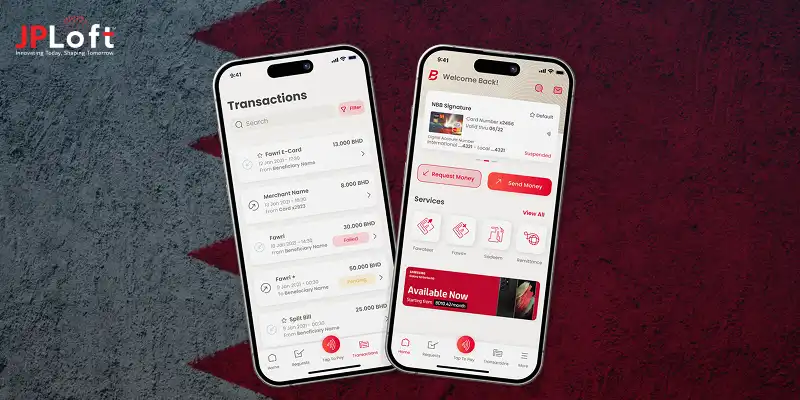

As a trusted app development company, JPLoft helps brands build secure, scalable, and user-friendly payment solutions that rival leading global wallets.

You probably can’t remember the last time you carried a wallet everywhere, right? With smartphones running your life from messaging to shopping, it’s no surprise that mobile payments have become the new normal.

Today, Google Pay, Apple Pay, and Samsung Pay are leading this digital revolution. According to Statista, over 2.8 billion people now use mobile wallets globally, and that number’s only growing! Another report shows contactless payments jumped by 30% in the last year alone.

Each platform promises speed, security, and simplicity, but the real question is, which one’s best suited for you? If you're an Android user or an iPhone enthusiast, this Google Pay vs Apple Pay vs Samsung Pay showdown will guide you in choosing the perfect tap-to-pay solution for your needs.

Google Pay Overview

Back in 2015, Google launched Google Pay (originally Google Wallet) with one simple goal: to make everyday transactions effortless. And it delivered.

Fast forward to today, and it has become one of the most widely used digital payment platforms, with over 150 million active users across 40+ countries.

From paying at your local café to transferring money with a tap, Google Pay blends convenience and security beautifully. It uses NFC and advanced encryption to keep your data safer than carrying a physical card.

What’s even cooler? You can earn rewards, manage bills, buy tickets, and store loyalty cards, all in one clean, intuitive app. It’s not just a payment tool anymore; it’s your personal finance companion built for the digital age.

► How Does Google Pay Work?

-

Start by downloading the Google Pay app and opening it on your Android device.

-

Add your debit, credit, or PayPal accounts by scanning your card or entering the details manually.

-

Set up a screen lock or use biometric security like fingerprint or face recognition for safe payments.

-

When you want to pay in stores, unlock your phone and hold it close to the contactless payment terminal; no need to pull out your wallet!

-

For online shopping or in-app purchases, simply pick Google Pay at checkout to speed things up with saved payment and shipping info.

-

Send or request money instantly from friends and family using just their phone number or email through the app.

-

Keep track of all your payments and transactions right inside the app, making it easy to manage your spending.

-

Thanks to advanced security measures like tokenization, your actual card details stay hidden during every transaction.

It's as simple as that: fast, secure payments at your fingertips, designed for your busy lifestyle.

Features of Google Pay That Make the App Stand Out

When you compare Samsung Pay vs Google Pay, what really grabs attention is how Google Pay blends simple design with powerful e-wallet app features. It’s not just about making payments; it’s about making your wallet smarter.

From easy money transfers to seamless integration with Google services and strong security, Google Pay packs a lot in one app to keep your financial life smooth and hassle-free.

Here are key features that make Google Pay a standout:

|

Feature |

Google Pay Description |

|

Device Compatibility |

Works on almost all Android devices and Wear OS smartwatches |

|

Payment Methods |

Supports debit, credit cards, bank accounts, PayPal, and more |

|

Security |

Biometric authentication, tokenization, and Find My Device support |

|

Peer-to-Peer Payments |

Send and receive money instantly with just a phone number or email |

|

Rewards & Offers |

Cashback deals and special offers from partnered merchants |

|

Multi-Use Functionality |

Store loyalty cards, boarding passes, event tickets, and IDs |

|

Bill Payments & Reminders |

Set up recurring bill payments and get timely payment reminders |

|

Integration with Google Ecosystem |

Syncs with Google Calendar, Assistant, and Chrome for smooth use |

1. How Google Pay Secures Its System?

When comparing Google Wallet vs Samsung Wallet, e-wallet app security is the top priority, and Google Pay does not disappoint. It employs multiple layers of protection to keep your money and data safe every step of the way.

First, Google Pay uses virtual account numbers (tokenization) instead of sharing your actual card details during transactions, making it nearly impossible for hackers to access your real card information. All payment data is encrypted with industry-leading standards, ensuring your details stay private.

To prevent unauthorized access, Google Pay requires you to set up a screen lock or biometric authentication, like fingerprint or face recognition. Plus, if your phone is ever lost or stolen, you can remotely lock or wipe your data using Google Find My Device, adding an extra layer of security.

This comprehensive protection makes Google Pay one of the top ewallet apps in Dubai and beyond, giving you peace of mind with every tap.

2. Advantages of Google Pay

In the ongoing Google Pay vs Apple Pay vs Samsung Pay debate, one thing’s clear—Google Pay is all about simplicity, reach, and versatility. It’s also worth noting how Google Wallet vs Samsung Wallet stack up when it comes to everyday use; Google’s ecosystem gives it a clear edge in convenience and integration.

If you ever plan to create an ewallet app, Google Pay’s success story offers plenty of inspiration; it’s the perfect blend of seamless UX and airtight security.

Here’s what makes it truly stand out:

-

Works across most Android devices and supports iOS for selected features.

-

Offers quick, contactless payments via NFC and integration with bank accounts.

-

Syncs perfectly with Google services like Assistant and Maps for smoother payments.

-

Allows peer-to-peer money transfers directly with phone numbers or emails.

-

Rewards users with offers, cashback, and discounts from partner brands.

-

Keeps your personal data secure with advanced encryption and tokenization.

-

Supports digital essentials like boarding passes, event tickets, and loyalty cards.

-

Provides smart spending insights and transaction tracking in one dashboard.

So, be it grabbing coffee, paying bills, or shopping online, Google Pay keeps it simple, fast, and secure.

3. Limitations of Google Pay

While Google Pay continues to dominate the Google Pay vs Apple Pay vs Samsung Pay scene, it still has a few drawbacks that may affect your overall experience.

Even with its sleek design and effortless payments, some functional limitations remind us that no digital wallet is perfect.

Here’s where Google Pay can fall short:

-

Not all global or local stores support Google Pay, which can make payments tricky in certain regions.

-

Requires a stable internet or mobile data connection for most transactions- offline payments are limited.

-

Works best on Android and has limited functionality on iOS devices.

-

Some banks enforce daily UPI or transaction limits that can restrict high-value payments.

-

Users sometimes report delays, verification errors, or failed transactions during high traffic.

-

Since it’s connected to your Google account, some users may worry about data tracking or personalization.

-

Without an NFC chip, contactless payments aren’t possible on older smartphones.

Despite these small hurdles, Google Pay remains one of the smoothest, most user-friendly payment solutions available today, proving that convenience often wins in the digital wallet race.

Apple Pay Overview

Launched in 2014, Apple Pay transformed the way iPhone users pay: simple, secure, and totally contactless.

With just a tap of your device, you can buy groceries, grab your morning coffee, or pay for your ride without ever reaching for your physical wallet. It’s all about making payments feel effortless, and Apple nailed that experience from day one.

When it comes to the Apple Pay vs Google Pay debate, Apple Pay shines for one big reason: its flawless integration with Apple’s hardware and ecosystem.

Every payment is verified through Face ID or Touch ID, and your real card details are never shared with merchants. Instead, each transaction uses a unique Device Account Number for extra protection.

For developers diving into iOS app development, integrating Apple Pay means giving users a seamless payment experience across iPhones, Apple Watches, iPads, and even Macs.

Today, Apple Pay is accepted in over 90 countries and supported by 85% of U.S. retailers, making it one of the most widely used digital wallets globally.

It’s not just fast- it’s one of the most secure ways to pay, boasting a 0.0008% fraud rate per transaction in 2025. That’s Apple magic backed by real-world numbers.

► How Does Apple Pay Work?

Apple Pay makes paying using your iPhone or Apple Watch fast, simple, and secure. It uses advanced technology to ensure your payment details are kept private, while letting you tap to pay at contactless terminals or checkout safely within apps and websites.

-

Add your credit or debit card details securely to the Apple Wallet on your iPhone, iPad, Apple Watch, or Mac.

-

Apple Pay replaces your real card number with a unique Device Account Number (tokenization) stored securely in the device’s Secure Element chip.

-

When you make a purchase in-store, hold your authenticated device near an NFC-enabled terminal. Your device creates a one-time dynamic security code (cryptogram) to authorize the payment without exposing your actual card data.

-

Authenticate transactions with Face ID, Touch ID, or your device passcode, ensuring only you approve payments.

-

For online and in-app purchases, choose Apple Pay at checkout and confirm with Face ID or Touch ID for a seamless experience.

-

If your device is lost or stolen, you can remotely suspend Apple Pay through Find My iPhone to prevent unauthorized use.

Apple Pay’s blend of convenience and security makes it a favored choice for countless iOS users worldwide. If you’re looking to build an app like Apple Pay, understanding its robust security architecture and seamless payment experience can be a great starting point.

The Standout Features of Apple Pay

When it comes to Apple Pay vs Google Pay, it’s like watching two tech titans battle it out for your digital wallet.

Apple Pay wins hearts with its flawless security and sleek ecosystem integration, while Google Pay appeals to users who love flexibility and reach.

Both make paying as easy as a tap, but Apple Pay adds that signature iOS touch that feels simple, stylish, and perfectly secure.

Here’s a quick look at some of Apple Pay’s key features:

|

Feature |

Description |

|

Ecosystem Integration |

Works seamlessly on iPhone, Apple Watch, iPad, and Mac |

|

Security |

Uses Device Account Number, tokenization, Face ID/Touch ID |

|

Acceptance |

Accepted by 85%+ of U.S. retailers and many transit systems |

|

Privacy |

Apple doesn’t store or track purchase data |

|

Multi-Use Wallet |

Stores credit cards, transit passes, tickets, and loyalty cards |

|

In-store Payments |

Contactless payments using NFC technology |

|

In-App & Online Payments |

Supports fast checkout with biometric authorization |

|

Device Compatibility |

Limited to Apple devices only |

1. How Apple Pay Secure Its System?

Apple Pay stands out in the Samsung Pay vs Google Pay vs Apple Pay security race by employing a multi-layered defense combining hardware, software, and network protections.

Unlike other top ewallet apps, Apple Pay stores your payment information securely in a dedicated chip called the Secure Element, isolated from the rest of the device.

Instead of transmitting your real card number, each transaction uses a unique Device Account Number through advanced tokenization, preventing exposure of sensitive data.

Authentication requires Face ID, Touch ID, or a passcode, ensuring only you can authorize payments. Each transaction is further secured with a dynamic cryptogram, a one-time code specific to every purchase that stops replay attacks and fraud.

Added protections include AI-powered fraud detection by issuers and real-time monitoring. Apple Pay also lets you remotely lock or suspend payments if your device is lost or stolen.

This robust security framework keeps Apple Pay among the safest mobile wallets, delivering peace of mind alongside convenience.

Understanding these measures is vital when comparing Google Pay vs Apple Pay or Samsung Pay vs Apple Pay, especially if you want to build a trustworthy digital wallet app.

2. Advantages of Apple Pay

When comparing Apple Pay vs Google Pay, Apple Pay shines with seamless user experience and airta ight security, making it a top choice for Apple users globally.

Its deep integration into the Apple ecosystem ensures smooth usage across devices, empowering users to make safe payments in stores, apps, and online.

Here are some key advantages of Apple Pay:

-

Easy setup by adding credit or debit cards to Apple Wallet, ready for immediate use.

-

Strong security through tokenization and biometric authentication, like Face ID or Touch ID.

-

Widely accepted at over 85% of U.S. retailers and many international locations.

-

Supports peer-to-peer payments with Apple Cash via the Messages app.

-

No need to carry the Cards—pay contactless with iPhone, Apple Watch, iPad, or Mac.

-

Enables quick checkout in apps and the Safari browser, reducing cart abandonment.

-

Ensures privacy by not storing or sharing transaction details with merchants.

-

Compatible with transit cards, rewards, and event tickets for a comprehensive wallet experience.

Apple Pay’s blend of security, convenience, and wide acceptance continues to set a high bar in the mobile payment space.

3. Limitations of Apple Pay

While Apple Pay remains one of the most secure and user-friendly wallets in the Apple Pay vs Samsung Pay vs Google Pay comparison, it still comes with certain drawbacks that users need to consider.

Even though Apple impresses with aesthetics and integration, its payment system has boundaries tied to geography, compatibility, and flexibility.

Here are some of Apple Pay’s key limitations:

-

Works exclusively on Apple devices like iPhone, Apple Watch, and Mac, making it inaccessible for Android users.

-

Limited availability in several countries—Apple Pay isn’t supported everywhere yet, particularly in markets like India.

-

No support for non-NFC terminals, restricting in-store payment options compared to Samsung Pay’s MST technology.

-

Transaction limits vary by region and merchant, which can be frustrating for users making high-value purchases.

-

Dependent on a stable internet or network for setup, verification, and online purchases.

-

Only compatible with participating banks, which limits its accessibility for certain users.

-

Some users find the setup slightly complex compared to Google Pay or Samsung Pay.

-

Works best within Apple's ecosystem but offers little flexibility beyond it.

Despite these restrictions, Apple Pay continues to lead the race in Apple Pay vs Samsung Pay comparisons for its unmatched security and simplicity, but it still has room for bro,ader reach and inclusion.

Overview of Samsung Pay

Launched in 2015, Samsung Pay revolutionized mobile payments by combining Near Field Communication (NFC) and its exclusive Magnetic Secure Transmission (MST) technology, allowing users to make payments at virtually any terminal that accepts a traditional card swipe. It started its journey in South Korea and quickly expanded to major markets like the U.S., U.K., China, and India, reaching over 1.3 billion transactions globally within just a few years.

Samsung Pay stands out among the top eWallet apps, offering users the ability to store credit cards, debit cards, membership IDs, and even transit passes in one secure digital space. It’s also integrated with loyalty programs and rewards to enhance user engagement.

For entrepreneurs aiming to start an online eWallet business, Samsung Pay serves as an excellent example of convenience meeting innovation. Its wide acceptance and compatibility with both NFC and MST technologies make it accessible for more users and merchants than many competitors. Over time, it has evolved into a complete digital wallet solution, proving that innovation in payments isn’t just about technology; it’s about making everyday transactions effortless and secure.

► How Does Samsung Pay Work?

In the world of mobile wallets, Apple Pay vs Google Pay, vs Samsung Pay are the top contenders revolutionizing how we make payments.

Each offers contactless transactions through NFC technology, but Samsung Pay takes it a step further by using Magnetic Secure Transmission (MST).

This unique feature allows users to pay at almost any terminal, even those that don’t have terminalFC. That’s what gives Samsung Pay an edge in the Google Pay vs Apple Pay vs Samsung Pay debate when it comes to flexibility.

Here’s how Samsung Pay works in everyday use:

-

Install the Samsung Pay app and sign in to your Samsung account.

-

Add your credit, debit, or gift cards by scanning and verifying them with your bank.

-

When ready to pay, swipe up from the bottom of your phone’s screen, select your desired card, and authenticate with your fingerprint, iris scan, or PIN.

-

Hold the device near the terminal—NFC works for tap-to-pay transactions, and MST works with older machines that still use magnetic swipes.

-

You’ll get instant confirmation once the payment is processed successfully.

By combining innovative technology, security, and near-universal compatibility, Samsung Pay has solidified its place as one of the most innovative mobile wallets globally—bridging the gap between modern and traditional payment systems.

Outstanding Features of Samsung Pay

Samsung Pay continues to push the boundaries of digital transactions by blending innovation, security, and convenience.

The integration of AI in finance offers smart fraud detection, real-time transaction analysis, and personalized spending insights, helping users stay secure and financially aware.

Its flexibility, wide acceptance, and integration with modern devices make it one of the most advanced eWallets available today.

|

Feature |

Description |

|

Magnetic Secure Transmission (MST) |

Enables payments at both NFC and traditional card-swipe terminals. |

|

NFC Contactless Payments |

Supports quick tap-to-pay transactions worldwide. |

|

AI-Powered Fraud Detection |

Uses AI in finance to monitor real-time transaction patterns and prevent fraud. |

|

Tokenization & Samsung Knox |

Protects sensitive transaction data through encryption and constant device monitoring. |

|

Rewards & Cashback Integration |

Offers loyalty points and cashback deals through Samsung Rewards. |

|

Digital Key & Smart Device Access |

Let's users store car keys, house kLet's ankeys via Samsung Wallet. |

|

Tap to Transfer |

Allows instant peer-to-peer payments by tapping Galaxy devices together. |

|

Cryptocurrency & 5G Support |

Enables cryptocurrency payments and faster transactions with 5G connectivity. |

|

Smart Budgeting Tools |

Helps users manage spending habits with AI-based alerts and expense tracking. |

|

Smartwatch Compatibility |

Works seamlessly with Samsung smartwatches for quick, hands-free payments. |

1. How the Samsung Pay Secure its App?

Samsung Pay uses a multi-layered security framework to protect users’ payment information, blending advanced technologies and rigorous monitoring.

Central to its security is tokenization, which replaces your real card data with a unique device-specific token during transactions, ensuring that merchants never see your actual card information. This reduces the risk of data theft compared to traditional plastic cards.

Samsung’s Knox security platform plays a vital role by continuously monitoring your device for malware and unauthorized access.

All sensitive operations, like fingerprint data and payment details, are stored in a dedicated secure environment isolated from other apps and malware.

Before each payment, Samsung Pay requires biometric authentication via fingerprint, iris scan, or PIN, guaranteeing only authorized users can approve transactions.

In addition, real-time fraud detection and behavioral analytics powered by AI in payments help monitor unusual activities, further protecting users from fraudulent transactions. If your phone is lost or stolen, Samsung’s Find My Mobile lets you remotely lock or wipe Samsung Pay to prevent misuse.

Samsung Pay’s security stack makes it a leader in the Samsung Pay vs Google Pay vs Apple Pay space, offering users a fast, convenient, yet highly secure payment method.

It stands out in Google Pay vs Apple Pay vs Samsung Pay comparisons for combining cutting-edge fintech defenses with unmatched compatibility across payment terminals.

2. Advantages of Samsung Pay

In the rapidly transforming digital payment landscape, consumers seek faster, more secure, and more convenient ways to pay. The competition between Google Pay vs Apple Pay, vs Samsung Pay highlights how innovation continues to shape the future of everyday transactions.

Here are some of the top advantages of Samsung Pay:

-

Works on both NFC-enabled and traditional magnetic stripe (MST) terminals.

-

Provides high-level security using tokenization, biometric authentication, and Samsung Knox encryption.

-

Offers a seamless reward system through Samsung Rewards for continued use.

-

Compatible with a range of Samsung devices, including smartphones, tablets, and wearables.

-

Enables contactless payments even at stores that don’t support modern payment systems.

-

Integrates with Samsung’s ecosystem, including Bixby and SmartThings, for a unified experience.

-

Allows users to manage and store multiple cards, membership IDs, and loyalty points easily.

-

Provides offline access for select payments, ensuring convenience without internet dependency.

-

Supports AI-driven fraud detection to enhance user safety and transaction accuracy.

This blend solidifies Samsung’s position in the Apple Pay vs Google Pay vs Samsung Pay competition, appealing to users who desire both convenience and broad compatibility.

3. Disadvantages of Samsung Pay

In the ongoing Google wallet vs Samsung wallet vs Apple Pay is a popular choice but faces a few drawbacks. Its transaction and usage limits, dependency on NFC technology, and regional availability can restrict user experience, especially for heavy transaction users or those in unsupported areas.

-

Google Pay transactions are limited by daily, monthly, and per-transaction caps set by banks and regulators, which can frustrate power users.

-

It requires NFC-enabled smartphones and payment terminals, reducing accessibility in locations lacking modern hardware.

-

Some regions and banks do not support Google Pay, limiting availability and card compatibility for many users.

-

The app largely depends on internet connectivity, making offline payments difficult or impossible.

-

Privacy concerns exist due to Google’s data tracking and personalized advertising models, which some users find intrusive.

-

Occasional system outages and delays in transaction approvals occur during peak usage or maintenance periods.

-

Merchants’ acceptance varies, and some do not support Google Pay universally, limiting where users can pay.

-

Some users find the setup and verification process complex compared to other wallet apps.

These limitations shape the user experience and inform decisions when weighing Google wallet vs Samsung wallet for payment solutions.

Comparison between Google Pay vs Apple Pay, vs Samsung Pay

When it comes to mobile payments, the big players are all trying to outdo each other. But which one is actually the best for you? Is it Samsung Pay vs Google Pay vs Apple Pay? Each offers its own unique features, making the decision a bit tricky.

For instance, Google Pay thrives with its easy-to-use platform and integration with Android devices.

On the other hand, Apple Pay is all about seamless integration with the Apple ecosystem, making it a favorite among iPhone users. And Samsung Pay? Well, it brings the ability to pay even without NFC, thanks to its MST technology.

So, how do you decide? Let’s break it down and compare these payment giants, side by side.

|

Feature |

Google Pay |

Apple Pay |

Samsung Pay |

|

Compatibility |

Android devices (Android 5.0 and newer); Wear OS |

iPhone (iPhone 6 and newer), iPad, Apple Watch, Mac |

Samsung Galaxy devices (Galaxy S6 and newer); Samsung Gear |

|

Payment Methods |

NFC, Google Pay API, Cards (Debit/Credit), PayPal, Bank Account |

NFC, Debit/Credit Cards, Apple Cash (peer-to-peer payments) |

NFC, MST (Magnetic Secure Transmission), Debit/Credit Cards |

|

Security Features |

Tokenization, Fingerprint or PIN, Google’s security infrastructure |

Face ID, Touch ID, Secure Enclave, Tokenization |

Fingerprint, PIN, MST technology, Tokenization |

|

Rewards/Promotions |

Google Play Points (Earn rewards for purchases) |

Apple Card cash back (Up to 3% on purchases) |

Samsung Rewards (Earn points, discounts, and promotions) |

|

International Availability |

Available in 40+ countries (including the U.S., India, Australia) |

Available in 30+ countries (including the U.S., UK, Canada) |

Available in over 20 countries (including the U.S., South Korea) |

|

Peer-to-Peerthe Payments |

Send/Receive money via Google Pay |

Send/Receive money via Apple Cash |

Samsung Pay Cash (Available in select markets) |

|

Integration with Devices |

Google Services, Google Assistant, Android Pay API, Wear OS |

Deeply integrated with Apple Ecosystem (iCloud, Apple Watch, etc.) |

Works with Samsung Galaxy devices, Samsung Gear, SmartThings |

|

Payment Methods Supported |

Cards (Debit/Credit), Bank Accounts, PayPal, Gift Cards |

Debit/Credit Cards, Apple Cash, Apple Gift Cards |

Cards (Debit/Credit), Samsung Pay Cash, MST for older terminals |

|

Offline Payments |

Supported for supported cards and devices (no internet required) |

Supported on iPhone and Apple Watch, even offline (no signal) |

Supported for contactless payments using MST (no internet required) |

|

Payment Limits |

Varies by bank, but generally high limits |

Varies by bank, but generally high limits |

Varies by bank, but supports higher transaction limits with MST |

|

Customization Options |

Google Pay integration with many third-party apps and services |

Apple Wallet integration with Apple services and apps |

Samsung Pay customization with Samsung Rewards and promotions |

|

Customer Support |

Online chat, phone support, FAQs |

24/7 support via Apple Support, online resources |

Samsung customer support, FAQs, Samsung Members app |

|

Unique Features |

Google Pay API for merchants, contactless in-app payments |

Apple Watch integration, Apple Cash peer-to-peer payments |

MST technology for payments at traditional card terminals |

So, with this being clear, let’s get to know who wins the debate of Apple Pay vs Google Pay vs Google Pay.

Mobile Payments Face-Off: Which One Comes Out on Top?

In the thrilling contest of Apple Pay vs Google Pay vs Samsung Pay, there’s no one-size-fits-all winner; it all comes down to your device, ecosystem, and specific needs.

Apple Pay dominates among iPhone users with its unparalleled privacy, wide acceptance, and seamless integration into Apple devices, boasting over 85% U.S. retail acceptance.

Google Pay impresses with its versatility across Android devices, growing global presence, and deep integration within Google services, making it a top choice for Android fans.

Samsung Pay’s unique MST technology lets it work on almost any terminal, appealing especially to Samsung device owners with older point-of-sale infrastructure.

Ultimately, which mobile wallet reigns supreme hinges on personal preference, device compatibility, and location, showcasing the diverse power of modern digital payments.

Why Partnering with JPLoft Helps You Make Smarter Tech Decisions?

Every great product starts with one tough question: what’s the right way to build it? The truth is, there’s no single answer.

That’s where JPLoft, a trusted eWallet app development company, steps in. We don’t just create digital products; we guide you in making choices that define long-term success.

Our experts take the time to understand your goals, audience, and business challenges to design the most effective strategy.

From selecting the ideal technology and features to ensuring scalability and performance, every recommendation we make is based on experience and insight.

Whether you’re starting from scratch or improving an existing platform, JPLoft helps you make confident, informed, and impactful decisions that drive measurable growth.

Conclusion

In the battle of Google Pay vs Apple Pay vs Samsung Pay, each platform brings its own strengths to the table.

Google Pay wins for flexibility and cross-device support, Apple Pay excels in security and ecosystem integration, while Samsung Pay stands out for its wide terminal compatibility.

The real winner depends on your device, region, and preferred features. What’s clear is that mobile wallets are no longer a convenience; they’re the future of payments.

As the world moves toward a cashless economy, the competition among these giants will only fuel more innovation, making transactions faster, safer, and smarter.

FAQs

All three use tokenization and biometric authentication, but Apple Pay’s Secure Element chip and privacy-first approach give it a slight edge in overall security.

Yes, but with limited features. iOS users can send or receive money using Google Pay, but contactless NFC payments are not supported.

Yes. Samsung Pay’s unique MST (Magnetic Secure Transmission) technology lets you pay even on older terminals that don’t support NFC.

Samsung Pay and Google Pay both offer cashback and loyalty programs, while Apple Pay focuses more on seamless payments with its Apple Card rewards.

If you’re building a custom payment solution, JPLoft, an expert app development company, can help design a tailored mobile wallet that fits your goals and users perfectly.

Share this blog