Key Takeaways:

Top stock trading apps have redefined investing by offering commission-free trading, real-time insights, and mobile-first portfolio management.

Leading stock trading platforms like Robinhood, Webull, eToro, and Fidelity Investments continue to set benchmarks with advanced features and seamless user experiences.

The best stock trading apps stand out through intuitive design, strong security, and support for multiple assets such as stocks, ETFs, and cryptocurrencies.

Comparing trading fees, features, and supported assets helps users choose the right stock app based on their investment goals and trading style.

As digital investing grows rapidly, building scalable and secure stock trading platforms presents strong opportunities for businesses entering the fintech market.

Stock trading apps have transformed how individuals participate in financial markets, turning smartphones into powerful investment platforms.

With the rise of commission-free trading, fractional investing, AI-driven insights, and real-time analytics, modern trading apps now deliver an experience once limited to professional brokers.

According to recent global fintech adoption trends, mobile-first investing and algorithm-powered decision tools are driving rapid growth in retail trading activity and user expectations.

Today’s investors seek intuitive interfaces, robust security, and intelligent portfolio support in one place.

The top apps for trading stocks in 2026 are Robinhood, Webull, eToro, Fidelity Investments, Firstrade, and more.

This blog explores the best stock trading apps shaping the digital trading landscape, comparing their features and business models.

Understanding Stock Trading Apps

Stock trading apps are digital platforms that allow users to buy, sell, and manage financial assets such as stocks, ETFs, options, and cryptocurrencies directly from their smartphones or web interfaces.

These apps have simplified market participation by removing traditional barriers like high brokerage fees, complex interfaces, and limited access to market data.

Modern trading platforms now combine real-time analytics, AI-driven recommendations, secure payment integrations, and user-friendly dashboards to support both beginner and experienced investors.

Let’s have a look at some of the key industry stats that can help better understand the transforming and growing global stock trading app market.

-

The global stock trading and investing app market is expected to grow from $63.6 billion in 2025 to $150.82 billion by 2030, expanding at over 18.5% CAGR.

-

Retail investors accounted for 58% of online trading platform users in 2025, showing strong individual investor participation.

-

Trading app downloads surged 47% globally, driven by mobile-first investing and zero-commission platforms.

-

About 77% of users prefer managing finances via mobile or web apps, highlighting the shift to digital trading and banking.

-

Global fintech revenue grew 21% in 2024, reaching around $378 billion, significantly outpacing traditional financial services growth.

These stats indicate the shifting user preferences towards the stock trading apps and why modern-day investors should plan to build a stock trading app.

Top Stock Trading Apps & Their Business Model

Modern stock trading apps have transformed how users trade, invest, and manage portfolios through mobile-first platforms.

From commission-free trading to AI-powered insights and real-time analytics, the best online stock trading apps not only follow the stock trading app trends but also offer advanced capabilities designed for today’s digital investors.

Below are some of the top stock trading apps leading the market, along with an overview of their key features and business models.

Understanding how these platforms operate provides valuable insight into what makes a successful and scalable stock trading ecosystem.

|

App |

Best For |

Assets Traded |

Key Features |

Business Model |

|

Beginners & mobile-first traders |

Stocks, ETFs, Options, Crypto |

Fractional shares, real-time alerts, simple UI |

PFOF, subscriptions, margin interest |

|

|

Active & technical traders |

Stocks, ETFs, Options, Crypto |

Advanced charts, paper trading, and extended hours |

PFOF, margin lending, premium data |

|

|

Social & copy trading |

Stocks, ETFs, Crypto |

Copy trading, social investing |

Spreads, conversion fees, and premium services |

|

|

Long-term investors |

Stocks, ETFs, Mutual Funds, Options, Bonds |

Research tools, retirement planning |

Asset management, advisory fees |

|

|

All-level investors |

Stocks, ETFs, Mutual Funds, Options, Bonds |

Research insights, portfolio tools |

Asset management, interest income |

|

|

Low-cost trading |

Stocks, ETFs, Options, Mutual Funds |

Retirement accounts, research tools |

PFOF, margin lending |

|

|

Professional traders |

Stocks, ETFs, Options, Forex, Bonds, Crypto |

Global markets, automation tools |

Commissions, subscriptions, margin |

|

|

Balanced trading |

Stocks, ETFs, Options, Mutual Funds, Bonds |

Options tools, analytics |

PFOF, advisory, margin lending |

|

|

Beginner investors |

Stocks, ETFs, Crypto |

Automated investing, fractional shares |

Financial ecosystem monetization |

|

|

Banking + investing users |

Stocks, ETFs, Options, Mutual Funds, Bonds |

Banking integration, portfolio tracking |

Margin lending, banking services |

|

|

Guided investing |

Stocks, ETFs, Mutual Funds, Options, Bonds |

Research tools, advisory |

Advisory, managed portfolios |

|

|

Advanced traders |

Stocks, ETFs, Options, Futures, Crypto |

Algorithmic trading, advanced charts |

Commissions, subscriptions |

|

|

Passive investors |

ETFs |

Automated portfolios, round-up investing |

Monthly subscription model |

|

|

Community investors |

Stocks, ETFs, Crypto |

Social investing, fractional shares |

Premium membership, tips |

|

|

Data-driven traders |

Stocks, ETFs, Options, Crypto |

Advanced analytics, paper trading |

PFOF, margin, premium data |

Now, let’s discuss what is the best app for trading stocks and other assets, understanding why they are popular and how you should pick the best app for trading crypto and stocks, as well as for your investing and stock trading needs.

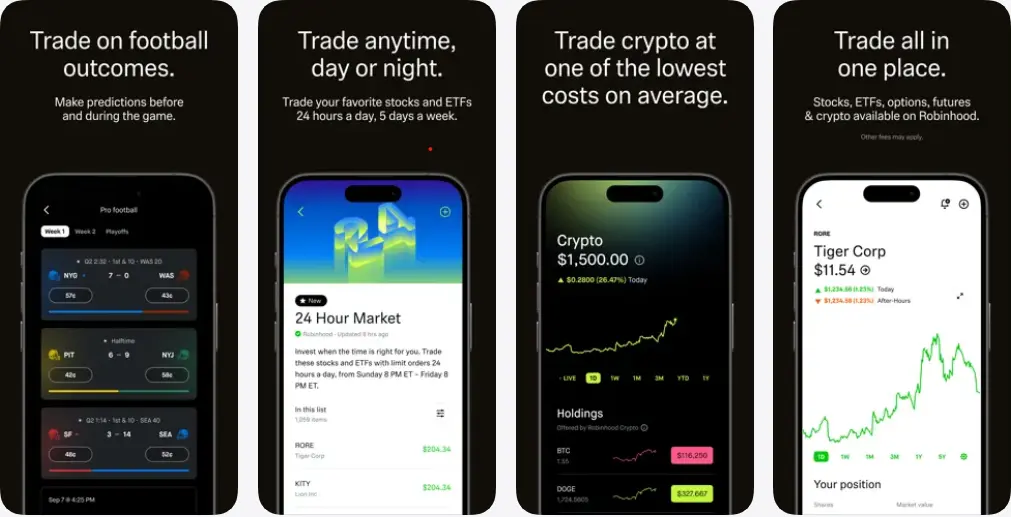

1. Robinhood

Robinhood is widely recognized as one of the best stock trading apps for its mobile-first experience and commission-free trading model. The platform enables users to trade stocks, ETFs, options, and cryptocurrencies with real-time insights and an intuitive interface.

Its simplified onboarding and user-friendly design make it ideal for individuals exploring stock trading platforms or learning how to buy stocks online.

With more than 20 million funded accounts and more than 26 million active users as of the last quarter of 2025, Robinhood consistently ranks among the most downloaded and top rated stock trading apps.

Key Features:

-

Commission-free trading and fractional share investing

-

Crypto and stock trading within one platform

-

Real-time market data, charts, and alerts

-

Advanced analytics and premium tools via subscription

Business Model:

For entrepreneurs planning to build an app like Robinhood, following its business model is important. The app generates revenue through payment for order flow, premium subscriptions, margin lending, and interest on idle funds.

This diversified approach allows the platform to provide a brokerage account free from traditional commission fees while monetizing advanced trading services.

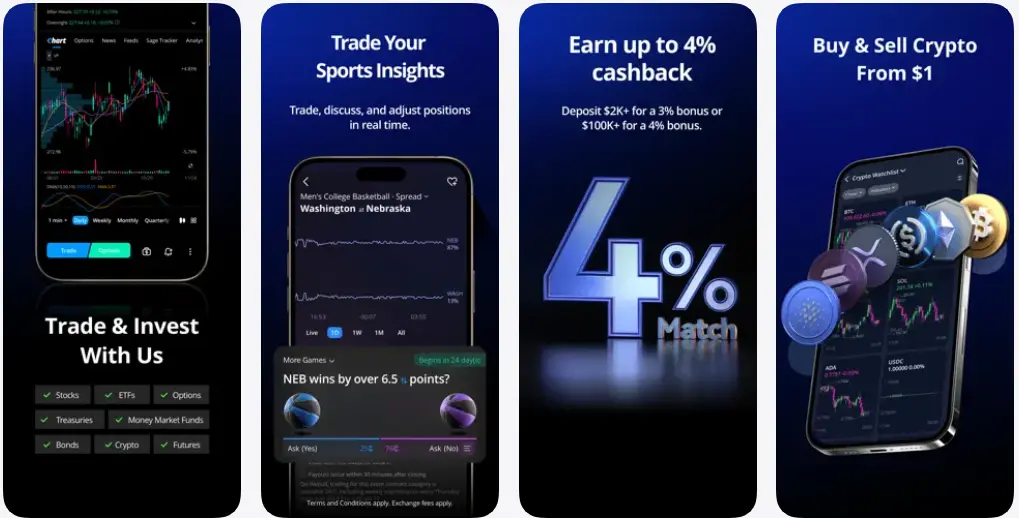

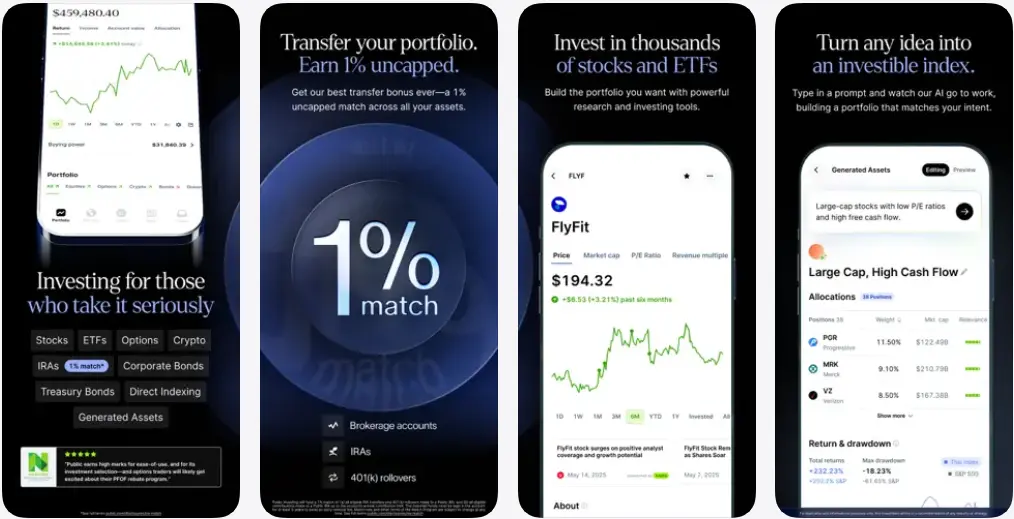

2. Webull

Webull allows investors to trade stocks, ETFs, options, and cryptocurrencies while accessing in-depth charts, technical indicators, and real-time market data.

Such service offerings make it the best stock trading app for users seeking advanced tools within a mobile-first trading environment.

Its feature-rich interface appeals to both beginners and experienced traders looking for powerful stock trading platforms without high entry barriers.

With millions of registered users, 50M+ downloads across devices, and strong global adoption, Webull continues to rank among the top stock trading apps for active digital investors.

Key Features:

-

Commission-free trading for stocks, ETFs, and options

-

Advanced charting tools and technical indicators

-

Extended trading hours and real-time market data

-

Paper trading feature for practice and learning

-

Crypto and stock trading within one app

Business Model:

Webull generates revenue through payment for order flow, margin lending, premium data subscriptions, and interest on cash balances.

This model enables the platform to offer a brokerage account free from commissions while monetizing advanced trading features and market data services.

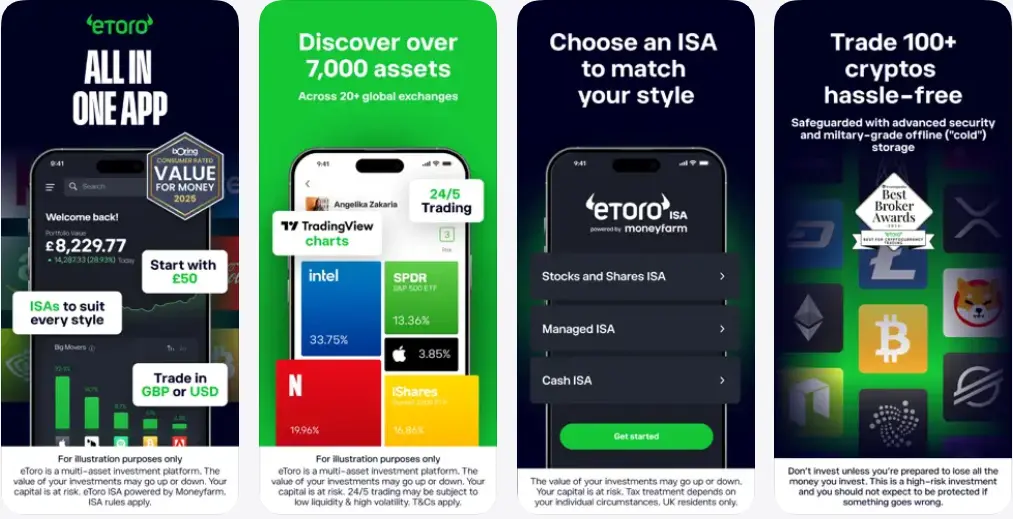

3. eToro

eToro is not only one of the best stock trading apps but is also being recognised as a social investing platform. It allows its users to trade stocks, ETFs, and cryptocurrencies from a single interface.

Known for its community-driven approach, the platform allows users to follow and replicate the strategies of experienced traders, making it appealing to beginners exploring how to buy stocks online.

With a global user base spanning millions of registered investors across multiple markets, eToro consistently ranks among top rated stock trading apps and leading multi-asset trading platforms.

Key Features:

-

Commission-free stock trading and fractional investing

-

Social trading and copy trading functionality

-

Crypto and stock trading on one platform

-

Real-time analytics and market insights

-

User-friendly mobile and web trading experience

Business Model:

eToro generates revenue through spreads on trades, withdrawal and currency conversion fees, and premium investment services.

Its diversified monetization strategy supports commission-free stock trading while ensuring sustainable platform growth and advanced trading capabilities. Such monetization opportunities make developing an app like eToro a viable option for entrepreneurs.

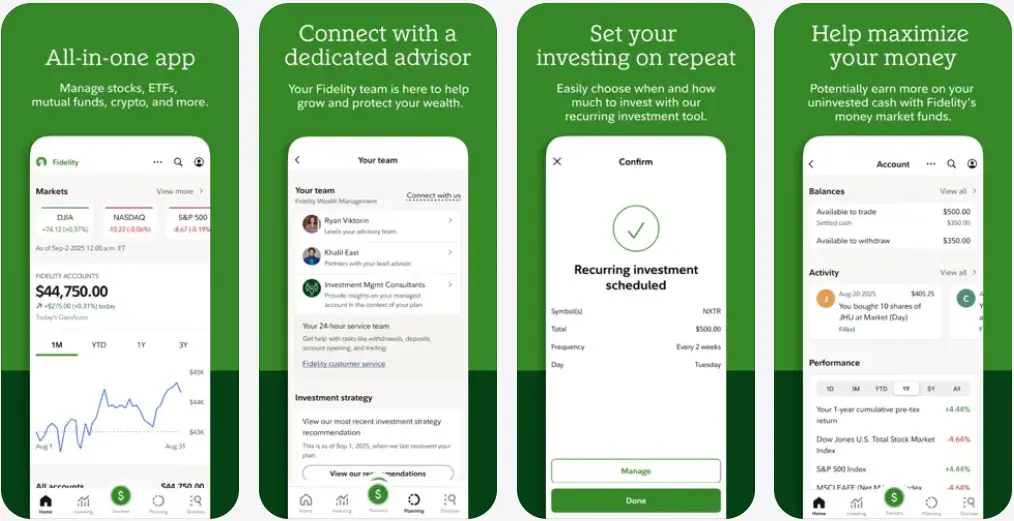

4. Fidelity Investments

Another popular stock app to consider for your investing needs is Fidelity Investments, offering a comprehensive trading experience backed by decades of brokerage expertise.

The platform allows users to trade stocks, ETFs, mutual funds, and options while accessing advanced research tools, market insights, and portfolio management features.

With 5M+ downloads on the Play Store, and known for its reliability and strong customer base, Fidelity serves millions of active investors and manages trillions in assets, making it a trusted name among the top rated stock trading apps and digital investment platforms.

Key Features:

-

Commission-free stock and ETF trading

-

Advanced research tools and real-time analytics

-

Retirement and long-term investment options

-

Fractional share investing

-

Seamless mobile and web trading experience

Business Model:

Fidelity operates on a diversified revenue model that includes asset management fees, advisory services, margin lending, and interest on client cash balances.

This allows the platform to provide a brokerage account free from trading commissions while generating revenue through long-term investment and wealth management services.

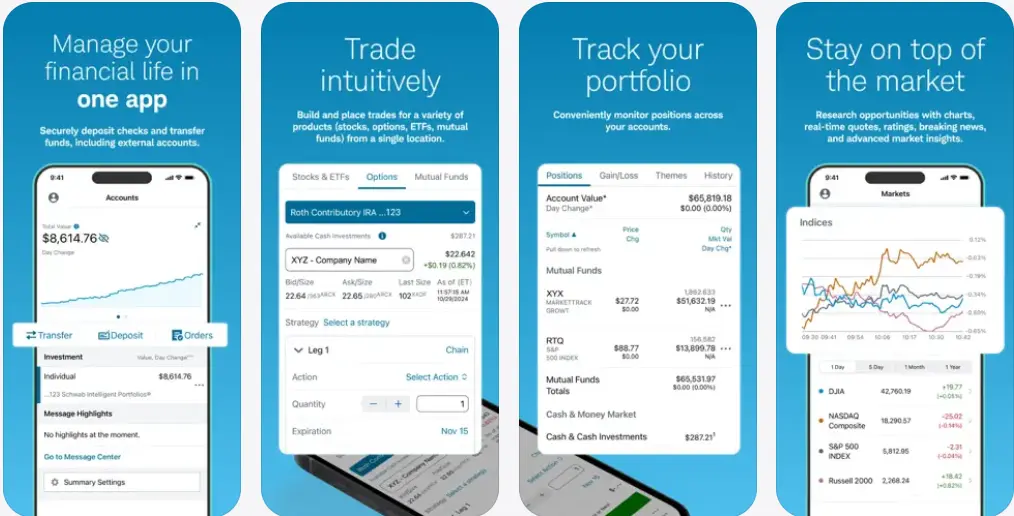

5. Schwab Mobile

Charles Schwab trading app stands among the top 10 stock trading apps, offering a comprehensive digital trading experience supported by decades of brokerage expertise.

The platform allows users to trade stocks, ETFs, options, and mutual funds while accessing in-depth research tools, real-time market insights, and long-term investment planning features.

With millions of active brokerage accounts and a strong global reputation, Charles Schwab continues to rank among the best stock trading apps for both beginner and experienced investors seeking reliable stock trading platforms.

Key Features:

-

Commission-free trading for stocks and ETFs

-

Advanced research tools and market analysis

-

Integrated banking and investment services

-

Retirement and portfolio management options

-

User-friendly mobile and web trading platform

Business Model:

Charles Schwab generates revenue through asset management services, advisory fees, margin lending, and interest on client cash balances.

Its diversified financial ecosystem allows the platform to offer a brokerage account free from trading commissions while monetizing investment management and premium financial services.

6. Firstrade

Another stock trading platform to consider is Firstrade, which allows users to trade stocks, ETFs, options, and mutual funds while accessing real-time market data and research tools.

The platform’s approach to offer commission-free trading, combined with a simple and accessible investing experience, is helping Firstrade gain global recognition among the best stock trading apps.

Its streamlined interface and zero-commission structure make it appealing to both beginner and experienced investors exploring reliable stock trading platforms.

With a steadily growing user base and strong digital presence, Firstrade continues to rank among the top stock trading apps for cost-effective online investing.

Key Features:

-

Commission-free trading for stocks, ETFs, options, and mutual funds

-

Real-time market data and research tools

-

Retirement and long-term investment options

-

User-friendly mobile and web trading interface

-

Multilingual platform support for wider accessibility

Business Model:

Firstrade generates revenue through payment for order flow, margin lending, interest on cash balances, and premium financial services.

This diversified model enables the platform to provide a brokerage account free from traditional commissions while monetizing trading infrastructure and value-added services.

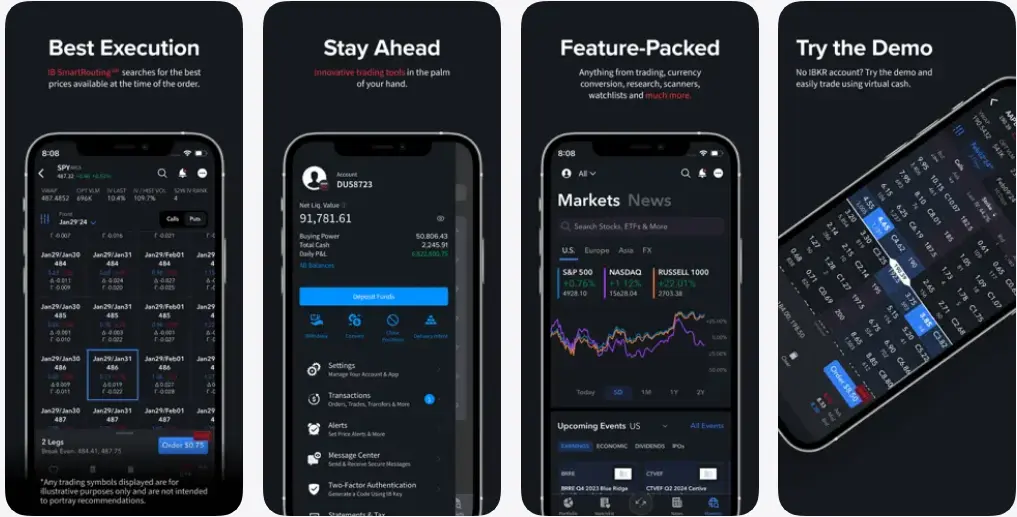

7. IBKR Mobile App - Interactive Brokers

Interactive Brokers is widely known as one of the best trading platforms for active and professional investors seeking advanced trading capabilities.

Their IBKR trading app supports trading across stocks, ETFs, options, futures, forex, and bonds through a highly customizable interface backed by real-time global market data.

Interactive Brokers has established itself among the top stock trading apps for serious traders looking for precision and flexibility in trading stocks online. 1M+ downloads on the Play Store, millions of registered users, and access to multiple international exchanges justify IBKR's positioning.

Key Features:

-

Access to global stock exchanges and multiple asset classes

-

Advanced charting, analytics, and trading tools

-

Low trading fees and competitive margin rates

-

AI-driven insights and automated trading options

-

Powerful mobile and desktop trading platforms

Business Model:

Interactive Brokers operates on a revenue model based on trading commissions, margin lending, subscription-based market data, and interest on idle funds.

This diversified structure allows the platform to offer competitive pricing while delivering institutional-grade trading tools and infrastructure.

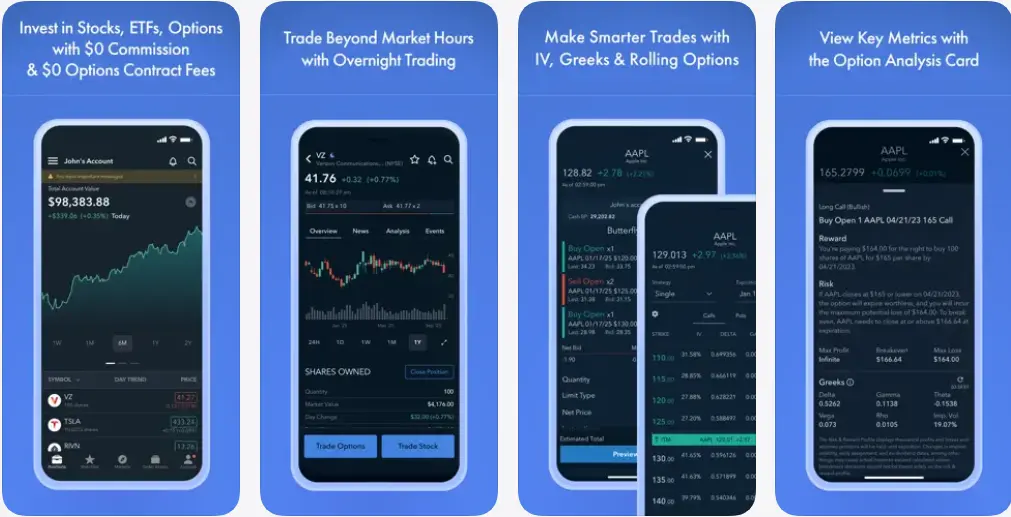

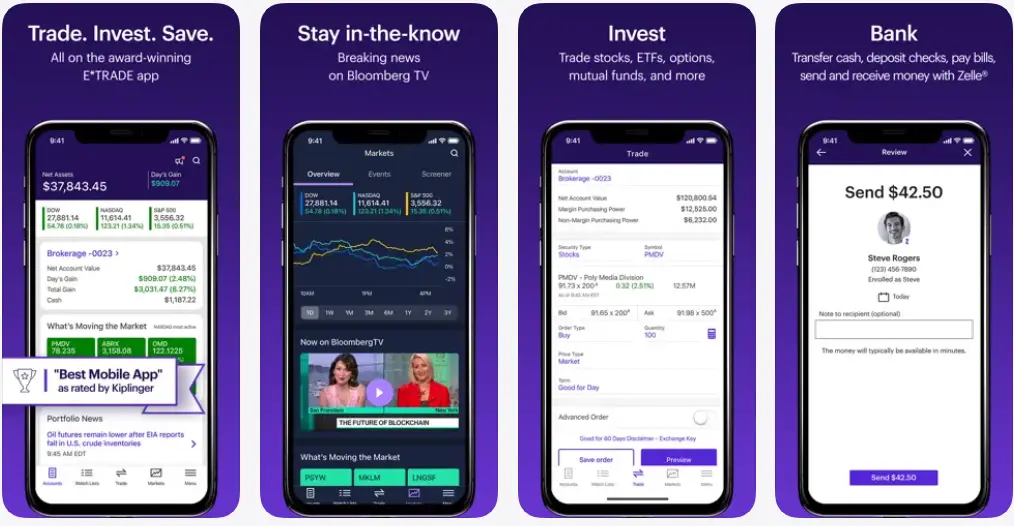

8. E*TRADE

Another popular stock app to consider for your investing needs is E*TRADE. It offers a balanced mix of simplicity and advanced trading tools.

The platform enables users to trade stocks, ETFs, options, and mutual funds while accessing detailed research, educational resources, and real-time market analysis.

Known for its intuitive interface and strong brokerage ecosystem, ETRADE serves millions of active accounts and continues to rank among the best stock trading apps for beginners as well as for experienced investors exploring digital trading platforms.

Key Features:

-

Commission-free trading for stocks and ETFs

-

Advanced options trading and analytics tools

-

Real-time data, research, and insights

-

Retirement planning and long-term investment options

-

Seamless mobile and web trading experience

Business Model:

E*TRADE generates revenue through payment for order flow, margin lending, asset management services, and interest on client cash balances.

This diversified approach enables the platform to provide a brokerage account free from traditional commission fees while monetizing premium trading tools and financial services.

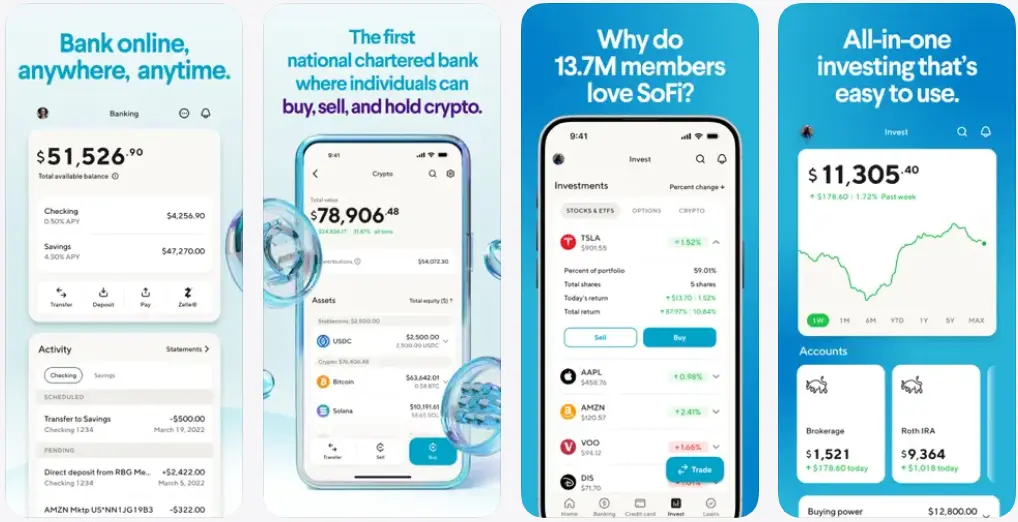

9. SoFi Invest

SoFi Invest is the best mobile app for stock trading for users seeking a simplified and all-in-one digital investing experience.

The platform enables users to trade stocks, ETFs, and cryptocurrencies while also offering automated investing and financial planning tools.

Its easy account setup and integrated financial ecosystem make it appealing to beginners learning how to buy stocks online and manage investments in one place.

With millions of users across its financial products, SoFi Invest continues to retain its position among the top stock trading apps and modern mobile investment platforms.

Key Features:

-

Commission-free stock and ETF trading

-

Automated investing and portfolio management

-

Crypto and stock trading within one app

-

Fractional share investing

-

Integrated financial planning and insights

Business Model:

SoFi Invest generates revenue through premium financial services, margin lending, payment for order flow, and interest on cash balances.

Its ecosystem-driven model allows the platform to offer a brokerage account free from commissions while monetizing value-added financial and investment services. Such a model encourages entrepreneurs to invest in building an app like SoFi.

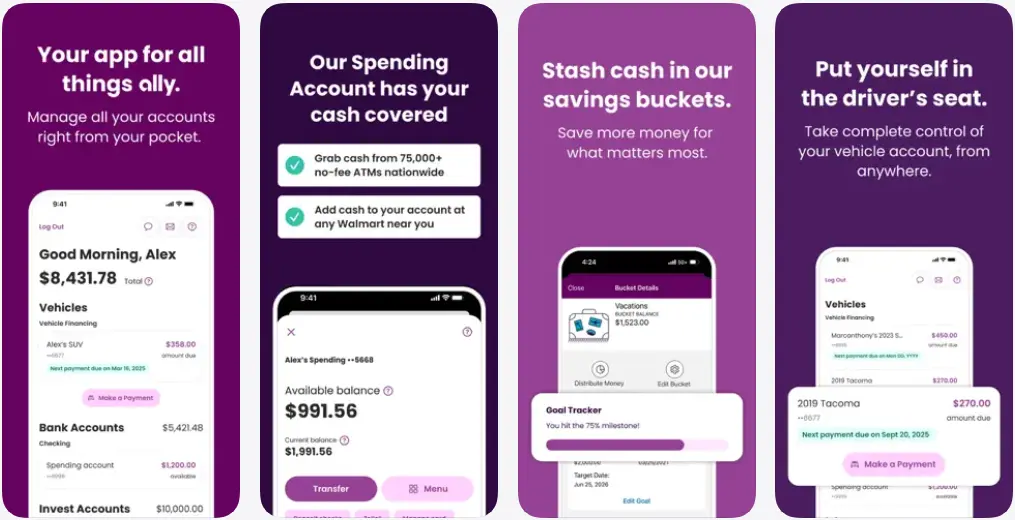

10. Ally Invest

Ally Invest is another popular option if you are looking for “what is the best stock trading app for beginners”. Its approach is to combine digital banking with commission-free investing in a single platform.

The app allows users to trade stocks, ETFs, options, and mutual funds while accessing real-time market data, research tools, and portfolio insights.

Its seamless integration with Ally’s banking services makes fund transfers and account management simple for investors looking to trade and manage finances together.

Key Features:

-

Commission-free trading for stocks and ETFs

-

Integrated banking and investment accounts

-

Real-time market data and research tools

-

Options trading and portfolio tracking

-

User-friendly mobile and web trading interface

Business Model:

Ally Invest generates revenue through margin lending, payment for order flow, managed portfolio services, and interest on client cash balances.

This diversified structure allows the platform to provide a brokerage account free from traditional trading commissions while monetizing financial and investment services.

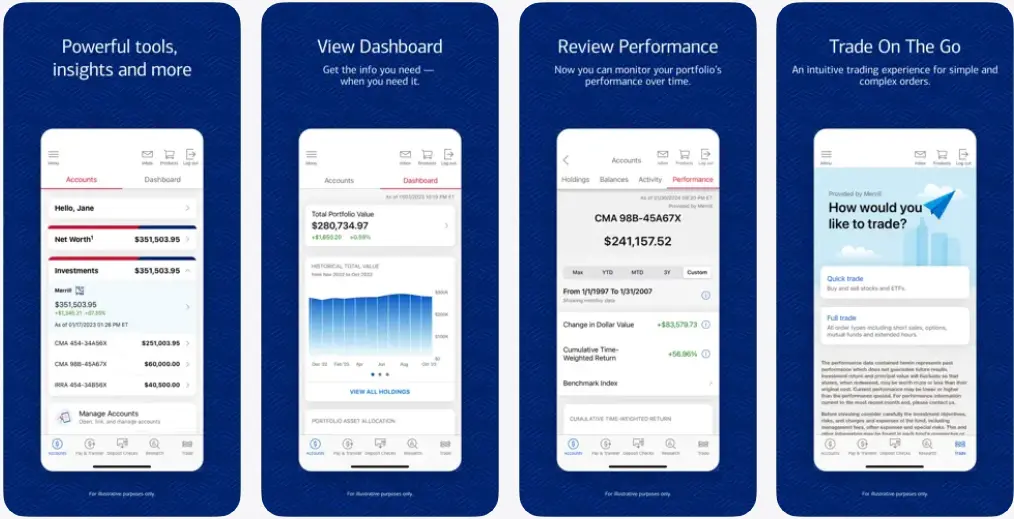

11. Merrill Edge

Merrill Edge is a well-established digital trading platform that combines online investing with comprehensive financial advisory services.

Recognized among the best stock trading apps, it allows users to trade stocks, ETFs, options, and mutual funds while accessing in-depth research, portfolio insights, and market analysis tools.

With millions of active brokerage accounts, Merrill Edge continues to rank among the top online stock trading apps for investors seeking reliability and long-term investment support.

Its integration with Bank of America’s financial ecosystem provides a seamless experience for users managing banking and investments together.

Key Features:

-

Commission-free stock and ETF trading

-

Advanced research and market insights

-

Integration with banking and financial services

-

Portfolio management and retirement tools

-

User-friendly mobile and web trading interface

Business Model:

Merrill Edge generates revenue through advisory services, managed portfolios, margin lending, and interest on client cash balances.

This diversified approach enables the platform to offer a brokerage account free from trading commissions while monetizing investment management and premium financial services.

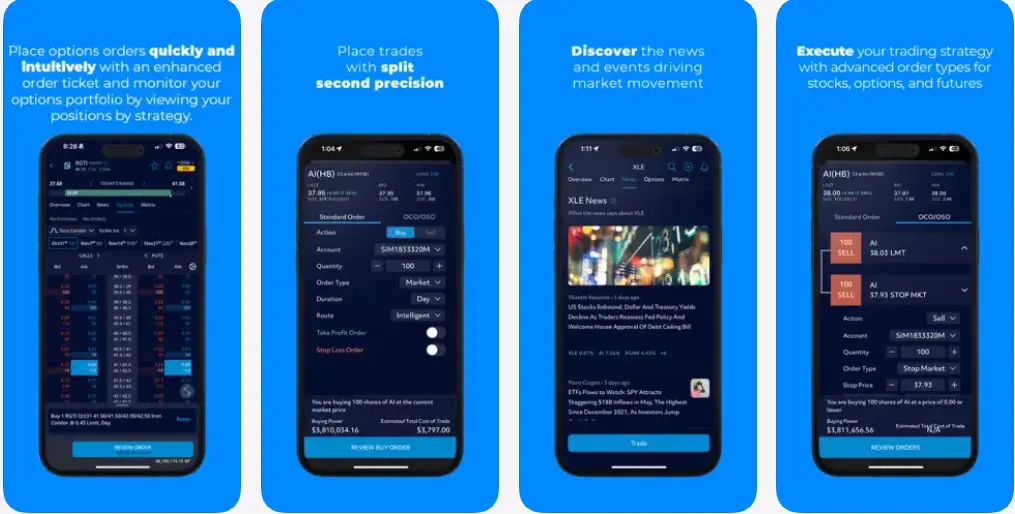

12. TradeStation: Trade & Invest

TradeStation is one of the best stock trading platforms for active traders seeking advanced analytics and high-performance trading tools.

The platform supports trading across stocks, ETFs, options, and futures with a focus on speed, automation, and data-driven decision-making.

Known for its powerful charting capabilities and customizable interface, TradeStation appeals to experienced investors looking for deeper control over trading strategies.

Key Features:

-

Commission-free stock and ETF trading options

-

Advanced charting and technical analysis tools

-

Algorithmic and automated trading capabilities

-

Real-time market data and customizable dashboards

-

Multi-device mobile and desktop trading platforms

Business Model:

TradeStation offers an interactive opportunity for entrepreneurs due to its diversified revenue model. It generates revenue through trading commissions on specific assets, subscription-based premium tools, margin lending, and market data services.

This diversified model allows the platform to offer competitive pricing while monetizing advanced trading features and infrastructure.

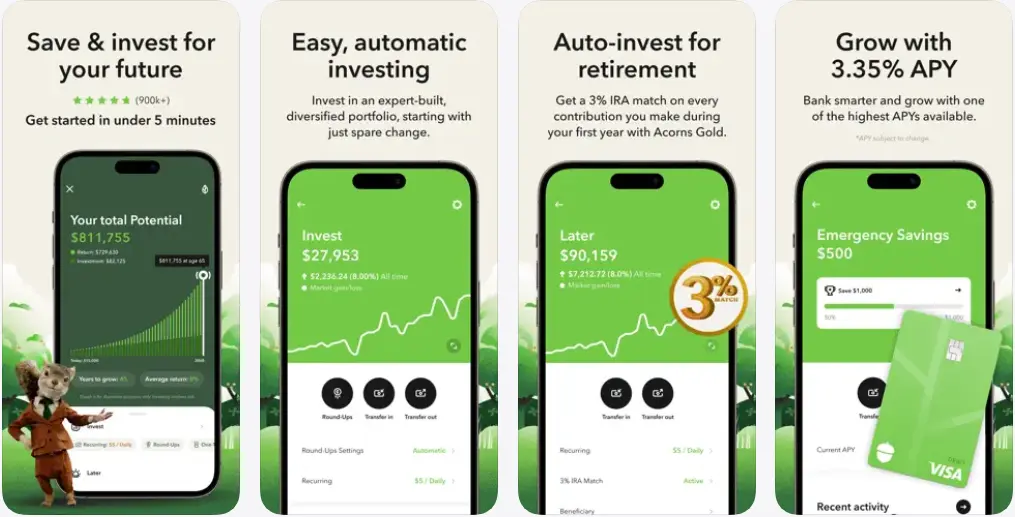

13. Acorns

Acorns has more than 10M downloads on the Play Store, and is one of the best stock trading apps for beginners, focusing on automated and micro-investing.

The platform allows users to invest spare change from everyday purchases into diversified portfolios of stocks and ETFs, making it easier to start trading stocks with minimal effort.

Its simplified approach and automated investing tools appeal to users exploring how to buy stocks online without actively managing trades.

With millions of users using the app for long-term investing and portfolio growth, Acorns continues to be a preferred option and top rated stock trading app for new and passive investors.

Key Features:

-

Automated micro-investing and round-up investments

-

Diversified ETF portfolios and portfolio management

-

Recurring investment and savings tools

-

Educational content for beginner investors

-

User-friendly mobile investing experience

Business Model:

Acorns operates on a subscription-based model, charging monthly fees for investment management, retirement accounts, and financial wellness tools.

This recurring revenue approach allows the platform to provide automated investing services while maintaining a simple and accessible experience for beginner investors.

14. Public – Stocks and Options

Public – Stocks and Options app has gained recognition as one of the best stock apps for users looking for a community-driven investing experience.

The platform allows trading in stocks, ETFs, and cryptocurrencies, while also enabling users to follow other investors, share insights, and explore market discussions.

Its transparent, social approach to trading stocks appeals to younger investors seeking interactive stock trading platforms that combine learning with investing.

With a rapidly growing user base and strong engagement levels, Public continues to be a strong trading app option focused on community and long-term investing.

Key Features:

-

Commission-free stock and ETF trading

-

Social investing and community insights

-

Fractional share investing

-

Crypto and stock trading support

-

Real-time market data and portfolio tracking

Business Model:

Public generates revenue through tipping features, premium memberships, interest on cash balances, and limited payment for order flow.

This diversified model allows the platform to maintain commission-free trading while monetizing advanced mobile app features and community-driven investment tools.

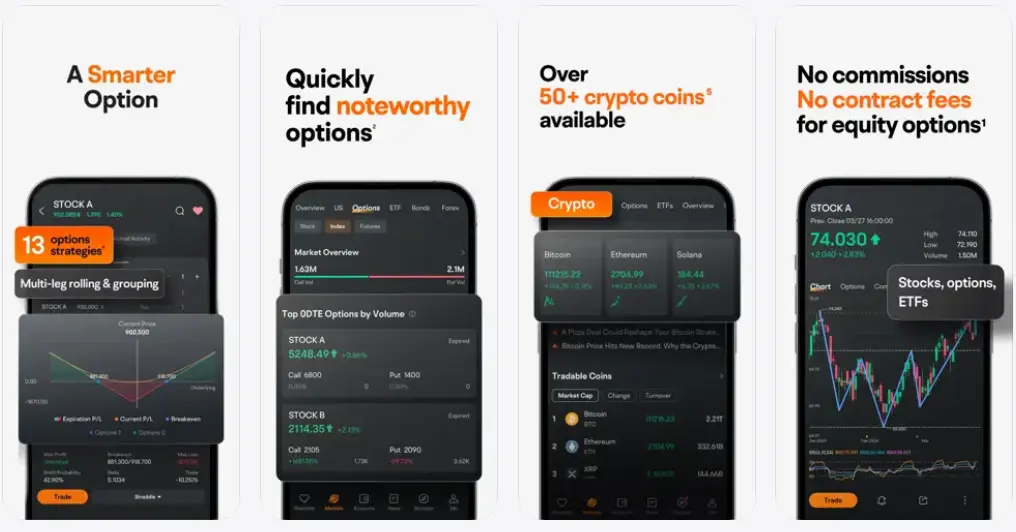

15. moomoo: Trading & Investing

moomoo Trading & Investing is considered among the top stock trading apps due to offerings like advanced analytics and a feature-rich trading environment for modern investors.

The platform enables users to trade stocks, ETFs, options, and other assets while accessing institutional-grade charting tools and real-time market data.

Its intuitive interface, combined with powerful insights, makes it suitable for both beginners and experienced traders looking for reliable stock trading platforms.

With a rapidly expanding global user base and increasing adoption among active traders, moomoo continues to gain traction as one of the best mobile apps for stock trading.

Key Features:

-

Commission-free stock and ETF trading

-

Advanced charting and technical indicators

-

Real-time market data and AI-driven insights

-

Paper trading and educational tools

-

Multi-device trading with customizable dashboards

Business Model:

moomoo generates revenue through payment for order flow, margin lending, premium data subscriptions, and interest on idle funds.

This diversified approach allows the platform to offer low-cost trading services while monetizing advanced tools and market data features.

Essential Features Of The Best Stock Trading App

The above-mentioned apps are among the top apps for trading stocks, but apart from these, there can be several others that suit your interests.

As user expectations evolve, modern stock trading platforms must go beyond basic trading and offer intelligent tools, real-time insights, and a user-centric interface that supports both beginners and active investors.

Here are some of the key stock trading app features that a leading or the best trading app should have:

► User-Friendly Interface

A clean and intuitive interface designed with the help of UI/UX design services is essential for smooth navigation and faster decision-making.

The best stock trading apps offer simplified dashboards, easy order placement, and seamless portfolio tracking for both beginners and experienced traders.

► Real-Time Market Data & Analytics

Live market prices, interactive charts, and technical indicators help users make informed investment decisions.

Real-time alerts and AI-driven insights further enhance trading accuracy and overall user engagement.

► Secure Login & Data Protection

Strong security features such as biometric login, two-factor authentication, and end-to-end encryption protect user data and transactions.

These measures ensure strong mobile app security, build trust and ensure safe trading across digital platforms.

► Multiple Asset Trading

Top stock trading platforms support multiple assets, including stocks, ETFs, mutual funds, and cryptocurrencies.

This allows users to diversify portfolios and manage all investments from a single app.

► Smart Portfolio Management

Advanced portfolio tracking tools provide insights into performance, gains, losses, and asset allocation.

Personalized recommendations help users optimize strategies and manage investments efficiently.

► Fast Transactions & Fund Management

Seamless deposits, withdrawals, and instant order execution are critical for modern trading experiences.

Secure payment integration ensures smooth fund transfers and enhances overall platform reliability.

► Advanced Capabilities

The stock trading platforms are required to focus on leveraging advanced technologies.

Such includes IoT, blockchain, and AI in stock trading, that can offer a better experience to the users. Such features also ensure the best mobile app for stock trading.

How to Choose the Right Stock Trading App?

Choosing the right stock trading app depends on your investment goals, trading style, and preferred features.

With many stock trading platforms available, selecting one that aligns with your needs can significantly improve your overall trading experience and long-term returns.

Here are some of the key factors that can help you choose the right stock app for your investment goals.

1. Define Your Investment Goals

Start by identifying whether you are a beginner, long-term investor, or active trader. Some top trading apps are designed for simple investing, while others offer advanced tools for frequent trading and technical analysis.

2. Check Fees and Commissions

Review trading fees, subscription charges, and hidden costs before selecting a platform. Most of the best stock trading apps offer commission-free trading, but may charge for premium features or margin trading.

3. Evaluate Features and Tools

Look for essential features such as real-time market data, advanced charting tools, portfolio tracking, and research insights. The right app should support your trading strategy and provide a seamless user experience.

4. Asset Availability

Before choosing the best mobile app for stock trading, ensure the platform supports multiple assets. Such can include stocks, ETFs, mutual funds, and cryptocurrencies. Access to diverse investment options helps build a well-balanced portfolio.

5. Security and Reliability

Choose among the top 10 stock trading apps that offer strong app security measures like two-factor authentication, encryption, and regulatory compliance. A secure platform protects your funds and personal information.

6. User Experience and Support

A smooth interface, fast transactions, and responsive customer support enhance usability and help decide what is the best app for stock trading. Reading user reviews and platform ratings can help identify the most reliable and top rated stock trading apps.

Why You Should Build A Stock Trading App Like Popular Ones?

The rapid growth of the global stock trading sector is not just appealing to new investors, but is also attracting investors’ interest.

But still, several investors are confused about whether they should invest in an app like the best stock trading apps or not.

The solution to such a concern is simple: as mobile-first investing continues to rise, building a feature-rich trading app similar to leading platforms can unlock long-term revenue potential and user engagement.

Let’s take a look at some of the reasons that justify the need to invest in an app like top stock trading apps.

1. Rapidly Growing Market Demand

The global trading app market is expanding quickly as more users prefer mobile platforms to trade and manage investments.

Commission-free trading, AI-powered insights, and real-time analytics are attracting a new generation of investors to digital platforms.

2. Multiple Revenue Opportunities

Modern stock trading apps generate revenue through diverse streams such as premium subscriptions, margin trading, advisory services, and interest on user funds.

This diversified app monetization model creates sustainable monetization beyond basic trading fees.

3. High User Engagement & Retention

Trading apps offer daily engagement through portfolio tracking, alerts, and market insights.

Also, the mobile apps promote frequent usage, which increases customer lifetime value and strengthens long-term user retention.

4. Scope for Innovation

AI-driven analytics, automated investing, and social trading features continue to reshape digital trading experiences.

Businesses entering this space can hire app developers and innovate with advanced technologies to stand out in a competitive market.

5. Scalable Long-Term Business Model

With the right technology and user experience, a stock trading app can scale globally and attract a large user base.

Successful platforms demonstrate how digital trading solutions can evolve into full financial ecosystems with strong growth potential.

Why Partner With JPLoft To Create A Successful Stock Trading App?

Choosing the right development partner is critical to building a secure, scalable, and future-ready trading platform.

Partnering with experts at JPLoft brings strong fintech expertise with a strategic development approach to create high-performance trading solutions tailored to modern investor expectations.

The team focuses on intuitive user experiences, real-time data integration, and seamless transactions to ensure platforms remain competitive in an evolving digital trading landscape.

As a trusted stock trading app development company, JPLoft emphasizes advanced technology integration, secure architecture, and scalable infrastructure that support long-term business growth.

From AI-powered analytics and multi-asset trading capabilities to robust security and compliance standards, every solution is designed to deliver reliability and performance.

With a focus on innovation and customization, JPLoft helps businesses launch powerful trading platforms that drive engagement, enhance user retention, and support sustainable growth in the digital investment ecosystem.

Conclusion

Stock trading apps have reshaped modern investing by making it easier to trade, monitor portfolios, and access real-time market insights from a single platform.

With features like commission-free trading, AI-driven analytics, and multi-asset investing, the best stock trading apps continue to enhance accessibility and user engagement.

As digital finance adoption grows, choosing the right platform becomes essential for achieving investment goals and managing risk effectively.

For businesses, the rising demand for mobile-first trading platforms highlights strong opportunities in the fintech space.

Focusing on user experience, security, and advanced technology will remain key to building competitive trading solutions that adapt to evolving investor expectations and market trends.

FAQs

The best stock trading app for beginners offers an easy interface, commission-free trading, fractional shares, and learning resources. Platforms with simple dashboards and guided tools help new investors start trading confidently.

Many modern stock trading apps support both stocks and cryptocurrencies in one place. These multi-asset platforms allow users to diversify investments and manage portfolios without switching between apps.

To choose the right app, compare trading fees, supported assets, security features, and user experience. Selecting a platform that matches your investment goals and trading style ensures better long-term results.

Top stock trading platforms use encryption, two-factor authentication, and regulatory compliance to protect user data and transactions. Choosing a trusted and well-reviewed app enhances security and reliability.

The cost depends on features, technology stack, security requirements, and platform complexity. Advanced apps with real-time analytics, AI insights, and multi-asset trading typically require higher investment.

Share this blog