From AI-powered loan approvals to paperless KYC to one-tap disbursements, the way people borrow (and lend) is changing fast and for the better.

We’re talking loan lending app trends that are flipping the traditional banking playbook on its head.

Whether you're a fintech founder, investor, or just a curious mind in the digital finance game, these trends are your cheat code to building smarter, faster, and more user-friendly lending platforms in 2025 and beyond.

Because let’s face it, nobody’s lining up at banks anymore. The loan revolution is happening in your pocket.

Loan Lending App Market Stats

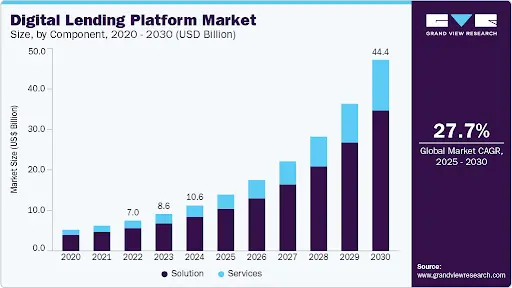

The loan lending app market is exploding. To be sure of that, we are here with some stats:

-

- The digital lending platform market is projected to generate $13.8 billion in revenue by 2025, with forecasts showing it could soar to $114.72 billion by 2034.

- This reflects a strong CAGR of 26.53% between 2025 and 2034, highlighting massive growth potential.

- In 2024, North America led the market, claiming the largest share at 35%, driven by advanced fintech adoption and digital infrastructure.

- Meanwhile, the Asia Pacific region is expected to witness the fastest growth rate throughout the forecast period, thanks to rising smartphone penetration and digital finance adoption.

- Among solutions, business process management took the lead in 2024, dominating the segment.

- However, looking ahead, the lending analytics segment is set to grow at the fastest pace, fueled by demand for smarter, data-driven lending strategies.

- North America is leading the charge, contributing 32.7% of global revenue, thanks to tech-savvy users and massive fintech adoption.

This is a golden time to create a money lending app, and make sure to work further.

TL;DR: If you’re building or investing in loan lending apps, you’re not just in the game. You’re in one of the hottest markets on the planet.

So, what are you waiting for? The future of lending is mobile, AI-powered, and ready to scale.

Let’s make money move, smartly.

Top Money Lending App Trends

Alright, let’s get real for a second.

If you're in the fintech game or planning to build the next big thing in lending, knowing the latest trends in loan lending apps isn’t just helpful, it’s essential.

The way people borrow money has totally transformed.

We're talking tap-to-borrow, AI-driven approvals, and digital wallets that do more than just hold cash.

So if you're thinking about diving into loan lending app development trends, this guide is for you.

Let’s explore the top 10 money lending app trends shaping 2025 and beyond, with insights that could take your app from concept to cash flow.

1. AI-Powered Loan Decisions: Smart Lending in Seconds

AI isn’t just hype; it’s the new loan officer.

The use of AI in loan lending apps now use artificial intelligence to assess a borrower's creditworthiness in real time.

No paperwork. No waiting. Just instant decisions.

These AI models can spot patterns that traditional systems miss, making them ideal for serving underbanked and new-to-credit users.

It’s faster, more inclusive, and seriously efficient. Plus, it reduces operational costs for lenders and improves user experience tenfold.

2. Personalized Loan Offers That Actually Feel Personal

Generic offers are out. Smart offers are in.

Loan apps now use data analytics and behavioural tracking to tailor loans to each user.

Spending habits, transaction history, and even in-app behaviour matter. This allows apps to send highly relevant, customized loan deals to every user.

Think Netflix-level personalization for money. The result? Higher conversions, better satisfaction, and longer user retention.

3. Biometric Security: Say Goodbye to Passwords

Security should feel easy. That’s why biometrics are booming. Face ID, fingerprint scans, and even voice unlocks are becoming standard.

No one wants to remember complex passwords. Biometric logins can be a great feature in loan lending apps as they are fast, secure, and friction-free, ideal for financial apps.

What’s better? It shows users you take their data seriously.

Security + simplicity = trust, which every money lending app needs to build. Biometric security is one of the most widespread loan lending app design trends in 2025.

4. P2P Lending Growth: Bye Banks, Hello People

Cut out the middleman and let borrowers meet lenders directly. That’s what peer-to-peer lending apps are doing and people love it.

Why? Because rates are better on both sides. Borrowers pay less, lenders earn more. It’s win-win.

These platforms use tech to match profiles, manage risk, and automate repayments.

No banks, just trust and a lot of backend algorithms.

5. Real-Time Loan Disbursement: Instant Cash, Zero Wait

Waiting days for loan disbursal is so last decade. Today’s users want money now, and loan apps are delivering just that.

Once approved, funds hit the user wallet in minutes. It’s quick, seamless, and exactly what borrowers expect in 2025.

The tech behind it? Instant payment gateways, APIs, and banking rails. No human in the loop, just smooth automation.

This is one of the most in-demand loan lending app trends globally.

6. Alternative Credit Scoring: Rethinking Risk

Not everyone has a perfect credit score, and that’s okay.

Alternative credit scoring looks beyond FICO, exploring mobile behaviour, bill payments, and even social profiles.

It’s a second chance for millions of underbanked users.

And for lenders, it opens up a whole new market with data-rich insights.

It’s fairer, broader, and often more accurate. Especially in emerging economies where credit bureaus lack depth.

This trend is redefining who gets to access money and how.

7. Blockchain-Based Lending: Transparency That Builds Trust

Blockchain isn’t just for crypto; it’s changing lending too. Immutable records and real-time settlements reduce fraud and speed up the process.

Every transaction is trackable and tamper-proof. That’s a big win for trust in an industry built on it.

These systems– often built through professional blockchain development services– offer lower fees, faster approvals, and streamlined compliance.

8. Smart Contracts: Automating the Entire Loan Journey

What if your loan agreement executed itself? That’s what smart contracts do. They’re digital agreements that trigger actions when conditions are met.

No delays. No human errors. Just code that works.When repayment is due, the system debits. When collateral’s needed, it locks automatically.

It’s fast, fair, and reduces administrative overhead. You’ll find smart contracts in many blockchain-based loan apps today.

To execute these trends successfully, hire dedicated developers with expertise in fintech solutions.

9. Super Apps: One Tap to Do It All

Users don’t want 5 finance apps. They want 1 that does everything. That’s why super apps are trending hard in loan lending app development.

Borrow, repay, invest, save under one digital roof. It simplifies the user experience and creates cross-selling opportunities.

Fintechs love it too.

More services = more engagement = more revenue streams.

All-in-one is all the rage: Loan lending trends are clearly heading toward bundled, unified ecosystems.

10. Hyper-Personalized UX/UI: Design That Feels Human

It’s not just what your app does, it’s how it feels.

UX/UI now focuses on customization, speed, and seamless journeys.

Think dark mode, swipe gestures, chat-like loan approvals, and voice search.

Every visual and interaction is tailored to user behaviour and preferences.

Why it works? Because friction is a conversion killer. Design that feels intuitive keeps users engaged and makes borrowing stress-free.

Modern UX is not just pretty, it’s powerful. This is one of the most consistent trends in loan lending app design.

Knowing these trends isn’t enough; for businesses looking to stay ahead, partnering with the best mobile app development company can ensure your app leverages these innovations effectively.

How to Make Your Loan Lending App Future-proof?

Let’s face it, tech doesn’t sleep. Especially not in fintech.

By the time you launch one feature, five new ones are trending.

So, how do you future-proof your app in a world where loan lending app trends change like Instagram algorithms?

Easy (well, sort of): You stay ahead of the curve by watching the latest trends in loan lending apps, building with flexibility, and focusing on what your users will need tomorrow, not just what they want today.

Here’s how to make sure your app doesn’t just survive but absolutely dominate the future of lending.

1] Stay Plugged into the Trends

You can’t build for tomorrow using yesterday’s playbook.

The fintech space is buzzing with money lending app trends from blockchain integrations to hyper-personalized user experiences. If you're not keeping an eye on the current trends in loan lending app development, you're building blind.

What should you be tracking?

-

- AI-powered approvals

- Instant disbursements

- Voice-enabled commands

If you are planning to start a loan lending business, stay in research mode, watch your competitors, and read product release notes. And please, don't skip the feedback from your users. That’s where real insights hide.

2] Build for Scalability

You might have 1000 users today. But what happens when you go viral next week and hit 50,000?

If your infrastructure can’t scale smoothly, those new users won’t stick around long. Building with a cloud-native, modular architecture allows you to scale on demand, not panic-deploy.

Scalability is one of the most practical loan lending app development trends that often gets overlooked. It's not flashy, but it's what separates startups from sustainable businesses.

3] Integrate AI (But Make It Useful)

Don’t just throw AI in for the buzzword.

Use it to:

-

- Approve loans faster

- Detect fraud before it happens.

- Score creditworthiness beyond outdated models

- Offer ultra-personalized loan recommendations.

The latest loan lending app trends prove that AI isn’t the future, it’s the now. But the trick is making it seamless. If users feel like they're talking to a robot, you've lost the game.

AI should work behind the scenes to make your app feel smarter, faster, and more human.

4] Make Security Invisible (But Unbreakable)

No one wants to type 8-character passwords with uppercase letters, symbols, and a drop of blood. That’s ancient UX.

The current loan lending app design trends focus on frictionless app security biometrics, one-tap verification, and adaptive authentication.

But here's the deal: while security should feel easy, it needs to be airtight.

With users trusting you with their money, data, and identity, invisible but ironclad security becomes a non-negotiable part of loan lending trends.

5] Think Global, Act Local

You’ve got global dreams? Perfect. But don’t forget to build locally smart.

Different countries = different financial laws, KYC rules, tax setups, and languages.

Skipping localization is like launching a boat with no rudder.

So if you're planning to scale across markets, ensure your app architecture supports:

-

- Multi-language support

- Multi-currency transactions

- Region-specific compliance modules

Smart localization is one of the future trends of loan lending app development, and it’s critical for serious growth.

6] Prioritize Data

Data is your cheat code.

It can tell you what users want, what’s working, and where you’re dropping the ball.

But it’s also one of the most sensitive assets in your business.

The latest trends in loan lending apps highlight two things:

-

- Use real-time analytics to personalize the journey.

- Give users control over their data with full transparency.

Balancing those two is where the real innovation happens.

7] Design Modular Features

The best fintech products aren’t built all at once. They’re built in blocks.

With modular development, you can:

-

- Launch faster with MVPs

- Plug in new features as trends shift.

- Update without breaking the whole app

This makes you more agile and responsive to the loan app trends that evolve every quarter. Think of your app like LEGO, snap it together your way, grow it your way.

How JPLoft Can Help You Develop a Trendy Loan Lending App?

Looking to build a high-performing, scalable loan lending app that stands the test of time?

JPLoft has got you covered.

As a leading loan lending app development company, we bring speed and a custom approach to fintech projects.

From AI-powered lending features to sleep UI, our team ensures your app is future-ready and built for scale.

Whether you’re launching a startup or upgrading an existing platform, we offer end-to-end solutions tailored to your goals.

With a focus on innovation and compliance, we turn your vision into a secure, smart and scalable money lending app.

Let’s bring something legendary together.

Conclusion

The digital lending space is evolving faster than ever.

With AI, blockchain, and real-time disbursement reshaping the borrower experience, your app needs more than just good code; it needs vision, agility, and future-proof thinking.

By tapping into these loan lending app trends, you can offer users more value, more speed, and more trust.

At JPLoft, we don’t just build apps; we build lending platforms that lead.

Ready to turn insights into innovation? Let’s create a money lending app that doesn’t just compete, it dominates.

FAQs

AI-driven loan approvals, alternative credit scoring, real-time disbursements, and biometric security are among the top loan lending app trends dominating the fintech space in 2025.

AI helps assess credit risk faster and more accurately, detects fraud in real-time, and enables personalized lending offers making it a key trend in loan lending app.

Blockchain enables transparency, tamper-proof transactions, and automated smart contracts. It’s becoming one of the most secure and scalable trends in loan lending apps.

Yes! Modular development and cloud-native architecture allow startups to integrate money lending app trends step-by-step, starting with an MVP and scaling smartly.

As a seasoned fintech tech partner, JPLoft brings custom development, AI integration, security, compliance, and innovation to the table, making sure your lending app thrives in a competitive market.

Share this blog