Key Takeaways:

P2P lending apps connect borrowers and lenders directly, cutting out banks, lowering interest rates for borrowers, and boosting returns for lenders.

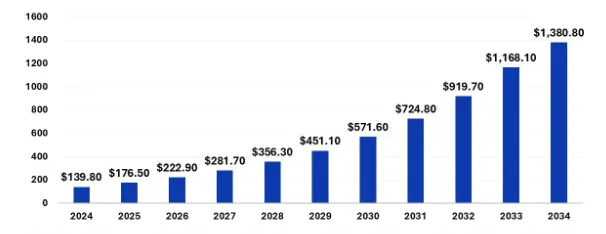

The P2P lending market is booming, valued at $177B in 2025 and projected to surpass $700B by 2031 with a 29% CAGR growth.

Essential P2P app features like secure payment gateways, automated loan processing, credit score monitoring, and personalized dashboards drive user trust and engagement.

Building a P2P app requires clear planning, from market research and compliance checks to choosing the right tech stack and creating a scalable architecture.

P2P app development costs range between $20,000 and $250,000, depending on features, security, compliance needs, and developer location.

P2P monetization strategies include origination fees, service charges, subscription models, and interest rate margins, making P2P platforms profitable and scalable.

Key development challenges include regulations, user trust, fraud risk, and scaling, but AI and blockchain can help overcome them.

Future trends like AI-based credit scoring, blockchain, and DeFi integration will make P2P lending apps smarter, safer, and more transparent.

The fintech space is booming, and so are the service offerings and users’ expectations. Such expectations are also reshaping the lending sector and have introduced several user-friendly and effective lending methods.

Among these, a popular approach is P2P lending, growing at a 29% CAGR, reflecting a promising opportunity for new-age entrepreneurs. If you are wondering how to build a P2P loan lending app, then no need to panic; follow the simple steps.

Start by conducting market research, understanding user expectations, and the competitor’s gap, draft an innovative app idea, and look for an experienced developer to help build your app.

If you want to know more about the peer-to-peer loan lending app development, then this blog is for you. In this blog, we will discuss every step in depth on how to create a P2P loan lending app.

From the basics of the P2P market to the technical requirements to make a P2P lending app, this blog covers it all. So let’s proceed further.

What is a P2P Lending App, and How Does It Work?

A P2P lending app is a platform that connects borrowers and lenders at a common place, and both can be individuals, not well-established lending institutions.

Due to such, the entire model is not dependent on any banking or lending institution. Making it one of the reasons that makes the platform popular. Further, it also offers reduced interest and easy credit access for borrowers, as well as improved returns for lenders.

But how does a peer-to-peer loan lending platform work?

The global P2P lending sector has been valued at $177B in 2025 and is projected to surpass a valuation of $700B by 2031. Such growth reflects a CAGR of approximately 29%. P2P lending is one of the major segments of US digital lending, with popular platforms such as Prosper, Lending Club, and cash advance apps like Dave.

North America is further among the regions leading the sector, with 37% of the market share in the global P2P lending market. This reflects on the potential opportunities for entrepreneurs to enter the P2P segment.

But simply focusing on the statistics is not enough. Along with the statistics, there is a need for you to be aware of how to build A P2P lending app, and for that, you need to know how these platforms work.

For a simplified understanding, it can be mentioned that there are two sides to P2P lending platforms: one is for the borrower, and the other is for lenders. The initial work is the same for both stakeholders,and later on diverges as per the platform functionality.

A] User Onboarding and Registration

The user downloads the app from the Play Store or App Store and registers themselves as either a lender or borrower. They provide their personal information, contact details, and even their bank details for a thorough verification and identity validation.

B] Profile Verification

The app then verifies the user profile, their credibility, and other provided details by connecting with the banks, credit institutions, and other relevant institutions.

From this stage, the platform works differently for both borrowers and lenders.

|

For Borrowers |

For Lenders |

|

Once their profile is verified, the borrowers can place their borrowing request or can see the available credit options. |

Once their profile is verified, they can add funds to their account, which can be lent to the borrower. |

|

The credit limit for the borrowers is defined based on their credit score and history provided by credit scoring institutions. |

Also, they can bid for the active loan requests placed by the borrowers on the application. |

|

Hence, based on such, the borrower places the request, and the amount is transferred to their account. |

Once disbursed, they can track their money, the repayment cycles, and their income from the interest on the loan amount. |

|

Post approval, the loan repayment process starts, in which the user is expected to pay a fixed amount in set intervals. |

In the meantime, they can look for any other investment or lending opportunity available on the platform. |

Why Invest in a P2P Lending App?

Now, a question arises: why should you invest in P2P lending when there are so many lending options available in the industry?

Such is important because the concern “How to create a P2P lending app?” can be resolved by hiring dedicated developers for your project. But why is the entire project significant?

Such a choice can be justified through the following key reasons:

-

Growing Market Demand: The global P2P lending segment is projected to become a multi-billion-dollar market by 2030.

-

High Return Potential: P2P eliminates the traditional banking and lending routes and simply focuses on connecting the lenders and borrowers. Such opens up routes for innovative revenue streams and high returns.

-

Low Investment: P2P lending apps have lower infrastructure requirements and limited approvals, making the business model scalable and low on operational costs.

-

Innovative Model: Modern-day tech can be leveraged to ensure the relevance and scalability of the business model. Such can include AI-based credit scoring or even automated loan matching.

-

Investor Interest in Fintech: Venture capitalists and global investors are steadily investing in lending platforms, considering the better return potential.

P2P Lending Platform Benefits

So, now it's clear that several reasons exist that justify why you should make a P2P loan lending app.

But along with these reasons, you must also be aware of several key benefits of investing in P2P lending apps. These benefits can be identified as:

A] Multiple Revenue Streams

The P2P lending apps have multiple revenue streams, including origination fees, late payment penalties, and even commissions.

Further, features can be added like insurance, wealth management, and BNPL integrations. Hence, offering multiple revenue streams.

B] Scalability Potential

The platform links the borrowers directly with the lenders, eliminating the middlemen. Even allowing borrowers with limited credit history to get credit and providing lenders with better returns on their investment.

Hence, such an approach can allow you to attract a large audience base and easily scale your P2P platform.

C] Data Monetization Opportunities

Valuable insights from the borrowers' and lenders' actions on the P2P app can further be monetized or can be used for better financial products and service offerings.

While planning on how to develop a P2P lending app, consider ethical approaches aligned with monetization models that need to be followed to retain user trust.

D] Low Operational Costs

A P2P lending app works by allowing a direct interaction between borrowers and lenders, without the involvement of any banking or financial institution.

Hence, this reduces the associated infrastructural cost, paperwork, and other intermediary charges, ensuring low operational costs.

Essential P2P Lending App Features for Success

The feature offered can make a P2P lending app more convenient, user-friendly, and support its scalability. Hence, it is essential to prepare a list of essential loan lending app features that you should incorporate in your checklist when deciding on “How to Create a P2P loan lending App?”.

Some essential P2P lending app features are:

1. User Onboarding and Registration

The app should allow easy user onboarding and registration with limited paperwork, as an extensive registration process and drive your users away.

However, while streamlining the process, don’t skip on essential background verification and credit profile evaluation of the users.

2. Personalized Dashboard

A key feature that can make your app more engaging and attractive is a personalized dashboard.

Also, you can provide users with the option to customize their dashboard, so that they can pick what should appear on the app’s home screen.

3. Automated Loan Processing

You can introduce a feature that automates the loan processing. As soon as the conditions on both the lender and borrower sides align, the loan amount gets processed automatically.

Such an automation can be done with the help of AI in loan lending apps and other API integrations that can allow real-time user profile evaluation and conduct credit checks.

4. Credit Score Monitoring

Users are very concerned about their financial health, and they look for ways to improve it. Hence, introducing a credit monitoring feature in your app can keep users updated in real time.

Also, such credit score monitoring can help conduct real-time user assessment and assist in loan processing.

5. Secure Payment Gateway

Another essential feature that your P2P lending app must have is a secure payment gateway. A lending software accepts and processes financial transactions from both borrowers and lenders.

Hence, such payments should be compliant to handle these transactions, protect users’ data, and be compliant with globally recognized standards and compliance, including PCI DSS and more.

6. Personalized Recommendations

Your app can leverage advanced AI in finance to offer personalized recommendations to users. Such recommendations can be for loan options available as per their credit score and financial history.

Also, your app can leverage AI and ML to help users plan their loan repayment cycles and any key practices that can help improve their credit score. But, to do so, you need to take help from an AI app development company with proven fintech expertise.

7. Real-Time Notifications

Along with the personalized notifications, an essential loan app feature to consider if deciding to make a P2P lending app is real-time notifications.

Such a feature is important to keep your audience updated and informed of any updates in their account and can help keep the users engaged and improve their experience.

8. Loan Calculator

An innovative feature to have in your P2P lending app is a loan calculator. Such can help users calculate the loan amount they are eligible for, the interest required to be paid, and the number of EMIs in which the dues will be paid.

Step-By-Step P2P Lending App Development Process

Thinking about how to develop a P2P lending app? You’re not alone. More people are turning to these platforms for easier ways to borrow and lend.

But here’s the thing: creating one isn’t only about writing code. You need research, careful planning, and the right decisions at each stage.

Let’s walk through the full process. Follow these steps, and you’ll be ready to build a loan lending app that is safe, useful, and scalable.

Step 1: Conduct Market Research and Analysis

The first step is research. Start by understanding what the market needs and how you can leverage it for your

► Know What Users Expect

Before you develop a peer-to-peer lending app, you need to know what people want. Borrowers look for easy access to loans with clear repayment terms. Lenders want security and a fair return on their money. If you don’t know these needs, your app could miss the mark.

► Learn from Competitors

Take a close look at other loan lending apps. Read their reviews in app stores. Notice where users complain about delays, confusing layouts, or unclear loan conditions.

Those issues are gaps that you can fill. At the same time, study their strengths. This way, you can see what’s standard in the industry and what could set you apart.

► Connect Research with Costs

Research is not complete unless you link it to the cost to create a mobile app. Your findings will help you decide which features are worth the money and which can wait.

If you invest wisely, you’ll save on development and still meet user expectations. Strong research prevents wasted effort and gives your app a clear direction from day one.

Step 2: Define Features and Compliance Requirements

Once the research is clear, it’s time to define the features before you proceed to develop a P2P lending app.

► List the Basics

Start with the basics: plan for your app signup process, loan request options, repayment tracking, and notifications. These features make sure your app works most effectively.

► Add Features That Build Trust

Beyond the basics, think of tools that make the app stand out. Risk checks and credit scoring reduce uncertainty for lenders.

Dispute resolution ensures problems can be solved quickly. Loan calculators and payment histories give borrowers more control. These add value without complicating the core user flow.

► Respect Rules and Regulations

Building features without compliance can sink your app. To build a loan lending app the right way, you must follow KYC rules, AML standards, and data privacy laws like GDPR.

These are not just legal checks. They give users confidence that your app is secure. When people trust the mobile app security of your platform, they are more likely to stay and recommend it.

Step 3: Choose Tech Stack and Architecture

Your loan lending platform tech stack decides how smooth the app feels. Hence, being careful in its selection is of utmost importance.

► Backend and Frontend Choices

For backend systems, Node.js and Laravel are common picks. They handle speed, structure, and security. For the frontend, React and Angular help create simple, fast, and responsive screens that users enjoy.

► Picking the Right Database

The database is another big decision. PostgreSQL is a solid choice for managing structured transactions. MongoDB works well for storing larger, less structured data. Each one has its strengths, and your choice should depend on how you plan to grow the app.

► Build with Flexibility

Keep your architecture modular. This means you can add new features later without breaking what already works. For example, you might launch with basic lending functions but later add blockchain contracts or AI scoring.

A modular design lowers long-term development costs and keeps your system flexible.

Step 4: Design Secure and Friendly UI/UX

Once your tech is ready, your mobile app design comes next. It should feel clear and easy to use. Don’t overload the screen. Keep calls to action obvious, like a simple “Request Loan” button in the right place.

► Inspire Trust with Visuals

Since your app handles money, trust is everything. Use secure icons, verified badges, and clear status indicators to reassure users. A smooth onboarding process, where people can verify identity and link accounts easily, will make a strong first impression.

► Test with Real People

Even the best design ideas need testing. Design an app wireframe to look for any development gaps or issues. Once finalized, run trials with users and watch how they move through signup, requests, and repayments.

If they get lost, adjust the design. A safe and easy user flow will help your loan lending app grow faster.

Step 5: Prototype and MVP Creation

Don’t rush into a full build. Start with an app prototype and then an MVP. This is a smaller version of your app that only includes the most important functions.

► What to Include in the MVP

Focus on the basics: loan requests, wallet integration, and repayment options. With these, you can test if people find value in your idea.

► Scale After Validation

An MVP cuts loan lending app development costs while letting you test real demand. Once you get feedback, you can add advanced tools like AI-driven scoring, smarter notifications, or even blockchain agreements. Growing step by step keeps you on the safe side.

Step 6: Add Third-Party and API Integrations

A peer-to-peer lending app doesn’t work in isolation. It connects with third-party services. Hence, planning for third-party and API integrations is significant for your app's performance and scalability.

► Essential Integrations for Functionality

Payment gateways make deposits and withdrawals possible. Escrow accounts keep money safe until terms are met. Identity verification APIs confirm authenticity, and credit scoring tools help lenders measure risk.

► Keep It Safe and Reliable

Every integration must be tested for security and accuracy. A failed payment or a wrong credit score can damage trust. E-signature services should also be added to make digital agreements legally binding. Secure integrations keep your loan lending app reliable for both lenders and borrowers.

Step 7: App Testing for Security, Performance, and Compliance

Mobile app testing is where you make sure the app is safe. Check login systems, encryption, and loan transactions. Add multifactor authentication and test it for gaps.

► Test Performance Under Load

Next, check how the app performs under stress. Simulate thousands of users applying for loans at once. A loan lending app that slows down or crashes will lose people quickly.

► Compliance Testing

Finally, verify that KYC and AML checks work as they should. Make sure reporting features meet regulatory standards. Working with app maintenance services here helps keep the app stable and compliant long after launch.

Step 8: Deployment, Support, and Maintenance

This is the final but not the last stage where you and app developers can rest. Several actions need to be planned and executed accordingly in the process of how to create a P2P loan lending app.

► Publish on App Stores

When everything is ready, publish your app. Publish your app on App Store and submit your app on the Play Store, or use cross-platform development for both. Follow each store’s rules to avoid delays or rejections.

► Stay Alert After Launch

Your work isn’t done after publishing. Keep monitoring performance. Fix failed transactions, handle disputes quickly, and answer user concerns. Good support is key to keeping people loyal.

► Long-Term Maintenance

Apps need regular care. Update features, fix bugs, and keep up with new regulations. This is where app maintenance services come in handy. A well-maintained loan lending app stays secure, profitable, and ahead of competitors.

Tech Requirements for a P2P Lending App

In the P2P lending app development process, choosing the right app tech stack matters the most. Such a tech stack is important to ensure the performance and scalability of your P2P platform.

The table below focuses on the recommended tech stack that is essential for any basic or advanced P2P lending app.

|

App Layer |

Recommended Technologies |

Why It’s Important for P2P Lending |

|

Frontend (User Interface) |

React Native, Flutter, Swift (iOS), Kotlin (Android) |

Provides a smooth borrower & lender experience across mobile and web. |

|

Backend (Core Logic) |

Node.js, Python (Django/Flask), Java (Spring Boot) |

Handles loan matching, repayments, and secure transactions. |

|

Database |

PostgreSQL, MongoDB, Firebase |

Stores borrower profiles, credit history, loan records, and transactions. |

|

Cloud Hosting & Scalability |

AWS, Microsoft Azure, Google Cloud |

Ensures data security, uptime, and ability to scale as users grow. |

|

Payment Gateway |

Stripe, PayPal, Razorpay, Braintree, Plaid |

Enables instant loan disbursal, EMI collection, and bank linking. |

|

User Authentication |

OAuth 2.0, JWT, Firebase Auth, Biometric APIs |

Protects borrower and lender accounts with multi-factor security. |

|

KYC/AML Verification |

Onfido, Trulioo, Jumio, HyperVerge |

Ensures compliance with financial regulations and prevents fraud. |

|

Credit Scoring Engine |

AI/ML models (TensorFlow, Scikit-learn), Experian/FICO APIs |

Assesses borrower credibility beyond traditional credit scores. |

|

Loan Matching Algorithm |

Custom-built recommendation engines |

Matches borrowers and lenders based on risk, amount, and interest rate. |

|

Notifications & Alerts |

Firebase Cloud Messaging, Twilio, OneSignal |

Keeps users updated on disbursals, EMIs, due dates, and offers. |

|

Analytics & Reporting |

Mixpanel, Google Analytics, Grafana |

Tracks repayment trends, borrower risk, and lender ROI. |

|

Admin Panel |

Custom dashboard with React/Angular + REST APIs |

Allows operators to manage users, disputes, compliance, and fraud monitoring. |

|

Security |

SSL/TLS, AES-256 encryption, PCI DSS compliance, OWASP standards |

Protects sensitive financial data and builds user trust. |

P2P Lending Platform Development Cost and Timeline

While focusing on how to build a P2P lending app, you should also focus on budget planning. The average cost to develop a P2P app can range anywhere between $20,000 and $250,000, depending on your app features and complexity.

Hence, you need to plan your app features and complexities, and accordingly set your budget that you will be spending on the app.

A basic money lending app development cost can range from $20,000 – $50,000. Further, a mid-range loan lending app can cost $60,000 – $120,000, and an advanced enterprise-grade app can cost $150,000 – $250,000.

|

Cost Component |

Estimated Cost Range |

What’s Included |

Timeline |

|

UI/UX Design |

$3,000 – $25,000 |

Wireframes, prototypes, and responsive design for borrowers & lenders |

3 – 6 weeks |

|

Frontend Development |

$5,000 – $40,000 |

Mobile/web app screens, borrower & lender dashboards |

6 – 12 weeks |

|

Backend Development |

$7,000 – $50,000 |

Loan matching engine, repayment tracking, scalable architecture |

8 – 14 weeks |

|

Database & Cloud Hosting |

$2,000 – $20,000 |

Secure database setup, cloud hosting (AWS/Azure/GCP) |

2 – 4 weeks |

|

Payment Gateway Integration |

$3,000 – $20,000 |

Stripe/PayPal basic vs. multi-gateway with instant settlements |

2 – 5 weeks |

|

KYC/AML & Compliance |

$2,000 – $15,000 |

Document verification, API integrations (Onfido, Trulioo, Jumio) |

3 – 6 weeks |

|

Credit Scoring Engine |

$3,000 – $40,000 |

Rule-based checks or AI/ML-powered risk assessment |

4 – 8 weeks |

|

Security Features |

$2,000 – $25,000 |

SSL, encryption, biometric login, PCI DSS compliance |

3 – 6 weeks |

|

Notifications & Alerts |

$1,000 – $10,000 |

Push notifications, SMS, personalized alerts |

1 – 3 weeks |

|

Admin Panel |

$2,000 – $20,000 |

User management, compliance tools, and fraud detection |

4 – 7 weeks |

|

Analytics & Reporting |

$2,000 – $20,000 |

Financial reports, dashboards, predictive analytics |

3 – 6 weeks |

|

Testing & QA |

$2,000 – $15,000 |

Manual + automated testing, performance/security checks |

3 – 6 weeks |

Based on the cost table, it can be identified that several factors exist that impact the final P2P loan lending app development cost.

Such includes:

-

App Feature and Functionalities: A simple app with basic borrower-lender matching will cost less, and with each added feature/functionality, the cost increases.

-

Tech Stack: The chosen tech stack further has a significant impact on your P2P lending app development cost. However, such a cost can better be compensated for with app scalability and growth.

-

Developer Location: The cost to develop a P2P App varies across regions. For instance, a mobile app development company in the USA will cost you more than a developer from India.

-

Compliance and Security Requirements: Financial apps need strict adherence to KYC, AML, and data protection laws. Stronger compliance measures and advanced security (biometric login, MFA, PCI DSS) significantly add to development costs.

-

Maintenance and Support Cost: It is important to address bug fixes, compliance updates, and feature enhancements of your P2P lending app. Hence, such costs add on to your set budget.

P2P Lending App Monetization Strategies

The only way to compensate for your P2P app development cost is to plan for key loan lending app monetization strategies.

Check out the approaches mentioned below for how P2P apps make money, and from these, you can pick relevant ones that align with your P2P business model.

A) Origination Fees

This is the one-time fee that is charged when a loan is disbursed. Every platform has its set standard, which can vary from 1% to 6% of the total loan amount processed.

B) Service Fees

A nominal fee is charged to the users (both borrowers and lenders) on each successful transaction. Such fees can include fees charged when the loan gets approved, fund additions, and even repayments.

C) Interest Rate margins

P2P apps connect borrowers with lenders, but in exchange for this, the app earns a small margin on the interest rate. For instance, a borrower might get the credit at 8%, but the lender might get only 7% and the remaining 1% is kept by the app.

D) Late Fee & Penalties

Another P2P app monetization strategy includes late fees and penalties. It is charged when the borrower fails to make repayment on time.

E) Subscription and In-App Purchases

These are also among the commonly preferred app monetization strategies adopted by the P2P apps. These include a premium membership for users.

For borrowers, such a subscription can bring loans at lower interest rates and waived transaction fees. Further, for lenders, it can be dedicated customer support, high-demand loan listing, and investment analytics.

F) Cross-Selling and Affiliate

To diversify their monetization strategy, P2P apps can plan for cross-selling financial products on their platform.

Through such cross-selling and partnerships, the P2P platforms can earn commission or affiliate fees.

Real-Life Examples of P2P Lending Apps

Peer-to-peer lending started gaining real attention in the United States. Several P2P lending apps showed how everyday people can borrow and invest without banks.

Here are four examples of the best cash advance apps or loan lending platforms that shaped the market.

1. LendingClub

LendingClub launched in 2006 and quickly became a leader in P2P lending. It started by letting regular investors fund personal loans. Borrowers applied online and received money without going through traditional banks.

Over time, it added services like auto refinancing and business loans. LendingClub has helped fund more than $60 billion in loans.

It remains one of the most recognized names in the U.S.; hence, creating an app like LendingClub is a significant business model to consider.

2. Prosper

Prosper came before LendingClub and started in 2005. It was the first marketplace that connected borrowers with people willing to lend. Borrowers could ask for loans up to $50,000. Investors could choose which loans to fund based on risk and credit score.

Prosper has funded more than $23 billion in loans. It proved that the idea to make a P2P lending app could work at scale.

3. Dave App

Dave is a popular financial app designed to help users avoid overdraft fees and manage money better. Instead of focusing on large loans, Dave offers small cash advances of up to $500 to cover daily expenses.

The app also provides tools like budgeting insights and credit-building features, making it more than just a lending platform.

With millions of users across the U.S., Dave has positioned itself as a go-to solution for people who want quick financial support without the heavy burden of high-interest loans.

4. Tilt (formerly Empower)

Tilt started as Empower and then rebranded. It focused on group lending and social money pooling. Friends or communities could raise funds for events, projects, or causes. It was later acquired by Airbnb, but left an important mark.

Tilt showed that lending could be social and not just one-on-one. Its model inspired others to create an app like Empower that blends finance with community.

Common Challenges in P2P Lending App Development

While focusing on how to create a P2P lending app, you also need to look for the potential P2P app development challenges.

These risks and challenges can be something that might act as a barrier in your app development as well as the app's functionality. These challenges can be:

1. Regulatory and Legal Challenges

Rules and regulations regarding lending, data protection, and AML are significantly reviewed and updated over time. Also, for specific regions, these regulatory aspects vary.

Hence, being updated and aligned with these regulatory and legal aspects is a key challenge. But it can’t be ignored, as any negligence can lead to a penalty and legal complications.

2. Credit and Default Risks

It is commonly noted that the borrowers on these P2P lending platforms have low credit ratings, which results in increased risk of default in repayment.

Hence, it becomes important to deploy robust credit scoring and validation models or use AI and alternative technology to ensure that investors’ money is secured.

3. User Trust and Acquisition

Building users’ trust at the initial level is challenging, as concerns about security, transparency, and data privacy are common in the fintech space.

Hence, such aspects rigorously impact the app's ability to acquire new users and retain its competitive positioning.

4. Scalability Issues

If you are proceeding with the basic version of your P2P app, with limited investment, you may face scalability issues in the long run. As the platform grows, the transaction and data volumes also rise.

Hence, to support such an improved scale, you need to invest in a better tech stack. Also, consider partnering with an experienced mobile app development company in Denver.

Future Trends in P2P Lending App Development

P2P lending is continuing to become one of the key segments in the fintech space, with expanding interest of users.

Following this, the future of P2P lending will be defined by its integration with advanced technologies, offering more personalized and accessible services to users.

Let’s take a look at some key trends in P2P loan lending app development that you can consider, along with deciding on how to develop a P2P lending app.

1. Use of Artificial Intelligence

The use of AI and related applications in P2P lending apps will scale at large. It will help refine credit scoring and personalize loan offers. Also, AI chatbots are becoming a popular option for developers planning to make a P2P lending app.

2. Enhanced Risk and Credit Evaluation

With emerging tech support, the P2P platforms will focus on adopting approaches to thoroughly evaluate the risks associated with each transaction. Hence, making the platform safe and secure for all.

3. Blockchain and DeFi

Another noteworthy trend in the field of P2P lending is the focus on decentralized finance models backed by blockchain in loan lending apps. Such will help boost transparency, security, and automation through smart contracts.

4. Gamification

P2P apps will plan for interactive elements that can help drive user engagement and encourage financial literacy. Such can include reward points, loyalty bonuses, and other aspects.

How JPLoft can help create a P2P Lending App?

By now, you must have a detailed understanding of how to create a P2P lending app and plan for its scalability. But to ensure such growth and scalability, you need to look for a trusted partner who can help you bring your vision into reality.

JPLoft is a leading loan lending app development company with years of experience developing fintech apps and helping startups scale. Whether you are planning for a basic MVP version or an advanced loan lending app with futuristic features, our experts can help you with all.

We are not just a company offering development services, but are your partner who better understands the market trends, development challenges, and project complexities. Hence, partnering with JPLoft can help you get a P2P lending solution that aligns with your goals and is ready to scale.

Conclusion

Now, we are at the end of the discussion on how to build a P2P lending app. It can be concluded that the rise of P2P lending is more than just a fintech trend. It’s a reflection of how people access and provide credit.

However, to build a P2P app, you need to plan for a proper balance between the market trends, compliance, innovation, security, and user trust. From planning the right features and tech stack to ensuring regulatory adherence and scalability, every step plays a significant role in your P2P platform's success.

If you are planning to enter this space, the effective way would be to start with a clear development strategy, a reliable tech partner, and a focus on long-term sustainability.

So, partner with the expert developers at JPLoft and create a peer-to-peer lending app that is accessible, tech-driven, and scalable.

FAQs

The cost to develop a P2P lending app can range from $20,000 to $250,000, depending on the planned features and functionality of the app. However, with the rising platform complexity, such a cost can increase further.

The key features of a P2P app include a personalized dashboard, automated loan processing, a loan calculator, a secure payment gateway, personalized recommendations, and other AI or tech-powered features.

The monetization strategies of P2P lending apps include origination fees, origination fees, service fees, earnings through interest rate margins, cross-selling, affiliate commission, and other innovative monetization models that can align with your P2P app model.

To develop a P2P loan lending app, you need to follow a thorough process from conducting detailed market research, drafting your app design, planning for the tech stack, and accordingly proceeding with the P2P lending platform development process.

P2P lending apps face several common challenges, such as regulatory and legal threats, the risk of default from users with low credit scores, difficulties in retaining users’ trust, and the need to scale the app in a competitive marketplace.

Share this blog