"Access is better than ownership." — Kevin Kelly.

This quote perfectly reflects today’s entertainment era, where people prefer instant access to shows, movies, and live events rather than traditional cable or physical media.

But what do the latest video streaming market statistics actually tell us?

They reveal that streaming has become the dominant way audiences consume content globally.

From Netflix and Disney+ to regional OTT apps, platforms are battling not just with massive libraries but also with personalization, immersive experiences, and AI-driven recommendations.

The statistics highlight rapid growth powered by subscriptions, ads, and transactional models, fueled further by the rise of 5G and smart devices.

For businesses, investors, and startups, these numbers are more than industry data; they’re insights into evolving user behaviors and opportunities to shape the future of entertainment.

Let’s learn about the complete video streaming market app stats in this blog.

An Overview of Video Streaming Apps

Video streaming apps deliver media content over the internet, eliminating the need for users to download files.

The growth of online consumption has catapulted video streaming apps to the forefront of contemporary entertainment. Ranging from Netflix and Disney+ to YouTube and local OTT players, viewers now increasingly opt for on-demand, mobile-based experiences over cable.

Now, platforms are not only fighting in terms of content libraries but also over personalization with the help of AI to suggest shows, improve quality, and keep users hooked.

Video streaming app market statistics from recent times have indicated that the sector is expected to keep its rapid ascent going with subscriptions, advertising income, and emerging technologies such as 5G and AR/VR applications.

For investors, media companies, and start-ups, the figures all point to one thing: the future of entertainment is apps with accessibility, immersive experiences, and data-driven personalization.

Hence, look at the broad area of video streaming market stats, and discuss the numbers below.

Key Insights of the Video Streaming Market Statistics

First, let’s have some key insights into the video streaming market stats.

-

Global Market Size: Valued at USD 104.1B in 2023, projected to reach up to USD 2.47T by 2035 (CAGR between 6.9% and 21%).

-

North America: Held 44.2% share in 2024 (~USD 46.05B), the U.S. alone at USD 39.8B.

-

Asia-Pacific: Fastest growth, China captured a 27% share in 2024; smartphone boom drives demand.

-

Europe: Accounted for 28.6% of global revenue in 2024, expected CAGR 21.7% (2025–2030).

-

User Behavior: Americans spend 3+ hours daily streaming; 72% satisfied, and 93% will maintain/increase subscriptions.

-

Revenue Models: Subscriptions lead with 52.8% share (1.8B subscriptions), AVOD at $38B (2023), TVOD to grow from $40.6B in 2024 to $132.9B by 2035.

-

Devices: Smart TVs (74.5%) lead, followed by streaming sticks (64%) and gaming consoles (43.5%).

-

Top Platforms: Netflix (277M subs), Prime Video (230M users), Disney+ (127.8M subs), WB Discovery (117M subs).

-

Content Trends: Live streaming leads with 61% share; short-form, interactive, hybrid storytelling, and niche originals are rising fast.

-

Tech Drivers: AI personalization boosts engagement by 30%, 5G enables 20× faster speeds, AR/VR and blockchain enhance immersive and secure streaming.

Are you ready to learn a detail on the video streaming industry stats? Let’s get ahead, together.

Global Video Streaming Market Size and Growth

Let’s look at the key video streaming market size and growth that will help you draft the current segment and evaluate present target audiences as well as future prospects of growth in the industry.

We understand that when you start an online video streaming business, looking ahead to its growth opportunities is paramount.

Hence, here you will learn about the global video streaming market size and the respective industry.

-

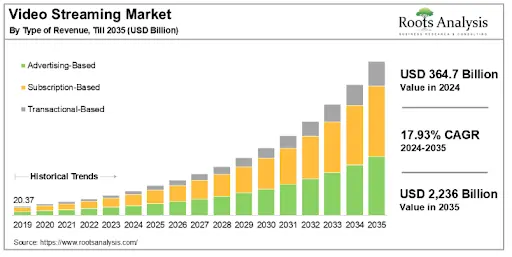

The global video streaming market size was valued at USD 104.1 billion in 2023, poised to grow from USD 111.28 billion in 2024 to USD 189.78 billion by 2032, which is growing at a CAGR of 6.9% in the forecast period (2025-2032).

-

Additionally, as per Grand View Research, the market size was estimated at USD 129.26 billion in 2024, which is projected to reach USD 416.8 billion by 2030. This market is growing at a CAGR of 21.5% from 2025 to 2030.

-

However, when it comes to Business Fortune Insights, the market size was valued at USD 674.25 billion in 2024 and is estimated to reach USD 2,660.88 billion by 2032.

-

The global video streaming market size accounted for USD 129.80 billion in 2024, and is further projected to reach around USD 865.85 billion by 2034, which is growing at a solid CAGR of 20.90% from 2025 to 2034.

-

Along with this, as per Straitsresearch, the video streaming market statistics represent a value of USD 130.28 billion in 2024, and are further projected to grow from USD 156.86 billion in 2025 to reach USD 692.68 billion by 2033, exhibiting a CAGR of 20.40% during the forecasted period (2025-2033).

-

The video streaming market size reached USD 192.0 billion in 2025, which is further forecasted to grow to USD 324.0 billion by 2030.

-

Based on the report by Zion Market Research, overall video streaming market size was valued at USD 615.93 billion in 2023, which was then predicted to reach USD 3226.07 billion by the end of 2032.

-

Research Nester has stated that the size of the market was over USD 416.16 billion in 2025, which is projected to reach USD 2.47 trillion by 2035, growing at a CAGR of 19.5% during the period between 2026 and 2035.

-

As per the research by Custom Market Insights (CMI), the complete video streaming software market is estimated at USD 11.54 billion in 2024 to reach USD 13.86 billion in 2025, which is expected to hit around USD 78.2 billion by 2034, growing at a CAGR of 21.09%.

-

The expected market size of the video streaming market is expected to be around USD 285.4 billion by 2034, from USD 104.2 billion in 2024.

-

Based on the research by Business of Apps, the video streaming industry generated $233 billion in 2024, which comprises free video streaming apps.

-

User penetration in the video-streaming app market sits around 17% in 2025. By 2027, this figure is expected to reach 20.7%.

This was all about the global market. However, what about building a video streaming app for the regional audience and users? Then, you should be aware of the regional market, right?

Hence, let’s check out the following section of the regional video streaming market insights.

Regional Video Streaming Market Insights

The regional video streaming insights will depict the current demand in the particular region.

When you start an online video streaming business, it's about serving your region first, and later comes other states, which is further followed by the global video streaming market.

Hence, in this section, we will discuss the overall regional video streaming market stats related to the specific regions, which will be helpful to understand the region-based audience interested in the video streaming landscape.

Let’s learn about the region-based video streaming market stats in 2025.

1. North-America Region

In 2024, North America led the market, holding a dominant share of over 44.2% with revenue of approximately USD 46.05 billion.

Here, the region's growth is driven by the high internet penetration, advanced infrastructure, and a strong presence of leading streaming service providers.

Here, you will find that the U.S alone displayed a market size of USD 39.8 billion, underscoring its pivotal role in this sector.

Additionally, the North American region is set to dominate around 39.1% market share by 2035.

2. Asia Pacific Region

The Asia Pacific video streaming market is projected to experience considerable growth by 2035, driven by the growing mobile-first streaming services.

Here, the number of smartphone users has increased from 150 million to 750 million from 2014 to 2022.

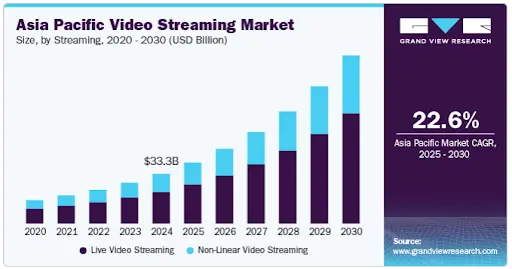

Along with this, as per the video streaming market stats of Grand View Research, which was estimated at USD 33.32 billion in 2024, it is projected to grow at a CAGR of 22.6% from 2025 to 2030.

The overall consumer segment dominated the Asia Pacific video streaming market due to its widespread adoption for personal entertainment and leisure.

Additionally, when it comes to the Asia-Pacific market, China's video streaming market trends have led to a share of 27% in 2024.

The reason behind such growth is a large population, high internet penetration, and strong consumer demand for streaming content, which has helped the region to reach the top position.

3. Europe Market

Europe is a significant market when it comes to analysing the use of video streaming platforms in the country.

This market is driven by increasing internet penetration, the popularity of online video content, and the increasing demand for live streaming services across diversified industries.

The overall European video streaming market generates a revenue of USD 36,979.3 million in 2024; furthermore, this market is expected to grow at a CAGR of 21.7% from 2025 to 2030.

.webp)

The global video streaming market generated a revenue of USD 129,257.3 million in 2024 and is expected to reach USD 416,839.4 million by 2030.

In terms of revenue, the European region accounted for 28.6% of the global video streaming market.

4. United States

The U.S video streaming market generated a revenue of USD 22,423.4 million in 2024, and is expected to reach USD 66,407.4 million by 2030. Furthermore, this market is expected to grow at a CAGR of 19.8% from 2025 to 2030.

There are many reasons for this increasing market growth, including the growing craze for content among users, increasing engagement for the original content, and much more.

Considering this regional market video streaming stats, let's move ahead to understand the user demographics and behavior in the proceeding section.

User Demographics and Behavior

Users in the video streaming market play an important role, and understanding their changing behavior is one of the crucial perspectives that you cannot ignore.

Hence, let’s proceed to evaluate the user perspective on video streaming apps.

Americans usually spend 13 hours and 11 minutes per day on digital media, and according to Forbes, 3 hours and 6 minutes is spent on video streaming services. These stats are only likely to increase in the future based on the current consumer demand.

Additionally, it has been observed that 72% of Americans love their user experience with video streaming services. Along with this 93% were intended to either maintain or increase their streaming options.

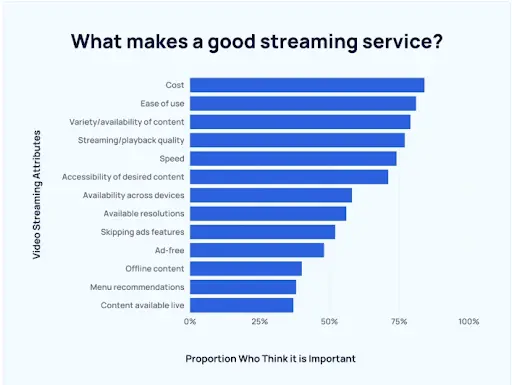

If you are imagining what makes a video streaming platform attractive and engaging to use, the reasons are cost, ease of use, availability of content, speed, and much more.

Hence, if you are designing a video streaming app, it is evident to opt for attracting and engaging design features such as accessibility of desired content, availability across desired content, and much more.

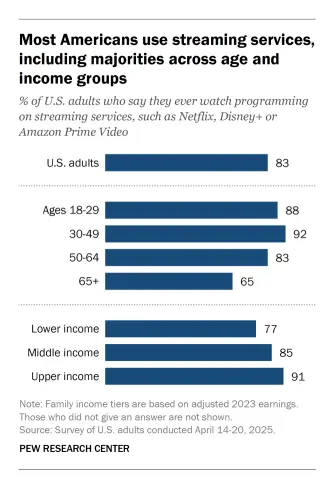

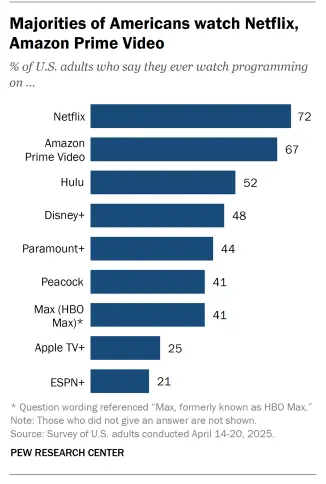

According to the PEW research center, about 88% of users are between the ages of 18 and 29, using video streaming platforms. While there are 92% of users fall under the age group of 30 to 49 years old, using the video streaming platform.

However, when you check out the above data, there is a majority of US people who prefer to watch Netflix and Amazon Prime Video.

Well, it can be stated that about half of the streaming service users aged 18 to 29 use someone else’s password to browse streaming shows.

With these user demographics, it will become simple to evaluate the current users' demands, which will further be helpful in bridging the existing gap.

Revenue Breakdown by Segment

When evaluating the core video streaming app market statistics, you should know what the revenue breakdown by segment brings to the table.

Revenue breakdown is a crucial pathway to know how the video streaming app market is sustaining in the high competition.

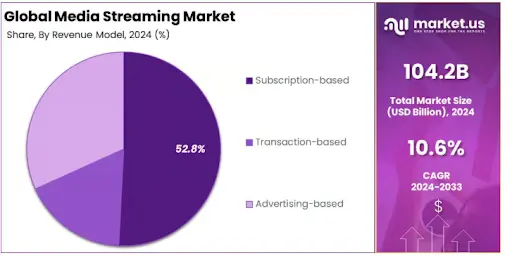

Based on the above graph, it can be depicted that the video streaming market, as per the revenue, is segmented into three areas: advertising, subscription, and transaction where the subscription and advertising market is leading the sector.

Let’s learn it all in this section.

1. Subscription-Based Segment

When it comes to the subscription-based segment, it holds a dominant market position in the media streaming market, capturing more than a 52.8% share. This leading position can be attributed to the consistent revenue streams as well as customer loyalty.

The overall subscription-based model’s dominance in the media streaming market is supported by the ability to provide convenience, value, and personalized experiences to the target users.

-

There are approximately 1.8 billion subscriptions to video streaming services.

-

Based on the reports of Forbes, it has been estimated that there were 1.1 billion subscriptions to the online video streaming services worldwide.

-

Along with this, at least one video streaming platform subscription can be found within 83% of US households.

2. Advertising-based Revenue

Multiple video streaming platforms are leaning on ad-supported models to expand their reach and stabilize revenue. Along with this, as per video streaming market stats, on the advertising video on demand (AVOD), the users watch content for free, but see pre-roll, mid-roll, or post-roll ads.

However, the free ad-supported streaming TV (FAST) channels do mimic traditional TV with scheduled programming and ads.

Additionally, the global AVOD market is expected to grow more in the coming years, reaching $38 billion in 2023.

3. Transactional-Based Revenue

The global transactional video-on-demand market is projected to grow significantly from 40.6 USD billion in 2024 to 132.9 USD billion by 2035.

This is the market that totally runs on the concept of where the users pay per use (eg, they buy individual content). It is further expected to grow at a 11.38% CAGR.

It means that if you are building an app like YouTube, then following the TVOD model can help you to stand out from the competitors and scale up your overall performance in this diversified market.

Now, let’s move ahead with the video streaming platform-based market stats to identify how diversified devices and platforms react.

Device and Platform Video Streaming Market Statistics

The device and platform play a very important role when it comes to the video streaming market. Here, if the videos do not work on the specific platforms, then it can result in losing the target users.

Additionally, YouTube is the most popular free video streaming app in the world, with 2.4 billion users. However, Netflix has the most subscribers of all video streaming platforms, standing at 277 million.

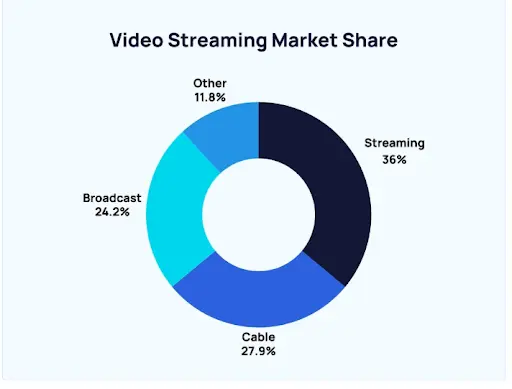

When it comes to how people like to watch their favorite series and serials, the Smart TV is the most popular streaming device, which is used by 74.5% of households. Streaming sticks come second at 64%. However, the gaming consoles are gaining ground and are used by 43.5% of viewers for streaming content.

36% of all TV usage is dedicated to streaming services.

Based on the above stats, streaming is now popular than either cable or broadcast, demanding 36% of the total TV usage.

It has been found that the viewers are streaming on the go, with 65% of streaming time spent on mobile and TV apps.

Let’s evaluate the top video streaming platform market statistics below.

.webp)

1. Netflix

Netflix is the app that has the most subscribers worldwide, at 277 million. Prime Video, primarily used by Prime subscribers, had about 230 million users.

When it comes to building a similar app, it's significant to look forward to the cost. Here, you should note that the complete cost to develop an app like Netflix varies from $25,000 to $250,000, which further depends on multiple factors such as the complexity of features, design, tech stack, and many others.

2. Prime Video

The revenue of Prime Video is approximately $14 billion in 2023. This platform has approx. 210 million users, most of them pay for the video streaming app via their Prime account.

The content spend for Prime Video increased in 2023 to $18.9 billion, which is higher than that of Netflix. Additionally, Prime Video and Netflix are tied in the very first place for market share in the US market.

3. Disney+

As of mid-2025, Disney+ has about 127.8 million paid global subscribers. In the US & Canada, about 57.8% of people use the video streaming app. Additionally, Disney+ had approximately 127.8 million global subscribers as of the third quarter of 2025, with reports also indicating 157 million global monthly active users.

Additionally, this platform had 127.8 million global subscribers, which places it as the third-largest service after Amazon Prime Video and Netflix.

4. WB Discovery

WB Discovery is one of the significant players in the production and distribution of TV programs and series. This platform counts 117 million subscribers as streaming swings to a profit.

By the end of September, Warner Bros. Discovery reached 110.5 million global streaming subscribers spanning its platforms Max and Discovery+.

Well, these were some of the common video streaming apps you can check out, and you can consider these top video streaming apps to further the development process.

Now, let’s proceed with the following section stating the content trends within the video streaming app market.

Content Trends in the Video Streaming App Market

When it comes to the streaming types, live video streaming leads the market, accounting for approximately 61% of the global share. Such dominance is related to the growing demand for real-time content that comprises sports events, concerts, and news broadcasts.

However, in the year 2024, the e-learning segment holds a dominant market position in the media streaming market through capturing more than 38.5% share. Such a type of prominence is largely driven by the overall global shift towards digital education platforms.

Let’s learn in detail about the content trends within the video streaming app market in this section.

1] A Shift to Short-Form Content

There is a rise in the short-form content in Asia, which is now influencing Western markets. Here, the platform is experimenting with vertical video feeds.

Here, the users are shifting towards the snackable videos that last anywhere from 30 seconds to 10 minutes.

2] Interactive and Gamified Experiences

Here, you need to select the ending shows, quizzes, polls, and gamified reality formats that will help you enhance the complete performance of the apps.

Additionally, there is a demand for shoppable content where the viewers can buy directly from the stream.

3] Originals and Niche Genres

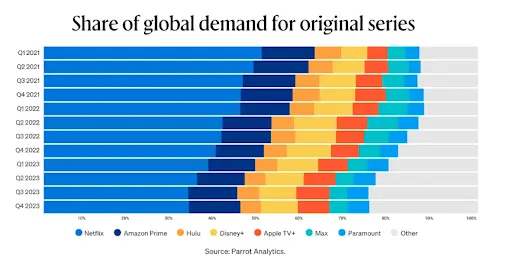

As per the above graph, the share of global demand for the original series is growing. According to the insights firm, smaller streamers, including Disney+ and even YouTube originals, grew their share to 36% in the past years. This represents a boom towards original series and content.

4] Hybrid Storytelling

The rise of the documented dramas, scripted reality, and blended animation, as well as live action, subsequently enhances the trend of hybrid storytelling video streaming apps.

Here, cross-format collaborations such as music, film, game, and drama play an efficient role.

5] Rise of Live Streaming & Events

The live streaming market size was estimated at USD 129.26 billion in 2024, and is projected to reach USD 416.8 billion by 2030, growing at a CAGR of 21.5% from 2025 to 2030.

Additionally, 61.8% of the video streaming market implies that the live streaming formats make up a smaller proportion within their categorization.

Till now, we have discussed the global, regional, revenue-based, and how diversified apps are leading in the video streaming app industry.

Now, let’s learn about video streaming industry statistics based on the impact of technology in the following section.

Impact of Technology on Video Streaming

The type of technology you select for improving your video streaming app completely changes the view and preferences of the users.

Partnering with an AI app development company can further enhance this experience by integrating personalization, automation, and smarter recommendations.

Present trends in technology play a vital role when it comes to video streaming platforms.

Hence, let's evaluate the role of technologies in the current video streaming market.

A] High-Speed Internet & 5G Deployments

5G networks have theoretical top speeds of as much as 20 Gbps, as opposed to 1 Gbps for 4G — a ~20× increase.

Practically, 5G enables streaming services to enable low-latency 4K and 2K video even during peak usage hours.

Further, for live content, 5G can lower production costs by up to 90% in certain instances due to simplified logistics and remote broadcasting.

B] Artificial Intelligence in Personalization of Content

AI-powered platforms for personalization reported a ~30% increase in viewer engagement and retention. AI in video streaming apps helps to provide users with personalized content by advising them on what’s most suitable to watch as per their preferences.

Over 75% of streaming services use AI to suggest content that is personalized for users.

AI enhances the efficiency of adaptive streaming by 25% on average, decreasing buffering or quality changes.

C] Cloud Computing & Scalability

Cloud infrastructure supports elastic scaling, absorbing traffic bursts for large releases or live events without hardware overprovisioning.

According to some research, it is possible to reduce operational costs up to 30% through improved utilization of resources.

Distributed content delivery (multi-region cloud + edge) allows platforms to minimize latency and failure likelihood when there is high demand.

D] Adaptive Bitrate Streaming (ABR)

ABR systems adapt the quality of video (bitrate) in real time in accordance with existing network conditions to minimize buffering and ensure viewing continuity.

Studies demonstrate that newer 5G networks provide 2K/4K low-latency streaming even during full load, boosting ABR's performance.

In actual implementations, adaptive streaming powered by AI is utilized by ~73% of leading platforms to make delivery optimal.

E] Immersive Tech: AR, VR & 360° Video

With 5G and edge computing's bandwidth headroom, immersive video forms are feasible in consumer applications (concerts, VR tours, interactive events).

The video streaming app market statistics state that the use of AR and VR in video streaming apps enhances user experience through providing immersive, engaging, and interactive user experiences.

They heighten user participation with content that's participatory, not passive, driving session times.

As platforms seek out differentiated experiences, immersive formats are a means of differentiation in the face of subscription fatigue.

F] Blockchain & Enhanced Security

Blockchain is being explored for decentralized DRM (digital rights management), verification of content monetization, and tracing piracy. With leading blockchain app development services, you can identify the importance of implementing blockchain for enhancing transparency.

AI-enforced copyright protection (with blockchain) reportedly decreased infringement cases by ~60% in certain platforms.

Since transactions are transparent and resistant to tampering, they establish trust among creators, platforms, and users for content ownership and payment.

Future Outlook of the Video Streaming Market

Learning about the future outlook will help you evaluate what will come next. It will help you to identify the key video streaming app trends.

Let’s evaluate the following future outlook within the video streaming market.

1. Ad-supported and Hybrid Monetization Models

Ad-supported and hybrid (subscription + ads) models are increasingly taking the place of pure subscription models. Advertising revenue will become a larger source of profitability, particularly in competitive markets where new paying user acquisition becomes more difficult. This model supports a lower entry price or is even free with ads.

2. Hyper-Personalization

With all this content out there, retention of users relies on the ability of platforms to surface what people want to view. AI and machine learning will drive more in-depth personalization—mood, context, viewing history, and even device usage-driven recommendations. What this essentially means is your app will require smarter backend algorithms, rather than UI sheen.

3. Rise of Interactive and Immersive Content

Streaming will not be a passive viewing experience. Watch for more attempts at interactive storytelling, game-ification of shows, and virtual/augmented reality overlays. These may change what "video streaming" is, more of an experience than a program.

4. Consolidation, Partnerships, and Vertical Growth

The market will witness further mergers, acquisitions, and strategic partnerships. Large media conglomerates will package streaming with telecom, gaming, or commerce. Smaller niche players will be acquired or have a partnership with larger systems in order to stay afloat.

5. Increasing Regional Content Demand

Emerging market growth will be fueled by regionally appropriate content, languages, local storytelling, and local voices. Global players will have to aggressively localize if they are to drive deep markets. This equally implies that copyright, licensing, and regulatory frameworks are paramount.

6. Pressure on Infrastructure: Latency, edge, Sustainability

Since consumers want instant, high-quality streaming (4K, live events), platforms will rely more and more on edge computing, improved CDNs, and adaptive streaming standards. In addition, sustainability will be an issue—energy consumption of streaming at scale is being questioned in technology circles.

How Connecting with JPLoft Can Help?

When it comes to building advanced digital solutions like AI-powered video streaming apps, choosing the right development partner makes all the difference. JPLoft is a leading video streaming app development company that specializes in delivering scalable, user-friendly, and future-ready platforms designed to meet global standards.

By connecting with JPLoft, you gain access to a team that not only understands the technical foundations of video streaming but also stays ahead of market trends such as AI personalization, hybrid monetization models, and immersive content delivery. With 6+ years of experience and 1100+ projects delivered, JPLoft has supported startups and enterprises with solutions tailored to unique business goals.

The brand emphasizes innovation, combining AI, AR/VR, blockchain, and cloud technologies to transform streaming platforms into engaging user experiences. Whether it’s enabling live streaming, integrating low-latency playback, or creating intelligent recommendation engines, JPLoft ensures your app maximizes audience engagement while staying cost-optimized.

We blend AI, AR/VR, blockchain, and cloud to turn streaming ideas into engaging products, from live streaming and ABR to multilingual search, recommendations, and analytics. If you’re planning to scale fast, you can also hire dedicated developers from JPLoft to extend your in-house team and accelerate delivery without compromising quality..

Partnering with JPLoft means securing not just an app but a long-term technology ally who can scale alongside your vision.

Conclusion

Video streaming is past experimentation and in scale mode. Market size projections vary, but all point upward, powered by subscriptions, ads, and a growing TVOD slice. North America leads revenue today, Asia-Pacific accelerates fastest, and Europe remains.

Usage habits favor Smart TVs, mobile, and on-the-go viewing; live, short-form, and interactive formats keep attention high. 5G, AI personalization, cloud, and ABR raise quality while AR/VR and blockchain shape the next wave.

For founders and media operators, the playbook is hybrid monetization, local originals, and infrastructure built for reliability. Partner with experts like JPLoft to turn these numbers into products audiences love.

FAQs

Subscriptions, advertising, and expanding TVOD revenues, reinforced by AI personalization, 5G rollout, cloud scalability, and adaptive bitrate streaming across platforms.

The global video streaming market is valued at over $192 billion in 2025, projected to exceed $416 billion by 2030 (Grand View Research).

North America leads revenue today; Asia-Pacific grows fastest, with China’s scale, smartphone adoption, and mobile-first viewing accelerating demand across markets.

Live streaming, short-form clips, and interactive experiences dominate attention, supported by watch parties, co-viewing, sports rights, and event-based moments globally.

Smart TVs lead household usage, followed by streaming sticks and gaming consoles, while mobile apps capture significant on-the-go viewing time.

Adopt hybrid monetization: subscription for loyalty, AVOD and FAST for reach, and TVOD for premium releases, events, and exclusives profitability.

Share this blog