Key Takeaways:

A BNPL app works by splitting payments into easy installments, which boosts user satisfaction and merchant conversions.

Choosing the right model (pay-in-4, rent-to-own, vertical BNPL, SME financing, card-linked BNPL) decides your revenue and risk strategy.

Winning BNPL apps rely on features like instant credit checks, flexible EMIs, biometrics, virtual cards, loyalty rewards, and an intuitive dashboard.

Building a BNPL app requires clear research, regulatory planning, secure payments, risk scoring systems, and a clean UI/UX.

The average cost to develop a BNPL app ranges from $20,000 to $250,000+, depending on features, security, and AI infrastructure.

Development timelines span 4 to 9 months, moving through discovery, design, backend, frontend, security testing, and launch.

Top BNPL apps like Klarna, Afterpay, Affirm, Zip, and Sezzle set the benchmark for smooth UX and transparent lending flows.

Compliance is non-negotiable — KYC/AML, PCI-DSS, lending laws, licensing, and data privacy must be in place from day one.

Key challenges include liquidity crunch, fraud risk, merchant integrations, and long-term user retention, all solvable with smart tech and planning.

BNPL apps make money through merchant fees, interchange, late fees, subscription tools, insights, and co-branded offerings.

AI is shaping the future of BNPL through predictive scoring, behavioral analytics, micro-lending, and embedded checkout journeys.

Did you know that the global Buy Now Pay Later (BNPL) market is projected to reach nearly $4 trillion by 2030?

That isn’t just a trend; it represents a massive shift in consumer psychology. Today’s shoppers crave flexibility. They want the freedom to buy what they need immediately without the crushing weight of high-interest credit card debt.

This demand has opened a massive door for entrepreneurs.

If you are looking to enter the financial space, this is your moment. When you create a BNPL app, you aren't just offering a payment method; you are offering financial breathing room.

For businesses and startups, this is one of the most lucrative entry points into the digital economy. Let’s look at how you can seize this opportunity.

Understanding the BNPL Ecosystem

So, what exactly is a BNPL app?

Think of it as the modern, digital evolution of "layaway," but with instant gratification.

Instead of waiting weeks to take a product home, customers receive it immediately. The app allows them to split the total cost into smaller, manageable installments over a set period.

Crucially, this is often done with zero interest if paid on time.

It is a win-win scenario. Merchants enjoy higher cart conversion rates, and customers get to manage their cash flow better without breaking the bank.

When you set out to create a fintech app like this, you are building a bridge between desire and affordability. You are empowering users to budget smarter while giving merchants the sales volume they crave.

How It Works: The User Journey

If you plan to build a BNPL app, simplicity is your best friend. The user experience should be frictionless. Here is how it usually looks from the customer's perspective:

-

Shop & Select: The user shops at a partner store (online or offline) and heads to the checkout.

-

Choose BNPL: Instead of a credit card, they select your BNPL service as the payment option.

-

Instant Approval: The app runs a "soft" credit check in seconds—no impact on their credit score.

-

Small Down Payment: The user pays a fraction of the cost upfront (usually 25%).

-

Schedule & Relax: The remaining balance is automatically deducted in installments (e.g., every two weeks).

Choosing the Right Model for Your BNPL Venture

One size does not fit all.

Before you develop a BNPL app, you need to decide which business model aligns with your goals.

Here is a breakdown of the different approaches you can take to stand out in the market.

1. Integrated Shopping Apps

This is the "Super App" approach used by giants like Klarna or Afterpay. Here, you create a Buy Now Pay Later App that acts as a shopping destination itself.

Users browse various brands within your app, and you handle the financing for everything they put in their cart. It’s an all-in-one ecosystem.

2. Off-Card Financing Solutions

This model targets mid-to-high-value purchases. Think furniture, electronics, or sports equipment.

It usually involves a longer repayment period (6–12 months) and may include subsidized interest.

It requires you to build strong partnerships with specific retailers who want to move expensive inventory.

3. Virtual Rent-to-Own

This is a vital model for inclusivity.

When you develop a Buy Now Pay Later App with a rent-to-own focus, you target users who might have poor credit scores.

You purchase the item, and the user rents it from you until the total value is paid off. It’s a great way to serve an underbanked audience.

4. Vertical-Focused Large Ticket Plays

Instead of being everything to everyone, go niche. You can develop a BNPL app specifically for high-cost industries like healthcare (elective surgeries), home improvement, or travel.

By focusing on a specific vertical, you become the expert solution for that industry’s specific pain points.

5. Card-Linked Installment Offerings

This is a "post-purchase" model. The user buys something with their existing credit card.

Then, your software steps in to convert that specific transaction into an installment plan. It’s seamless because it leverages the plastic they already have in their wallet.

6. SME Sales Financing

Don’t forget B2B! Small businesses need cash flow, too.

You can create a BNPL app that allows businesses to buy inventory or equipment now and pay later. It helps SMEs grow without draining their working capital immediately.

So, these are some of the most common types of BNPL ventures. Now, let’s explore the different features that are important for launching a new Buy Now Pay Later platform.

The Emerging BNPL App Market

The Buy Now, Pay Later (BNPL) app market is undergoing a significant transformation, driven by the global surge in e-commerce, increasing digital payment adoption, and a strong consumer preference for flexible, interest-free installment options.

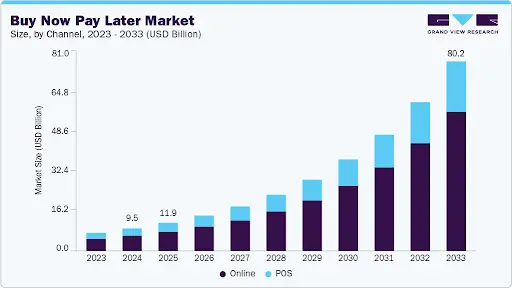

Let's examine the key insights from the BNPL app market statistics:

-

The estimated total value of the BNPL app market is USD 9.50 billion. The market is forecasted to reach USD 80.15 billion by 2033.

-

CAGR (2025-2033): The Compound Annual Growth Rate is projected at 27.0%.

-

Largest Market in 2024: North America held the dominant market share.

-

Fastest Growing Market: Asia Pacific is expected to exhibit the highest rate of growth throughout the forecast period.

This growth opens big doors for anyone ready to hire mobile app developers and build a strong BNPL product, but first, let’s break down the core features you’ll need.

Features to Have in a BNPL App To Stand Out

The market is getting crowded, and simply splitting payments isn't enough to win anymore.

To truly capture the modern consumer, you need to offer a seamless, intuitive experience that solves real friction points.

Focusing on the right Buy Now Pay Later App Features is the difference between an app that gets deleted and one that becomes a daily financial companion.

Here are the essential features your app needs to dominate the space.

1. Instant Credit Decisioning

No one likes waiting in line, especially online.

Using AI-driven algorithms, your app should assess a user's creditworthiness in seconds via a "soft check."

This keeps the user in the shopping flow, boosts conversion rates instantly, and ensures they don't abandon their cart due to a lengthy, bureaucratic approval process.

2. Flexible Repayment Scheduling

Don't box your users in with a single option.

While "pay in 4" is the industry standard, offering customizable options for weekly, bi-weekly, or monthly payments gives users real control.

This flexibility reduces default rates because customers can choose a timeline that aligns perfectly with their actual paycheck cycle.

3. Advanced Security & Biometrics

Trust is the currency of finance. Implementing FaceID, fingerprint scanning, and two-factor authentication (2FA) is non-negotiable.

These standard Fintech app features protect sensitive financial data, ensuring your users feel safe connecting their bank accounts to your platform while keeping fraud attempts at bay.

4. Smart User Dashboard

Transparency builds loyalty.

Your app needs a clean, intuitive dashboard where users can see upcoming payments, total outstanding debt, and payment history at a glance.

This helps users manage their budget effectively and prevents the "sticker shock" of hidden fees or forgotten due dates.

5. Virtual Cards

Make your service universal.

By generating a temporary virtual card for online shopping, users can utilize your BNPL service at merchants that haven't officially integrated with you yet.

It vastly expands where your customers can shop, making your app their go-to payment tool regardless of the store.

6. Automated Payment Reminders

Help your users succeed. Life gets busy, and missed payments hurt everyone.

Sending friendly, automated push notifications or SMS reminders a few days before a due date significantly reduces delinquency rates and saves your customers from frustrating late fees, keeping the relationship positive.

7. In-App Shopping Marketplace

Keep them in your ecosystem. Instead of just being a payment method, build a catalog of partner stores directly inside the app.

This drives traffic to your merchant partners and creates a seamless browsing experience where financing is already baked in, increasing average order value.

8. Loyalty & Cashback Rewards

Gamify financial responsibility. Reward users for paying on time or paying early with points, discounts, or cashback.

This positive reinforcement not only encourages healthy financial habits but also turns casual users into brand advocates who stick with your platform over competitors.

Now that you have a clear vision of the features that drive success, let's break down the actual steps you need to take to create a Buy Now Pay Later App.

How to Create a BNPL App?

Building a financial product is a journey, not a sprint.

To understand how to develop a BNPL app that truly disrupts the market, you need a roadmap that covers everything from initial research to post-launch monetization.

Here is a comprehensive guide to turning your fintech vision into a functioning, profitable reality.

Step 1: Conduct Market Research and Define Your Niche

Before writing a single line of code, you must understand the landscape. You can’t just replicate what exists; you need to find the gaps where the giants aren't looking and claim that territory for yourself.

► Identify Your Target Audience

You need to get granular here.

Are you targeting Gen Z fashionistas who need split payments for streetwear, or families managing monthly grocery bills?

Pinpointing exactly who will use your app allows you to tailor the user experience and marketing language to their specific pain points and spending habits.

► Analyze Competitors

Don't just look at Klarna or Afterpay; look at what they aren't doing.

Study existing BNPL apps in the market to identify their weak spots, whether that’s high fees, clunky interfaces, or poor customer support, and use those insights to position your product as the superior, more user-centric alternative.

► Understand Regulatory Requirements

Fintech is a high-stakes game with strict rules.

You must dive deep into the legal and financial regulations that govern BNPL services in your target regions.

Ignoring compliance laws regarding lending, data privacy, and consumer protection can sink your startup before it even floats, so consult legal experts early.

Step 2: Define Your App’s Core Features and Functionality

When you begin the process to create a Buy Now Pay Later app, the feature set is your toolkit. You need to balance simplicity for the user with robust capability for the business.

►User Registration and Profile Creation

Onboarding is the first hurdle; make it effortless. Ensure users can easily create accounts with secure login options like email, phone number, or social logins.

The goal is to get them through the door and verified (KYC) as quickly as possible without compromising security, reducing the drop-off rate during sign-up.

► Payment Methods and Installment Options

Choice is the ultimate luxury. You should offer flexible payment plans, such as weekly, bi-weekly, or monthly installments.

By giving users control over how they split their payments, you align with their cash flow, making them more likely to complete a purchase and return for future transactions.

► Credit Assessment and Risk Scoring

This is the brain of your operation. You need to develop or integrate a system to evaluate a user’s creditworthiness instantly and set purchase limits.

A smart AI-driven risk engine protects your bottom line by filtering out bad debt while approving reliable customers in seconds, keeping the experience fluid.

► Payment Reminders and Notifications

Help your users win. Add features that notify users of upcoming payments, due dates, and balances via push notifications or SMS.

This isn't just about collecting money; it's about customer service, helping users avoid late fees, and maintaining a positive relationship with your financial brand.

Step 3: Select the Right Technology Stack

The app tech stack is the foundation of your house.

To develop a Buy Now Pay Later App that is fast, scalable, and secure, you need to choose technologies that play well together.

► Frontend Development

Your users judge the book by its cover. Choose robust frameworks like React Native or Flutter for a seamless and responsive user interface (UI).

These cross-platform tools allow you to build for both iOS and Android simultaneously, ensuring a consistent, high-quality experience that looks and feels native on any device.

► Backend Development

This is where the heavy lifting happens. Use server-side technologies like Node.js or Python for secure transactions and data management.

Your backend needs to handle thousands of simultaneous requests without crashing, managing everything from user logic to complex financial calculations with absolute precision and speed.

► Payment Gateway Integration

Money needs to move smoothly. Integrate secure and reliable payment gateways like Stripe or PayPal for transaction processing.

This is crucial for handling incoming down payments and outgoing merchant settlements securely, ensuring that money moves exactly where it is supposed to go without technical hiccups or security scares.

► Database Setup

Data is your most valuable asset. Implement databases like MySQL or MongoDB to store user information, transaction histories, and payment schedules.

A well-structured database ensures that user records are retrievable instantly and that your financial ledgers remain accurate, which is critical for both customer service and regulatory auditing.

Step 4: Design an Intuitive User Interface (UI) and Experience (UX)

In the fintech world, confusion leads to abandonment.

If you want to build a BNPL app that sticks, the design must be so intuitive that a user can finance a purchase while walking to the bus stop.

►User-Friendly Design

Complexity is the enemy of conversion. Create a simple and engaging UI that makes it easy for users to navigate through their purchase and payment process.

Use clean lines, readable fonts, and obvious call-to-action buttons so users never have to guess what step comes next in their financing journey.

►Responsive Design

Your app needs to look good everywhere. Ensure the app works smoothly across all devices, from the smallest smartphones to large tablets.

A responsive design adapts to different screen sizes and orientations, guaranteeing that no functionality is lost and the app remains accessible to every potential customer, regardless of their hardware.

► Easy Payment Process

The checkout should be a straight line, not a maze. Streamline the checkout and payment process with clear and simple steps for users.

By minimizing the number of taps required to complete a transaction, you reduce friction, lower cart abandonment rates, and significantly increase the overall volume of successful loans processed.

Step 5: Develop the Backend Infrastructure

While the frontend captures the user, the backend captures the value.

This is the engine room where you ensure that every promise made to the user is kept securely and efficiently.

► User Data Security

Trust is hard to gain and easy to lose. Implement end-to-end encryption for data security and privacy.

This ensures that sensitive personal information, such as social security numbers and bank details, is unreadable to hackers, protecting your users from identity theft and your company from catastrophic reputational damage.

► Transaction Management

You are running a digital ledger. Build a secure system to handle payments, installment schedules, and transaction records.

This system must be able to track money moving in and out in real-time, handling refunds, partial payments, and settlements with zero margin for error, ensuring your books always balance.

► Risk Management System

You need a digital bouncer. Create a backend system to assess and manage user credit risk, track outstanding balances, and prevent fraud.

This system continuously monitors user behavior to flag suspicious activity and adjusts credit limits dynamically, protecting your capital from bad actors and high-risk borrowers.

Step 6: Integrate Payment Systems and Financial Institutions

You cannot operate in a silo. To succeed, you need strong connections with the wider financial ecosystem that powers global commerce.

► Payment Gateways

This is your connection to the banking world. Connect with payment processors to facilitate payments through credit/debit cards, bank transfers, or mobile wallets.

Offering a variety of funding sources ensures that users can pay you back using whatever method they prefer, reducing friction in the repayment process.

► Partner with Merchants and Banks

Growth comes from collaboration. Build partnerships with merchants and financial institutions to support the BNPL feature and manage credit lines.

Merchant partnerships drive user acquisition, while banking partners can provide the necessary capital and underwriting support to scale your lending capabilities without drying up your cash flow.

Step 7: Test the App (Beta Testing)

Never launch blindly. App testing is the phase where you polish the rough edges. Even a small bug in a financial app can mean lost money, so rigor is required.

► Usability Testing

Watch real humans use your product. Conduct thorough testing to ensure the app is user-friendly and intuitive.

By observing beta users, you can identify confusing navigation paths or poorly worded instructions that you might have missed, allowing you to refine the experience before the public ever sees it.

► Security Testing

Think like a hacker to stop a hacker. Test for data security vulnerabilities to protect sensitive user information.

This involves running penetration tests and vulnerability scans to find weak points in your code, ensuring that your firewall is bulletproof and your user data is locked down tight.

► Performance Testing

Can you handle the Black Friday rush? Make sure the app performs smoothly, even under high traffic and heavy transactions.

Stress testing your servers simulates thousands of concurrent users to ensure your app doesn't crash when it matters most, guaranteeing reliability during peak shopping seasons.

► Bug Fixing

The job isn't done until it works perfectly. Address any bugs or technical glitches that come up during testing.

Prioritize critical issues that affect payments or data integrity first, ensuring that your launch version is stable, professional, and ready to handle real financial transactions without embarrassing errors.

Step 8: Launch the App

The stage is set. Now it is time to introduce your solution to the world. A successful launch isn't just about hitting publish; it's about generating momentum from the moment you submit your app to the app store or publish your app on the Play Store so users can finally discover and download it.

► Marketing Strategy

You need to make some noise. Develop a marketing plan to attract users, such as offering promotions or incentives for first-time users.

Whether it's zero interest for the first month or a discount at partner stores, giving users a reason to try your app is essential for initial acquisition.

► App Store Optimization (ASO)

If they can't find you, they can't download you. Optimize the app’s description, keywords, and visuals to improve visibility on app stores (Google Play, App Store).

High-quality screenshots, a compelling description, and strategic keyword placement help you rank higher in search results, driving organic traffic to your download page.

► Launch Campaign

Create a moment in time. Plan a launch event or online campaign to spread the word about your BNPL app.

Collaborate with influencers, issue press releases, and use social media blitzes to create a "fear of missing out" (FOMO) that drives a surge of downloads on day one.

Step 9: Post-Launch Monitoring and Maintenance

Launching is just the starting line.

What really keeps you ahead is how fast you fix issues, refine features, and level up performance.

This is exactly where Mobile app maintenance services step in, making sure your product stays stable, updated, and ready to outperform anyone in your space.

► User Feedback

Your users are your best product managers. Collect user feedback on the app's performance and any issues they face.

Reviews and support tickets provide a goldmine of information about what features users actually want versus what you think they want, guiding your future roadmap.

► Bug Fixes and Updates

Stagnation is death in tech. Regularly update the app to fix bugs and introduce new features based on user needs.

A consistent update schedule shows users that the app is alive and being cared for, building trust and ensuring compatibility with the latest phone operating systems.

► Scalability and Server Management

Prepare for success. Ensure your backend infrastructure can handle increased users and transactions as the app grows.

As your user base expands from thousands to millions, your server architecture needs to scale automatically to prevent slowdowns, ensuring the app remains fast and responsive at any scale.

So, these are just some important steps to how to develop a Buy Now Pay Later App.

Let’s talk about the benefits of Buy Now Pay Later app development.

Benefits of BNPL App Development

Here’s the thing: last year, 44% of US Gen Zers (approximately 30 million young people) used BNPL services. So, this is the right time to grow your business online with a BNPL app.

When you invest in BNPL app development, you’re basically building a system that helps users shop confidently and allows businesses to grow without friction.

Let’s get to know the benefits one by one:

► Benefits for Users

Here are some of the best benefits of users with BNPL apps:

1. Instant Access to Products

Users can get what they want right away without waiting for payday. This is the biggest emotional win, and it’s why creating a mobile BNPL app makes shopping feel rewarding instead of stressful, boosting trust and satisfaction.

2. Flexible Payments

People love options. With BNPL, users can break heavy bills into smaller chunks that don’t feel painful. It creates a sense of control and reduces anxiety, especially for big-ticket purchases or unexpected needs.

3. Zero or Low Interest

Many BNPL services offer interest-free periods, which feels like a cheat code compared to traditional credit. This motivates users to pick BNPL over other forms of financing because they feel they’re saving money instantly.

4. Better Budget Management

BNPL apps help users spread expenses across weeks or months.

Instead of draining their account at once, they can plan smarter and stay organized. It’s financial breathing room without giving up the things they want.

5. Super Smooth Checkout

No long forms. No complicated banking steps. Just a quick tap and done.

A fast checkout process makes users more likely to complete purchases and builds loyalty because the entire experience feels simple and friendly.

► Benefits for Businesses

Here is one of the top benefits BNPl app development has to offer to businesses:

1. Higher Conversion Rates

When shoppers see that they can split payments easily, they stop abandoning their carts. It eliminates hesitation, making customers more confident about buying.

This directly boosts sales and makes BNPL app development a strong revenue driver.

2. Bigger Average Order Value

BNPL encourages users to explore more premium products since the cost feels manageable.

Businesses often see higher-ticket purchases simply because users don’t have to pay everything up front, increasing overall revenue effortlessly.

3. Improved Customer Loyalty

A business that makes payments flexible instantly feels more customer-friendly. People remember that experience.

The easier it is to shop, the more often they return, creating long-term loyalty and repeat sales.

4. Reduced Checkout Friction

A smooth BNPL flow creates a clean, fast purchasing experience.

No user wants to fill a 20-field form when they’re excited about a product. Less friction equals more completed orders and fewer lost opportunities.

5. Access to New Customer Segments

If you are wondering, is BNPL profitable for businesses? Well, BNPL helps businesses attract customers who don’t use credit cards or prefer alternative payment methods.

It opens the door to younger shoppers, budget-conscious users, and first-time buyers who want simple, flexible payment options.

As much as the benefits matter, understanding the cost is equally important because it helps you plan smarter and invest with clarity.

How Much Does it Cost to Develop a BNPL App?

The overall price for developing a custom and feature-rich Buy Now Pay Later app can go from $20,000 to $250,000+. The cost can go up or down as per your features, project complexity, location of developers, and other factors.

To give you an idea, here is a breakdown of the cost:

1. Basic BNPL App ($20,000 – $40,000)

Best for startups testing the market.

Includes:

-

Simple user onboarding

-

Basic KYC

-

Basic checkout integration

-

Loan limit calculation

-

Simple admin panel

-

Standard UI

-

Ideal for MVPs with limited features.

2. Mid-Level BNPL App ($40,000 – $80,000)

Balanced version with better features and security.

Includes:

-

Advanced KYC + document verification

-

Credit scoring engine (rule-based)

-

Merchant dashboard

-

Multi-gateway payment integration

-

EMI scheduling & reminders

-

Better UI/UX

-

Stronger encryption

3. Advanced BNPL App ($80,000 – $150,000)

Ideal for enterprise launches.

Includes:

-

AI-driven credit scoring

-

Custom risk engine

-

Automated fraud detection

-

Real-time analytics dashboard

-

Full merchant ecosystem

-

Wallet system + payouts

-

High-end UI/UX + custom animations

-

Multi-country deployment

4. Enterprise BNPL Ecosystem ($150,000 – $250,000+)

For banks, large fintechs, or UAE/US/UK-level deployments.

Includes:

-

Multi-tier lender network

-

Full underwriting suite

-

AI-based risk modeling

-

High-volume payment orchestration

-

Compliance modules (PCI DSS, SOC2, GDPR)

-

White-label merchant solutions

-

Multi-platform (web + Android + iOS)

Here is a simple visual breakdown for the cost:

|

App Level |

Estimated Cost |

What You Get |

|

Basic |

$20K–$40K |

MVP, basic KYC, simple loan flow |

|

Mid-Level |

$40K–$80K |

Better UI, scoring, dashboards, EMI tools |

|

Advanced |

$80K–$150K |

AI scoring, fraud detection, multi-gateway |

|

Enterprise |

$150K–$250K+ |

Full fintech ecosystem with compliance |

Now that you know the cost, the next question is how long it takes to build a BNPL app from start to finish.

What is the Timeline to Build a BNPL App?

Building a buy now, pay later platform is a complex journey balancing financial compliance, rigorous security, and a seamless user experience.

Typically, the process spans 4 to 9 months, depending heavily on feature density and regulatory requirements.

The timelines fluctuate based on whether you are launching a focused minimum viable product or a full-scale banking ecosystem.

Success requires a rigorous phased approach, ensuring your platform is secure enough to handle real money.

This timeline assumes a standard agile development team (PM, Designers, Developers, QA) working on a custom build.

|

Development Phase |

Estimated Duration |

The Mission & Milestone |

|

1. Discovery & Compliance |

2 – 4 Weeks |

The Foundation. Defining the lending logic, selecting third-party APIs (KYC, credit checks), and navigating crucial financial regulations. Milestone: SRS Document & Legal Clearance. |

|

2. UI/UX Design |

4 – 6 Weeks |

The Trust Factor. Designing an interface that feels secure and frictionless. If it looks "sketchy," users won't link their banks. Milestone: High-Fidelity Prototypes. |

|

3. Backend Construction |

8 – 12 Weeks |

The Engine Room. Building the credit decision engine, database structure, and integrating payment gateways (Stripe, Plaid, etc.). Milestone: Functional API Architecture. |

|

4. Frontend Development |

6 – 10 Weeks |

The Build. Coding the iOS, Android, and Web apps. This usually runs parallel to the backend phase once the API is stable. Milestone: Clickable, Functional App. |

|

5. Security & QA Testing |

3 – 5 Weeks |

The Stress Test. Rigorous penetration testing, bug squashing, and load testing. There is zero margin for error with financial data. Milestone: Security Certification. |

|

6. Launch & Deployment |

1 – 2 Weeks |

The Liftoff. App Store submission, server deployment, and "Day 0" monitoring for immediate patches. Milestone: Live on App Stores. |

However, to break through the competition and make sure you sign in the market, you need to know about the market-leading BNPL apps. This is what our next section will be about.

Top BNPL Apps

The rise of top BNPL apps shows how quickly shoppers are moving towards flexible, interest-free payments.

Let’s look at the standout BNPL players reshaping how people shop today:

1. Klarna

If you love shopping without paying everything up front, Klarna will feel like it was built for your lifestyle.

It’s one of the Top BNPL apps because it gives you quick approvals, flexible pay-in-4 plans, and a fun shopping feed that makes browsing way too easy.

And if you ever plan to develop an app like Klarna, this is the kind of smooth, user-first experience you’ll want to match, because it hooks shoppers across thousands of stores without making the process feel heavy.

2. Afterpay

Afterpay is the app you rely on when you want something now but prefer breaking the cost into smaller bites.

You pay in four simple installments, no interest, no hoops to jump through.

It’s clean, predictable, and perfect when you want a BNPL option that just works every single time. Fashion lovers especially swear by it.

3. Affirm

If you’re the kind of person who hates hidden charges, Affirm will feel like a breath of fresh air.

Everything is transparent, from interest rates to repayment plans.

It’s great for bigger purchases like electronics or travel because it gives you long-term options that feel manageable. You know exactly what you’re getting into before you tap “Confirm.”

4. Zip Pay

Zip Pay is the flexible friend of the BNPL world.

You get your own spending limit, and you decide how to repay, weekly, fortnightly, or monthly.

It’s quick to set up and keeps things simple, so you always feel in control. If you like mixing small daily purchases with the occasional big buy, this one fits right into your lifestyle.

5. Sezzle

Sezzle is perfect for you if you want a BNPL app that keeps things flexible without adding pressure.

You get interest-free installments, easy rescheduling, and friendly reminders that actually help you stay on track.

Younger shoppers love it because it feels supportive, not stressful, and the whole experience builds real financial confidence.

And if you’re curious about the cost to develop a BNPL app with this kind of user-friendly flow, Sezzle is a great example of how thoughtful features can shape both trust and retention.

Now that you’ve seen what the top BNPL apps are doing right, let’s talk about the part no BNPL platform can skip: compliance.

The Non-Negotiable BNPL Compliance Checklist

Understanding how to build a BNPL app requires realizing that regulatory adherence isn't just a box to check; it is the shield that keeps your business legal and your users safe.

In the BNPL space, you are effectively acting as a lender, which invites scrutiny from financial authorities. Failing here can lead to massive fines or an immediate shutdown.

Here are the critical compliance pillars you must secure:

1] Identity & Anti-Money Laundering (KYC/AML)

You must prove you know who your users are to prevent money laundering and terrorism financing.

-

Customer Identification Program (CIP): Mandatory verification of name, address, and government ID (often handled via APIs like Onfido or Jumio).

-

Watchlist Screening: Checking users against OFAC (Office of Foreign Assets Control) and PEP (Politically Exposed Persons) lists.

-

Suspicious Activity Reports (SARs): A system to flag and report transactions that look like laundering.

2] Data Security & Payments (PCI-DSS)

In the context of professional BNPL software development, security standards are rigorous because you are handling sensitive financial data.

-

PCI-DSS Compliance: If you process, store, or transmit credit card information, you must meet the Payment Card Industry Data Security Standard.

-

Data Encryption: All sensitive data must be encrypted both in transit (TLS/SSL) and at rest (AES-256).

-

GDPR / CCPA: If you operate in Europe or California, you need strict protocols for how user data is collected, stored, and deleted upon request.

3] Consumer Protection & Lending Laws

This is the "Fair Play" section of compliance to ensure users aren't being exploited.

-

Truth in Lending Act (Reg Z): You must clearly disclose the terms of the loan, including the APR (even if it is 0%), payment schedule, and total repayment amount before the user agrees.

-

Fair Credit Reporting Act (FCRA): If you perform hard credit checks or report user behavior to credit bureaus, you must comply with strict accuracy and dispute resolution standards.

-

ECOA (Equal Credit Opportunity Act): Your lending algorithm must be tested to ensure it does not discriminate based on race, religion, or gender.

4] Lending Licensing

-

State-by-State Licenses: In the US, lending licenses are often regulated at the state level. You may need a separate lender's license for every state you operate in, or you may need to partner with a chartered bank to "rent" their charter.

-

Critical Warning: "Buy Now, Pay Later" is currently under intense scrutiny by regulators like the CFPB (Consumer Financial Protection Bureau). Regulations in this sector are evolving rapidly; what is compliant today might change tomorrow.

The focus must immediately shift from policy to building a scalable product. This means institutions need to quickly hire mobile app developers who possess the specialized skills necessary to conquer BNPL's complex technical and financial hurdles.

Key Challenges and Strategic Solutions in BNPL Development

BNPL is booming, but turning the idea into a reliable app is where things get interesting.

From credit scoring to security gaps, every step brings a new twist. Let’s explore the key challenges and solutions that shape a strong Buy Now Pay Later Platform.

Challenge 1: The Cash Flow Gap vs. Automated Liquidity

The fundamental risk of the BNPL model is the "liquidity crunch." You must pay the merchant the full amount immediately, but the user pays you back in small increments over 6 to 8 weeks.

If your user base grows too fast, you can literally run out of cash to fund new loans before the old ones are repaid.

Solution: You cannot rely on venture capital alone for this. The solution is to secure a "warehouse line of credit" (debt facility) from a bank early on.

On the technical side, you must implement a real-time automated ledger system that balances merchant payouts against incoming repayments to forecast cash flow needs weeks in advance.

Challenge 2: Balancing Speed with Security (The Fraud Paradox)

When you set out to build a BNPL app, you face a difficult paradox: customers demand instant approvals (under 10 seconds), but thorough credit checks usually take days.

This speed creates a massive vulnerability window for "soft fraud," where bad actors use stolen identities to purchase goods and vanish.

Solution: Traditional credit scores are not enough. You need to implement an AI-driven risk engine that analyzes behavioral biometrics.

By tracking data points like typing speed, device location history, and email longevity, your system can flag bots or stolen IDs in milliseconds without slowing down the user experience.

Challenge 3: Merchant Integration Fatigue

Merchants are already juggling dozens of plugins on platforms like Shopify, Magento, and WooCommerce.

If your API is difficult to install or slows down their checkout page, they simply won't use it.

Solution: The goal is to create a BNPL app that feels invisible. The solution is an "SDK-First" architecture. Instead of asking merchants to build custom connections, you provide pre-built Software Development Kits (SDKs) and plugins.

This allows a merchant to add your payment button to their checkout page with just a few lines of code, reducing friction and boosting adoption rates.

Challenge 4: The "One-Time Use" Trap

Many users view BNPL services as a one-time utility for a specific expensive purchase.

Once the debt is paid off, they often delete the app, leading to high churn rates and high customer acquisition costs.

Solution: You must evolve the product from a simple "Lending Tool" into a "Shopping Companion." The solution is to build a gamified loyalty ecosystem.

Create an in-app marketplace that offers exclusive discounts, price-drop alerts, and a rewards system where on-time payments unlock lower fees or higher credit limits to keep users coming back.

Monetization Models For BNPL Apps

Here’s the thing. When you build a BNPL app, the real power isn’t just in smooth checkouts but in how smart your revenue engine is.

BNPL platforms earn through multiple Mobile app monetization models that turn every transaction into steady growth.

And for anyone planning to build a Buy Now Pay Later app, understanding these money-making paths is non-negotiable.

How BNPL apps make money:

-

Merchant discount fees: Brands pay a small cut because BNPL boosts conversions and basket sizes.

-

Late fee revenue: Not the focus, but still a controlled income stream.

-

Interchange fees: Every card-backed repayment earns a fraction.

-

Premium partner promotions: Merchants pay for priority placement or campaigns.

-

Subscription plans: Advanced credit tools, reports, or budgeting features.

-

Data-backed insights: Anonymous user trends sold as business intelligence.

- Co-branded credit offerings: Banks and fintech partners share revenue.

Each path opens new profit channels in Buy Now Pay Later App Development, helping you make a BNPL app that stays sustainable, scalable, and genuinely valuable for both users and merchants.

Future of BNPL Apps: AI, Predictive Scoring & Market Evolution

The next era of BNPL will be defined by AI in mobile app development, transforming these platforms from simple payment options into sophisticated, personalized financial ecosystems.

For any company planning to develop a BNPL app, the real opportunity lies ahead, where the smartest platforms won’t follow the market; they’ll shape it.

1. AI Credit Scoring: Dynamic Risk Assessment

The future of BNPL relies on moving beyond traditional FICO scores. With AI in finance, models analyze vast amounts of alternative data, including transaction trends, device metadata, and geo-location patterns, to assess creditworthiness in real-time, often in under 50ms.

-

Impact: This enables financial inclusion by responsibly underwriting thin-file borrowers (those without extensive credit history), expanding the market while reducing default rates.

2. Behavioural Analytics & Hyper-Personalization

AI monitors user interaction within the app and across e-commerce sites to identify patterns indicative of future behavior. This allows for personalized lending and fraud detection.

-

Predictive Limits: Credit limits and repayment schedules are dynamically adjusted based on a user's spending habits and repayment history, offering longer terms to low-risk customers.

-

Fraud Detection: Machine Learning algorithms detect anomalies (e.g., a purchase location far from a usual shipping address) in real-time, instantly flagging suspicious activity that deviates from the user's established behavioral profile.

3. Embedded BNPL in eCommerce (The Invisible Checkout)

BNPL will become completely integrated into the merchant's technology stack, making it an "invisible" financing option.

-

Evolution: Instead of being a separate payment option, BNPL functionality will be integrated earlier in the shopping journey (e.g., product page or cart view), providing personalized financing estimates before checkout.

-

Benefit: This frictionless experience boosts cart conversion rates and increases average order values for merchants.

4. Micro-Lending Expansion (Small Loans, Big Data)

BNPL solutions are expanding beyond traditional retail purchases into everyday micro-transactions and services (e.g., paying for utilities, transport, or even groceries).

-

Model Shift: This involves offering smaller, more frequent installment loans, requiring the AI model to be highly granular and capable of handling a much higher volume of low-principal transactions.

5. Cross-Border BNPL

As e-commerce becomes global, BNPL providers are working to facilitate purchases across international borders.

-

Challenge: This requires instant currency conversion and compliance checks against different regional financial regulations (e.g., GDPR, state lending laws) during the single checkout flow.

-

Solution: Platforms must use global identity and risk APIs to bridge diverse credit scoring environments, creating a seamless experience for the user regardless of the merchant's location.

Successfully tackling the intense technological demands of AI scoring and embedded finance requires specialized expertise; this is why many forward-thinking institutions choose to partner with leading mobile app development companies.

How JPLoft Can Help You Develop a BNPL App?

Here’s the thing. Building a BNPL platform that feels smooth for users and safe for your business isn’t just about coding screens and payment flows.

It’s about getting risk, compliance, UX, and scalability to work together without friction. And that’s exactly where JPLoft steps in.

As a seasoned BNPL app development company, JPLoft helps you shape a product that approves fast, protects against fraud, and keeps your users coming back.

You get an app built with intelligent credit scoring, secure transaction layers, and a checkout experience that feels effortless on every device.

We also guide you through integrations, third-party APIs, data privacy requirements, and performance tuning so your platform can grow without breaking.

If you want a BNPL solution that’s future-ready instead of just functional, we’ll help you build it the right way from day one.

Conclusion

If you’re serious about stepping into fintech, this is the right time. Start by defining your BNPL model, designing a clean UX, integrating secure payments, adding AI credit scoring, ensuring compliance, and hiring experts to build your custom BNPL app.

The BNPL space is only getting bigger, and understanding how to create a Buy Now and Pay Later app gives you a real advantage.

From smart credit scoring to seamless UX and airtight compliance, every piece you add shapes a platform users will trust and return to.

With the right partner guiding your tech, security, and scaling decisions, you’re not just launching another payment tool; you’re entering one of the fastest-growing digital markets with confidence.

FAQs

A BNPL app lets users split purchases into interest-free installments, offering instant approvals, flexible repayment plans, and a smooth checkout experience for both shoppers and merchants.

Developing a BNPL app costs $20,000 to $250,000+, depending on features, AI scoring, security layers, compliance needs, tech stack, third-party integrations, and overall project complexity.

Start by choosing a lending model, securing financial partners, ensuring compliance, building the platform, integrating risk scoring, onboarding merchants, and launching with a strong marketing strategy.

Building a BNPL app typically takes 4 to 9 months based on design, features, AI scoring, compliance, backend infrastructure, testing, and full-scale deployment.

You can build a BNPL app by choosing your model, integrating secure payments, adding AI scoring, ensuring compliance, and partnering with experienced fintech developers for end-to-end support.

Share this blog