Do you know that the global fantasy sports market size is expected to reach USD 56,381.2 million by 2030?

Well, yes, it's true.

But the real question is: why should you care about these numbers?

For everyday sports fans, understanding the fantasy sports app market statistics simply means knowing how popular fantasy leagues have become and how millions of people now compete for fun, prizes, and bragging rights.

Well, what do the fantasy sports app market statistics display?

The fantasy sports app market statistics show how quickly virtual sports platforms are growing, attracting global users, and reshaping digital sports engagement.

From an investor’s or an entrepreneur’s perspective, however, these statistics are far more than just numbers.

They reveal how fast the industry is expanding, which regions are driving the most demand, and what revenue models (like entry fees, subscriptions, and NFTs) are scaling profitably.

In short, learning these stats helps identify not just where the market stands today, but also where the opportunities lie for tomorrow.

We will walk you through the demographics, global market, and trends here. Let’s proceed together.

What is a Fantasy Sports App Market?

A fantasy sports market is a segment of the mobile digital ecosystem and web-based platforms where users can create virtual teams using real-world players.

This type of market comprises various businesses that develop and host these platforms, which generate revenue through strategies such as entry fees for contests and premium subscriptions.

Here, users can create virtual teams based on actual game performance statistics, and further can participate in leagues or contests for entertainment, prizes, or bragging rights across different sports like basketball, soccer, football, etc.

Are you the one seeking to start an online fantasy sports business?

Well, then, learning about the market statistics can be a significant option for you. Fantasy sports app statistics will enhance your knowledge of the current market and relevant competitors in the field.

This will help you estimate the future demands of the target users and then build a mobile app accordingly.

Additionally, you can assess the current situation regarding regional and global usage, which helps in gaining a timely understanding of users' perspectives while they participate in virtual teams and fantasy sports leagues.

Key Highlights of the Fantasy Sports App Market Stats

Let’s begin with learning the key highlights of the fantasy sports app market that you can learn in the preceding blog.

-

The global fantasy sports market is expected to record a CAGR of 14.6% from 2023 to 2032.

-

Additionally, this market is growing through a robust transformation, with its size projected to reach approximately USD 13.11 billion by 2034, rising from USD 4.77 billion in 2024.

-

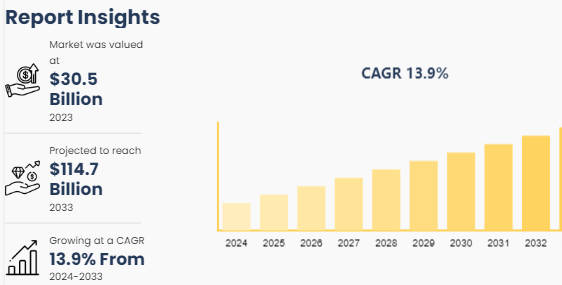

As per the latest fantasy sports app market stats, the global fantasy sports market size was valued at $30.5 billion in 2023 and is further projected to reach $114.7 billion by 2033, growing at a CAGR of 13.9% from 2024 to 2033.

-

As per the regions, approximately 57 million adults in the U.S participated in fantasy sports in 2025.

-

The Asia-Pacific region is pacing a 14.08% CAGR by 2030.

-

The dominant age group from the 18 to 39 years age bracket makes up a significant portion of fantasy sports players in the U.S.

-

The leading apps in the fantasy sports app market are FanDuel, ESPN fantasy sports, DraftKings, and Yahoo fantasy.

-

The trends that the current fantasy sports app market follows are AI, IoT, personalization, and many others.

Now, let's learn about the fantasy sports app market in detail below.

Global Fantasy Sports App Market Overview

The global fantasy sports app market represents the worldwide online demand. This will help you predict the future global demands in the present era.

To build a fantasy sports app, the foremost step is to conduct in-depth market research. Here are the global market stats below.

-

The global fantasy sports market size is projected to reach USD 56,381.2 million by 2030, from USD 24,853.7 million in 2024.

-

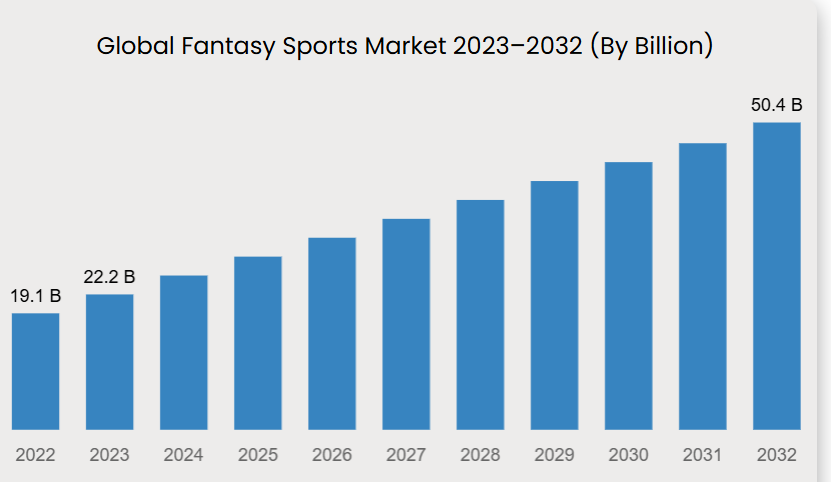

As per the research conducted by the CMI team, the global fantasy sports market is expected to record a CAGR of 14.6% from 2023 to 2032. In the year 2022, this market has reached a valuation of USD 19.1 million, and by 2032, this valuation is anticipated to reach USD 50.4 billion.

-

Additionally, as per motor intelligence, the fantasy sports market is expected to reach a market size of USD 37.28 billion in 2025, and is projected to hit USD 71.24 billion by 2030, advancing at a 13.83% CAGR.

-

Through the revenue model, the entry-fee contests accounted for 61.83% of the fantasy sports market size in 2024, whereas NFT/token-gated formats are scaling at a 14.65% CAGR.

-

As per global fantasy sports app market statistics, in 2022, the size was 19.1 billion, and in 2023, this market was 22.2 billion. Further, it is expected to reach 50.4 billion by 2032. Hence, it is the right time to convert your fantasy sports app idea into reality.

-

Additionally, the fantasy sports app stats based on global size report USD 32.21 billion in 2024, and is expected to grow from USD 36.75 billion in 2025 to reach USD 105.58 billion by 2033, which is growing at a CAGR of 14.1% during the forecasted period (2025-2033).

-

As per the report of Yahoo Finance, the fantasy sports market revenue is expected to reach USD 49.53 billion by 2028.

-

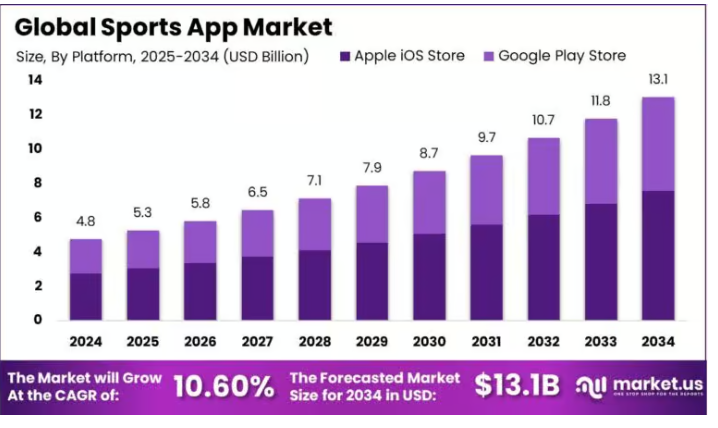

As per the stats of market.US, this market is growing through a robust transformation, with its size projected to reach approximately USD 13.11 billion by 2034, rising from USD 4.77 billion in 2024. This promising growth does reflect a steady compound annual growth rate of 10.6% between 2025 and 2034.

-

Here, the global esports market is poised for substantial expansion, with its value projected to reach approximately USD 16.7 billion by 2033. Additionally, this growth reflects a strong CAGR of 21.9% over the forecast period from 2024 to 2033.

-

Additionally, the global fantasy sports market size was valued at $30.5 billion in 2023 and is further projected to reach $114.7 billion by 2033, growing at a CAGR of 13.9% from 2024 to 2033.

-

The global sport app market size was estimated at USD 4.81 billion in 2024 and is predicted to increase from USD 5.32 billion in 2025 to approximately USD 13.22 billion by 2034, expanding at a CAGR of 10.64% from 2025 to 2034.

Now, moving ahead, let’s explore the region-wise fantasy sports app statistics in the section below.

Region-Wise Statistics of the Fantasy Sports App Market

If you want to design a fantasy sports app, it is important to note that region-wise stats can help you enhance the performance of your app.

Let’s discuss the region-wise statistics below.

1. Brazil

Brazil opened a regulated sports betting framework in January 2025, with an annual turnover estimated to reach USD 34 billion by 2028.

Apart from sports betting, 69% of Brazilians play the federal lottery, and 38% play fantasy games. Not only that, but a lower number of 36% of Brazilians invest in Casino Online. Additionally, only 33% use informal bets on diverse subjects that are worth money but are not done on a website.

2. North America

When we look towards geography, North America dominated with a 38.76% share in 2024, in the fantasy sports, yet Asia-Pacific is forecasted to climb at a 14.08% CAGR to 2030.

In 2024, North America remained the leading regional contributor for more than 36% of the global market share, with the revenue generation of around USD 1.71 billion. With this region, the United States alone was valued at approximately USD 1.62 billion.

An estimated 84 million adults in the U.S. and Canada participated in fantasy sports in the past 12 months, up from 81 million in 2024, including 77 million Americans.

Across both countries, approximately 57 million people played fantasy sports (53M U.S., 4.2M Canada), while 66 million bet on sports.

Approximately 57 million adults in the U.S. participated in fantasy sports in 2025, with the Fantasy Sports & Gaming Association (FSGA) estimating 53 million U.S players and adding another 4.2 million in Canada.

84 million adults in the U.S and Canada participated in either fantasy sports or sports betting in the 12 months before July 2025.

3. United Kingdom

The fantasy sports market in the UK is expected to reach a projected revenue of US $3,067.0 million by 2030. A compound annual growth rate of 12.7% is expected for the fantasy sports market from 2025 to 2030.

Additionally, the UK fantasy sports market generated a revenue of USD 1,538.4 million in 2024 and is expected to grow at a CAGR of 12.7% from 2025 to 2030.

4. Asia-Pacific

Asia-Pacific is pacing a 14.08% CAGR by 2030. This number is catalyzed by India’s cricket-centric user base and expanding 4G penetration. Dream11’s 210 million accounts show the scale potential of local sports passions and inexpensive data use.

5. China

However, the China opportunity hinges on policy clarity, but Japan and Australia already provide the regulated pathways with high per-capita income.

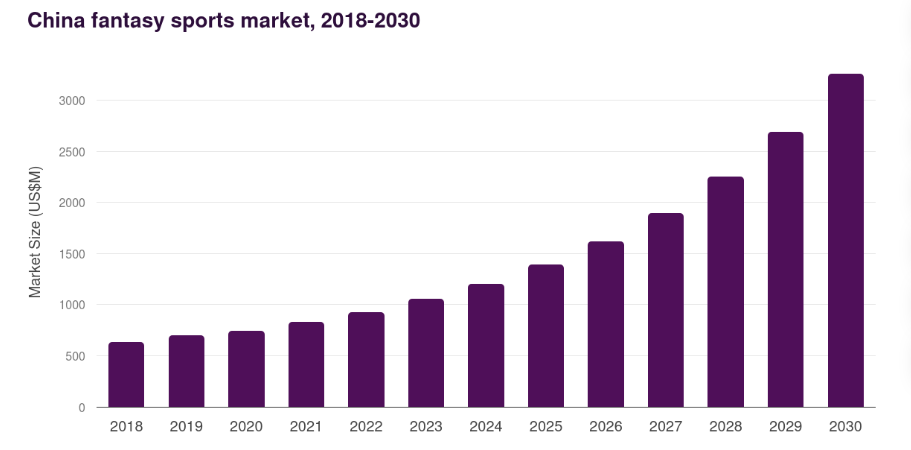

The fantasy sports market in China is expected to reach a projected revenue of US$3,257.4 million by 2030. Here, the compound annual growth rate of 18.6% is expected for the Chinese fantasy sports market from 2025 to 2030.

Now, let’s learn about the user demographics & behavior as per fantasy sports app market statistics in the following section.

User Demographics & Behavior: Fantasy Sports App Market Stats

Learning about the demographics & behavior will help you to determine the current learning behavior of the users.

Hence, let’s evaluate demographics below.

1] Fantasy Sports Mobile App Usage

Mobile usage represented 65.43% of all the fantasy sports transactions in 2024, and the channel is growing at a 14.87% CAGR to 2030, as the operators have included push alerts, quick deposits, and geolocation features.

The worldwide fantasy sports mobile app usage is rapidly increasing, with the market expected to grow from approximately $30.83 billion in 2024 to over $59.63 billion by 2029.

2] Fantasy Sports App Usage by Age Group

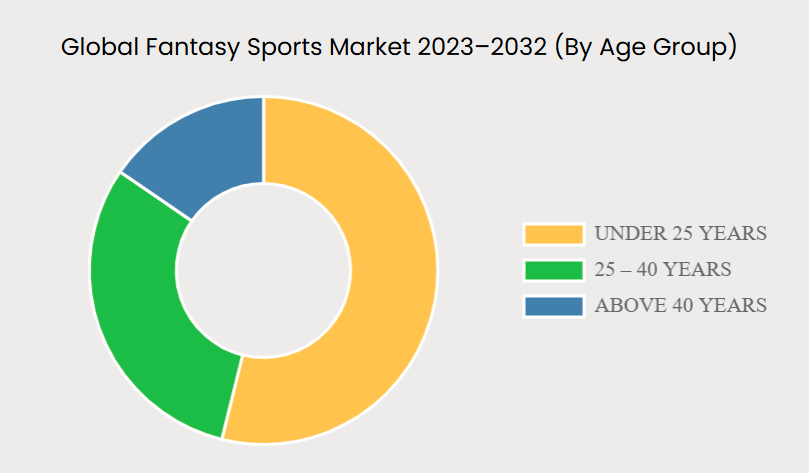

As per the above image, the fantasy sports app statistics represent the diversification in the age group. It can be stated that people under the age of 25 are more fond of playing fantasy sports.

The dominant age group from the 18 to 39 years age bracket makes up a significant portion of fantasy sports players in the U.S.

Additionally, as per the FSGA report, the report indicates that 60% of players are male, with similar gender demographics, and as per 2022, the total number of fantasy sports players in the U.S was approximately 50.4 million.

Here, you will observe that 39% of females are using a fantasy sports app.

Now, let’s move forward to learn about the usage of the fantasy sports app in the following section.

Leading Fantasy Sports Apps and Their Global Usage

When it comes to competing with the top fantasy sports apps, it's essential to learn about their strategies and competitive scenarios.

Hence, let’s learn about the popular apps below.

1. Fanduel

In 2024, Fanduel reported about 4.5 million users, and it added approximately. 700,000 new users that year. This platform has generated over $5.79 billion in revenue in 2024, at a 19.6% increase from the previous year.

Over $50 billion was wagered on FanDuel in 2024, a 26% increase from 2023. Additionally, the platform had 4.5 million active users in 2024. Additionally, in a similar year, this app was installed over 10 million times, where the majority of the installs came from the US.

Additionally, the app had 10.8 million downloads in 2024. Since January 2020 through the end of 2024, there are 23 million people who downloaded Fanduel’s sportsbook + iGaming apps in the U.S.

Given such massive growth and popularity, many startups and businesses are exploring the cost to develop an app like FanDuel to enter the booming fantasy sports market, which lies between $30,000 $80,000+.

2. Draftkings

DraftKings had about 4.8 million active users in 2024, which is a 30% increase from the previous year. Additionally, it has reduced its net loss again in 2024 and has 4.8 million active users in 2024, where over one million users were added over the last year.

Additionally, in the US, DraftKings had 4.8 million active users in 2024, adding over one million users last year. The revenue made by DraftKings was $4.7 billion in 2024, almost all of which came through its sportsbook service.

Fanduel is the frontrunner in the US sportsbook market, with Draftkings in a solid second place. Many people choose DraftKings as an app to boost their performance within the fantasy sports market.

To develop an app like DraftKings, it's important to look ahead for the strategies and steps that will help you to achieve the significant target.

3. ESPN Fantasy Sports App

The fantasy sports app is always in season. You can play ESPN fantasy football, fantasy men’s basketball, fantasy women’s basketball, and hockey. This has become one of the famous and most played apps due to its amazing features.

Here, the users can create and manage teams, draft players, make trades, view live scoring, receive player news, expert analysis, and chat with league-mates.

As per Statista, the current revenue for the ESPN fantasy sports app is $0.55 million. ESPN accused of stealing tech in $200 million trade secrets lawsuit.

Over 13 million fans are playing ESPN fantasy football in 2024. Throughout August, leading up to week 1, the ESPN fantasy app was no.1 among all other apps, with about 9.3 million unique visitors.

4. Yahoo Fantasy Sports App

The Yahoo fantasy sports app offers season-long playing and daily fantasy sports for football, baseball, basketball, and hockey, which allows users to manage teams, draft team players, trade, and compete in leagues with friends or the public.

The Yahoo fantasy sports app has between 5 million and 10 million installs on Google Play. When it comes to drafting the national ranking, Yahoo was the most popular fantasy sports app in the U.S., trailing the ESPN fantasy app by 3.7 million unique visitors.

Along with this, the app is the biggest competitor. Its app was used by millions. Here, 85% of the Yahoo fantasy users used the mobile app, and approximately two-thirds used it daily.

You can create an app like Yahoo fantasy sports, after including the crucial strategies that begin from the market study, and end with the launch of the app.

You can find the summarized usage of these apps under the given table.

|

App |

Usage / Users / Downloads |

Key Highlights |

|

FanDuel |

|

Very strong brand among daily fantasy + betting; combines fantasy sports with sportsbook/gaming verticals; high app visibility and broad user engagement. |

|

DraftKings |

|

Competes closely with FanDuel; offers daily fantasy, sportsbook, and iGaming; popular for a variety of contests. |

|

ESPN Fantasy |

|

Very strong in content, media integration, and a trusted brand; high engagement during football season; known for user-friendly tools and a broad reach beyond just fantasy (news, stats, streaming). |

|

Yahoo Fantasy Sports |

|

Yahoo has a deep history in fantasy sports, wide coverage of sports, good brand loyalty, high mobile usage, and strong community features. |

After considering the above stats related to popular fantasy sports apps, let’s proceed with the different types of fantasy sports in the following section.

This will provide you with information about the types of fantasy sports market statistics in the following section.

Fantasy Sports App Statistics Based on Sports Types

When you look at the fantasy sports app market statistics, you will find differences as per the sports types and sports contests.

Hence, let’s discuss it all in this section.

Type 1: By Sports Type

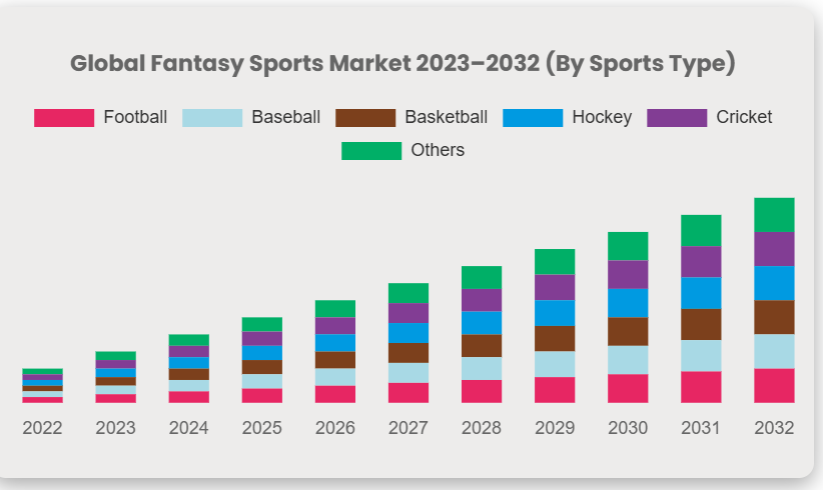

Under this head, you will find the diversification based on diversified sports types. These types include football, basketball, baseball, and more, defining the fantasy sports app market stats.

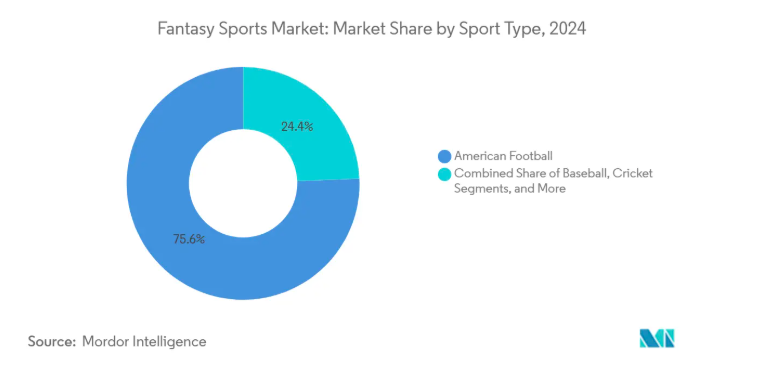

When it comes to sport type, American football led with 75.63% fantasy sports market share in 2024. Additionally, esports is expanding at a 15.32% CAGR through 2030.

Based on the above figure, Football is the most played fantasy sport, followed by baseball, basketball, hockey, cricket, and others. The usage of fantasy sports types is continuously scaling and growing till 2032.

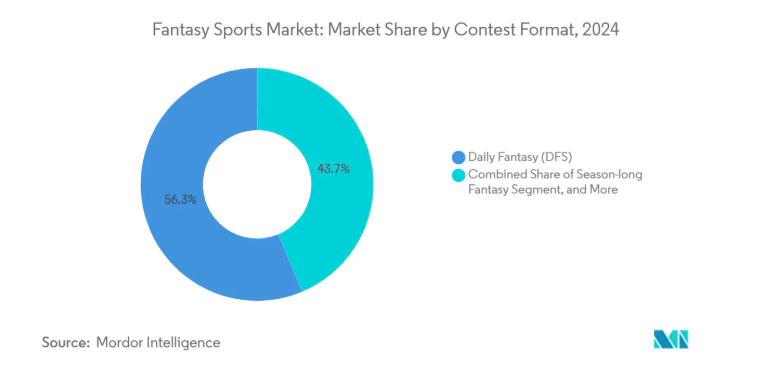

Type 2: By Contests

Here are the fantasy sports market stats and their apps as per the contest-wise report.

Through the contest format, the daily fantasy sports industry experienced a growth of 56.32% of the total fantasy sports market size in 2024, where the in-play fantasy is rising at a 14.32% CAGR.

Moving ahead in the guide of fantasy sports app market statistics, let’s examine the trends below.

Fantasy Sports App Industry Trends: AI, IOT, & More

The fantasy sports app trends, such as artificial intelligence, the use of IoT, and machine learning, are enhancing the overall competition in the market.

Let’s evaluate the complete list of trends below to understand it all in-depth.

1) AI-driven personalization & predictive analytics

What's New: The sports analytics market reached $4.79B in 2024 and will grow to $24.03 by 2032 (22.5% CAGR), enabling ML models for player forecasts, lineup optimization, and fraud/abuse prevention.

Perplexity in fantasy sports apps helps businesses personalize well to make around ~40% more than competitors; 71% of customers anticipate personalized experiences.

Make an Impact Now: Improved player projections, personalized contest suggestions, and intelligent risk/bonus targeting that drive ARPU and LTV.

Why it Matters Next: Personalization becomes table stakes; it's a moat for conversion and retention.

2) Live/in-Game (micro) Engagement & Betting Integration

What's New: The U.S. sports betting market was $17.94B in 2024, with a 10.9% CAGR to 2030; 80%+ of bets occur on mobile; FanDuel/DraftKings now account for ~40% and ~33% revenue share, respectively. Sports like F1 are taking data-driven betting to the next level to enhance fan engagement.

Impact Now: Fantasy apps ride in-game demand with live stats, flash contests, and micro-props to grow session length and monetization.

Why it Matters Next: As live watching moves to streaming, real-time competition becomes a foundational engagement loop.

3) IoT & player-tracking data (Next Gen Stats)

What's happening: NFL Next Gen fantasy sports app Stats records player location/speed ~10x/sec with 200+ data points/play rate through RFID sensors; wearables market is $84.2B in 2024 (forecast 13.6% CAGR to 2030).

Impact Now: More detailed real-time metrics (separation, xYAC, time-to-throw), upgrade scoring models, projections, and integrity surveillance.

Why it Matters Next: With more leagues providing tracking feeds, fantasy scoring can be more in-depth and detailed, opening up new contest types.

4) Gamification & lifecycle automation led by push

What's Happening: Intelligent push can initiate 2.6× more app opens; wider mobile push campaigns demonstrate +182% sessions, +116% buys, +73% lifetime when optimized. Adding gamification can act as an important fantasy sports app feature to boost user experience.

Impact Now: Missions, streaks, pick'em minigames + smart notifications increase DAU/MAU and decrease churn in off-peak sports windows.

Why it Matters Next: As acquisition costs increase, engagement science (journeys, badges, dynamic rewards) is a critical driver of unit economics.

5) Women's sports surge = new fantasy inventory

What's Happening: Women's elite sports revenue projected to top $2.35B in 2025 (Deloitte); WNBA Draft viewership increased 511%; Women's NCAA championship averaged ~19M viewers (up 89% YoY).

Impact Now: Actual demand for women's fantasy games (WNBA, NCAA WBB, international football) and sponsorships with new audiences.

Why it Matters Next: First movers can grab white-space participation and advertiser attention.

6) Esports & new verticals

What's Happening: The international esports industry keeps growing (several regions illustrating growth over 2029 in TBRC data).

Impact Now: Includes year-round slates and younger audiences; fantasy products can repurpose core mechanisms (salary caps, drafts) for esports.

Why it Matters Next: Diversifies dependence on seasonal highs; opens global TAM.

7) Media + fantasy convergence (content → contests)

What's New: ESPN Fantasy Football reached an all-time high of ~13M players in 2024; streamers drive personalized sports moments and data-intensive highlights to curb churn.

Effect Now: Closer content + contest loops (live programming fueling entries, creator selections, shopable odds) drive higher engagement peaks on game days.

Why it will Matter Next: Anticipate more rights-holder + fantasy partnerships and contextual real-time surfaces within streams.

Why Select JPLoft as Your App Development Partner?

Choosing the right technology partner is crucial for success, and JPLoft stands out as a trusted Fantasy sports app development company with a proven track record in delivering scalable, innovative, and user-centric solutions.

With years of expertise, we have empowered startups and enterprises across the globe to turn their app ideas into high-performing digital products.

What makes JPLoft different is its customer-first approach, where each project is tailored to meet the client’s unique goals.

From conceptualization and UI/UX design to development, deployment, and post-launch support, the team ensures end-to-end excellence. Backed by in-depth market research and industry insights, JPLoft helps clients align their apps with current trends and future opportunities.

Our developers specialize in the latest technologies, including AI, real-time analytics, IoT, and gamification, making apps more engaging and future-ready.

Partnering with us means not just building an app but creating a long-term competitive advantage in the growing fantasy sports industry.

Conclusion

Fantasy sports is scaling fast, with multiple reports projecting the market to multiply through 2030–2034. When you look forward to the market stats of the fantasy sports app, you will find a surge in growth.

Global demand, strong mobile adoption, and expanding verticals (women’s sports, esports) are widening the addressable audience. Region-wise momentum in North America, APAC, and regulated markets like Brazil underscores sizable entry opportunities.

Leading apps (FanDuel, DraftKings, ESPN, Yahoo) validate usage at scale, while AI, IoT data, and gamified lifecycle marketing raise engagement and LTV. The takeaway: act now with rigorous market research, data-led product strategy, and compliance-first operations.

FAQs

It’s the ecosystem of apps and web platforms where users draft virtual teams of real players. Businesses earn via entry fees, premium subscriptions, ads, and emerging formats like NFTs.

Estimates show ~$30.5B in 2023 with projections ranging to USD 56,381.2M by 2030, and longer-term outlooks crossing $100B by 2033, at ~13.9–14.6% CAGR across studies.

North America leads with ~36–39% 2024 share and ~USD 1.71B revenue, while APAC is accelerating at ~14.08% CAGR to 2030. Brazil’s 2025 regulation signals sizable near-term opportunities.

The 18–39 age group dominates. Mobile drives ~65.43% of transactions, and participation is broad (e.g., 84M adults in the U.S./Canada engaged in fantasy or betting recently).

FanDuel logged ~4.5M users and ~10.8M downloads in 2024; DraftKings had ~4.8M active users; ESPN Fantasy hit ~13M players; Yahoo shows high mobile reliance (≈85% usage).

AI improves projections and personalization; IoT tracking enriches scoring; push-led gamification lifts sessions and purchases. Together, they raise engagement, LTV, and differentiation for future-ready apps.

Share this blog