Ever wondered how much does it cost to develop a digital wallet app like Payit in the UAE?

The cost to clone the Payit app in the UAE can typically range from AED 147,000 TO AED 550,000 ($40,000 to $150,000), depending on a lot of factors.

If you're thinking of building your own digital payment solution, you're not alone. With Payit becoming a go-to choice for fast, secure, and cashless transactions in the UAE, many startups and enterprises are jumping on the eWallet trend.

But let’s be real– Payit-like app development cost isn’t just a number you can Google. It depends on your feature list, tech stack, compliance needs, user experience, and more.

Still, you need a solid estimate to plan your budget, pitch to investors, or choose the right development partner.

That’s where this blog comes in.

We’ll break down the real costs behind a Payit-style app–by–feature, platform, and region–so you can move forward with clarity (and confidence).

If you're serious about building a digital wallet that’s secure, scalable, and investor-worthy, this guide is your starting line.

Let’s get started:

Overview of the Payit App

Those who don’t have complete knowledge of the Payit App often enquiries: What exactly is the Payit App?

Payit is the UAE’s first fully digital wallet app, launched by First Abu Dhabi Bank (FAB) to simplify cashless transactions for individuals and businesses. It offers a seamless way to send, receive, and manage money, all without the need for a bank account.

As per their claims, the app has crossed 1 million+ downloads, proving its popularity among UAE residents looking for quick, secure, and paperless payment solutions.

With 2,000+ payment acceptance points across the UAE, users can pay bills, shop online, scan QR codes in-store, and even split bills with friends.

It’s backed by over 3,000 app reviews, reflecting a high level of trust and usability.

Perhaps most impressively, Payit is available in 200+ countries and territories, making it not just a local digital wallet but a global payment solution.

It’s a perfect example of how you can create an eWallet app that delivers convenience, scale, and impact.

Besides that, it has a very streamlined working:

-

- User downloads the Payit app from the App Store or Google Play.

- Quick account setup using a valid Emirates ID—no bank account needed.

- Add money to the wallet via a linked bank account, salary deposit, or FAB cash deposit machines.

- Start making payments at over 2,000+ acceptance points, both online and in-store, using QR codes or your mobile number.

- Send or receive money instantly to anyone in the UAE—even if they don’t have a Payit account.

- Pay utility bills, mobile recharge, and government services directly from the app.

- Split bills or request payments from friends and contacts easily.

- Withdraw cash without a card from FAB ATMs if needed.

- Enjoy international transfers to 200+ countries at competitive rates.

- Track all transactions and set spending limits using the app’s intuitive dashboard.

No wonder people want to create an eWallet app like Payit. After all, it’s more than just a wallet– it’s a lifestyle enabler.

Coming to the point that made you Google the blog in the first place, “How much does it cost to create an eWallet app like Payit?. We will talk about the same in the next section:

How Much Does it Cost to Develop a Digital Wallet App like Payit?

When you’re thinking about developing a digital wallet app like Payit, one of the first questions that comes to mind is, How much does it cost to develop a digital wallet app like Payit in the UAE?

Typically, the cost to create an eWallet app like Payit in the UAE ranges between AED 150,000 to AED 550,000 ($40,000 – $150,000+) in the UAE.

The cost can vary significantly depending on your goals, the complexity of features, and the quality of the development team.

Several factors influence this cost, such as the platform (iOS, Android, or both), the type of features (peer-to-peer payments, integrations with banks, security measures), and your app’s design and scalability.

It’s important to choose the best mobile app development company that can align with your vision and ensure the app delivers a smooth user experience while remaining secure and scalable.

Here’s a detailed breakdown of the cost to create an eWallet app:

|

Development Stage |

Estimated Cost (AED) |

Estimated Cost (USD) |

|

MVP Version |

AED 150,000 – AED 220,000 |

$40,000 – $60,000 |

|

Mid-Level App |

AED 220,000 – AED 370,000 |

$60,000 – $100,000 |

|

Advanced App (Payit-level) |

AED 370,000 – AED 550,000 |

$100,000 – $150,000+ |

The cost to launch a new Payit-like app generally has a lot of factors around it, so make sure you know about them all:

Factors Affecting the Overall Cost to Create an App like Payit

When it comes to overall cost to develop an app like Payit, remember it is not just a figure that we can tell and you go with it.

Several factors come to play an important role in finalizing the price you have to pay for Payit like app development.

Let’s get to know one by one:

1. App Features

When it comes to digital wallet features, they are crucial to the success of your app.

If you’re planning to develop an app like Payit, it's important to include both essential and advanced features to differentiate yourself from the competition.

But how does features affect the cost to create an app like Payit? As per layman’s rule, basic features tend to be more affordable, while advanced ones can drive up the cost.

The more complex the features, the higher the price tag.

|

Feature Type |

Example Features |

Cost Impact |

Details |

|

Essential Features |

User registration/login- Payment processing- Transaction history- Balance management |

Low to Medium |

Basic features that are necessary for the app to function, ensuring usability and core functionality. |

|

Advanced Features |

Peer-to-peer transfers- Investment options- Virtual cards- AI-based spending insights |

High |

These features add sophistication and competitive advantage but can significantly increase development complexity and cost. |

2. Development Team Location

It's a well-known fact that the location of your development team can have a major impact on Payit-like app development cost.

When calculating your total expenses, don’t forget to take location-based pricing into account.

If you hire mobile app developers from the US or Australia, expect the rates to be higher. However, opting for developers from regions with lower hourly rates, like India or the Philippines, can help bring those costs down.

This difference is mainly due to the varying cost of living in each region, which naturally affects the pricing.

|

Region |

Hourly Rate (USD) |

Typical Features Cost |

Why it Matters |

|

United States |

$100 - $250 |

High |

Higher cost of living leads to premium developer rates. |

|

Australia |

$80 - $150 |

High |

Similar to the US, but generally more affordable in comparison. |

|

India |

$20 - $60 |

Low to Medium |

Cost-effective rates due to lower cost of living. |

|

Philippines |

$15 - $50 |

Low |

One of the most cost-effective regions with a strong developer pool. |

3. App Design

One common factor among the top eWallet apps is their clean and visually appealing design.

To attract users to your app, it's essential to ensure that the design is both attractive and user-friendly.

We recommend starting with prototypes and wireframes before diving into full-scale development to ensure the design meets user expectations.

|

Stage |

Task |

Estimated Cost |

Details |

|

Prototypes & Wireframes |

Design wireframes |

$3,000 - $10,000 |

Initial design stage, ensuring the app meets user expectations. |

|

Full Design |

UI/UX design |

$5,000 - $20,000 |

Comprehensive design work to finalize the app’s look and feel. |

|

Usability Testing |

Gather user feedback |

$2,000 - $8,000 |

Testing the design with real users to refine it. |

4. Testing

App testing is a crucial step in the development process, influencing the overall Payit development cost significantly.

It ensures that the app functions flawlessly, providing users with a smooth experience while preventing costly errors post-launch.

The more thorough the testing, the more likely your app will thrive in a competitive market.

|

Testing Type |

Tasks Involved |

Estimated Cost |

Importance |

|

Unit Testing |

Test individual features |

$1,000 - $5,000 |

Ensures that each feature works as expected in isolation. |

|

Integration Testing |

Test how features interact |

$2,000 - $8,000 |

Verifies that different parts of the app work together. |

|

User Acceptance Testing (UAT) |

End-user testing |

$3,000 - $10,000 |

Ensures that the app is ready for market release. |

5. Choice of Platform

Once you have a mobile app idea, one of the important steps you need to take is deciding whether to opt for Android app development service, iOS app development services or both.

We don’t blame you, even the best of us get stuck here.

But, remember your decision will have an impact on the overall cost to develop a digital wallet app like Payit.

How?

Here's the deal: native app development for both platforms can get pricey. But no worries!

Cross-platform development (using tools like React Native or Flutter) lets you build your app for both without the extra cost.

Sure, native apps have some perks, but cross-platform gives you more bang for your buck without skimping on functionality!

|

Platform Type |

Pros |

Cons |

Cost Impact |

|

Native (Android or iOS) |

Optimized performance |

- Higher development cost |

High |

|

Cross-Platform (React Native, Flutter) |

Single codebase |

- Performance may be slightly lower than native |

Medium |

6. Maintenance & Updates

When considering the cost to create an app like Payit, don’t forget the hidden factor of app maintenance services.

Initial development is just the start; your app will need regular fixes and improvements.

Security updates and bug fixes are crucial to keep the app running smoothly.

Adding new features and enhancing the user experience will keep your app competitive.

Long-term maintenance can sometimes cost as much as the initial launch, so plan for ongoing expenses!

|

Maintenance Type |

Tasks Involved |

Estimated Annual Cost |

Details |

|

Security Updates |

Regular security patches |

$5,000 - $20,000 |

Essential to protect users’ financial data. |

|

Bug Fixes |

Identify and fix post-launch bugs |

$3,000 - $15,000 |

Regular bug fixes to maintain smooth functionality. |

|

Feature Enhancements |

Add new features |

$10,000 - $30,000 |

Continuous improvement to keep users engaged. |

7. Third-Party Integrations

As much as third-party integrations enhance your app’s capabilities, it also increase the overall cost to develop an eWallet app like Payit.

Integrating payment gateways, banking APIs or other third party services ( including fraud detection systems) can drive up the overall Payit like app development cost, especially if they require custom configurations.

So, make sure to work with only those integrations that are reliable , secure, and scalable to avoid future headaches and keep development costs under control.

|

Integration Type |

Example |

Estimated Cost |

Why It Matters |

|

Payment Gateways |

PayPal, Stripe, or Square |

$5,000 - $15,000 |

Necessary for processing transactions securely. |

|

Fraud Detection |

Anti-fraud systems |

$5,000 - $10,000 |

Adds an extra layer of security for users. |

|

Banking APIs |

Integrating banking services |

$10,000 - $30,000 |

Enables real-time access to financial data. |

8. App Security

When developing an app like Payit, security isn’t just a "nice-to-have" feature — it’s essential.

Protecting sensitive financial data means investing in high-level security protocols like encryption, multi-factor authentication, and fraud detection systems.

Implementing these layers of protection requires time and resources, pushing up the development cost.

But here’s the thing: while it might be an upfront investment, it’s totally worth it.

Without solid digital wallet security, your app is at risk of data breaches, which could harm your reputation and cost you far more in lost users and legal fees. So, think of it as a long-term safeguard!

|

Security Feature |

Example |

Estimated Cost |

Why It Matters |

|

Encryption |

Data encryption at rest and in transit |

$5,000 - $15,000 |

Ensures that user data is always protected. |

|

Multi-Factor Authentication |

Two-step verification |

$3,000 - $10,000 |

Adds a second layer of protection. |

|

Fraud Detection |

AI-driven fraud detection |

$7,000 - $20,000 |

Helps prevent unauthorized transactions. |

As we have laid the foundation of there are several factors that can impact how much does it costs to create an app like Payit.

But, with costs soaring high, it shouldn’t stop you from turning your eWallet app idea to a successful solution, which is why we will discuss simple ways to reduce the overall Payit clone app development cost.

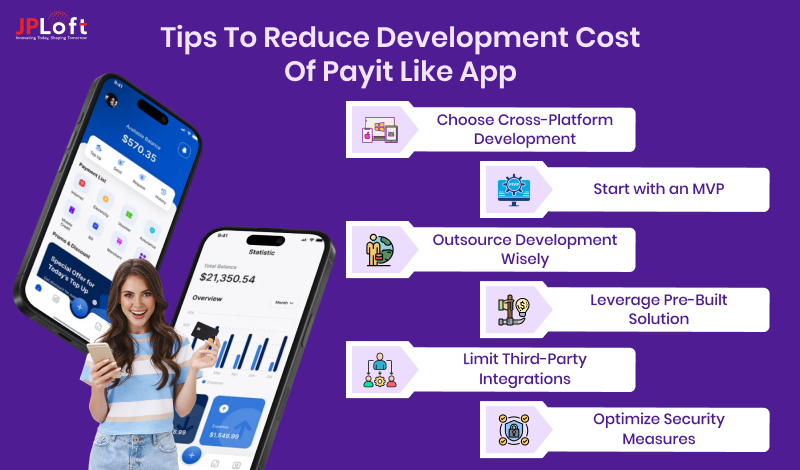

How to Reduce the Overall Cost to Develop a Digital Wallet App like Payit?

When it comes to the cost to create a digital wallet app like Payit, many factors contribute to the overall price.

However, with the right strategy and planning, you can significantly reduce costs without sacrificing quality or essential features.

Focus on smart development choices, efficient outsourcing, and leveraging existing resources- including advancements like AI in digital payments- to keep the cost to develop an app like Payit within budget, while ensuring scalability and security.

1] Choose Cross-Platform Development

Opting for cross-platform development tools like React Native or Flutter allows you to build one codebase for both Android and iOS.

This approach dramatically reduces the cost to build an app like Payit compared to developing separate apps for each platform.

Plus, it cuts down on the development time, making it an ideal solution if you want to keep expenses low without compromising on functionality.

2] Start with an MVP (Minimum Viable Product

Launching your digital wallet app as an MVP helps you focus on core features first.

Instead of building a complex product from the get-go, prioritize essential features like secure payments and user authentication.

This approach helps reduce the cost to develop an eWallet app like Payit by eliminating unnecessary features in the initial phase.

It also provides an opportunity to gather feedback and iterate in addressing the challenges of digital wallet adoption, such as user trust and retention.

3] Outsource Development Wisely

Hiring dedicated developers from regions with lower hourly rates, like India, Eastern Europe, or Southeast Asia, can significantly reduce the cost to develop an app like Payit.

These areas have a robust talent pool with experience in developing eWallet apps.

By outsourcing, you can save money while still getting top-tier expertise without paying the high rates typically associated with developers from the US or Western Europe.

4] Leverage Pre-Built Solution

Rather than building every feature from scratch, consider leveraging pre-built solutions and APIs for payment processing, security, and other essential functionalities.

These ready-made components can save both time and money, reducing the overall cost to create a digital wallet app like Payit.

Integrating well-established payment gateways and fraud detection systems is often more efficient than developing them in-house from the ground up.

5] Limit Third-Party Integrations

While third-party integrations can add valuable features to your app, they can also raise costs, especially if they require complex customization.

To keep the cost to create an eWallet app like Payit under control, be selective about which integrations are absolutely essential for your app’s success.

Prioritize integrations that enhance the user experience and drive transactions, while skipping less critical add-ons that can be added later.

6] Optimize Security Measures

Security is a major concern for digital wallet apps, and while you don’t want to skimp on protection, you can still manage your budget effectively.

Implement cost-effective security measures like encryption, multi-factor authentication, and tokenization to protect sensitive financial data.

These basic yet effective measures reduce the risk of data breaches, ultimately lowering the cost to develop a digital wallet app like Payit by minimizing the need for expensive security fixes post-launch.

By following these strategies, you can keep the cost to develop an app like Payit manageable without compromising with quality, allowing you to start an online eWallet business that has strong roots and is successful in the market.

Now, you have a pretty good idea about the cost of Payit-like app development and ways to reduce the cost. Let’s find out different ways to make money from such an app.

How Payit like App Make Money?

One of the common questions you may have is, “How does a Payit-like app make money?”

As a smart investor, the first thing that crosses your mind is profits.

This is why it’s crucial to employ top digital wallet app monetization models that generate revenue consistently.

Let’s explore some popular models:

1. Transaction Fees

Digital wallets like Payit charge a small fee for each transaction made within the app, whether it's a money transfer, bill payment, or purchase.

These fees add up quickly, especially with high transaction volumes, providing a steady revenue stream for the app.

2. Subscription Model

Offering premium features or services on a subscription basis can be an effective app monetization strategy.

Users who want enhanced functionalities, such as higher transaction limits, priority support, or additional security features, can pay a recurring fee, boosting the app’s revenue over time.

3. Payment Gateway Fees

When users link their payment methods (e.g., debit cards, credit cards) to the wallet, the app earns a commission from payment gateways like Visa or Mastercard.

Each time a user completes a transaction using these gateways, the app receives a percentage, making it a profitable model for Payit-like apps.

4. Ad Revenue

Displaying ads from third-party networks is a common way to monetize a digital wallet app.

Whether it’s banner ads, interstitials, or native ads, Payit-like apps can earn revenue based on the number of impressions or clicks on these ads.

This model works well for apps with large user bases.

5. Affiliate Marketing

Digital wallets often partner with e-commerce platforms, online services, or financial institutions.

They can earn commissions by promoting services like loans, insurance, or shopping offers to their users.

This affiliate model is particularly lucrative if the app has a diverse user base with varied needs.

6. Data Analytics Services

With permission from users, Payit-like apps can gather anonymized data about spending patterns and financial behaviours.

This data can be monetized by selling insights to financial institutions, marketers, or research firms, providing the app with a passive income stream.

7. Interest on User Balances

When users store funds within the app, digital wallets can earn interest on those balances, especially if they partner with financial institutions.

The app can share a portion of the interest with users while keeping a percentage for itself, turning idle funds into a revenue source.

Each of these monetization strategies can be fine-tuned depending on the app’s user base and market, helping you build a profitable Payit-like digital wallet.

How JPLoft Can Help You Develop a Digital Wallet App like Payit?

Looking at Payit, it looks like it is a smart investment idea.

If you really want to create a digital wallet app like Payit, this is your time to shine. Take help from JPLoft, the best eWallet app development company in the UAE, to turn your idea into a successful solution.

With over 10 years of experience and more than 1,100 projects successfully delivered, they possess extensive knowledge and expertise in developing exceptional solutions.

Their proven track record ensures a deep understanding of what it takes to create high-quality, impactful projects that meet client needs and drive results.

Conclusion

In conclusion, the cost to develop a digital wallet app like Payit depends on various factors such as features, platform, design, and development complexity.

However, choosing the right development team, leveraging scalable technologies, and focusing on security and user experience can impact the final price.

It’s important to conduct thorough market research and plan the app’s features and functionalities carefully to meet both user needs and budget constraints.

Understanding these factors will help you estimate how much it costs to develop a digital wallet app like Payit effectively.

FAQs

The cost typically ranges from AED 147,000 TO AED 550,000 ($40,000 to $150,000), depending on features, platform, and design complexities.

Essential features include secure payment gateways, user authentication, transaction history, P2P transfers, and integrations with banking systems.

Development time varies but typically ranges from 4 to 12 months, depending on the complexity and number of features.

Major challenges include ensuring data security, compliance with financial regulations, and providing a seamless user experience across multiple platforms.

While a limited budget may restrict some features, focusing on core functionalities and gradual expansion can make the project more feasible within budget constraints.

Share this blog