The world has changed drastically, and people live in the digital age. The shift from traditional buying to online shopping is a long process. In the wake of the epidemic, the continuous evolution of digital technology is becoming more frequent. Because of this, payments are getting increasingly digital. This requires dedicated developers to develop the necessary electronic wallets.

We are witnessing the emergence of new mobile-based e-wallet services each day. People today prefer to pay for their purchases using mobile banking, debit, or credit cards. This is the quickest payment method. The most effective e-wallet apps include PhonePe, Mobikwik, and Paytm. Finding a reliable Mobile app creator for the most efficient apps that can interact with your clients would be best.

What is an eWallet?

An e-wallet can be described as a mobile or digital wallet that allows you to transfer funds online. These wallets work like online banking; however, you must deposit funds into each wallet to make more Money. You can also link every bank account to the wallet and trade it instantly. It is as easy as using the QR codes or the recipient's mobile phone number.

Thanks to these new technologies, it is only a few seconds, and the users can use it faster. EWallets are currently used to conduct transactions to trade for Ethereum bitcoin, cryptocurrency, and others. This has led to a rise in demand for cryptocurrency wallet development since many people are now beginning to invest in cryptocurrency.

However, since these wallets comprise our financial information, it is essential that these payment gateways be secure and that all information entered is always encrypted so that it is inaccessible.

Industries that can leverage the advantages of Mobile Wallet Applications

On-Demand Grocery and Food Apps

Everyone has an iPhone and is looking for home items and luxury goods through e-commerce apps. A few people are highly attracted to buying items on the Internet. Because of obsolete applications and the gap between buyers and sellers, the demand to develop food delivery applications is increasing and is currently being replaced by various small-scale businesses and industrial startup companies. The increasing number of products available online is a positive choice, considering that the increase in demand has been so huge that the behavior of users has increased significantly.

Online Bill Payments

The days of going to an electricity company's address to pay your electricity bill for the month are long gone. It can be done effortlessly and at your home. This feature does not just simplify payment but also assists customers in paying on time. Nearly all e-wallets allow customers to pay off all outstanding debts via the application. This includes phone, gas bills, and utility bills.

Ticketing and Booking

Another significant business that has paid to make e-wallets successful is the ticket and reservation business. Users can now utilize the wallet to purchase trains, planes, and bus tickets. With this wallet's help, users can also reserve tickets for movie screenings and even book concert tickets.

On-Demand Taxi Booking

Do you book cans and pay Cash? This is extremely old, and a majority of times, it has yet to happen. People are shifting their priorities as health is a significant goal, but they are beginning to pay using e-wallets. First, it ensures trust between mobile app developers. In addition, it's the most convenient and effective business method.

Ecommerce Industry

Everyone has an iPhone, and everyone is searching for household items and luxury items in e-commerce applications. Many people are attracted to buying items on the Internet. With the emergence of persistent apps that impact both buyers and sellers, the amount of online wallets is growing, and numerous small-scale businesses and startups are flourishing in this field.

This massive increase is expected to continue because of a significant shift in consumer behavior that has led to purchasing more online items. Additionally, many users prefer to pay in advance and don't need to pay for anything.

Types of Transaction Methods in Wallet Apps

Since the eCommerce market has emerged as the winner of this COVID-19 epidemic and the population has become reliant on it for purchasing essential products, this dependency has also led to eWallets. There are a variety of methods that can be used to conduct payments online and transactions. The most commonly used methods include:

Mobile App Wallets

This concept has been introduced previously since we've already talked about the subject once and will discuss more in the coming days. Some of the most well-known eWallets apps that changed the payment process include Google Pay, Samsung Pay, Android Pay, Venmo, and many more.

Internet Banking

If you have a bank account, there's no doubt that you'll also have access to internet banking. This technique has been in the news for a couple of months. To make payments using Internet banking, customers must first register a receiver by filling in all the necessary information. After that, they must wait until the receiver can add them to their payee list. Now, you're in a position to complete transactions.

Near Field Communication (NFC)

It is a non-contact method for making payments. Users do not need to interact with other devices when making NFC payments. Instead, the receiver's pay pad scans the receiver's code. Even though older phones don't feature this technology, all modern phones are equipped with this online payment method.

Sound Waves Payment Methods

This contactless payment method is a new fast transaction payment method that lets users complete transactions using the sound waves generated through mobiles. This payment method can easily be integrated into any phone, feature card swipers, etc.

Bluetooth or iBeacon

iBeacon is a Bluetooth low-energy technology released by Apple with the iPhone 7 and is available exclusively for iOS clients. This is a novel and unique way of providing payment services based on location. Beacons are tiny transistors that transmit signals to Apple devices when they are within proximity.

Bluetooth technology works similarly to this. It detects all closed devices and can be utilized by most eWallet solutions.

QR Codes

This type of technology is employed by those who make regular payments. To make payments, you need to take a picture of the QR code on the recipient, and the payment can be made quickly and in a simplified manner.

Blockchain

This technology is embedded in many eWallet apps since they offer security and a stable environment. Most businesses use apps that integrate Blockchain since the payments made using blockchain technology are massive in value.

Benefits of eWallet Applications for Making Payments

Many businesses have their wallets, like Amazon Pay, Google Pay, and Apple Pay, and make Money on every transaction through the wallet. Thus, each business gives customers different information to allow users to use their wallets. E-Wallet is an excellent option for anyone who uses the Internet to make online purchases today. These platforms offer easy access to payment options and simple storage of mobile Cash. The advantages of an e-wallet are:

Convenient

It provides greater convenience for many customers. Shoppers can make purchases in a matter of minutes. Place your device into the cash drawer or scan it to pay for purchases. This means your shopping experience will be quicker, simpler, and more enjoyable. Additionally, the faster the transaction, the fewer checkout lines will be at the shop.

High Security

E-Wallet offers advanced security to users by ensuring that every transaction can be carried out using a PIN, password, or fingerprint reader. When you make a purchase using your electronic wallet, you don't have to divulge your credit or debit card information, offline or online. Third-party service providers store the information. It is protected by biometrics or a password. It is possible to access your e-wallet if you lose your device or get an alternative.

Enhanced Payment Options

Digital wallets offer customers a simple method to complete transactions. They also give companies that use this technology an edge in the market. Improve your customer's payment experience and provide a new dimension to each purchase. Freecharge lets you use your digital Cash in many places, such as. PayPal also has partners, including eBay, Best Buy, and Southwest. Thus, e-Wallet offers many options and also saves you time.

Less Transaction Fee

Merchants can cut down on the cost of bank transactions by using their credit cards for payment that can be used with electronic wallets. These cards are digital and comparable to gift cards sold in stores, except that there is no charge for issuing plastic cards. Additionally, it's not the bank's card that allows banks to end the payment process and cut the transaction cost.

Also Read: Develop an ewallet App Like Venmo

Receded Cart Abandonment

The most significant benefit to retailers lies in the shorter basket distance. This increases the sales. Making the purchasing process simpler allows more customers to finish the purchase. In a study of shoppers who left the carts of their choice, most said it needed to be clarified or took too long.

Monetization Options Offered by eWallet Applications

Billing Commission

The applications used by humans earn a portion of each individual's transaction. This is among the most sought-after methods to make Money and is most well-liked using open electronic wallets.

eCommerce Enablement

The wallet lets users create companies and sell their products via the application. Other companies can also sign contracts with you, allowing the sale of their products through the platforms you provide—the interests of the business. Through attracting new customers, it will be a platform that has an active user base, where many brands and companies can learn more about the platform. Customers can contact you to incorporate the payment gateway into your application.

Advertising

We know that different apps will be shown in advertisements to promote. Getting space on third-party brand applications and earning Money through this application is possible. The cost of serving ads differs based on the date and time an ad will be displayed.

Types of eWallet Applications

The data saved in wallets for mobile devices is protected, making it more difficult for cybercriminals to swindle them. Actual debit and credit cards are susceptible to being stolen or copied. However, they are challenging to steal since mobile wallets have encrypted keys that don't provide valuable details. These are the major types of electronic wallets:

Closed Wallets

Closed wallets are bonded to a specific merchant, and users can spend their funds on transactions made by the merchant. The funds cannot be used to make payments or withdraw to other third-party vendors or merchants. One sample is an Amazon Pay wallet.

Open Wallets

Open wallets can be used directly by banks or other third parties. Open Wallet lets customers use mobile wallets to purchase transactions or withdraw Money from their accounts. One example of an open mobile wallet is PayPal. It allows users to shop online and shop while withdrawing funds.

Semi Closed Wallets

The semi-closed wallet permits users to use their wallet credit to pay multiple merchants if each merchant and the mobile wallet business sign the contract. Customers can also take Money from their bank accounts. In a closed wallet, users are not able to take Money out.

Must-have features of E-Wallet Applications

The mobile application is only great, as are its features. Before you begin the eWallet mobile app development process, conduct market research to identify the objectives of your app. To make it a market leader, you must integrate certain basic features into your app if you need help with everything with your distance from an experienced e-wallet app developer who can create solid and secure mobile wallet applications.

The eWallet application is used by many users, which is why you have to design distinct panels for every user. The E-Wallet mobile app has three panels: reseller, user, and models.

Developing individual applications in each area gives users full access to all features. This lists the most intriguing options available on the panels for applications.

User Panel

1. User Registration: The initial screen shows the area where users are. To use the application, users must sign up for an account. Sign up with an existing mobile number or use Facebook or Twitter credentials to sign up for an account.

2. Connect Bank Account: After creating the account, users can add their desired bank account to receive or transfer funds.

3. Add Money: For the transfer of funds, users can add funds to the wallet of the app using the bank account that is linked to it.

4. Check the balance: Users can quickly check the available balance on their bank account or the application wallet in just a few clicks.

5. Transfer Cash: This feature lets users perform transactions easily using the application.

6. Bill Payments: An additional feature permits users to pay utility bills like television recharge, electricity bill recharge for mobile phones, and many more.

7. Accept Money: The wallet application lets the user pay into their account wallets or directly to their bank account.

8. Transaction History: All payments made in the past are recorded in the transaction history, and users can access it at any time.

9. Invite Friends: Giving Cash back or points to users who invite their contacts to the application will increase its popularity in the marketplace.

Merchant Panel Features

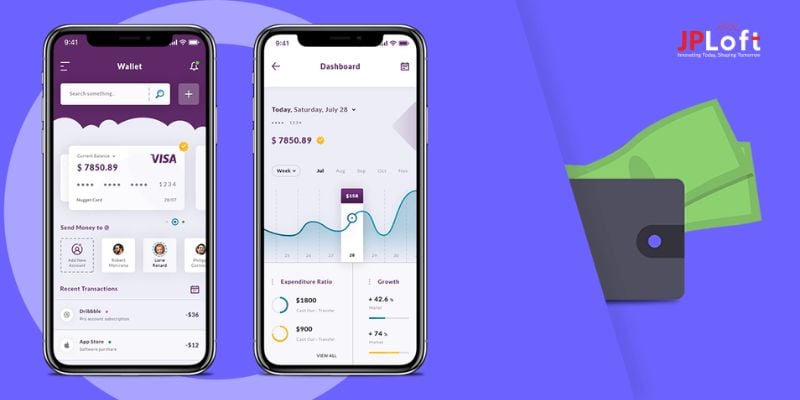

1. Intuitive Dashboard: This feature provides you with an overview of all the items you purchased from your dealer and all aspects of transactions.

2. Edit Profile: Merchants can input information like name, bank account details, and business address.

3. Add Products: Merchants can update their products by using the user wallet software by using this function.

4. Create QR Codes: Merchants can create QR codes to collect customer payments, allowing quick and easy transactions.

5. Customer Management: Sellers can manage the customer's information through the view of transaction history.

6. Withdraw Money to Bank: All Money from clients can be transferred directly to the bank using this feature.

7. Offer Discounts and Coupons: To attract more customers, sellers may offer discounts on all purchases.

8. Loyalty Points: Point's products also assist businesses in drawing customers to the application.

Admin Panel Features

1. Dashboard: The primary and additional information all registered traders and users need is at the top of the page. Administrators can also keep track of app performance from the dashboard.

2. New Offers: Administrators create new offerings and listings to attract and motivate users to the wallet app.

3. Manage the Users: The administrator tracks and supervises every user's actions, including transactions, personal information, and actions performed.

4. Revenue Management: This feature lets administrators create weekly, daily, and monthly total earnings.

5. Analytics and Reporting: The administrator reviews all information about the total number of people who have registered as users. This includes the highest number of offers, the number of completed transactions, and the application's overall functionality via the administration panel.

6. Add/Block user: Administrators can block users on the application by monitoring their actions in the wallet application. Additionally, new users can add to the app based on the person who meets the application requirements.

Cost of eWallet Application Development

The data stored on mobile wallets is secured, making it harder for hackers to fool them. Credit and debit cards can be hacked or duplicated. However, they are challenging to take because mobile wallets have encrypted keys that need to reveal important details.

Estimating the cost of an eWallet app isn't feasible since various elements impact the development cost. However, calculating estimates for a similar project is feasible by constructing an initial concept prototype. Some of the most commonly used factors that impact the eWallet app development cost include:

Development Platform

Suppose the application is created on a single Android or iOS platform; the price will depend on the features you plan to incorporate into the application. Generally, an app developed specifically for the iOS platform is more expensive than one designed for the Android platform. However, if you wish to have your app to be compatible with different platforms, you can select

Size of the App

The program's size is among the main factors determining the cost of applications. The overall cost is minimal because of the program's small size, limited number of pages, and minor features. Additionally, if you seek more features for your application, you will need more space to incorporate features. That is, there are more pages, and it will cost more.

Design of the App

The emphasis here is on the UI/UX components, which show that the user interface should be straightforward and interactive. The UX/UX designer manages the navigation and graphics and creates the program following.

Geographical Location

It is also one of the primary aspects that affect the final price of programming. Since the cost of resources varies between locations and places, this can impact the cost of constructing an electronic wallet.

The cost to create an eWallet app is contingent upon all the above variables. The initial cost for building the simplest Android e-wallet is around $20,000 to $45,000. Android platform is between $20,000-$45,000 and $80,000-$15,000 for the app's more advanced features.

The same app for the iOS platform is priced between $25,000 to $55,000; however, the premium version costs $100,000 to $150,000. Additionally, the cost of adapting an app to meet a new need is contingent upon the difficulty and efficiency of the requirements.

Technology Stack for eWallet App Development

-

-

SMS, Phone, and Voice Verification: Nexmo

-

Front-End: CSS, HTML5, Angular, and JavaScript

-

Cloud Environment: AWS, Azure, Google Cloud, and Salesforce

-

Data Management: Datastax

-

Real-Time Analytics: Big Data, Hadoop, Apache, and Spark

-

Payment: PayPal, Stripe, PayUMoney, and Braintree

-

Database: MongoDB, HBase, MailChimp, and Cassandra

-

Push Notifications: Twilio, Urban Airship, Amazon SNS, and Push.IO

-

Email management: Mandrill

-

QR-Code Scanning: ZBar Code Reader

Team Structure for eWallet App Development

In addition to searching for an eWallet app development company, you'll require a group of people who manage the whole development process. The team structure for the development of an eWallet application:

-

-

App developers

-

Front-end developer

-

The Back-end Developers

-

UX/UI designers

-

Quality Analyst

-

Business Analyst

-

Project Manager

-

Conclusion

Making a solid e-wallet app is challenging; many mobile app developers can do it properly. Developing a successful and market-leading e-wallet application requires time, expertise, and committed resources. Thus, before you hire a mobile app development company, you should know the track record of the company and its efforts to develop applications for electronic wallets on mobile devices.

The process of creating an electronic wallet application can be a good investment. It can also be profitable when you design it correctly. The price of developing an app for e-wallets can differ according to various aspects, including the features you're looking at, the platform you want to use, and app complexity.

It is crucial to evaluate the choices and hire mobile app developers to ensure your app meets your customers' needs and offers secure and reliable payment methods. By utilizing a sensible plan and execution, the e-wallet application could provide millions of users with an easy and popular payment option.

FAQs

1. What factors influence the expense of creating an Ewallet mobile application?

The price for Ewallet to develop mobile apps depends on many factors, such as the complexity of features, features, platforms (iOS, Android, or both), design, time to develop, and where the team is located. Other factors like security features, integration with third-party applications, and scalability requirements affect the total development cost.

2. How do I make Money from my Ewallet mobile application?

Ewallet applications offer a variety of options for monetization, including transaction fees, subscription models, in-app ads, and partnerships with merchants for commission-based revenue. You can also explore partnerships with financial institutions to develop revenue-sharing models or adopt a freemium approach, which offers essential services at no cost and pricing premium services.

3. How many security precautions must be included within the Ewallet app? And how will they affect the development costs?

Security is the most crucial aspect when it comes to the creation of an Ewallet app. Ensuring end-to-end encryption and secured login options with biometric authentication and methods to detect fraud can significantly affect the development price. Maintaining robust security measures is essential to gain users' confidence and ensure the safety of sensitive financial information.

4. What time will it usually take to create an Ewallet mobile application?

The development time of an Ewallet mobile app is contingent on the application's complexity and features. The basic version can require a few months, and more sophisticated apps with complex functions and integrations may take longer. It is essential to go through careful planning, design, and testing to guarantee the success of a reliable and solid Ewallet application.

5. Do you have ongoing expenses for keeping an Ewallet mobile application after its creation?

Maintaining an Ewallet application is a constant expense for hosting the server and updating security, bug fixings, and feature enhancements. In addition, you will have to pay for customer marketing support and compliance with changing industry standards. Regular updates that can meet the latest technologies and user expectations are essential to the longevity of the application.