With smartphones becoming ubiquitous worldwide and their increasing convenience for people from various walks of life, mobile payment methods such as E-wallets (also called digital wallets or virtual wallets) are becoming more widespread across all cultures and geographical locations. E-wallets enable individuals to manage their money electronically using contactless technology.

Statista reports that mobile wallets are currently the preferred payment method among Americans when shopping online, surpassing other payment technologies by nearly four to one. ApplePay and GooglePay are competing as future mobile payment technologies, with 9 million new Apple Pay users expected between 2022 and 2026 alone.

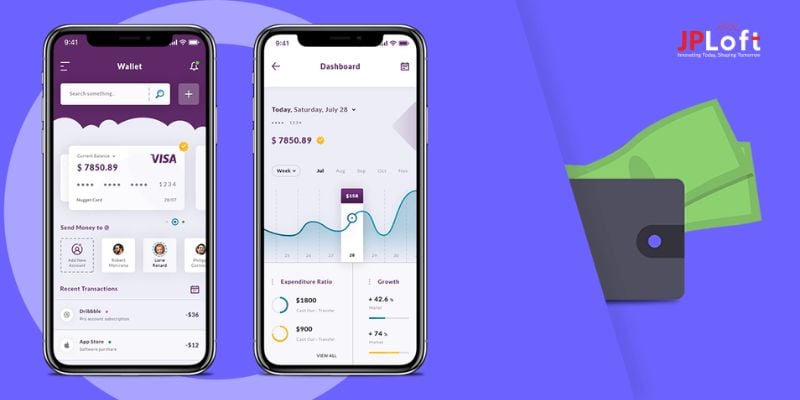

Developing digital wallet applications could be the ideal way to expand services while simplifying customer processes. If you are a new company looking for explosive growth potential within an industry, developing an electronic wallet app could prove profitable in 2019.

In this comprehensive guide, we discuss all of the critical elements required for digital wallet application development. From cost implications and essential features to development process security stack and technology stack - and much more - this book provides invaluable guidance for developing digital wallet applications in 2024 or even beyond! Join us as we uncover plans to develop the next generation of digital wallets!

What is a Digital Wallet?

A digital wallet transforms how we manage our finances and makes transactions easier in today's rapidly moving world. It's basically a software application that acts as a virtual version of our physical wallet. With an electronic wallet in your pocket, you don't have to carry around a large wallet stuffed with cards and documents. All you need is a smartphone that has an application for mobiles.

Making an online wallet is easy. After installing the app on your smartphone, enter your credit or debit card information into Secure Platform. The details are secured and stored as tokens with a unique device identification code called a cryptogram. When you conduct transfers or transactions using cryptograms or tokens, they are used as a virtual ID that ensures secure and fast transactions.

The days of placing cards into terminals at point-of-sale or fumbling with security PINs. Digital wallets facilitate contactless transactions, which increases efficiency and convenience with robust security features. With the changes in the FinTech landscape, digital wallets are becoming more than mere payment method repositories. They are transforming into complete ecosystems, providing storage for digital goods typically stored in physically based wallets.

From loyalty points and gift cards to tickets for events and boarding passes, Digital wallets combine a variety of items into one easily accessible platform. This fusion of functions not only simplifies our everyday transactions but also helps lay the foundation for a time when physical wallets could disappear.

Digital wallets go beyond technological conveniences; they represent a paradigm shift in how we deal with our finances and live our lives online. As technology develops and evolves, we can anticipate that the digital wallet will play a more important role in shaping our way of life in the contemporary world.

Key Mobile Wallet Companies

The statistics on the market for digital wallet development are impressive. With seamless transaction processes and ingenious features in digital wallets, these companies revolutionize how we manage our money in the modern age. Before we create a digital wallet application, we will look at the most popular mobile wallets:

Amazon Web Services, Inc. (AWS)

Amazon Web Services (AWS) is a world market leader in cloud computing. The company is known for its extensive and robust system. AWS offers scalable solutions that meet a variety of business requirements. AWS offers cutting-edge AI and machine-learning capabilities that allow businesses to be innovative and improve efficiency in their processes.

Visa Inc.

As a worldwide payment technology firm, Visa Inc. is synonymous with convenient and secure financial transactions. Its global network ensures quick and secure transactions across boundaries. In addition, the Visa Token Service (VTS) is a unique feature that increases protection by replacing private card data with unique tokens, reducing the chance of being a victim of fraud.

American Express

American Express, a stalwart in the world of financial services, is well-known for its high-end credit card services. The membership rewards program, which gives points on every purchase, is an innovative feature that boosts customer loyalty. Furthermore, the company's emphasis on customer service and protection against fraud helps to establish its reputation as a credible company.

PayPal Holdings Inc.

PayPal Holdings has revolutionized online payments through its user-friendly platform. One of the most notable features is its strong protection for sellers and buyers, which helps build confidence in online transactions. Furthermore, the integration of One Touch allows users to purchase securely and seamlessly using a single swipe and enhances the user experience.

Apple Inc.

Apple Inc. is synonymous with innovation, and its Apple Pay service is no exception. The company's commitment to users' security and privacy is illustrated by its seamless integration of Face ID and Touch ID to make transactions secure and easy.

Google Inc.

Google's payment solution, Google Pay, is acknowledged for its ease of use and adaptability. Its integration with various Google products makes it easier to pay. Additionally, Google's commitment to a robust security system like tokenization improves the security of its payment services.

Mastercard

The Mastercard global payment network is synonymous with safe and quick transactions. Its Priceless Cities program, offering exclusive discounts and experiences, increases the overall customer experience. Mastercard's dedication to improving digital security with initiatives such as the Cyber Resilience Institute contributes to its standing in the field of financial technology.

Alipay

Alipay is a prominent mobile payment platform that has changed the face of financial transactions in China. Integrating features that enhance lifestyle, including entertainment and social features, within the Alipay app provides a complete and exciting user experience. Alipay's use of advanced technology, such as facial recognition, improves safety.

Samsung

Samsung Pay, a mobile payment service, stands apart by using Magnetic Secure Transmission (MST) technology, which allows users to make payments using traditional magnetic stripe terminals. Its integration with Samsung Knox, a defense-grade security platform, increases Samsung Pay's credibility.

AT&T

AT&T, a major in the field of telecommunications, has expanded its services to include mobile payment. Combining mobile and payment services offers customers an integrated and seamless experience. The company's long-standing position in the telecoms industry is a contributing factor to its standing as a leader in the ever-changing digital payment world.

These businesses are considered to be pioneers in a time when mobile wallets have led the way. Whether you're an experienced user or are just beginning your journey to financial freedom online, the top mobile wallet firms offer a future in which your transactions aren't just safe but seamlessly integrated into your daily life. Let's now look at the ways to develop an app for mobile wallets.

Types of Mobile Wallet Apps

In the mobile payment world, understanding the various kinds of electronic wallets is crucial in determining the best digital wallet solution to fulfill the needs of specific users. This section thoroughly reviews the various types of digital wallet applications that range from open and closed wallets to niche and hybrid options, each with distinct characteristics and applications. Learn how these different types affect your strategy for digital wallets and the user experience. Let's look at each of them:

Closed Wallets

Closed wallets are wallets a particular company provides to its customers to conduct transactions only within its ecosystem. They are only used to purchase products and services from the wallet service provider.

A typical example is a store-specific wallet that lets customers spend money and make purchases within the retailer or company. These wallets often provide rewards or loyalty points, which can increase customer loyalty.

Semi-Closed Wallets

Semi-closed wallets let users perform transactions at specified merchants and locations. In contrast to closed wallets, they're not limited to one firm's network, but they are limited in the places they can be utilized.

They are accepted by an exclusive network of merchants who have signed a contract with the wallet service. This arrangement provides users with greater flexibility than closed wallets while providing the security of transactions in a secure environment.

Open Wallets

The open wallet is the most flexible kind of digital wallet. It is usually issued by financial institutions or banks and permits users to purchase items, withdraw cash at ATMs, and transfer money.

Their relationship with banks typically ensures that they adhere to the strictest financial guidelines, providing users with the highest security and confidence. They are akin to traditional banking solutions while allowing the convenience of online transactions.

Niche Wallets

Niche wallets target certain market segments or cases. They are created to meet the specific requirements of a specific market or sector, such as wallets that support cryptocurrency transactions or offer certain rewards.

They offer features and functions designed specifically for their intended audience, such as improved security for cryptocurrency transactions or integrated tools to manage loyalty points in a variety of retail settings.

Hybrid Wallets

Hybrid wallets combine the features of closed, open, and semi-closed wallets. They provide a flexible solution that meets an array of transaction needs.

Combining various attributes, they appeal to a wider audience and offer the convenience of open wallets and the benefits of semi-closed or closed systems.

Prepaid Mobile Wallets

Mobile wallets with prepaid cards are virtual wallets that allow users to load funds before making transactions. They don't necessarily require linking to the bank account.

The wallet is topped up with a certain amount of money, and the user utilizes the money for various transactions until the balance runs out.

Key Features to Incorporate Into Your Digital Wallet

A list of essential between non-core and core aspects is essential in determining a digital wallet app development strategy. Some essential functions you should include within your application that is based on finance are:

Invoicing and Transaction Reconciliation

The digital wallet needs to integrate an auto-reconciliation manager to efficiently manage reconciling transactions between various third-party systems, such as billing systems, banks, and payment gateways. This feature will automate periodic reconciliations, such as reconciliation of trust accounts with partner banks, system evaluation, biller's reconciliation, and bank-to-wallet and bank-to-wallet reconciliations, reducing manual effort and simplifying the process.

Multi-Asset Accounts

Give your customers the ease of having funds in different currencies in their accounts. This feature is designed to meet customers' requirements with different international transactions.

Also Read: Features of Digital Payment Gateway

Expense Tracking

Equip your application with an expense-tracking feature to enhance the user experience. Monitoring users' spending helps increase their financial awareness and improve their financial management.

Payment History

Transparency is essential. Ensure that users have access to their transaction history to increase customer loyalty and establish trust between your app and its users.

Account Management

Add a function that allows users to modify the information on their bank accounts, including payment details, card information, and preferences, subject to a thorough authentication process to ensure security.

Bluetooth Integration

Consider incorporating Bluetooth (and iBeacon for Apple devices) to make physical stores more user-friendly. When shoppers close to Bluetooth beacons within a shop, they automatically open or send out notifications regarding available deals, improving the shopping experience.

The other features of a user include:

-

-

Log in using Social Login and seamless onboarding

-

User Authentication

-

Bank Account Integration

-

Account Balance Check

-

Contactless Money Transfer

-

Bill Payments and Reminders

-

Chat Support

-

Push Notifications

-

Loyalty & Rewards

-

Bulk Payments

-

Split Payments

-

Store Features are:

-

-

Interactive Dashboard

-

Product Management

-

Profile Management

-

Account Verification

-

Customer Management

-

Promotional Offers & Discounts

-

Loyalty Points & Rewards

-

Staff Management

-

POS Integration

-

Administration The features include

-

-

QR Code Generation

-

User & Merchant/Vendor Management

-

Real-Time Analytics

-

App Security Enhancement

-

Reporting & Auditing

-

Transaction Management

-

App Support & Maintenance

-

Dashboard Management

-

Our Approach to Developing a Digital Wallet Application

The process of developing a digital wallet application involves various phases. Each step is essential to creating an app that is user-friendly and functional. Let's look at the process:

Product Discovery

At this stage of digital wallet mobile app development, the team determines the app's goal, intended audience, and features. Market research and competitor analysis aid in determining the app's distinctive selling point. The scope of the project, its goals, and requirements are defined, and the road map to develop the app is also laid out.

Designing

Within this development phase, the user experience and user interface design are analyzed. Designers create prototype wireframes and visual designs that are in sync with the app's mission and intended audience. The design process creates an attractive and easy-to-use user interface.

Development

The digital wallet application development phase aims to turn the design concept into a functioning application. Digital wallet app developers create the code, implement the functions, and integrate APIs and other third-party services. Depending on the application's complexity, both back-end and front-end development are considered.

To ensure the security of the user's data, SECURITY measures are implemented during this digital wallet app stage of development. Consult with our development company to create the digital wallet app.

Testing

Quality assurance is an essential element of developing a digital wallet application. Since it assists in addressing glitches and bugs and fixes these issues prior to launching the application, you can utilize different types of testing on other gadgets and operating platforms. Usability, functional, security, and performance testing are all forms of testing. This process ensures that users enjoy a flawless and bug-free experience.

Digital Wallet App Launch

Once the testing and quality standards have been met, it is time to release the application through an app store like Google Play Store or Apple. Developers create the app listings, upload the content, and submit the application to examination. The application is then made accessible to users for use and download.

Maintenance and Support

The work continues after the app is launched. Maintenance and ongoing support are vital for user feedback and bug fixes, as well as for releasing updates and increasing the application's capabilities. This ensures that the app is secure, updated, responsive, fast, and in line with users' needs.

Collaboration between teams (such as developers, designers, testers, marketers, and designers) is necessary at each digital wallet app development phase. Effective tools for managing projects and communicating aid in keeping projects on schedule and within deadlines.

Be aware that user feedback plays an important role in the process. Continuous feedback collection, evaluation, and iteration help enhance the application's features and user experience over time. Furthermore, the security of digital wallets is a major concern.

Implementing encryption protocols, strong security measures and compliance with data protection standards are essential to protecting users' personal and financial data.

Utilizing the steps above, a user-friendly interface, and security tools, you can create a digital wallet application that meets the requirements of both merchants and users.

Average Cost of Developing a Digital Wallet Application

The cost for developing white-label digital wallet application could start as low as $100,000 and go to millions of dollars, depending on the specifications of your project and objectives. If you have to employ an internal team for the development of this app, the cost could be anywhere from $500,000 to $1,000,000; however, you can reduce the costs by using an external development team.

To better understand your budget expectations, it is essential to discuss the details of your project with your digital wallet app development company. Define the technology stack you'll need, the number of experts required to complete the project, and the dates you'll need to meet. All of these elements will influence the final cost. In addition, you must include the cost of maintenance. It could be quite expensive too.

How Do These Digital Wallet Apps Work?

Since this article is dedicated to assisting you in understanding how to build digital wallets and how to use them, it is essential to talk about how digital wallet apps function. These are the steps taken by the user to utilize the app:

-

-

The person downloads the wallet app.

-

The user can enter his credit card details into the application.

-

The application saves the bank or card details securely.

-

To make a payment using an electronic wallet, users must pass their authentication using their OS device.

-

He keeps his phone close to the terminal or pays with his mobile. Number, thereby authorizing the transaction using additional security procedures implemented in the application.

-

To finish this process, a variety of technical procedures are used in tandem with the application to enable transactions, including quick response codes and near-field communications (NFC) as well as magnetic secure transactions (MST). Together, as the complete payment processing process, digital wallets provide users with an easier, safer, and more pleasant experience when it comes to payment.

Also Read: Cost and Monetization Strategies For Ewallet Mobile App Development

As a seasoned FinTech application development company that we work with, we can aid you (start-ups and companies) develop and personalize mobile wallet apps according to your specific business requirements. Learn about these technological procedures in depth to learn how they enable payments through mobile wallets and help create a contactless payment culture.

Quick Response Codes or QR Code

QR codes are a form of machine-readable code, also known as barcodes that usually store information in the form of a set of black-and-white pixels. Smartphone cameras can read them, and this is a brand-new method of making payments.

If scanned with a smartphone camera, QR codes direct users to the relevant information and allow them to make easy payments online. QR codes provide a multi-faceted way to connect to the internet. With just a few seconds, users can make contactless payments without effort, allowing customers to enjoy a smooth and easy experience.

Near Field Communication (NFC)

Near-field technology, also known as NFC, is a wireless data transmission technique that uses electromagnetic signals to allow smart devices, such as tablets, laptops, smartphones, and various other devices, to exchange and transfer data near. Utilizing NFT to create digital wallets lets customers (sender) and businesses (receiver) use payments that do not rely on contactless.

However, close-field communications transactions require the merchant's terminal and the client's device to be equipped with NFC. That means both parties need to be within a centimetre and a half of each other to communicate. This is a more secure way to transfer and receive money.

Magnetic Secure Transmission (MST)

MST is yet another wireless and mobile payment technology that can replicate payment made with traditional magnetic stripe systems that use chips and modern credit card no-swipe terminals. If you plan to develop a digital mobile wallet application, especially for the United States, ensure you enable MST digital technology within your application.

The US is notoriously slow when it comes to accepting new payment technologies, such as NFC. If you anticipate rapid growth in the use of your wallet's mobile application, make sure you allow both NFC and Magnetic Secure Transmission (MST) technology. By 2022, around 90 percent of merchants will accept MST, making your app compatible with virtually all payment terminals.

Security Compliance For Digital Wallet App

Despite the increasing popularity of Android, creating an Android virtual wallet or an iOS virtual wallet right from scratch takes a lot of time and effort to bring them into line with regulatory compliance requirements. According to the Payment Card Industry Data Security Standard (PCI DSS),it is essential to protect cardholders' information anywhere. A reliable online wallet for which users rely on the security structure, the commodity, and convenience. To ensure high-quality performance and delivery of your mobile wallet's product, you should implement the security and regulatory structures below for the digital wallet development.

Ensure Data Privacy Compliance

It is essential to follow the most effective practices to implement the privacy rules for data applicable to the region or state in which you wish the application to operate. A few of the most common rules and regulations that are important to implement include the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA).

Multi-Factor Authentication

You should use multi-factor authentication to add a layer of security to your wallet application. For instance, the iPhone application uses facial recognition or PIN, a password, and the device numbers to verify the customer's identity.

Secure Data Transmission

In the digital world, it is essential to protect your data, even while in transit. To ensure a safe and more efficient mobile application experience, Make sure that the developers have implemented SSL/TLS/VPN encryption. These encryptions enable secure data exchange between your application and server.

Secure Data Storage

It is essential to secure the user's data and financial information, such as credit card information, at rest. Safe storage methods, such as encryption or hashing, protect the user's personal information from unauthorized access and activity.

Regular Security Audits and Updates

With the increasing number of cybersecurity incidents, data leaks, and data breaches, there is a constant increase in the need for compliance and regulation around cybersecurity and a changing technological landscape. The effects of data breaches have an enormous impact on the financial sector, which can lead to higher fines and lawsuits. Therefore, keeping your mobile wallet app undergoing security audits to detect vulnerabilities and install regularly scheduled security updates is imperative.

Industries Profiting from Digital Wallet Application Development

The widespread use of mobile wallet apps has revolutionized diverse industries, allowing them to respond to consumers' ever-changing preferences and habits. Through the development of payment applications, industries like travel, banking, retail, and transportation are changing their own payment experience and offering easier and more secure payment options. Let's look at how these sectors use mobile wallet apps to enhance customer experiences and sales and keep away from their competitors.

eCommerce

Ecommerce uses digital wallets that provide safe and secure payment options to streamline checkouts and gather real-time data about customer spending habits to help with targeted marketing. This method provides further security through biometric authentication and encrypted payment codes that cater to those who prefer transactions with cash and increase conversion rates."

Banks

Banks use digital wallets to offer an easy and secure payment method. This allows customers to manage their finances and make transactions from the convenience of their smartphones. The biometric authentication process and the encrypted payment codes add additional security. Digital wallets can help provide customers who are not banked with the most modern and seamless bank experience.

Travel And Transportation

The transportation and travel industry uses digital wallets for seamless payments, allowing users to book and pay via mobile devices without a physical or cash-based card. Biometric security and encrypted payment codes provide security-grade payment methods. Digital wallets can enhance customer satisfaction and facilitate cashless transactions.

Retail

Many retail stores now accept digital wallets as payment options to give customers a quicker, more secure checkout experience. Digital wallets also allow retailers to gather valuable information regarding their customers' spending habits for specific marketing campaigns.

Food Delivery

Restaurants and food delivery companies use digital wallets to simplify payment for mobile and online orders. Digital wallets let customers pay quickly and conveniently without cash or credit cards.

Entertainment

Digital wallets are becoming increasingly popular in the entertainment industry. Many companies accept them as payment options for tickets, online subscriptions, and in-app purchases. Digital wallets can also provide an additional security option for consumers to make payments.

Healthcare

Digital wallets are used in healthcare to allow patients to pay insurance premiums and medical bills quickly and securely. They also enable healthcare providers to speed up payments and cut administration costs.

The Key Takeaway

If you're creating an online wallet, you need to think about how users will use it and what features it must have. You'll have to pick the best type of app that will appeal to the people you want to target. Most importantly, you must make the user experience enjoyable to encourage users to use your wallet. To differentiate yourself from the other wallets that use digital technology and gain a bigger part of market shares, it's crucial to work with a trusted developer of digital wallet apps such as JPLoft.

We have assisted clients with complete digital wallet application development and integration services and can assist you in planning every stage of your product's development and launch. Utilizing our knowledge and assistance throughout development, you can broaden your payment options and enhance the customer experience.

FAQs

1. What's a mobile eWallet application?

Mobile eWallet apps are electronic wallets that allow users to manage and store their payment information and conduct transactions using their mobile devices. An eWallet can also include other features like loyalty programs and digital receipts.

2. How do you create a Digital wallet application?

After you've decided on the aspects that will make your app different from the competition, you need to contact a seasoned developer who understands the requirements to create an effective electronic wallet app. They can help you select the best technology stack to aid you in turning your concept into reality using prototypes, designs, testing, and deployment.

3. How much will it cost to create an e-wallet application?

The cost of creating a digital wallet app depends on many factors, such as the application's complexity, features, and the developer's expertise. In general, the price can be anywhere from $20,000 to $250,000 or greater. It is important to collaborate with a development team to obtain an accurate estimate based on your individual needs.

4. What will it take to develop an app for digital wallets?

An organization's digital wallet differs from another in terms of functionality, features, and business models. This all adds to the app's ease of use and complexity. Therefore, the time needed to develop a digital wallet application depends on the level of complexity of the app's features. Creating a functional digital wallet application generally takes up to six months.

5. What are the advantages of a wallet application for my company?

Digital wallets provide an easy and secure method for your customers to make payments in your business application. They can streamline your business processes by eliminating the requirement for cash and the physical processing of payments. In addition, you can utilize digital wallets to collect important information about customer behaviour and patterns of spending and formulate your strategies in the future based on this information.