With the constantly evolving technological landscape for financial technology, the one innovation that has gained prominence is the Robo-Advisor system. This revolutionary technology has changed how we think about investing and is set to transform the entire financial sector.

As per Statista, the robo-advisor market is predicted to hit an estimated $1,802 billion by 2024. It boasts an annual increase of 8.06 percent. The market could grow to $2,274.00 billion in 2027. This highlights the growing popularity of this innovative investment strategy.

Today, when enterprises are forced to evolve and implement innovative strategies to remain ahead of the curve and stay ahead of the competition, investing in the advancement of robo-advisor platforms is no longer an option but an essential. By boosting productivity, reducing operational costs, facilitating the financial process, and enhancing strategy for managing wealth, The benefits of a robo-advisor system are numerous.

What is a Robo-Advisor and How Does it Work?

The robo-advisor functions as an automated investment platform that uses algorithms and draws on AI and machine learning. The main goal of a robo-advisor is to automate financial management. This makes it particularly beneficial for those new to the market or investors with fewer portfolios.

This is an in-depth review of the operation of a robo-advisor system for an investment company.

-

Information for Investors: User input is crucial information such as their investment goals, levels of confidence in risk, and any other important information.

-

Algorithmic Portfolio Building: The algorithm creates an investment portfolio designed to satisfy an investor's particular requirements and draws insights from available data.

-

Continuous monitoring and adjustments: The robo-advisor continuously checks investments and adjusts to keep the desired balance between return and risk.

This automation method removes investors from the continual stress of making investment decisions by streamlining the entire procedure.

How FinTech Software is Transforming Investment Management

The following article will examine how robo-advisors are changing investment management and leveraging FinTech tools to offer more intelligent and better financial services.

1. The Emergence of Robo-Advisors

Robo-advisors gained popularity due to their ability to offer cost-effective, efficient, and personalized investment advice. In a study by Grand View Research, the global market for robo-advisories has been forecast to grow to $1.4 trillion by 2028. That's an exponential growth rate.

2. Lower Costs and Fees

In comparison to traditional investment management solutions, robo-advisors generally offer lower charges. According to research done by Backend Benchmarking, the average cost of management for robo-advisors ranges from approximately 0.25 percent, significantly less than the 1- 2 percent charged from traditional advisers.

3. Personalized Investment Strategies

Robo-advisors employ sophisticated algorithms and artificial Intelligence to design a customized investment strategy based on objectives for financial planning, risk tolerance, and time frames. The individualized approach guarantees that the investment strategies align with each client's needs.

4. Enhanced Accessibility and Affordability

Robo-advisors have revolutionized how we manage our investments to make them more accessible to more people. FinTech solutions for investment have removed the requirement for substantial minimal investment requirements, which allows those with fewer portfolios to get expert investment guidance.

5. Data-Driven Insights

Robo-advisors use data analytics to provide essential insights into markets, the behavior of investors, and the performance of portfolios. In analyzing vast quantities of information, these systems can make educated investment choices and adjust strategies in response to changes in market situations.

6. Efficient Portfolio Management

FinTech Software has allowed the robo-advisor to effectively manage portfolios by automating processes such as the rebalancing process and harvesting tax losses. These tools help improve the performance of investments and reduce tax obligations, saving investors time and money.

7. Increased Transparency

FinTech solutions for fintech that are used by robo-advisors offer transparency in reporting. This gives investors a real-time view of the performance of their portfolios as well as fees, investments, and holdings. Transparency increases trust and allows investors to make more informed choices.

8. Human Touch and Automation

Though robo-advisors are mostly automated, several platforms have hybrid solutions that blend technological solutions and access to human advisors. This approach to investing offers investors two options: the ease of automated systems and the knowledge of human experts.

9. Adoption by Institutional Investors

Robo-advisors don't just apply to private investors. Institutional investors are also taking advantage of this new technology. In a report by PwC, 73 percent of wealth management companies currently use or contemplate using robo-advisors within their offerings for services.

10. Security and Risk Management

FinTech solutions for software used by robo-advisors focus on the security of their clients and manage risk. Multi-factor authentication, robust encryption, and regulatory compliance procedures are in place to guard investors' private information and ensure security in the investing environment.

Key Features of the Robo-Advisor Platform

Robo-advisors have a variety of unique attributes that allow them to be distinct from the rest of automated investments. They allow investment companies to manage the complexity of the financial market efficiently and meet the ever-changing demands of their customers. In the following paragraphs, look at the various aspects of the robo-advisor development platform further.

Portfolio Management

Robo-advisors provide a full range of services for managing portfolios for clients. They provide the initial design of a diverse portfolio to meet clients' goals and the ongoing checking and automatic rebalancing of the portfolio to ensure it stays aligned with their goals. The proactive strategy for managing portfolios seeks to optimize return and minimize risks.

Risk Tolerance Assessment

The robo-advisor offers an onboarding procedure that includes an extensive questionnaire. It evaluates the customer's attitude toward risk as well as their goals in terms of finances. This vital step guarantees that an investment strategy that the platform will be able to meet the clients' ability to deal with market fluctuations and losses.

Automatic Rebalancing

Monitoring and constantly modifying a portfolio is possible because of the automatic rebalancing feature, an essential attribute. This feature regularly evaluates the amount allocated to assets to ensure it aligns with client expectations. In doing this, it reduces the risks and increases volatility. This automated procedure ensures that the portfolio will maintain the desired risk-return ratio in the long run.

Asset Allocation

Robo-advisors utilize mean-variance analysis to determine the best allocation of assets and create strategically diverse portfolios. This sophisticated method seeks to determine the optimal balance of return and risk when selecting holdings based on their past performance and their relationship.

Investment Analytics

Robo-advisors make use of investment analysis to analyze and continuously rebalance portfolios. Through processing and understanding giant data sets, the automation allows informed choices to alter your portfolio to maintain the asset allocation desired to meet the client's financial goals.

Diversification

Diversification is crucial in investment, and robo-advisor platforms can provide access to various investment types. This unique feature ensures that investors can distribute their funds across multiple industries, sectors, and geographical regions, reducing the effects of performance decline in one specific area.

Tax-Loss Harvesting

Tax-loss harvesting is a successful tax technique used by robo-advisors who aim to maximize tax-free returns to investors. This strategy involves selling low-performing investments to recover losses. Capital gains offset the losses, thus lowering taxes on the portfolio of investments.

Investor Education

Robo-advisors emphasize the education of investors by providing numerous resources and tools to set objectives. The tools offer investors the knowledge they need to make informed choices about their future financial security, increasing their financial literacy and encouraging them to take a proactive approach within the investing process.

Tax Optimization

Robo-advisors provide sophisticated strategies for tax optimization. The most prominent is the tax loss harvesting. The software can pinpoint opportunities to offer investments for a profit. This helps offset capital gains as well as reduces investors' tax burden. Furthermore, these platforms facilitate capital gains by carefully considering the tax consequences of every trade to ensure no tax consequences.

Tax-efficient asset allocation ensures that investments with more significant tax implications are held in tax-efficient accounts. Additionally, robo-advisors offer automated tax-advantaged investment, maximizing results in tax without constant supervision by hand. The comprehensive approach to tax optimization aligns with the robot-advisors' desire to maximize returns while ensuring an efficient tax rate for their portfolios.

Rebalancing

Robo-advisors are of great value with constant monitoring and automatic rebalancing of portfolios. They employ sophisticated algorithms to keep track of markets, asset performance, and the portfolio's composition. Automated adjustment capabilities ensure that the portfolio aligns with the asset allocation plan.

The robo-advisor can make real-time choices to purchase or sell investments while ensuring the portfolio is balanced. This systematic and objective rebalancing method manages risk by keeping the portfolio in line with an investor's tolerance for risk. The investors benefit from a non-intervention yet flexible strategy that can react rapidly to changes in the market. Risk management is designed to meet the financial objectives of clients.

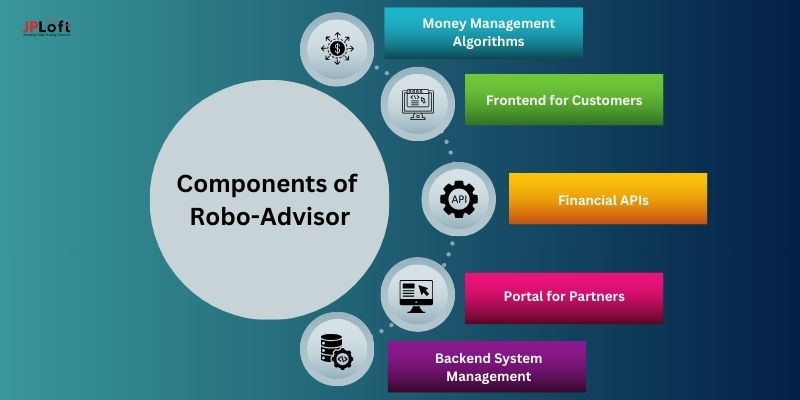

Components of a Robo-Advisor

For a robo-advisor to be effective, the following key elements must work together. When combining the appropriate components, you can create a simplified financial system that serves every client. These fundamental elements are:

Money Management Algorithms

In the background of the simple user interface of customers, you'll discover the heart of the robo-advisor - the machine-learning platform, which includes AI algorithms. This crucial component allows for personal portfolio choices, including the possibility of hundreds of options tailored to each user's specific needs and tastes.

The algorithms meticulously analyze client data - their goals, risk tolerance, and investing ability - to create and maintain the best portfolios. Furthermore, the additional algorithms may provide other functions, such as tax loss harvesting and student loan management, increasing the effectiveness of the robo-advisor's services.

Frontend for Customers

A robo-advisory service is designed with an easy-to-use interface. It is typically an online dashboard or mobile/web app. Clients are required to complete their onboarding process, which includes the Know Your Customer (KYC) and profiling. The space allows users to track and manage their investments. Its design is accessible and provides important interaction points.

Financial APIs

The Financial Applications Programming Interfaces (APIs) are crucial to ensure the proper functioning of platforms for robo-advice. When connected with bank accounts, APIs allow for the automated management of long-term investments and offer advice on the most efficient money management methods.

Mainly, they handle essential functions, including the execution of trades, portfolio balances, and the integration of supplementary financial systems. In the end, they are the core of functions offered by robo-advisors with a system for managing portfolios that is systematic as well as personalized financial planning recommendations.

Portal for Partners

Employers who want to offer competitive 401(K) plans using an online robo-advisory service must have a separate portal for partners. This dashboard lets employers track balances, pay earned, and other pertinent measures. The report provides a thorough study of employees' efficiency and engagement while working within an automated advisory framework, which allows efficient management of retirement plans and financial wellness programs.

Backend System Management

A highly effective and accurate automated advisory system needs a solid backend base. This platform allows financial advisors to develop and verify portfolio balance strategies. It also facilitates the creation of a robo-advisor and the supervision of the investment algorithm, which encourages continual improvement. By monitoring overall financial performance, the back end ensures that the robo-advisor complies with stringent quality and reliability standards.

How to Build a Robo-Advisor Platform?

To ensure the effectiveness and efficiency of the robot making, the design requires a well-planned strategy. We suggest partnering with a fintech app developer as their experience can bring an individualized focus on the robo-advisor's platform that will ensure the best creation and deployment.

We will go over the main steps in developing a robo-advisor system.

Discovery Phase

The main focus of this phase is setting ROI objectives and making educated technological approximations. For a seamless transition, it's advised to hold a pre-flight workshop. This is an opportunity to use the workshop to define the top elements, define the business objectives, and establish the technology structure needed to achieve the best solution.

Design

The job involves creating the interfaces for consumer-facing websites and mobile apps. It consists of creating user flow diagrams and developing low-fidelity UI wireframes, then progressing to high-fidelity UI screens. It is essential to design an interactive prototype, test the design with people, and adjust the UX/UI according to their comments. Additionally, it's necessary to include developers in the designing process to ensure that it is practical and feasible.

Development

When the proof of concepts and design is confirmed, the next step is to move into the design stage. At this point, you have to write code and run manual and automated tests to discover and correct the issues and glitches. It is suggested to adopt an agile approach to development that releases updates every two weeks to increase the quality of products and market suitability.

Hiring a dedicated project and product manager is essential for smooth and seamless coordination between the team of developers, which comprises frontend developers, backend engineers, mobile engineers testing, and UX/UI engineers.

Proof of Concept

A proof of concept is expected to test the effectiveness of machine-learning algorithms about a robot-advisor. It involves the development of ML algorithms that analyze information from customers to create portfolios that are tailored to individual preferences. Different portfolio models are developed and evaluated based on historical data on stock markets.

Deployment and Maintenance

Launching the robo-advisor service to people will require a change from the system to a production environment. If applicable, apps for mobile devices will be made available to both the App Store and Google Play. Regular maintenance involves monitoring the system's efficiency, dealing with issues, and assessing user interaction patterns. This helps inform the next update cycle. This ensures that new updates bring in functions and address any problems users have yet to notice.

Benefits of Robo-Advisor Platform Development for an Investment Firm

Firms investing in robo-advisors benefit from operational efficiency, data-driven information, and enhanced client interactions. They can position their businesses as competitive leaders in the rapidly changing world of finance. We will examine the many benefits below in more detail:

No Minimum Account Balances

Robo-advisors can provide financial advice with the requirement of a minimum balance on your account. Human wealth managers typically set excessive minimums because their revenue depends on their client's assets. Therefore, they consider the advice of low-balance accounts to be unprofitable. However, the robo-advisors' online platforms are easily scalable. They can effectively serve customers of every asset class. Their greater availability makes them particularly valuable to investors beginning with limited capital.

Emotion-Free Decision-Making

A person's emotions could negatively affect financial decision-making, leading to adverse outcomes. Robo-advisors can provide excellent advice on investments free of emotional influence. Their recommendations are based on objective analysis to ensure investors receive advice based on a rational analysis of the facts, not biased opinions.

Cost-Effective Solutions

Digital advisors provide various benefits, but one of them is the fact that they are affordable. In terms of annual charges, they are less than with personal finance management. The charges are typically less than an experienced financial advisor would cost: about 0.2-0.4 percent of the balance. Cost efficiency is one reason that makes robot advisors an excellent alternative for people looking for financial advice free of the high costs usually related to the traditional administration of wealth.

Real-Time Analytics and Advice

Automated financial advisors, also known as robo-advisors, provide benefits regarding real-time analysis and advisory capabilities. Contrary to human finance managers who are constrained because they cannot constantly track the market, Robotic advisors are always accessible. They swiftly respond to developments in the market, can change their recommendations for all clients, and respond quickly to market conditions.

Comprehensive Documentation

For the successful management of investments, it's essential to have a plan to be in place. Robo-advisors make this easier, unlike traditional finance professionals who require clients to keep track of advice over channels. This mobile application provides advice in a structured way, with a documented format, facilitating the process of accessing and tracking clients. The app's persuasiveness shows how robo-advisors can assist clients in keeping track of financial direction.

Conclusion

The development of robo-advisors represents a significant advancement in the FinTech business, revolutionizing how people use financial services. This exploration has shown that they provide users unparalleled access, efficacy, and personalized financial guidance, making it easier to access wealth management and investing opportunities regardless of financial knowledge or experience.

Combining artificial Intelligence with machine learning algorithms has enabled robots to study vast quantities of information quickly and provide personalized investment suggestions and portfolio management strategies. Additionally, their capacity to adjust to changing patterns in the market and users' preferences guarantees constant optimization and relevance within an ever-changing landscape of financial markets.

Within the framework of fintech app development company, the significance of the robo-advisor platform cannot be understated. They play an integral part in fostering the frontiers of technology within the financial services sector. Utilizing their knowledge in software development, data analytics, and user experience design, Fintech app development companies can significantly influence the future of advisory and financial services.

FAQs

1. What is the Robo-Advisor Platform in the FinTech business?

A Robo-Advisor service that is part of the FinTech sector is a platform that provides automated and algorithm-driven financial plans and investing services. They employ sophisticated algorithms for creating and managing investment portfolios based on user inputs, financial goals, risk-taking capacity, and the market's conditions.

2. How does the Robo-Advisors system work?

The Robo-Advisor platform operates by gathering information from its users regarding their financial goals and risk preferences, the time frame for investing, and their financial circumstances. The system then applies algorithms to analyze this information and provide appropriate portfolios for investment consisting of diversified portfolios of assets like ETFs, bonds, stocks, and mutual funds. It constantly monitors and adjusts portfolios to ensure they align with the customer's objectives and the market's environment.

3. What are the main advantages of a RoboAdvisor platform?

Some of the key features of the RoboAdvisor platform are automated investment management for portfolios, goal-based investments, and risk assessment tools strategies to optimize tax, low costs compared to traditional financial advisors, easy-to-use interfaces to manage accounts, as well as access to education resources on personal finance and investing.

4. What is the Robo-Advisor platform's security level for managing your risk of investments?

Robo-Advisor's platform is security-first and uses advanced encryption strategies to safeguard users' private and financial data. In addition, trustworthy platforms follow standards for security and protocols like GDPR and SEC guidelines. Customers must select platforms with robust security practices and adhere to the most effective guidelines for protecting their accounts, such as having unique passwords and using two-factor authentication.

5. How can I personalize my investment strategies with a Robo-Advisor system?

Most Robo-Advisor systems have some form of customization of investment strategies according to the preferences of users and financial objectives. Most users can alter risk tolerance, investment timeframe, and asset allocation to personalize their portfolios. Some platforms also offer alternatives for investing with social responsibility and the capability to remove specific companies or industries from portfolios based on ethical issues.

Share this blog