Fintech apps allow users to manage their finances, borrow money, trade cryptocurrencies, or invest in global companies, all within the same app. Apps that are AI-driven can often perform better than traditional financial institutions. Fintech is a growing market that offers new solutions every year. We can see the boom in the need for Fintech App development in past few years. Analysts predicted that the global industry revenues would reach $188 billion in 2024, even before the pandemic. Not to mention, global lockdowns have shifted attention even more to digital options. The stunning possibilities attract an increasing number of enthusiasts. The number of fintech companies surpassed 25,000 last year. Fintech businesses can still compete in a market that seems saturated. JPLoft has partnered with many financial tech companies over the years. We know what it takes for a small company to succeed in the financial sector, especially if planning to create an app. To help you get going, we have compiled a list of essential information and steps that every FinTech start-up should know before launching a FinTech business.

How the Need for Fintech Applications has Grown in Last Few Years?

The pandemic has shifted the focus even more to digital payments. Global FinTech market size reached $110.57 billion by 2020. The market is expected to grow at a 20.3% CAGR between 2021-2030 and reach $698.48 2030. FinTech apps are being adopted so quickly that the number of FinTech start-ups has tripled over the past two years. In 2018, nearly 70% of senior executives at traditional banks saw the opportunity to build a FinTech company as an essential opportunity. Global investment in FinTech has increased in value. In 2021, it could reach up to $226.7 billion.

- Valuations: Out of the Fintech 250, 118 companies are valued at $1B+ or more.

- Highest valuation: Stripe's current value is $50B. It is America's second most valuable private company, only behind SpaceX.

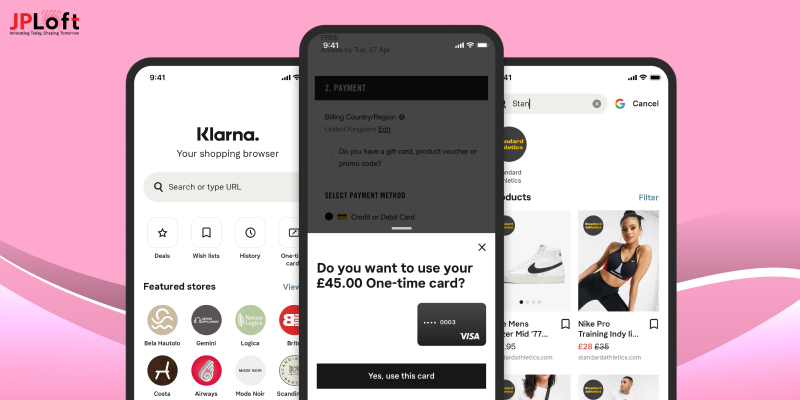

- Best investment: Klarna received $1B in funding from unnamed investors by early 2021.

- Most Invested: Klarna with more than $3.5B of equity funding since 2010.

- Funding Dynamics: Since 2017, 250 fintech firms have raised an incredible $115B in equity funding.

- Geography: Although most fintech superstars are in the US, nearly 40% are from other regions, including the UK, India, France, Brazil, Germany, Indonesia, and Nigeria.

How Fintech Startups Comply with Regulations?

Financial services that do not comply with government regulations are doomed. If you are planning to build a FinTech company, the first thing to do is understand local policies. You should be able to understand the restrictions, conditions, and risks. Let's look closer at the laws and regulations in the largest fintech markets.

- You can learn a lot from companies in the same industry as your project.

- RegTech software powered by the cloud can be used to monitor and verify compliance with regulations

- Hire a security law specialist who can analyze the legal environment.

- Fintech consulting from a company with relevant experience in your area.

Fintech Regulation in the US:

Federal and state laws govern fintech companies in the US. You should review the following documents to learn more about the national regulations.

- Electronic Fund Transfer Act. EFTA protects funds transferred using ATMs, credit cards, and other electronic transactions.

- Fair Credit Reporting Act (FCRA). FCRA regulates the way financial institutions collect and use data on consumers.

- Anti-Money Laundering Act. AML also includes the Patriot and Bank Secrecy Acts. These documents govern anti-money-laundering measures such as cross-border transactions.

- Gramm-Leach Bliley Act (GLBA). GLBA requires financial services to reveal how they plan to store and share user data.

- Jumpstart our Business Start-ups Act. JOBS is a collection of crowdfunding platform requirements. This act contains requirements for disclosure, registration, and fundraising limits.

Fintech Regulations in the EU

Many laws in the European Union regulate differently with financial services. The most common regulations are:

- Payment Services Directive. PSD1 and PSD2 govern obligations for electronic service providers and their users. This includes payments, refunds, and revoking of payments, as well as liability for unauthorized payment tools.

- General Data Protection Regulation. GDPR regulates how fintech institutions handle client data and how they transfer it outside the European Economic Area.

- Fintech Action Plan. FAP introduces universal rules for digital finance, retail payment, and crowdfunding platforms.

- MiFIR (Markets in Financial Instruments Regulation). MiFIR is a set of standards that apply to investment firms and trading platforms, emphasizing transparency in trading processes.

Fintech Regulations in the UK

A single regulatory framework does not govern fintech companies in the UK. Financial SaaS firms must, therefore, evaluate their business's type, size, and scale to determine if they fall within the regulatory boundaries. You should be examining:

- FCA Guide to Rules and Guidance (FCA). The FCA Handbook includes requirements for banks, insurance companies, investment firms, and other financial services.

- Rulebook of the Prudential Regulation Authority. The PRA Rulebook establishes standards for financial institutions and evaluates the risks these firms pose to financial stability.

These regions constantly change their policies to adapt to the ever-changing fintech market.

Step-by-Step Guide on How to Start a Fintech Company

We'll walk you through the steps to build a FinTech company and successfully ensure its launch and development. Make sure you follow all the steps carefully.

1. Start with an Idea

It all starts with a simple idea. You can't help but think about how much easier, quicker, cheaper, and more convenient it would be if there were a solution. This idea is a part of the modern fintech world.

- Cryptography

- Fiat

- Combination of crypto/fiat

You can also focus on enterprise or consumer needs by making your fintech software b2b- or b2c-software. Let's look at some popular finance domains.

- Money Transfers

- Investment software

- Trading software

- Loaning solutions

- Neobanking

- Billing

- Accounting

- digital payments

- Personal finance management

- Insurance

2. Back Your Idea

You can have an idea but need to support it with research. You must prove that your solution solves the problem for consumers and that it is a real one. Ideal research would include:

- Understanding the needs of your target audience is essential.

- Competitive Analysis

- Binding Regulations

- Available technologies

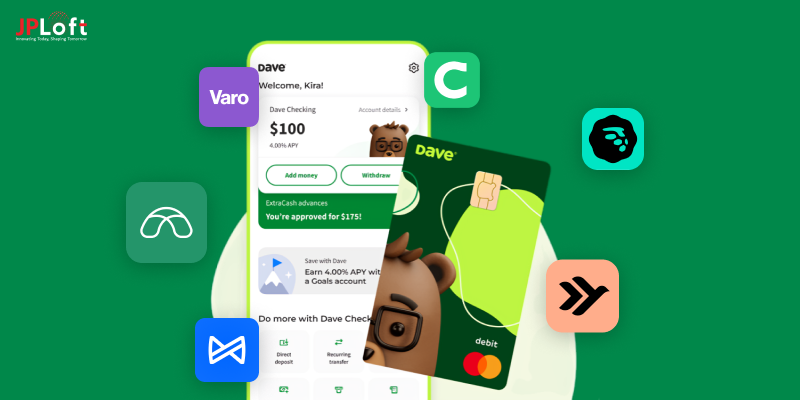

Knowing your audience intimately can be a daunting task. Founders often assume that they already know what everyone wants because they have been in their customers' shoes. Wrong; surveys can help. The research phase is usually the most enjoyable. The research is necessary to launch a fintech company that relies on a mobile application. You can use analytics platforms such as data.ai and sensor tower to discover the tech stack of successful start-ups within your niche. You must be familiar with apps like Chime Current Varo and David if you wish to create a Neobank. The regulations are the most difficult to understand in the financial domain. There are many regulations and standards, including the PCI DSS. Companies must meet the federal and state regulatory requirements to ensure compliance.

- SEC

- FINRA

- CFBP, CFBP acronym, and other abbreviations

If you don't have a strong regulatory background, finding a middleware solution that will handle all the compliance and data protection issues is best. When exploring the available options in financial technology, look for solutions already on the market. This will allow you to develop a prototype faster (more about this later). You must also ensure you have the technology (e.g., artificial intelligence, machine learning, etc.) to make your solution a reality. Bit-Size Takeaway What you learn during this stage about:

- Customers and their real needs

- Regulation framework

- Tech limitations

- Competitive Analysis

3. Find Funding

When you get to the funding stage, it's time to face your harsh reality. Will people who have already made much money believe in you, your solution, and your team? It's great when you can fund yourself or get enough money through crowdfunding. Regardless, the funding aspect will be central to your networking efforts. It's still going to be difficult despite the many options available:

- Venture capital (VC) funding

- You can also find out more about crowdfunding.

- Traditional (painful and painful) bank loans

- angel investors

- Business accelerators/incubators

- Government grants and subsidies

- Family and friends

You will also have to decide how much control you are willing to relinquish over your company, how FinTech app development can help you build missing relationships, and whether or not equity is an option for employees. You will still need resources after you launch an MVP. If you think strategically, this is the fastest way to scale and grow your user base.

4. Validate your Idea with a Model

You have some cash and a plan for a fintech start-up. You're now ready to make this idea a reality. Choose from the following options to continue on this path.

- Wireframing

Sketches of the main screens are drawn. Visualizes what the customer will see once the software is finished.

- Rapid Prototyping

The screens are polished and clickable. You can see the changes in screens based on user input (even though this is a simulation). It's an improved representation of what you envision. You can show it to test users and get feedback on the UX/UI. JPLoft prefers to begin with rapid prototyping to avoid wasting time and resources during the coding phase and to ensure we build a product-market-compatible solution.

- No-Code Proof of Concept Development

No-code development involves creating a real app by using drag-and-drop UI building blocks. This is limited because blocks are not customizable, and you end up with a generic-looking app. Fintech founders usually partner with a design and development agency at this stage or hire a freelancer to achieve professional results. The prototype is used as a tool for fundraising and must accurately represent the app's capabilities. Moreover, the prototype should validate your software's fit with the market, if not to some extent.

5. Prove that Your Idea Is Viable

Next, you'll need to create a more tangible proof-of-concept that your customers can use to get desired results. Now is the time to start with the development process. You have three choices:

- no-code development

- low-code development

- custom development

As you can guess, customization levels increase gradually with each approach. In the case of no-code, customization is minimal, while low-code customization is slight, and with the third option, customization is unlimited. Focus on one or two features your team can create within three months. This is the ideal timeframe for developing an engaging user experience around a central feature. A proof-of-concept is designed to iterate further on the product/market fit through customer feedback analysis and selecting the following features to maximize ROI after delivery. PoCs usually aren't meant to be released publicly. You can give it to your most loyal customers or a hyperlocal market. If you opt for a low code or custom development scenario, you will still need the assistance of a FinTech app development company.

6. Build an MVP

Your proof of concept will eventually reach a point where you are comfortable releasing it to the public. Iterating a PoC is what it takes to build a Minimum Viable Product. You'll also need to spend money marketing your product at this stage. You can't ignore one thing when assembling an MVP. Integrations with analytics engines that allow you to gauge app performance and user behavior are essential. After your launch, you will be tracking several metrics to ensure that your fintech company is set up correctly.

- Users reaching their goals in the app

- Bugs and Issues (Sometimes Crashes)

- slow-downs

- Conversions

These analytics services provide the data that will be used to optimize your CI/CD Infrastructure and make new updates. You won't need to worry about the details. You can set up a cost-effective cloud infrastructure with 99% uptime.

7. Iterate and Be Ready to Pivot

You've already been iterating on your FinTech application since step #5. Monitoring the app's performance, optimizing its monetization, and continuing iterating until you reach a brick wall is essential. Then you pivot. Building relationships that will broaden your horizons and allow you to reach more customers is also essential.

Major technologies required for how to build a FinTech startup

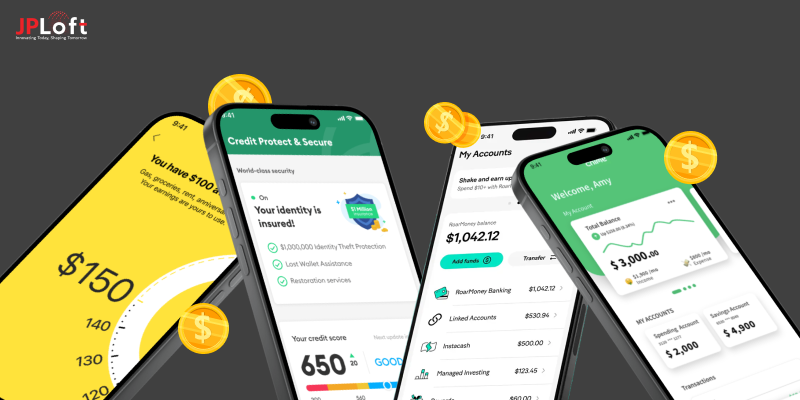

You should keep up to date with the latest technology trends so that you can integrate them into your FinTech business and effectively build a FinTech company. You will be better able to serve your customers with better technology. This is a list of the essential but basic technologies you will need to start a FinTech company.

Artificial Intelligence

AI analyzes real-time information and recommends the most effective course of action. AI is used to solve financial problems. It can, for example, be used to detect fraudulent activity in insurance, digital banking, etc.

Blockchain

Blockchain technology can help you follow up with transparent and reliable FinTech app development services. It creates a series of uneditable time-stamped data that cannot be deleted. It also saves decentralized.

Cybersecurity

Cybersecurity is the primary concern of every FinTech firm looking to build a FinTech company. You must be careful about handling and storing customer data before starting a FinTech company. Your team should implement various security measures to reduce the risk of data theft and security breaches.

Microservices

Microservices can organize an application as a collection of connected services. This creates a decentralized system that is distributed. You can easily integrate any new solution into your infrastructure.

The Key Takeaway

Come prepared if you are determined to build a FinTech company. Fintech is not an accessible domain for any team to work in, but it often delivers on its promises and makes its founders extremely successful. You must be adept at modern technology and finance, creative, and ready to make high-pressure decisions, pivot, and experiment. It may take you years to succeed in such a highly competitive market. Do you still have questions about how to launch a FinTech business? You are looking for a FinTech software company to help you execute your FinTech ideas. JPLoft can help you. Hire FinTech Developers from JPLoft to ensure a seamless development of FinTech solutions. Since working in the software industry, we have created digital solutions for many international and Fortune 500 firms. Our approach is to listen first to our client's problems and provide solutions. Fintech products with high stakes can be difficult to launch, but they are often worth the effort. Launch your MVP after validating your idea. Let your users help you refine your product.

FAQs

1. What are the banks doing with FinTech?

Banks use financial technology to make it easier for their customers to access cash and credit. Chatbots, mobile apps, and machine-learning algorithms are used by banks to provide customers with immediate access to funds and to improve the user experience. Fintech apps offer customers a text and voice-enabled platform, allowing them to perform many banking tasks. They can also provide detailed answers to questions and requests. For this reason, several banks have developed AI-powered virtual assistants.

2. Can FinTech start-ups replace or substitute banks?

- FinTech start-ups offer several advantages over traditional financial institutions. They allow operators to be creative and provide services more quickly and affordably to their customers. FinTech has thus been able to shake up and disrupt financial services.

It's unlikely that it will replace banks. This is because banks and other established financial institutions enjoy a much higher level of client trust and loyalty. This has often been built up over many years. FinTech and conventional banks working together is a very popular concept in the financial industry. FinTech firms expand their client base and gain access to existing customers, while banks gain new technology and ways of delivering services.

3. How do you Build a FinTech Company?

Consider these key factors when building a FinTech company:

- Know the regulatory rules.

- Carefully choose your target market or niche.

- Establish a competitive advantage.

- Build your team by hiring the right talent.

- Prioritize data security.

- Secure funding.

- Select the scope of your MVP.

- Plan for product launches and improvements.

Share this blog